Educational Video

The PPP – Paycheck Protection Program – has grown into the largest part of the CARES Act Stimulus. This video, from May 26, gave updates on how to handle PPP Loan Forgiveness.

All right, everybody. I’m going to get started. So welcome. Thank you for joining. This is about PPP Loan Forgiveness, thus the title WTF to do with PPP. As I said, this is unchartered territory. We have not had anything like this. There’s no precedent. There’s only the guidance that we’re getting from the SBA and treasury and it’s not fantastic, to be perfectly honest. So I’m going to just go ahead and hop right in. You should be able to see in the chat, there’s a link to download a PDF of the slides, if you want to follow along. I’m telling you I have 40 slides to go through in an hour. We are going to blow through this. Okay? Nobody’s going to be an expert by the end of this but you’ll have an understanding of what you need to do for this PPP Loan Forgiveness. So that being said… And I’m going to try to figure out how to share my screen.

I’m going to screen share and to keynote. All right. Hopefully you guys are seeing the actual… not the whole everything and just the slideshow itself but… Okay. So what to do with PPP? We’re going to go over today, the source, the use and the forgiveness. And our objectives are to figure out how much to borrow, although at this point you probably have already borrowed, presumably, that’s why you’re here. How much of it to use? How you’re going to maximize forgiveness? Which is really the ultimate goal here, is to get as much of it maximize as possible. How much to repay if you need to? Guidance, which is a timing time bomb and how we’re going to just play this game overall and some strategies.

So there are so many pitfalls here. It’s a little bit crazy. So one of the first things right off the bat is borrowing money incorrectly. They’re spending on non-allowed uses and spending on unforgivable uses, because usable and forgivable are not the same, just to make this extra complicated. Spending at the wrong time. There is a specified covered period and it is not the same for everybody. So, that makes it even more fun. Drop in payroll, drop in your employee head count, spending the wrong way on the wrong items and then failing to prove that you are forgiven. This is not automatic. You have to apply for the loan forgiveness.

So right off the bat. Borrowing incorrectly. I’m sure everybody heard in the news all about the… It was big public companies that were claiming the small business administration, PPP loans or Harvard or any of these ridiculously big companies that got this money. And what the Fed nailed them on was there’s a certification saying that you have no other resource for getting this money, which if you’re a public company, that’s obviously not true. If you’re Harvard is definitely not true, you don’t even need charged tuition. So they kind of forced their hand and said, “All right, give it all back. We won’t prosecute you.”

But that doesn’t mean that just because you’re a small business, you did everything correctly. You could have made mistakes and errors in your borrowing application. There could be problems. Yes, under a certain size, they’re not really going to look at you but over $2 million of PPP loan, that’s not the situation. So every step of this has these good faith certifications, right? Funds will be used to retain workers, finance payroll, make mortgage, right? Silly payments. That’s really all that you can do with this PPP loan, right? It’s not, “Well, I’m going to get it and figure it out later. I’m going to use it on what I need.” You have to certify that you’re only using it for the specified things.

Now, on top of that, there are other stipulations. So there’s a no double dipping, right? You can’t use the same dollars for your PPP and then for the EIDL. So if you’re thinking like, “Oh, well, I’ll pay for payroll but I’m going to say that my EIDL also went to payroll.” You’re double-dipping, you’re going to have a problem. You can’t make this good faith certification. If you’re misrepresenting either on your initial application… And we’ve already been hearing stories about fraud, people who made up fake payroll return, tax returns and submitted it.

Those people are being prosecuted. If you spend at the wrong time and I’ll get into that in detail, you don’t have this money forever to spend for the forgiveness. It’s within a certain allowable timeframe. And if you fail to trace the proceeds to the expenses, right? Yes, money is fungible but you need to document the crap out of this to get it forgiven. And then this is… If anybody’s looked at the form 3508 that they put out, this is just some screenshots of that form. It’s an 11 page document with schedules and instructions. And it is all over the place. It is not like a linear first calculate A then calculate B. It has you bouncing back and forth. I do have a tool, I can show you at the end for help with trying to calculate this, if you are trying to calculate it on your own.

There’s going to be a lot of different calculators out there. They are not all going to be correct. You just have to understand, if you pull something off the internet… For example, I was in a continuing education yesterday about this. They said, ADP, the big payroll processing company has a calculator that they put out and there’s already been chatter that it might not be right. So you have to be super, super careful. You can’t just download somebody’s calculator and assume that what they’re putting out is correct and just use it. You really have to think about this. You have to be super intentional. Very, very careful. All right. I got a question. When you say not to double dip, if the funds go into your deposit account, continue to pay payroll and rent utilities usual, how do we keep records of this properly?

Leslie, I’m going to answer that later on in this webinar. So that’s a great question. That’s the crux of the whole thing. And so, this is the beginning of the form. Now, it’s going to ask you all these questions. Like you have to know your payroll schedule. And if you’re not the person in charge of the payroll schedule but are running payroll but you are the owner of the company, you’re going to have to make sure this information is correct, because you are signing certifications. And then you see there’s this line. If borrower together with affiliates applicable receive PPP loans in excess of two million click here, you are subject to extra scrutiny, not extra documentation necessarily but two million was the threshold that the SBA has, where they are really going to look at you much more closely.

