Careers span decades, but most jobs are substantially shorter. The modern career involves far more employment changes than were involved a few decades ago. While wages have stagnated at the bottom of the market, salaries for high earning knowledge workers have increased steadily over the years. During the COVID-19 Pandemic, this was further exacerbated by the ability of office workers to work from home while non-essential workers that couldn’t become remote employees found their employment and income cut short.

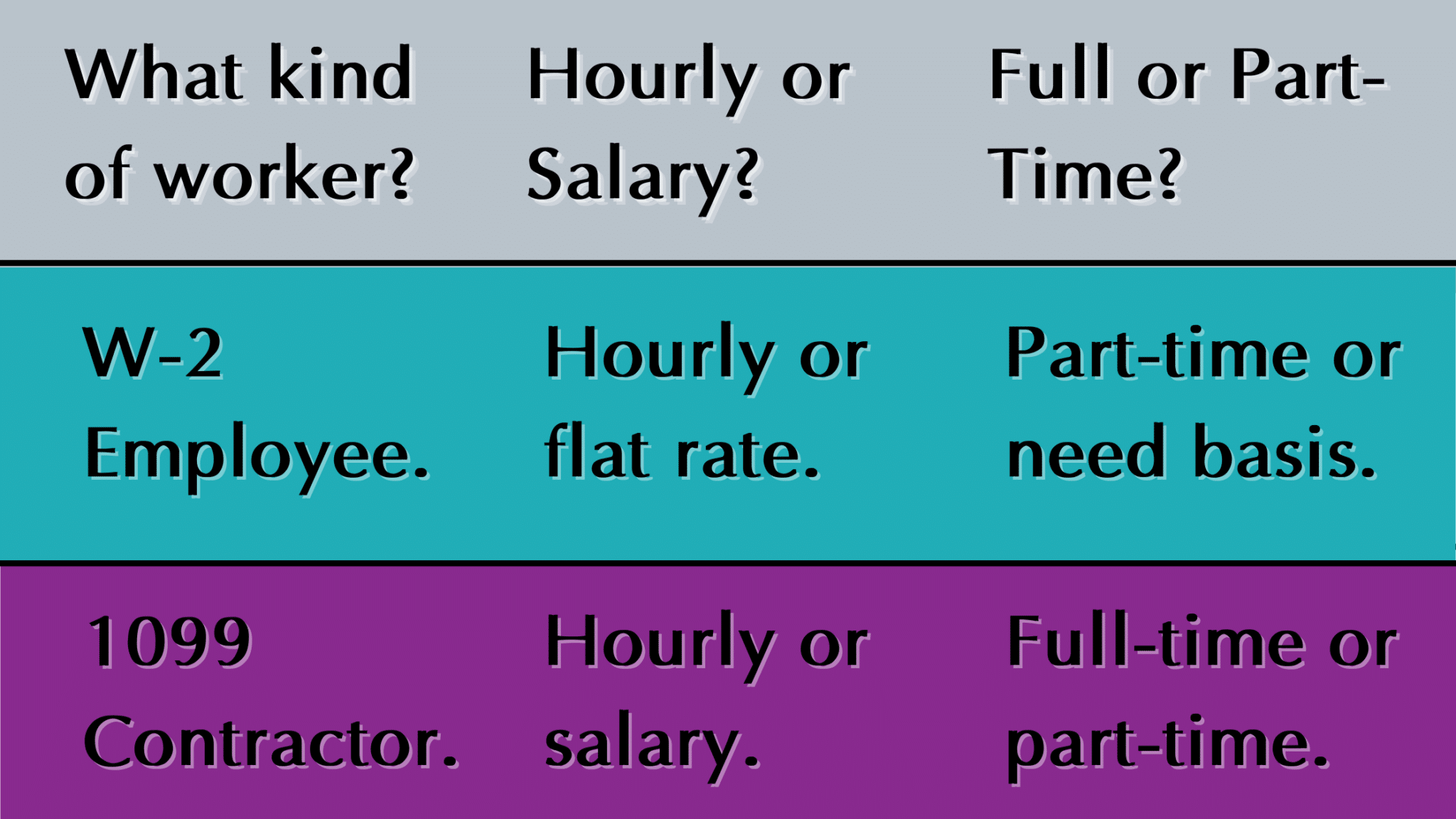

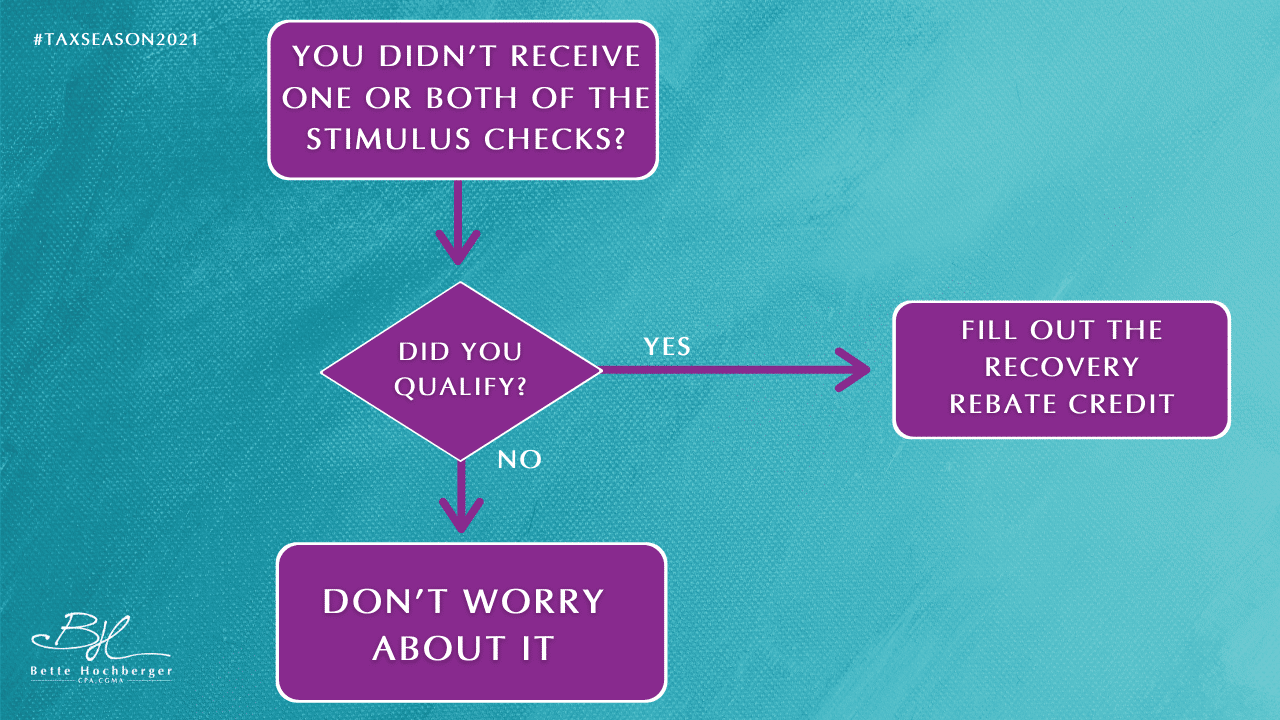

Most people earn some or all of their income from some manner of a job, earning wages or a salary. Employment tax issues often revolve employee status, and many decisions around corporate structure are related to the need for the owner to be an employee – on payroll – or not. The most common numbers looked at for economic health are the jobs report, unemployment rate, and wage growth rates. The increasingly flexible economy has huge benefits for those with high earnings able to utilize a variety of new services, but for lower skilled employees, they have often struggled to find permanent employment instead of a series of 1099 Gig Jobs.

We help employers determine how to classify their workforce, determining who needs to be covered by payroll vs the 1099 process. The need of the modern entrepreneur to maintain flexibility may often create counter intuitive scenarios, like an S-Corporation running owner payroll while their team is predominately 1099 Contractors.

As a small business oriented CPA firm, we help owner operators navigate these financial, legal, and moral quandaries as they build their business.