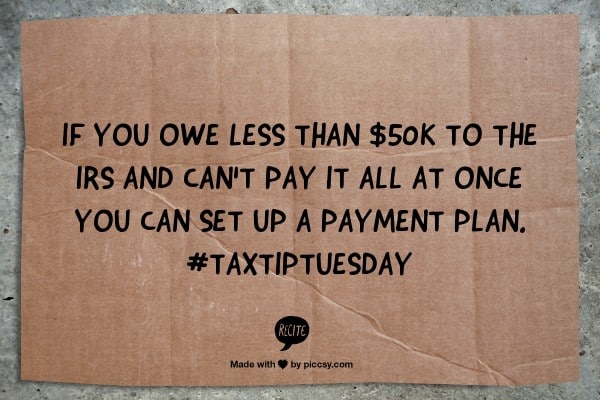

When you owe the government money, there are many steps that occur before the Treasury sends guys with guns to collect. If you don’t pay, they may put a tax lien on your property and accounts. You can often settle up with installment plans or payment plans. If you owe back taxes, there is always a way to get caught up.

Assisting taxpayers that are dealing with IRS audits is known in the accounting profession as IRS Representation, because we are serving as your representative in interacting with the IRS. State Revenue Representation is handled in a similar manner, but often your state tax audit runs in parallel to your federal one.. Any tax resolution program will require getting into compliance with your filings, demonstrating a good faith effort to avoid future errors, and reaching a settlement with the IRS or state revenue department regarding the back taxes and any relevant interest.

Many people arrive with years of unfiled and unpaid taxes, finding the process of catching up daunting. If you resolve your situation before the IRS locates you, it is easier and less expensive to resolve. Many taxpayers go several years without filing and think that they won’t be bothered, only to find the IRS contacting them demanding years of payments all at once.

Once the tax officers have contacted you, the timeline to manage your compliance situation goes quickly, so securing competent IRS Representation early in the process is important to minimize the back taxes, interest, and penalties owed.