And then there’s this whole crazy calculation for full-time equivalent employees, FTEs. I’m going to go into more detail but there’s stipulations that you have to keep close to your same head count as you had before the corona apocalypse. And here’s the certifications that I mentioned. There are fines. You can go to jail, like there’s some serious consequences. You’re saying that what I’m turning in matches the IRS. I’m not making anything up, et cetera, et cetera. I’m going to that a little bit more. So filling out this form and it’s a beast of a form, the guidance is very unclear and we’ve had this issue from the onset with PPP when they first announced it. They were coming out every day and you can go back and watch my old webinars about the stimulus packages.

They would change every day, they were changing the interest rates, they were changing terms. It was just nonstop, literally on a daily basis. Sometimes more than once a day, they were changing things. This is a brand new program. Normally, with these kinds of things, they go through a legal system where it gets hashed out. And over time we have case law or we’ve got precedents that show us, this is the right way to do it. This is how they’re going to view things. We have no idea what the SBA is going to do with this. They’ve shown already that they don’t really care what the rules Congress lays out for them, what the rules are. They kind of make it up as they go. And we just don’t know what they’re going to do once people start needing to put in for this forgiveness.

And it’s probably going to start in the next couple of weeks because this program opened in April. So you get eight weeks. In June, people need to start putting in. So we probably will have more guidance for those that were either fortunate or unfortunate, depending on how you look at, it to get their money early on. We have so, so many questions. A lot of times we have no answers and we just don’t have time right now. So, this was a good takeaway. Don’t make irreversible decisions based on incomplete guidance, if you think, “Oh, Hey, well, you can pay for a mortgage and well, I’m just going to try and see if I can take it on my house because I’m working out of my house [inaudible 00:10:38] not fly.” So we’re going to be really careful about how we spend and how we document this money.

Okay. We got question and question about forgiveness stipulation. Employee account has to be the same. What are the dates account has to be compared? Also, does it have to be the same head count, literally, same list of employee? We’re going to cover basically all of those questions later on but they’re fantastic questions and that’s some of the most complicated parts of this. Let’s see. Will you cover how to use this forgiven for self employees that you schedule C? The answer is yes. That’s the short answer. The complicated answer is there is very, very, very little guidance and we don’t know a whole lot yet about the self-employed. So that’s still up in the air. I don’t have so many answers to it at this point.

Okay. So the purpose of PPP was designed to keep businesses with their employees, right? And we wanted to keep people off of payroll, keep them working and that was why the intention is that you have to primarily spend it on payroll costs. And if it goes primarily, which is really 75% or more to payroll costs, you can get a ton of forgiveness for this. And then we had some other issues with the self-employed independent contractors, where ultimately they had applied for their own and they’re going to have to qualify for themselves, which is going to be fun to figure out.

So there’s three aspects. There’s the source, whether and how to apply, which we’re probably a little bit beyond that at this point. The use, using this for allowable uses and then the forgiveness. And we have to jump through a lot of hoops for this forgiveness. Just wait and see. So this is… If you already got your PPP, there’s probably still money out there. I heard that there’s some companies that realized that they calculated incorrectly, they’re going back trying to get more. That is supposedly an option. I don’t know of anyone personally, who’s doing that or any banks that are looking for that but that’s an individual case-by-case talk to your lender. But you can qualify for the lesser of 10 million or average monthly payroll times 2.5.

So the payroll costs, what does that cover? Wages, state unemployment taxes, health insurance and employer on the employer side retirement contributions. Business mortgage interest payments, right? Not personal. You can’t use this on your house. No prepayments. So you can’t pay ahead and none of the principal qualifies for business rent payments, utilities and interest on other debts incurred before February 15, 2020. And you’re going to see this date over and over again, February 15, 2020.

Now, you notice actually in this slide here for use, we’re looking at interest on other debts. It has… I’m sorry. The interest on other debts is number five. We got five uses here. For forgiveness, there’s only four because we lose that interest on other debts. You can use the funds for that. It is not forgivable if you use that. So for forgiveness, they really still primarily want you working with the payroll costs. The business mortgage interest, now the part that is forgivable has to be incurred before February 15, 2020. The rent payments, your lease agreement has to be enforced before February 15th, 2020. Utilities have to be in service before February 15th, 2020.

And we are getting a little bit more guidance about what is utility, electric, gas, water, transportation, not quite sure what the hell transportation is. We don’t think it’s your car, FYI. If you’re like, “Well, I use my car for my business.” We don’t really think it’s for that but we don’t know. So that’s when it those up in the air things. Telephone, internet but again, it had to be already in place. So if you went and at the end of March, when the lockdown started said, “Oh, hey, I need a higher speed internet connection.” You might get pushback on the forgiveness because it wasn’t in service in February.

So again, use and forgiveness are not the same. I can’t stress this enough, not the same thing. Oh no, it’s going to flash at you. So you can imprint on your brain. The hardest part of it, I think to understand is that what you can use it on and what you can get forgiven aren’t the same things. So this little chart, I kind of copied it largely from the continuing education I said in on yesterday. This is a great way to see what you can use but what can you get forgiven. So payroll, use it, yes. Forgiveness, yes. Mortgage interest, remember business mortgage interest. So if you own your office space, things like that. Yes, it’s usable. It’s not forgiven unless it was incurred, meaning you already had the mortgage set up before February 15. Rent, yes, it’s usable. Forgiven, no. Unless your lease agreement was enforced before February 15th.

