There are numerous forms required by the IRS and State Revenue organizations. Tax code compliance will often require the filling out of various tax forms to comply with state and Federal rules.

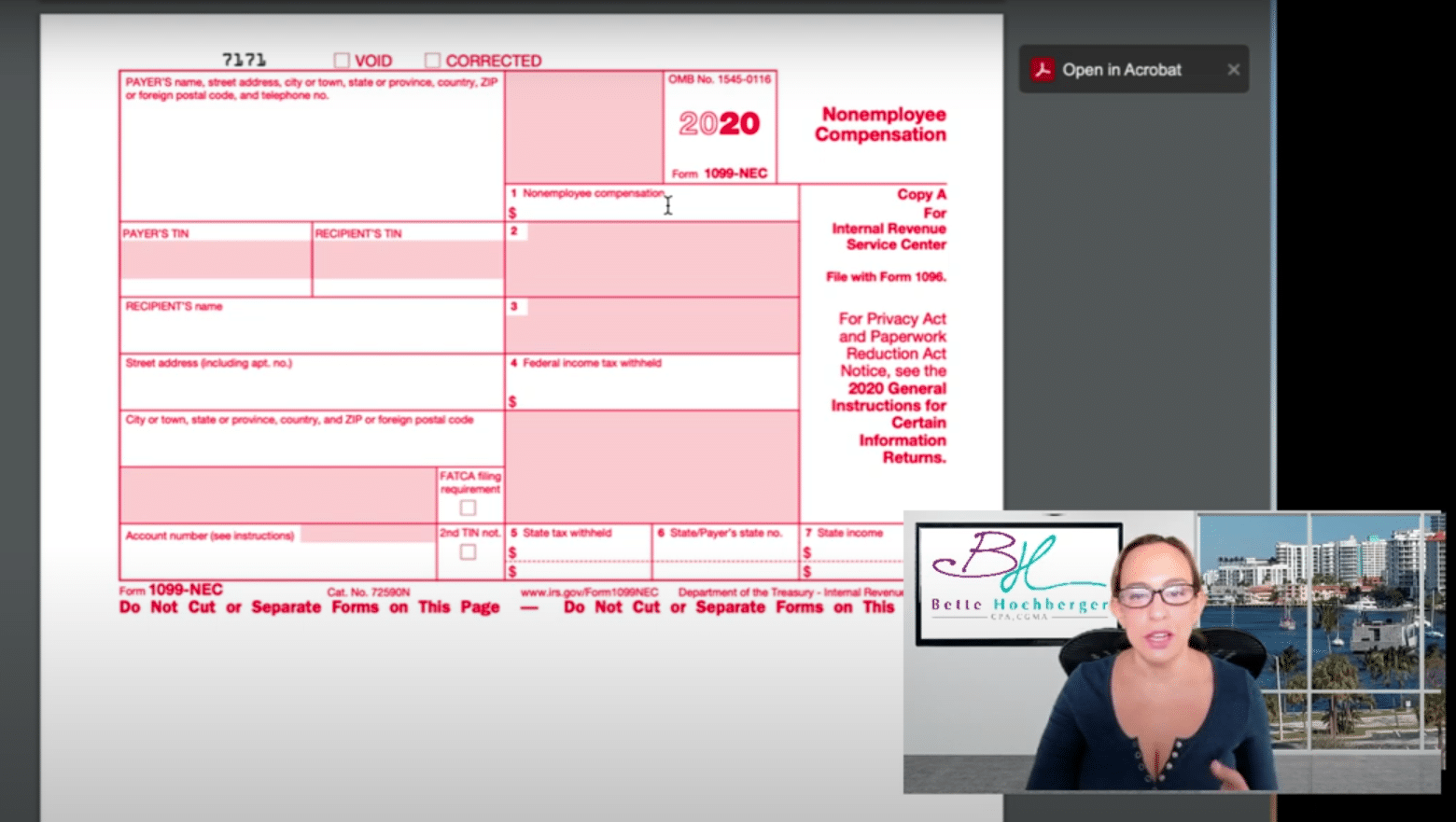

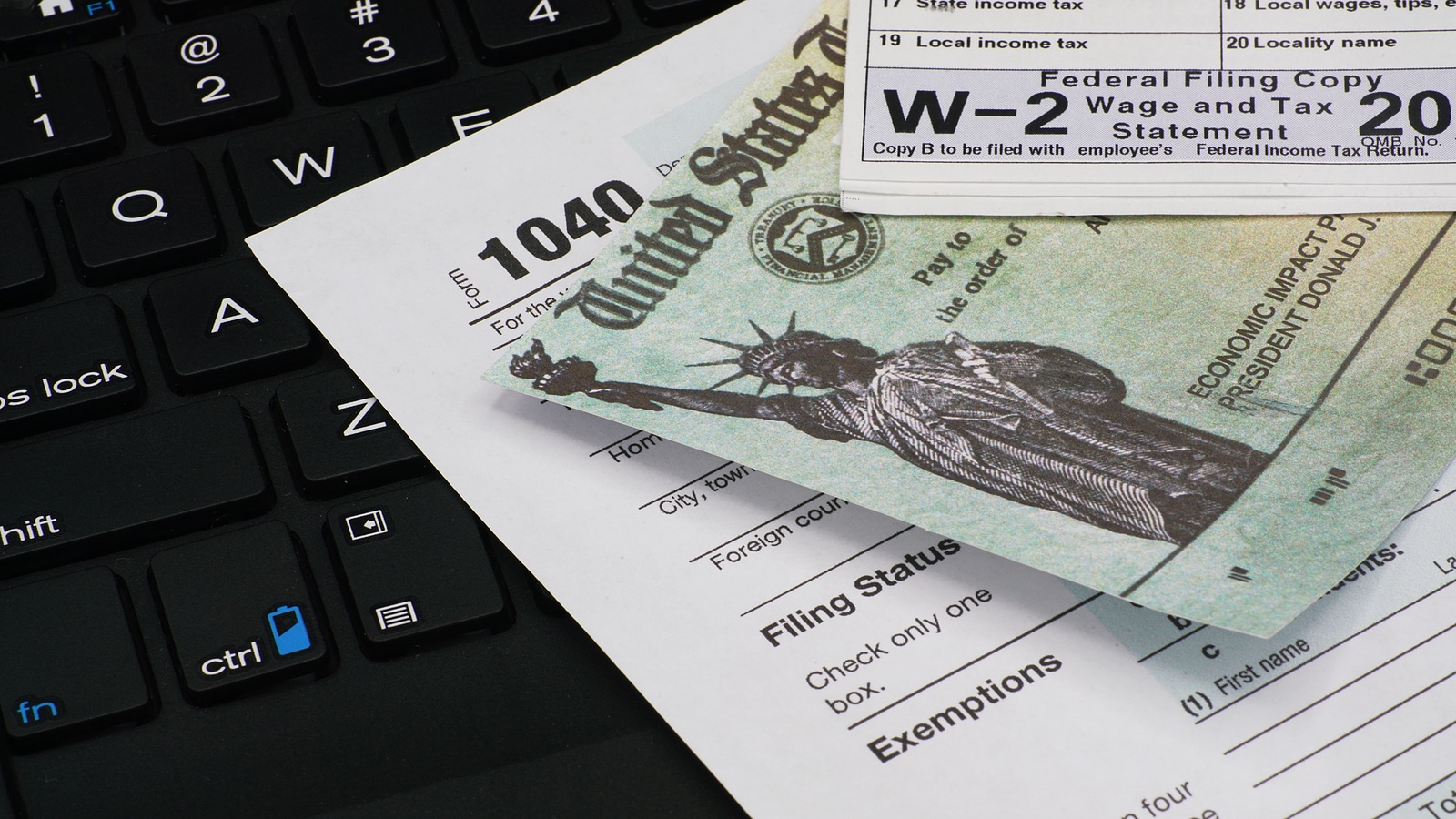

Many common tax forms for individuals include the W-2, 1040, 1040-SR, 1099-NEC, and the 1099-MISC. Prior versions of the 1040 include the 1040-A and the 1040-EZ, retired after 2018.

The 1040 is the standard American Individual Tax form, everyone can file it.

The Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

1040A was an American individual income tax form. Your income must have been less than $100,000 and could only be from certain income sources. Only certain adjustments to income and tax credits could be claimed. Not itemization was allowed.

The former 1040EZ was the simplest of the 1040 forms individual taxpayers, limited to only those of moderate income and extremely simple financials. You could only use this form if you have no dependents, income is less than $100,000, claim no income adjustments (like student loan deduction), don’t claim tax credits other than the earned income tax credit, amongst other things. T

The W-2 is the report of wages for people that work a job that are paid a wage or salary, referred to as “on payroll.” The 1099-NEC (formerly the 1099-MISC) is used to report money paid to a contractor or vendor for non wage or salary work. This is referred to as “contractors” or “off payroll.”