Meals and entertainment deductions cover the deduction category that now only applies to meals. This is normally a 50% deduction, but for 2021 and 2022 it's 100% for restaurants.

Venture Capital vs Angel Investors Explained

Bette Hochberger, CPA, CGMA2022-05-09T23:25:47-04:00Entrepreneurs should consider the pros and cons before taking in venture capital or Angel Investments. The early stage financing can launch a high growth business, but also puts demands on the team to hit these growth targets.

Accounts Receivable Aging Summary in Quickbooks

Bette Hochberger, CPA, CGMA2022-05-09T23:39:53-04:00Learn how to use the Accounts Receivable Aging report in this live demonstration of an extremely powerful and underutilized tool

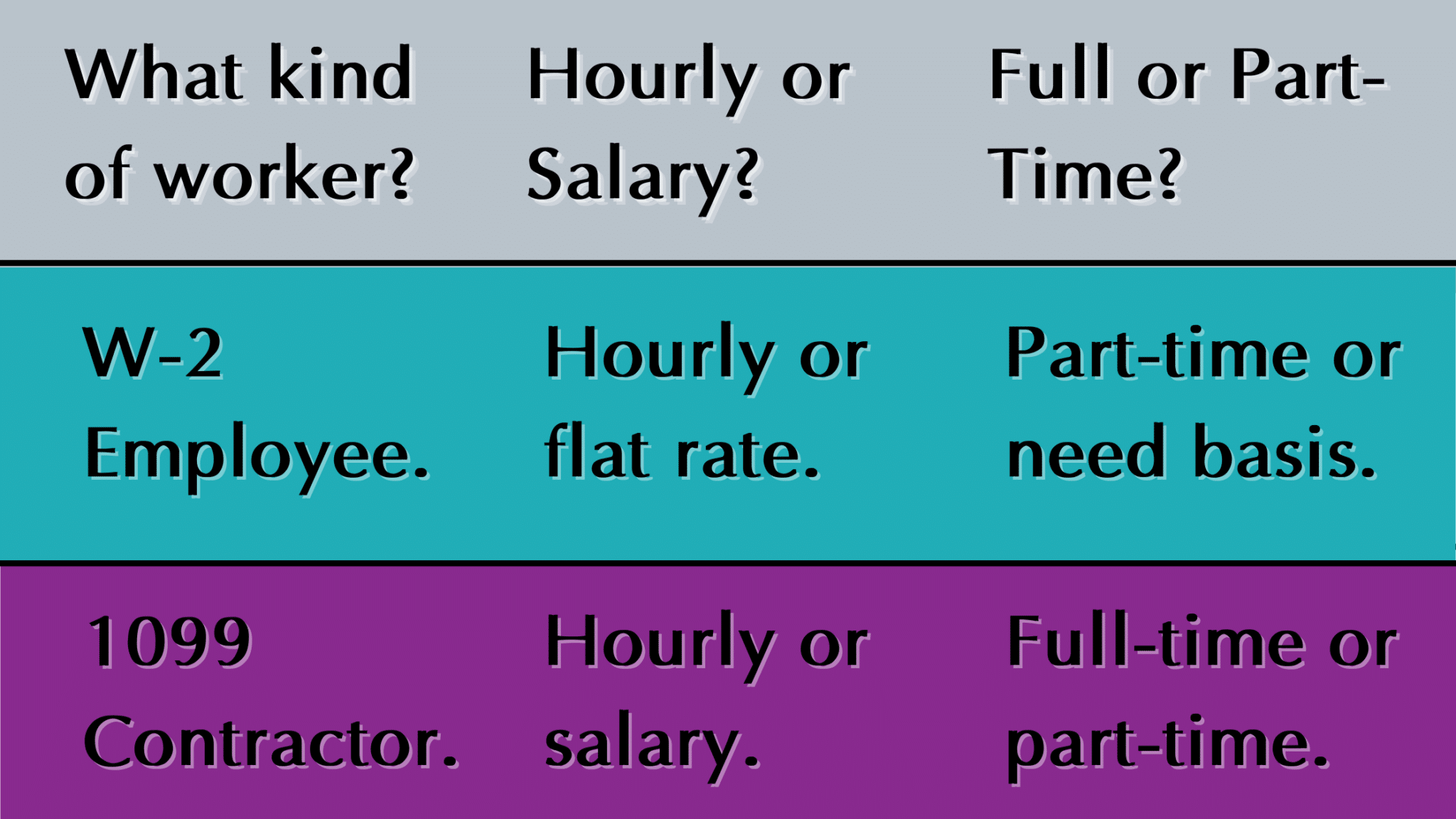

Employees (W-2) vs Contractors (1099)

Bette Hochberger, CPA, CGMA2022-05-10T21:08:13-04:00When deciding between W-2 Employees or 1099 Contractors, you need to consider both the tax implications and the legal status.

Florida Residency: How to Establish It

Bette Hochberger, CPA, CGMA2022-05-09T23:54:40-04:00Florida Residency means not paying state income taxes, so if you are moving to Florida, make sure you quickly get your residency established.