Utilities, yes. It’s usable. Forgiveness, no, unless it was in service before two, 15. Interest on other debts incurred before two, 15. So if you have other loans ahead of time, yes, you can use it. No, you will not get forgiveness. Okay. And the no is red, it’s bold. And then other expenses, while you probably have a lot of other things that you run your business, besides payroll rent or mortgage, utilities or interest, none of that is allowable under PPP. If you have an EIDL you can use it but not for the PPP. Okay? This is just the PPP use and forgiveness.

Payroll. Now, not all payroll costs are the same for the PPP, right? Ee is shorthand for employee. So employees that live inside the U.S., a hundred percent, yeah. You can use that and you can get forgiveness for it. But if you have employees that live outside the U.S., no, they don’t qualify. Right? And salaries, wages, commissions, tips, their vacation, sick leave, a lot of these things are covered. There are some stipulations of people who go on leave under the Family First Act. This goes back to double-dipping. So if you’re getting covered under Family First, no, you can’t get forgiveness under a PPP. All right. And then the payment of employer side employer or the business side of your retirement contribution plans, you can also use it and get forgiveness.

Payroll taxes. Well, this is super confusing. Blows my mind a little bit. So forgiveness for the employee federally withheld payroll taxes, the employee, not the employer, the employee. Yes. Use it and you can get forgiveness. State and local unemployment taxes withheld from employee. Florida, where I am, we don’t have these… I think New York, New Jersey have those kinds of taxes. Yes, they can be used. And yes, they can be forgiven. Federal payroll taxes paid by employer. No, do not put your FICA on there. Do not say my social security coming out on the employer side. It is an expense to you. It is not usable and it’s not forgivable for PPP. FUTA, form 940. That is a federal unemployment that the employer pays. No, not covered, not forgiven. But the state employer unemployment. So in Florida, that’s our RT-6, Florida reemployment, which is its own disaster that we’re not talking about today.

That is usable and forgivable. And worker’s comp, no, does not qualify for that. Workers’ comp is really an insurance, it’s really not… It’s related to payroll but it’s really not a payroll tax. So spending on non-allowed uses. Borrowing application and certifications are violated, right? So if you said, when you made the application, “I’m going to use this for my payroll.” And then you’re like, “Oh, I need to go buy a new truck.” You violated the certifications that you signed. Now, depending on how much money you got, will determine if they’re really going to come after you. If you’ve got a small, like five, $10,000 loan, you’re probably not going to jail. If you got a $2 million loan and there was a news article about someone… I don’t know, the guy’s name. It’s someone out of Atlanta who was a reality star, lied on his application, made up stuff and then went and bought like jewelry and cars.

He’s probably in jail now. Now another effect of this is the loan becomes recourse, right? And what does that mean? You as the borrower become personally liable, because the whole aspect of this that we haven’t really discussed much is that with PPP, you’re not on the hook for it, personally. So if you got the PPP and your business ends up tanking and you shut your doors in July and you go through and not everything’s forgiven, you actually have no personal recourse. They can’t come after you individually, which is super unusual for the SBA. Usually everything is personal guarantee on the SBA. And then also if you’re violating the certifications, you don’t get forgiveness and it becomes a regular loan. You have to pay it back.

Suggestions on how to use PPP money. All right. This is what I did. I would highly recommend for everyone to do this. Set up a separate bank account, deposit those loan proceeds into that separate bank account. Don’t mix it in with your regular operating funds or anything else like that because it’s going to become super complex to trace how this money is used. Okay. What if it’s already deposited and first disbursement was made? You’re still okay. You can track it. You’re just going to have to be very, very careful with how you track it. Putting it in a separate bank account makes it much easier because you just have a lot more clarity where you can see like, “Okay, this 10,000 went into his bank account and I started paying my rent out of it.”

It’s not a problem if it’s some of it’s already happened. If you could still open another account, it’ll make the rest of the documenting super easy for you. All right. Only pay allowable expenses and costs from that bank account. If you can set that up, track them on a spreadsheet, make a digital folder like Google drive is your friend or Dropbox. PPP loan forgiveness, title it that and start throwing copies of receipts, canceled checks, payroll reports, all that stuff. The name of the game here is CYA, cover your ass. That’s what you want to do. You will need to make sure you can cover all of this stuff. You can document everything.

So things to watch out for. We are all stressed out right now, right? When you’re stressed and you’re in fight or flight, you don’t make the greatest decisions. You’re definitely not thinking terribly logically but here you have to be very specific and you have to be very logical about how you use their funds. It’s not, “Well, I just needed to get cash in and I’ll figure it out later.” And the reason is you only get eight weeks to do this right. So there might not be time to figure it out later. You’ve got to figure it out now. You’ve got to figure it out from the very beginning, right? Don’t make goofy, broad, rounded up transfers. And my example here, I think my electric bill’s around 400. Well, if it was really only $365 and you transferred 400 into your operating account to pay it, well, now the difference is not forgivable because you didn’t pay 400, you paid 365.

So you have to be really, really exact. And then if you don’t prove what you spent the loan proceeds on, you’re in trouble. You’re not really in trouble at the small dollars but you won’t have it forgiven. Especially for the folks on here who are my tax clients, this is very different than filing taxes. Taxes I largely take your word for it. The onus is on you. Nobody’s looking at your documentation unless you get audited. And this is quite frankly the opposite. This is you have no forgiveness until you show the documentation and prove it.

