Educational Video

PPP Loan Forgiveness Application and Calculators

The Treasury department released the PPP Loan forgiveness application. It’s 11 pages long – wow! You can find that here.

If you are trying to see what the loan forgiveness calculation entails, you can see the calculator developed by the American Institute of Certified Public Accountants (AICPA):

Go to this website- https://www.aicpa.org/interestareas/privatecompaniespracticesection/qualityservicesdelivery/sba-paycheck-protection-program-resources-for-cpas.html

In the center of the page under Featured Resource, click the link PPP loan forgiveness calculator. It will down load an excel file.

There will be many calculators that you will find on the internet. Not all of them will be correct. You, the borrower, will still need to certify that the calculations are accurate. Beware of what “tool” you use!

Florida Reemployment – Changing Your Claim Date

Anyone trying to claim unemployment in Florida has probably encountered some problems. The state is trying to process as quickly as possible. They know there are problems, including issues with claim dates being wrong. This is the date as of when you want reemployment to start. If you need to modify your claim date you need to go fill out this webform:

https://claimdate.myflorida.com/recertification

Florida Reemployment Updates

Florida has released a new website for applicants, including self-employed people. The new site is http://floridajobs.org/

If you are still having trouble accessing the reemployment system (like I am!), I highly suggest reaching out to your local State Representative. I called mine and the aid I spoke with was very helpful. She sent me a release form to go advocate to the reemployment office on my behalf. Find your representatives here: www.myfloridahouse.gov

Update Webinar Replay

On April 22, 2020 I did an webinar updating information for the COVID-19 stimulus options. You can watch the replay here. Updates on the PPP, EIDL, unemployment, and how self-employed people can get assistance from these programs. The Senate approved additional funding so hopefully these programs open up soon to get financial help to small businesses!

Where’s my IRS stimulus check??

Still haven’t received your IRS stimulus check? You can check on it’s status with the IRS Get My Payment application here. You can also use this application to update your direct deposit information with the IRS.

Contact Your Senator!

Over a week ago I put in my loan advance request for the EIDL. As of Tuesday April 7 I’ve received $0 of that advance! The SBA has changed the rules on all of us, repeatedly. I called Senator Marco Rubio’s office and left a message with constituent services. They actually called me back, and emailed me a consent form so they can go ahead and speak with the SBA on my behalf. If you live in Florida please feel free to call Sen. Rubio’s office as well and also fill in this form. If enough tax payers complain, they can put pressure on the SBA to do what they are supposed to do. Find the form here:

Privacy Consent Form – Standard 2020 (fillable)

Webinar Replay

On Friday April 3, 2020 I did a webinar on the various options available from the government. Did you miss it? Catch the replay below. Please note that the information presented is valid as of April 3, 2020, unless disclaimed in the video. This is a highly fluid area, with changes being made daily. Please check back often.

COVID-19 Loans and Grants

The new stimulus package has many new and confusing options, and we’re here to help. We will help you figure out which programs are right for you and your business.

If your company’s whose books are up-to-date, we can move really fast. If your company’s books aren’t up to date, we’ll review what is needed and help you chart a course to get your records together and application out the door.

You can file on your own, but engaging a CPA can help you verify that there aren’t errors that will slow your application; additionally we can help you review the tax implications.

The initial one hour consultation includes the following:

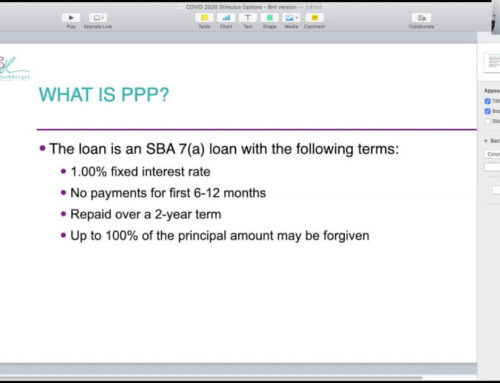

- Review the SBA programs

- Review the status of your business

- Evaluate your tax situation (based on your most recent tax return)

- Cash Management Advisory Session to help you make the best decision for you, your business, and your family.

- Help you decide which program should to move forward

Once we have a plan, we can move forward quickly to get your records in order and application into the SBA.