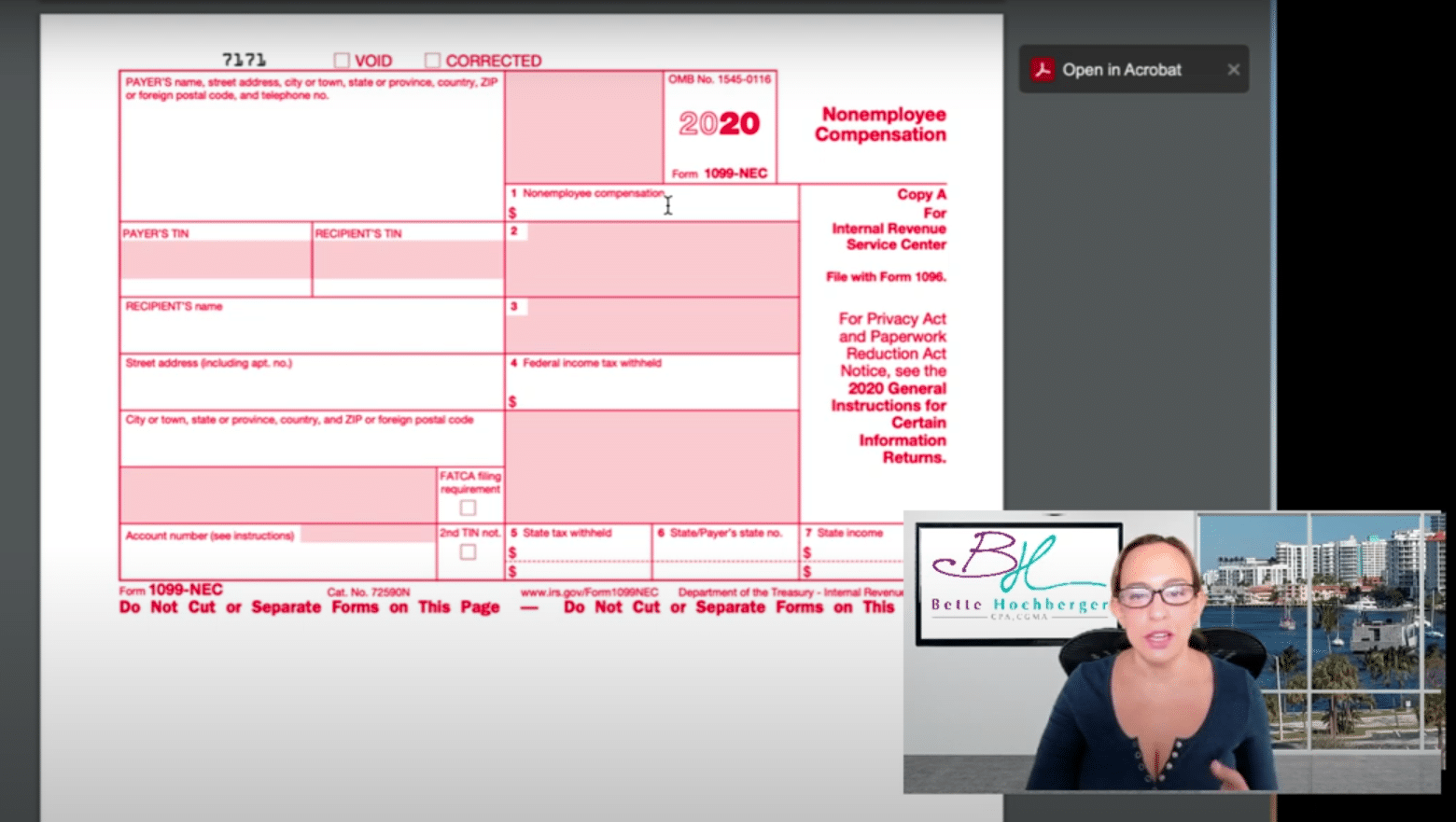

1099-NEC Forms – How to

Bette Hochberger, CPA, CGMA2021-05-05T21:03:43-04:00This video will walk you through the 2020 filing season, so in 2021 new, the 1099 NEC, 1099 Non-Employee Compensation. This form replaced 1099 Miscellaneous, or Misc. So if you have contractors, subcontractors, independent contractors, whatever you want to call them, people who are not employees, not on regular payroll, you're going to need to fill out this form to report what you paid them if it was over $600. So I figured the best thing would be to go ahead and let's walk through it together.