So it’s put it all together. It’s like a reverse audit. I’m going to put all my documentation together and then show it to the SBA and my lender. And they’re going to say, “Yeah, your day.” So it’s really the opposite. They’re not taking your word for it. You have to have this papered. So for a lot of small business owners, this is probably very different way of operating than what their normal business practices are.

All right. What costs can you include? So this is where we’re having a lot of difficulty because it’s costs incurred and payments made, right? And the keyword there is and. This is a little bit of logic and this is not going to be a common sense argument. This is very specific, costs incurred and paid. So paid and incurred versus paid or incurred, right? Those are not the same thing, if you really think about it. Cost would need to happen during the covered period, right? This is this eight weeks. So it’ll get into more detail. As well as paid for during those eight weeks. So question, if you meant to put in your retirement contributions for 2019, the employer side and you didn’t get to it, could you pay them now? Maybe, they’re not incurred now but they’re being paid now.

And again, this is where your size of your loan and the amount of forgiveness you’re trying to get, is probably not guaranteed but probably going to play a big part of whether or not it is deemed forgivable. The covered period, which I keep mentioning. It’s the eight week period following the date of the loan. This is going to be different for every single borrower. It is not as of a certain date. It is from when you get the money, count eight weeks out, okay? This is where we need those incurred and paid costs to happen. Payroll, you get a little wiggle room because payroll cycles aren’t necessarily going to coincide with when you randomly got your PPP money.

So paid means the day the paychecks are distributed or ACH transfers initiate, incurred is the day employee pay is earned, right? So you might have a lagging payroll. So maybe you pay twice a month but it’s lagged. So if I work May 1st through May 15, maybe I don’t get paid for it until May 30th, right? That would be a lag. So my pay and my incurring is a little off kilter. Payroll costs incurred but not paid during the last pay period of the covered period are considered paid if paid on or before the next regular payroll date. Ooh. All right? So here they’re giving you a little bit of leeway as to when you can run your payroll.

A question that I asked the tax attorney yesterday in the webinar I was in, that I have not heard back yet. Can you change your pay schedule to accommodate this now? I don’t know. That’s an interesting question. Maybe you can, maybe you can’t. We don’t have any guidance on it. And don’t know if that’s something that we would even get guidance on before it’s too late. Non-payroll costs. They also must be paid during the covered period, paid on or before the next regular bill date. Even if the bill date is after the covered period. So again, you’re getting a little bit of leeway here. Now, the interesting thing is they’re letting you pay late rent interest in utility if you pay it during the covered period, right?

And if you’re incurring those but you don’t pay them until after, that’s also going to qualify. So you’re really got a lot of moving targets here. It’s a little bit insane, I would say. You’re going to be looking at calendars and watching date payments. It’s going to be a little bit confusing. All right. We’re going to move on to independent contractors. Can amounts paid to independent contractors be included in payroll costs? The very, very first round of PPP information that had come out for just calculating the loan, initially said yes, later was changed to no, because they wanted the independent contractors to get their own PPP.

Does that make any sense? I don’t know. I guess it does to somebody in the government. So this was the treasury interim rule, page 11, no independent contractors have the ability to apply for PPP loan on their own. They do not count for purposes of borrowing PPP calculations. And then from the treasury FAQ on this, no, any amounts paid by businesses to independent contractors are excluded from businesses payroll costs. Okay. I know there are people out there. I have many inquiries about, “Well, I got funding to cover my independent contractors.” By the read of the treasury rules in FAQ’s, they don’t qualify. But this might be an area where your lender is able to get this forgiven for you. And right now we just don’t know how that process is going to work because nobody’s done it yet.

Sole proprietors. Okay. Here’s this self-employed that Robin had asked about. All right. So must have been business on February 15th. So if you just became an Instacart delivery person in April, you’re not qualifying for this. You had to have self-employed income without a loss and schedule C because then you don’t have self-employment income. You only have a loss. Principal place of residence in the U.S. filed a 2019 form 1040 schedule C. And if you didn’t, because you could have started your business between January 1st and February 15th of this year, there’s going to be special rules that we don’t have yet. Isn’t that fun? So we don’t know what to do with those people.

This is another chart. It’s going to be similar with what is the item? What can you use it for and how do you get forgiveness? So if you filed your 2019 schedule C and this is only up to a hundred thousand, there’s the same cap on wages for regular payroll. You’re going to divide 2019 schedule C by 12 and multiply by 2.5. That’s going to give you your loan amount and how much you can use, right? And those uses are the same. It’s the… I’m going to call it payroll costs, it’s really not payroll though, for you. It’s kind of your general income, utilities, business, mortgage interests, business lease, et cetera.

How is it going to be forgiven? No idea yet. We need guidance. We’re still waiting for it. It’s not out yet. If you were not in business in 2019, you can wait for guidance. But as I keep saying, you don’t really have time here. You’ve got to figure this stuff out kind of quickly or you can make a reasonable projection, which I’m guessing is what’s going to end up happening because the longer it takes for the SBA and treasury to come out with these rules, the harder it’s going to be for anybody to figure out what’s happening.

