Educational Video

Tax Extensions are a safe, legal, and reasonable way to get more time to file without paying penalties. You can quickly fill out Form 4868 and get a tax extension. Note, in 2020, because of COVID-19, the deadline was shifted, which had some implications. IRS Form 4868 – 2019 Addition.

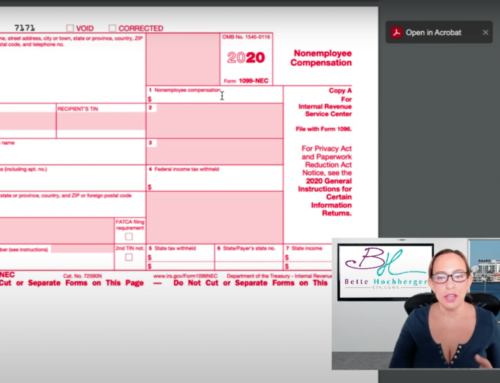

We’re getting close to the individual filing deadline, April 15th, 2019, for tax year 2018. So I thought it might be useful to show you how to fill out your own tax extension. This is the form, it’s Form 4868. Now the easiest way to find this is to go ahead and just Google IRS Form 4868, and it’ll pop up. You can grab it right from the IRS. And hopefully, my internet will keep up here. So you’ll see a bunch of these ads. You can skip all that. Go right to the IRS.gov one. Grab that fill-in PDF. And make sure you’re using the correct year. So if you’re using this for a year other than filing your 2018, you can follow the same instructions, but make sure you’ve got the right year up here. So there’s some information. You can read through it, but basically you want to get down here. Now the quick and dirty way to just make sure you file this is to fill it out, and we’re going to end up putting a bunch of zeros in. So, I’m just going to make up some information here. I’m in Hollywood so I’m going to use that.

And then you would put your actual social security number here. Now, if you’re married, filing jointly, you want to make sure you get your spouses in here so that you’re both extended. You would put their name up here also. Now, really you’re supposed to put actual information in here, but if you’re just want to make sure your butt is covered as far as having filed a timely extension, you can just go ahead and put zeros in here like this. Oop, sorry, went a little too far. This right here, this alone will get you covered. If you take this and you mail this in by April 15, and I always tell people if you’re mailing stuff to the IRS, mail it certified return receipt. You get those green cards. That is your proof of filing, your proof of mailing it on what date, and if the IRS claims they never got your form, you can use that as your proof that it was received.

So that’s the real quick and dirty. You’ll print this out. You can out that part where it says detach here and send that on its way into the mail. Somewhere there’s an address for it – I file tax extensions electronically.

Now here’s the thing to remember. An extension of time to file is not an extension of time to pay. So what does that mean? Well, right here, we’re just filing a bunch of zeros, but say you actually knew that your tax liability was $10,000 and you know you paid nothing in and you know that you’re going to owe $10,000, well, you’re going to still accrue penalties and interest for not paying. You won’t get the failure to file penalties. That’ll get stopped with the extension form, but you are going to still owe the money. So you’re going to owe the tax. You’re going to accrue interest on that unpaid tax and your payment and late payment penalties. Now, if you were going to pay that 10,000 right there, or any other amount, you would put it right here and send that in with your check. Or, you can go online and pay or use EFTPS if you know what that is. The IRS doesn’t love getting checks, but they will take your check, and they will cash it so don’t worry about that. You can still send them some paper, not their preferred method, but they will take it.

And if you know that you did, “Oh, hey, I did make an estimated payment in there,” and you know how much that is, you can put that in, and maybe now your balance is only 8,000, and you can figure out how much you’re going to pay. And if you don’t even want to go through any of this stuff, honestly, if you just put in the amount you’re paying with your extension and leave all the rest of that blank and just put it right here, the IRS will still take your check, and you will still have an tax extension filed.

So, make sure you’re not late. You still have some time as of my posting of this video. You cannot file these after the 15th or after whatever the day is. So, if you’re late, you’re late. But go ahead, get those in, gives you until October 15th or whatever date it happens to be if that’s over the weekend. So it gives you a few more months to get everything together. Well, I hope you found this helpful. If you have any questions, you can leave them in the comments. You can reach out to my office as well.

You can get the form from the IRS, IRS Form 4868.