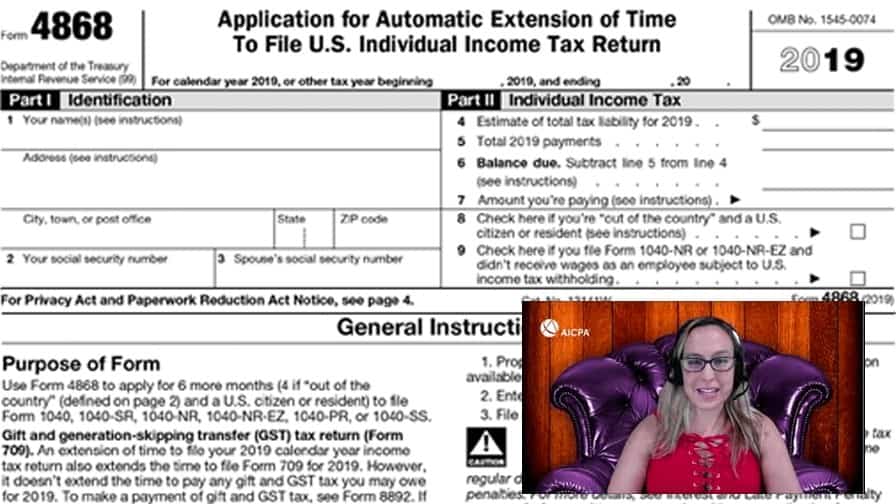

IRS Form 4868 – 2019 Version

Bette Hochberger, CPA, CGMA2020-12-01T00:23:14-05:00Because of the novel Coronavirus, COVID-19, the IRS moved tax deadlines to July. This may create challenges for quarterly payments, since your business results are likely different than in the past.

PPP Info: WTF to do with PPP??

Bette Hochberger, CPA, CGMA2020-12-01T00:29:48-05:00The PPP Program evolved into the largest part of the COVID-19 Stimulus program. While the SBA has continued to tweak rules, this historic video advises on how to implement your PPP Program.