All right. Tax consequences. Any amount forgiven does not have to be paid back. All right. So it’s kind of like free money. Any amount forgiven is excluded from gross income. Now, this is different because in normal tax world, if you’ve got forgiven loans, they’re taxable to you but here it’s not. It’s really quite amazing. This is a point of contention. Are the related expenses deductible? The IRS right now says, no. And it seems unfair at the surface but if you think about it, you’re getting the income for free, right? You’re not paying any taxes on the income. If you took the expenses and deducted those, you’re kind of double-dipping. But the AICPA, who is the American Institute of Certified Public Accountants and Congress are fighting it. So we still don’t know. It’s up in the air but it’s possible that these are not going to be regular deductions on your tax return.

No idea what that’s going to look like. Hopefully, it’s not too big of a pain in the butt. But again, you’re going to make your tax preparer, especially if it’s me, very happy if you’ve kept great records of all this PPP stuff. Allowable but not forgivable. Ooh, what happens? Well, that… And remember, there’s at least one use that it’s a permitted use but it’s not qualifying for forgiveness. So basically, it becomes a regular loan, right? Those PPP funds have to be repaid. The loan remains non-recourse because of their allowable uses not the other allowed uses. Remember, like, don’t go buy jewelry and cars unallowable and fraudulent. But if you use it for other interest on other debt that you have, that’s okay. Borrowing applications certifications are not violated. So it’s not fraud. Basically, what I just said.

Spending outside the covered period. So this is the… If you spend it at the wrong time, you can lose some forgiveness. Covered period is the eight weeks starting the day the proceeds are received or the alternative payroll covered period, which is eight weeks starting the first day of the first pay period following receipt of the proceeds. They’re giving you a little bit of leeway to choose what works better for you, which should hopefully also make some of what you need to calculate, might be a little easier. I’m coming back up by a question. Say sole proprietors that cover all self-employed even if LLC, yes. If you’re a single member, LLC, you’re treated the same way as a sole proprietor for this purpose, also for your taxes, it’s the same. If you’re an LLC of partners, that’s like a whole different situation. There’s a little bit different partnership rules, which I didn’t really go into because there were super, super technical and really specific.

All right. This alternative payroll is only if you’re bi-weekly or more frequent. So if you’re bi-weekly or weekly, I don’t know how you could be even more frequent than that but it’s not for everybody. All right. This is where we start getting into the hairy parts, right? Salary reduction. So forgiveness is reduced. If any employee had wages reduced by more than 25% during your eight week covered period versus the beginning of the year. Okay. And then there’s a safe harbor on here though. June 30th, each employee forgiveness, not reduced if annual salary, as of June 30th, exceeds average annual salary between February to March. Ooh. That is a little bit of a crazy safe harbor. But I think what they’re trying to get at is, it’s the middle of… I guess, towards the end of May, right? A lot of places are still not open yet or not very open.

Are they expecting you to bring in all your employees, if your business is only at 25% capacity and pay all of them? And can you stay in business past June at that point? That’s why they’ve got these safe harbors in case you’re not quite there yet and not quite ready to bring employees back on right away but you’re going to have to get them back in by June 30th. Headcount reduction. I actually had somebody email me about this. Like a day after they got their PPP loan, they had a time employee that left. It wasn’t like, they were fired or anything like, they just like, “I’m done. I’m not doing this anymore.” So this is pretty complex. This makes you do a little bit of math. You’re going to jump through some hoops to figure some of this out.

The drop in number of employees or average paid hours. So maybe you bring all your employees back but maybe they’re only half time now. So you’re not paying them for as many hours, right? Or maybe you can only really bring back a couple employees. Not everybody. Forgiveness is reduced if the borrower’s average weekly FTE employees covered during period is less than the reference period. Right? But again, there’s safe harbors. So if you’ve reduced your FTE levels between February through April and then you restored them but not later than June 30th. So again, they’re kind of being a little bit understanding that everyone not might be back up and running. You might not be able to actually bring everybody back in a reasonable way until June. But the deadline for this is June.

Hopefully, we don’t have a lot of state counties, cities that are still super locked down by June. I don’t know what those people are going to do otherwise, because they’re going to be screwed if they got PPP loans. All right. What if employees won’t come back? We’re hearing a lot about this. Employment is so appealing right now because there is that extra federal $600 per week. You’re hearing a lot of stories, especially people who don’t make a whole lot, not wanting to come back because they’re making more being unemployed.

Well, obviously, there’s a lot of problems with that but for the PPP, as far as we’re concerned, if you can document that you made as the employer, a good faith written offer to rehire the employee but the employee rejected or the employee during the covered period had to be fired for cause, where they voluntarily resigned or requested a reduction of hours, that’s not going to negatively affect you for the PPP calculation. Again, you need to document, document, document, get it in writing. Even if you’re not in an industry where you normally have things in writing, you’re still going to want to have that. Like for example, restaurants, I don’t know how many restaurants have written offer letters for servers, things like that but you’re going to have to get stuff written offer.

I mean, even if you end up with a text message conversation, if you can screenshot and print, at least you have something to document and somebody won’t come back. All right. Here’s another problem. If you spend too much on non-payroll, wait, the rule is you need to spend at least 75% on payroll costs. So you’re going to take all of your payroll costs divided by point 75. All right. So your forgiveness then is not going to exceed this amount. So 75% of the costs have to go to payroll. If not, now we’re going to take our payroll costs divide by 75% and that’s going to be the max forgiveness. I don’t know why they use the same exact percentage. I don’t know how they came up with it. It makes it a little bit confusing but here’s my example for you. If you’ve got 5,000 payroll costs, you divide that by 0.75, you get 6,667. All right. So, that would be the cap of your forgiveness, if your payroll wasn’t or if your costs weren’t at least 75% payroll.

