Educational Video

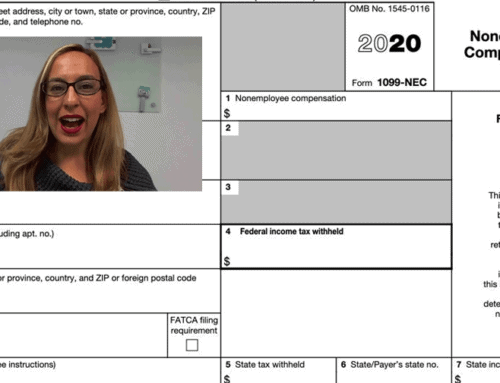

Hi, I’m Bette Hochberger, CPA, CGMA. This video will walk you through the 2020 filing season, so in 2021 new, the 1099 NEC, 1099 Non-Employee Compensation. This form replaced 1099 Miscellaneous, or Misc. So if you have contractors, subcontractors, independent contractors, whatever you want to call them, people who are not employees, not on regular payroll, you’re going to need to fill out this form to report what you paid them if it was over $600. So I figured the best thing would be to go ahead and let’s walk through it together.

Now, I am going to tell you that most of the time, you’re not going to file these on paper anymore. The government is getting a little bit more tech-savvy these days, so it’s easier for you and for them and everyone involved if you go ahead and find someone to do this for you electronically. There’s a lot of relatively inexpensive services out there that you can find. I like track1099.com. I think it’s what it’s called. There are a few others. If you Google it, you’ll find it. And, oop, let me get to the right page. Oh, no. There we go, 1099 NEC.

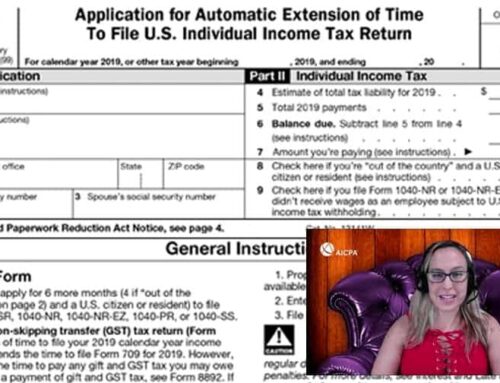

So this is the forms, this is what it looks like, and it has a lot, a lot of pages. It’s kind of all the same stuff and some instructions, yadda, yadda. Also, if you’re going to use these forms, you’re not supposed to print them off the website, so that’s another thing. It gives you a little bit of a warning there.

So if you were going to fill this in, and you’ll see this is not a fillable PDF, but basically what you’re going to put in here is the payer is you, if you’re the business owner or the business. You’re going to put in your information. So if you have ABC Corp. and your address is 123 Main Street, et cetera, you would put all that information in.

Then in Box 1 over here, Non-Employee Compensation, you’re going to put the dollar amount that you paid the individual. The payer’s TIN is your business’s EIN, and the recipient’s TIN, it could be an EIN if it’s a business. If it’s an individual, it’s going to be a social security number. You see, these other areas are kind of, I call it grayed out, truly like redded out; there’s nothing to fill in there. Once in a great while, you’re going to have some federal tax withholding. I hardly ever see that, so this is usually left blank. Then this part’s relatively self-explanatory. Recipient, so who are you paying? This is their name, their address, et cetera. Then there’s some other stuff here and there.

I happen to live in Florida. We don’t deal with state tax withholding. But even so, beyond the Florida thing, a lot of times, you don’t see withholding on these 1099 NECs. I think you would know if you were in that situation. So if in doubt, you’re not. You’re not in that situation.

Now you get into some of the other copies, and here you’ll see you actually can fill this part in. This is not the one that goes to the federal government. It doesn’t go to the IRS, so I guess they’re, like, “We don’t care what you send.” This one’s for the state tax department, so you can fill whatever information you need to fill in there, one, two, et cetera. It’ll let you fill all this kind of stuff in kind of how I was walking you through it before when it wants to work. It’s pretty straightforward.

There are multiple copies because there’s a copy for the recipient, which would be for their records. This is for your state tax return, if you have one, again, if you’re filing on paper. This is the employer or the payer, as we’re referring to them. That’s their copy.

Now, the tricky thing, if you do hand out these 1099 NEC forms on paper, you are going to have also to file this form, which is 1096. This is a summary; it’s a summary form of all the various 1099s you could be filing. It might be a little hard to see on the screen, but if you pull up that form, you’ll see there are so, so many different things you’ve probably never even heard of—some of these things I never even come across, even in my practice.

But you’re going to have to find the one marked NEC, which, oh my goodness, I can’t even… Oh, here it is, NEC, and you’re going to have to; well, this won’t let me click it because, again, it’s the red fileable copy that they don’t want you to do fill-in form. They want you to order the actual papers. You can get them from the IRS, or you can get them from Staples. Office Depot usually sells these, but you’re going to put the filer’s name in your business. It’s the payer or filer; it’s the same thing, street address, et cetera—person to contact. If you have like a bookkeeper or a manager, someone who should be fielding questions should arise, you would put their information here, email address, et cetera.

This is the employer identification number of your business or social security number if you’re a sole proprietor. You’re handing these out and the total number of individual forms that you’re filing. That would be a combination where you would have your NECs and all those. So if you have a couple of 1099 Miscellaneous, a couple of 1099 NEC, stick them together on the form. Then you’re going to total that federal income tax withheld. Again, that’s what I said. You’d probably never going to have. It’s probably going to be zero. Then the total amount you’re paying. So this is the little box. Let me see if I can bring that back up for you. Let’s see, somewhere useful. It’s this. It’s not the Employee Compensation box that wasn’t letting me fill anything into it. This is where you’re going to total all of these across, however many you have, to come up with the number for 1096, and that’s going to go over there in Box 5.

Then you have to sign it. Someone has to sign it. They want a wet signature, so my advice, sign it in blue, so they don’t kick it back and say, “Hey, you didn’t file this,” title, date, all that good stuff. Then it tells you right on here, “Where are you filing this?” Yeah. So it’s not so bad.

Oh, I will tell you if you file online, which I highly highly recommend. Don’t spend your time filling in these forms on paper. If you file it online, there is no 1096. I guess because it’s all directly going to the IRS, going right into their system, they don’t need a summary to make sure they have everything that you’re claiming to send out. So that’s one extra nice thing. You have one less form to fill out if you fill these 1099s out online.

So that’s it. It’s a pretty straightforward form. Not so hard to get through. Again, recommend getting this done online, especially if you have a lot. Please don’t do them by hand. Oh, my goodness. That’d be a nightmare. Yeah, and that’s it.

I hope that was helpful. I hope you enjoyed it. If you did, give me a “like.” You have any questions, drop them in the comments below, and make sure you subscribe. We’ll see you next time.