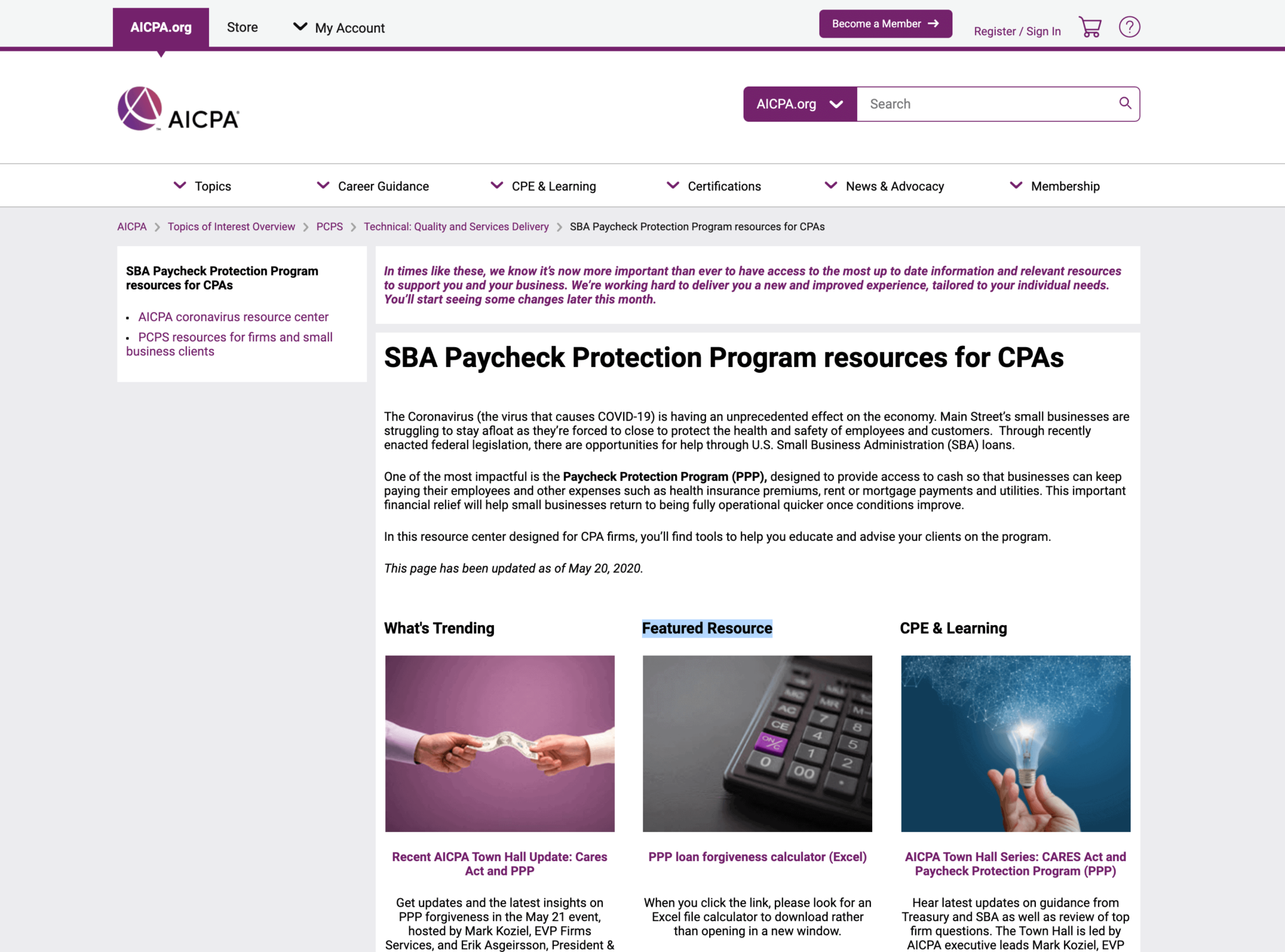

COVID-19 – STIMULUS AND LOAN APPLICATION SUPPORT

Bette Hochberger, CPA, CGMA2020-12-04T00:02:50-05:00CARES Act, the Stimulus Act for the COVID-19 novel Coronavirus, had a lot of moving parts. This was Bette's summary from May 22, 2020.