Let’s see. What if all funds are used for payroll, is it a hundred percent forgiven? The short answer is yes. You can use at least 75% to payroll, right? So the problem is if your non-payroll goes above 25%, if you use it all for payroll, you’re probably fine. Forgiveness process. Okay. So time check here. This is the general process. It is going to be highly specific to your lender. Okay. That can be frustrating. I know for me, I got Bank of America. They basically said, “Don’t call us about this. We won’t talk to you.” If you’re with maybe a nicer bank, you’ll get a little bit more feedback than what I’ve been getting. So here’s the general process, right? You’re going to have that SBA form that you’re going to have to fill out.

It’s got the PPP schedule A, you need that payroll documentation, payroll reports, copies of the tax returns that you are sending to the IRS and to the state. So your 941s, your state unemployment tax, then you want to see receipts or canceled checks, especially if you’re handing out old cash and payroll, if it’s direct deposit, it’s a little easier to show because there’s not so much of keeping canceled checks that you have to deal with. You’re going to have to go through that FTE calculation and all that documentation. For the non-payroll costs, if it’s a mortgage, you’re going to have to include a copy of the mortgage, right? And remember it’s business mortgage only.

An amortization schedule to show that what you’re paying for is only the interest portion and amortization schedule basically breaks down your interest and your payment. For those who don’t know. Receipts or canceled checks, something to show that yes, the mortgage company got your payment and yeah, they deposited it, cleared the bank, et cetera. If you’re going for rent, you need a copy of your lease agreement, receipts, canceled checks, utility payments, receipts, canceled checks. All of these things, keep copies. You’re going to have to make these borrower certifications.

So you had to make certifications to get the loan. Now you’re making certifications that you used it, how you needed to. A dollar amount for which forgiveness is requested, was used to pay costs or eligible, includes applicable reductions due to decreases. Like we kind of went through before, does not include non payroll costs, blah, blah, blah. Funds not knowingly used for unauthorized purposes. Calculations are accurate. And you’re saying I did good math, right? That’s part of this is that I didn’t screw up my calculations.

The required documentation’s provided, everything is true. Everything’s consistent with what I’m giving to the IRS. So if you find there was a mistake in your payroll and you have to go amend returns for some portion of this, you might have an issue later on. So hopefully everything is correct when you’re filing. Yeah, keep this documentation for six years, six years, keeping this documentation. What do you have to keep, that PPP scheduling worksheet, documentation supporting each line on schedule A, documentation with job offers and refusals, firings, resignations. Documentation that you submitted with your loan application, right? So if you don’t have whatever you put in for that loan, go find it because you’re going to need it. It’s just more and more… Basically anything that had to do with PPP, you’re going to have more and more paperwork and you’re going to just have to hold onto it.

All right. So that is a blow through, like I said, it’s a lot to cover. This is so new. It is so different. This is not a service that is included with anything else that I do. So for example, if you are a tax client, do not assume that I am doing this for you or that my firm is going to do this for you. This is completely new. It is completely different. Yes, we are offering a service to do this, if you don’t want to go it alone. And quite frankly, I would be nervous to go this alone as a small business owner, just because there is so much and it’s changing constantly. So we are putting some packages together to help do those calculations, put together the documentation, help you track it properly in your books. This is a really very different from anything else that any of us have seen before, right?

It’s brand new. There’s no guidance except as it comes out, there’s nothing to say, “Well, what did we do before?” There is no before. So we are available. I don’t know if I’m going to do any more webinars, even on this matter because it’s just going to get more and more nuanced and detailed at this point. But in other things, I do have a business book club that we moved it to being virtual and set up a group on Facebook. If you want to learn some more about how to make your business better, come join it. It’s on Facebook. We’re [inaudible 00:46:11] start with why in about a month. I’m putting a lot of general information about stimulus out on my Facebook page. It’s also on my bettehochberger.com/covid-19. And who’s got questions?

Also, I just wanted to throw this up there for the Game of Thrones fans, A Lannister always pays his debts. It’s a little humor about loans if there’s such a thing. Okay. Another question. Do you know if nonprofits have different kinds of requirements, rules regarding PPP? I do not believe so. I think they are roughly the same because you still have to mostly spend it on the payroll. You’re looking payroll for the most part that 75%. You’re still dealing with those limits. Hold on. Okay. I’m going to hop in the chat because it’s [inaudible 00:47:08]. I couldn’t see it while I was doing the thing.

If you pay yourself via draws, should you write yourself a check weekly, true payroll? I would like to send you [inaudible 00:47:18] not super clear. Okay. 1099 subs. Everything coming out is saying that it is not going to be forgivable. Again, your lender might have something else to say but according to everything that I have read and every time I ask the question, they’re saying no, on 1099 subs. Pay yourself via draws. Draws are not covered for S-corporation owners. It is just payroll, right? Can you get away with it? Maybe, there’s no guidance right now. So far, they’re just saying that it’s payroll, payroll, payroll, payroll. I am paying for house hard money. Paying interest only as construction company considered investment property [inaudible 00:48:01] in the name of the one biz paid by my biz. That might qualify if it’s in the name of the business but just the interest, right? Only the interest portion. And you’re going to have to follow their amortization schedule. If you only get forgiveness in 75%, 25… Oh, sorry. Telephone.

