S Corporations get their name from filing on IRS Corporation rules Subchapter S. This popular small business structure is legally a corporation, but taxed as a pass through entity. Until the single member LLC (files as a sole proprietorship) or a multi-member LLC (files as a partnership), the S Corporation allows the business to divide the payments to the owner into payroll (subject to payroll taxes) and profits (not subject to payroll taxes). In contract, the other structures require the owner to pay self employment taxes on the full income.

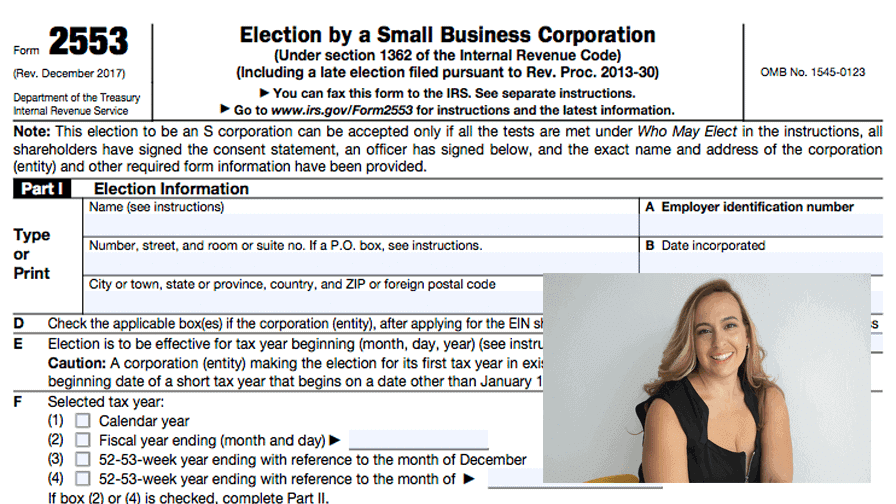

S Corporations must have a limited number of shareholders (< 100), a single class of stock, and be entirely owned by natural persons or estates. This structure is a very popular, and tax advantaged status for small businesses. This status avoids double taxation of a C Corporation, and also allows you to avoid self employment taxes by dividing your income between payroll and profits, with payroll subject to FICA taxes and profits being subject to ordinary tax rates less the Qualified Business Income deduction.

Under the 2017 The Tax Cuts and Jobs Act (TCJA), S Corporations because even more advantageous. When you have pass through business income, you receive a tax deduction of 20% of your “Qualified Business Income.” There is a qualification test based type of business, but only for taxpayers with a taxable income over $332,600 (or $163,300 for singles) in 2020, increasing each year.

For most small business owners, this essentially reduced their tax bill on all business profits, which is generally the majority of their income. For high earning individuals, it is important to review the QBI qualification rules, but if your income is under the threshold, you simply get your taxable income reduced.