Could you only get forgiveness in 75%, 25% for the portion of money that you use, if you don’t need the balance? I don’t totally know what that means. If you don’t need the money, you’re actually supposed to give it back to them. There is a deadline for that. I don’t know what it was. It might’ve passed. Paperwork for a hard money private lender. I don’t think it matters if it’s not conventional. I think there’s still going to want to see it. And you’re probably still going to need an amortization table. Start date. Does it go by the date we received EIDL or PPP? So for this, the covered period starts, when you got the date, you got the PPP. How do you pay yourself? You have to go through payroll, unless you’re self-employed. If you’re self-employed, LLC single member of file, schedule C, then it’s different. But if you’re on payroll, you got to run on payroll. Let me see, let me show you guys a couple of things. I’m going to share a screen again here.

So this is… Let me pull it up. This was released by the AICPA. So it’s the American Institute of Certified Public Accountants, who put out a lot of about the PPP, the whole process. They’ve had a ton of information. It might be very technical because it is really for CPAs but it’s open to the public. So they created this workbook to go through. Now, notice it says here, draft as of May 21st, 2020, I don’t know if it’s ever going to stop being a draft because they’re just going to keep changing things, right? And this is another fun thing that they have in here. It’s this yellow box, your judgment and interpretations of the act maybe necessary, right? So even the biggest CPA organization in the country, doesn’t have all the answers. That’s what we’re dealing with. But this will walk you through a lot of what you need to do.

I haven’t used this yet. I’m going to start playing with it for myself to make sure that I get all my forgiveness as much as possible. Here’s that schedule A, that they were talking about, where you’re going to have to keep this compensation and there’s different compensation for different types. Like here, we’ve got an amount paid to owner employee self-employed general partners. Like there’s just… everybody’s different. Not all of it is the same thing. So worksheet A, non-payroll cost tracker, payroll accumulator. Well, that’s going to be fun. And if you’re in a really employee-heavy business, like if you’re in a restaurant or a hairstyle salon, something like that, where you’re really needing to track hours, you’re going to have a field day with this because there’s just so much information that you need to keep and you need to have immaculate records.

You should have good records anyway but you know not all industries deal with things the same way. And then this is the FTE input to try to deal with some of those calculations, right? And again, your judgment interpretations of the act may be necessary. And this is going to be a moving target. All right. Let me stop sharing so I’ll answer some more questions. If you got a hundred thousand, I only use 80k per the rules and can pay the extra back, I get forgiveness 75, 25% [inaudible 00:52:37] that doc and Excel. I don’t think I can share it over here. I can find it… I will share that link out. AICPA. Let me see what else I got on questions here. Okay. What are terms of repayment if you don’t qualify for the forgiveness?

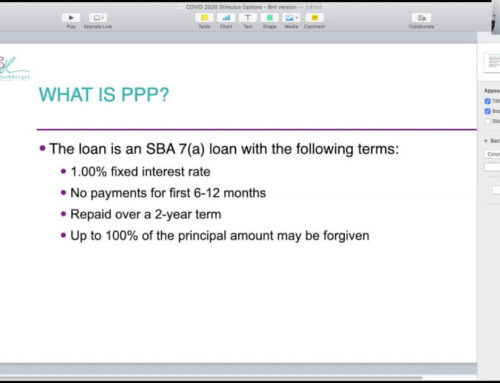

So it’s a 1% loan, they give you, I think, two years to repay and it’s pushed off for six months. Now, what’s the other interesting thing is nobody’s sure, because what I heard was they’re accruing interest from the second they sent it to you, is the loan itself forgiven is the loan and the interest forgiven? We’re not totally sure. So that’s an interesting point. That’s one of those we’ll get more guidance eventually. And in LLC is the employer’s salary forgivable? I would need a little bit more information because it depends. Are you an LLC filing a 1040 schedule C? If so, that’s where we’re waiting on guidance. We don’t really know what they’re going to do. The start date, so that it starts the day you get the PPP loan, not the EIDL, right? And the EIDL if you got that grant is supposed to reduce your forgiveness.

And I don’t totally know what that looks like yet. Does forgivable wellness depend on existing cash in the business bank account, whether the company makes profit or loss in the financial year? Sorry, guys. It does not depend on cash in the business bank account on existing cash. So the forgiveness is the PPP proceeds that you’ve got, right? So whatever you received. So if you got a thousand dollar PPP loan, you have the ability to forgive that thousand dollars. But only if you spend it at least 75% on payroll and up to 25% on those other allowable costs with all of the stipulations on how they let you spend. Now whether the company makes profit or loss in the financial year, if it’s the schedule C, that might matter, we don’t know yet. If it’s a regular business, it should not matter because it’s… [inaudible 00:55:12] I say regular business I don’t really mean that schedule C is not a regular business.

If you’re an entity, that’s not a schedule C, not a sole proprietor. So if you’re an S corporation, a corporation, it should not matter how profitable your business is. It should only matter what you spent it on. If that makes sense, right? So I could still have such a crappy year but I managed to bring back employees and pay them and get that… I can get that forgiven, even if I ran into the red for the whole year, because maybe this goes on for so long, maybe my business was really badly affected. Forgiveness will include both amounts requested EIDL and PPP. Okay. So the EIDL, if you’ve got the EIDL loan and it wasn’t really going to cover it too much in this, is a completely separate loan. But the EIDL advance, which was what turned into a thousand dollars per employee, that is supposed to reduce your forgiveness.

I don’t know exactly how that works. I don’t know if it’s even in these spreadsheets, worksheets or not yet. Hold on one second. I lost my mouse. I’m trying to… I want to share out the Excel spreadsheet here. Okay. So if you go to this website, this AICPA website and I’m going to throw that up on my personal website also. In the center… Here, let me share the screen. It’s easier than describing it. SBA paycheck. So you go here, you’re going to scroll down to this gray box featured resource, right? PPP loan forgiveness calculator, right. And it downloads a file, you might need to repeatedly download this file and make sure that you’ve got whatever their latest version is because it’s still a draft.

If we have PPP money intermingle in the operating account, do you recommend new transfer money to a new account? Should we transfer the operating account money to new account demonstrate amount? I would say it does not really matter which money you move. It might be just easier to say, “Okay, I got $10,000 PPP, I’m going to go open a new account and transfer it.” I took it and I transferred it all to my payroll account because I’m anticipating using it all for payroll. But either way, you could either move one or move the other. It might just be more practical to move just the PPP, because if you have other things that hit that operating account, it might be a challenge to get like auto pays and things like that out of that account.

Can I pay an existing employee substantially more during the eight week period? That’s a great question. We’re not really sure. It seems like maybe no but possibly a bonus. And that’s one of those waiting for more guidance, because why wouldn’t everyone just do that? I’d be like, “I’m just going to pay everybody more.” Because if you think about it, you got a loan based on 2.5 times an eight week average of 2019. But now you’re only going to pay them across eight weeks. You’re not paying… You got the loan on more than what you’re going to pay out, is basically what I’m saying. So that is a good question that we don’t totally know the answer to.

Would monthly storage costs be considered forgivable? Possibly, if you have a rental agreement or lease agreement, you probably could get away with it. That’s one of those things to contact your lender about. I would think that that would probably be on the reasonable to assume, yes. What is your advice on my initial question? Hold on. Let me go scroll back up to Leslie’s… When you say not to double dip, if the funds go into your deposit account, continue to pay payroll and pay rent utilities as usual. How do we keep records of this properly? Okay. So if you’re not going to move it into a separate bank account, you need to probably keep at least a spreadsheet, right?

You’re going to have a spreadsheet that says, I use this money here, put the total PPP loan at the top. Okay. I paid this money out of it and just have it subtracts, subtract, subtract. You’re going to keep all those documentations. So if you’re covering your rent, you need the lease agreement, you need the canceled checks. If you’ve got the mortgage, you need that mortgage agreement, you need interest, you need all this stuff. Let me find back where I was. Is there any way to amend EIDL application, which we submitted online? Whew. I have no idea. I know that… I actually did get an EIDL loan. They did not really ask me for any documentation at all, which I thought was really crazy. They let me pick how much I wanted. EIDL is a whole separate situation.

Let me see. Oh, hold on. If you keep records very well organized, just keeping a spreadsheet with PPP related expenses will be good instead of opening a new bank account. Yeah. If you keep it very, very clean, yes. You can. You could just do a spreadsheet and you don’t have to open a separate bank account. If we did a small mistake. Abdul, I don’t know what that’s in reference to. I’m sorry, if you want to give me a little more clarification. I’m not sure if you mean on the EIDL or what? I don’t know that you can’t really do much of anything with EIDL except say, no, I don’t want it. PPP, if you have an error on your calculation for the initial borrowing, there was something that you could do. I think it was due like May 14th or something like that. So it might be too late.

Let me see if I can scroll back down here. Okay. I think we got everyone. Oh, wait. No, there’s more. Small mistake on the EIDL. Yeah. I don’t know. EIDL, I will tell you the process for me was I got an email from a contractor from someone working for the SBA for the EIDL. He said, “We need to see proof that your business is real.” So they said a license, a schedule C tax form, there was something else. So I just sent him a copy of my CPA firm license from the state, my printout from sun biz, with Florida that shows that I’m up to date. And that was it. That was all they asked me for. So what you could do is maybe redo the calculation. And I don’t know how they came up with the amount of the loans either. They didn’t say like, it’s 2.5 times, whatever. It roughly looked like it was income less subcontractors.

And then half of that, roughly. Not even an exact amount, it was about… You can always take less than what they offer you if you’re concerned. I don’t know anything about how to deal with that EIDL process. It’s a little bit more of a like traditional loan with the EIDL. Yeah, sorry. Oh, are there any other good information about that one? Okay guys. So, like I said, we are offering this as a service to help people with PPP loan, documentation, calculations. This is not for the faint of heart. It is overwhelming even for us tax folk, because it is so different and we’re going to end up with a mess comp next texts in any way, trying to figure this all out. So feel free, reach out to me. I will see if I can help you.

And if you’re trying to go it alone, best of luck to you. Keep an eye out. I think Forbes also has some good information out there. That’s another area. You’ve got to really pick and choose who you’re looking at for your information because not all information is created equal. Don’t read it in life. The regular news, they’re kind of morons. They don’t really know what they’re talking about and they’re going to get it wrong. You need a reliable source. All right. And with that, thank you, everybody. Enjoy your Memorial Day weekend.