Educational Video

COVID-19 Stimulus information: learn how to maximize your utilization of the CARES Act and its various options for COVID-19 Stimulus.

This information was current as of 4/22/2020 – and part of our COVID-19 Stimulus Series.

On this webinar we review updates on the various government stimulus programs. We will go over:

– PPP/Payroll Protection

– Payroll Tax Credit

– Unemployment

– Information for self-employed/independent contractors/gig workers

Okay. Hopefully everyone can see the slides. Might see a little bit of my head, it’s okay. All right. And I’ll try to keep an eye on the chat if anybody’s got questions. So, I’m going to get started. So, thank you for joining. This is The update. I know not a lot of time has passed since the original but here we are. a lot has changed in two weeks. It’s been a long two weeks. So, here’s what we’re going to talk about. We’re going to do a little recap, changing tax deadlines again, updates on individual rebates, unemployment, PPP with the loan forgiveness and EIDL. And the new thing I really want to talk about is the employee retention credit. So, you’ve heard of news, This is OLDS. The OLDS on the tax deadline, nothing is new about this. They moved everything that was due April 15th to July 15. There were some weird hiccups in that including the second quarter estimated payment for 2020 which was still due in June. But other things like IRA contributions, HSA contributions, retirement plans, all that got pushed off into the future.

So here’s what’s new, actually somebody realized either in Treasury, I guess, maybe Congress, I’m assuming this was a Treasury decision that it made no sense to have the second quarter estimated payment due in June when the first was due in July so they went ahead and move that forward also. So now on July 15th are due your tax filings, if you don’t file an extension, and your first and your second quarter estimated payments. But for a lot of people they might not be making those payments because if your income has been dramatically affected you might not have anything estimated to pay in. So that’s the big change. Practically everything got pushed forward by a congressional and executive components to COVID-19 Stimulus.

There are a few weird deadlines here and there. Some states were not very cooperative. I know I have a bunch of technology startup clients in Massachusetts and Massachusetts moved their corporate filing deadline but if you didn’t pay their corporate excise tax by April 15 they were going to charge you interest. So, there is a screw you from Massachusetts. I guess that’s not so surprising. But most states did eventually conform just because it’s insanity but you’ve got to keep an eye on it if you’re in a taxable state. And if you are, you might want to consider moving to Florida where we don’t pay income tax.

The individual rebates, this is the $1,200 per person for taxpayers and their spouses is the best known COVID-19 Stimulus. These have actually been going out. I have had a lot of people tell me that they received it direct deposited into their bank. There are phase outs, you maybe don’t qualify depending on what your income is. And then if you haven’t gotten it yet but you think you should there’s a big where’s my money. So, I have heard of some problems. For example, some people have told me they got their $1,200 and I said, “Well, what about the $500 per kid?” They did not get that. No clear information but the bet conjecture on what I think is going to happen is that after they get some of these out or some portion of these $1,200 direct deposits out they’re going to go back and try to figure out dependents because it’s actually a little bit tricky. There’s an age restriction on the dependent. I have seen confirmation in fact that if you have a child age dependent who is 18 to 24 and they’re full-time you are not going to get money for them. And if they didn’t file on their own, which many college age dependents don’t, they’re not going to get $1,200 either. So, that’s a little bit of a screw job there.

Might it make sense to file a quick 2019 return? Maybe. It really depends on your individual tax situation. It’s not that easy to just say, “Oh yeah, have them file it.” Because if you’re the parents and you’re supplying their support and they really don’t have income you might be losing out on more than $1,200 if you would otherwise claim their tax credits and other things. So, it’s not that straightforward. It’s definitely a case by case individual decision, and one of the less popular parts of COVID-19 Stimulus. Just be aware that if you’ve got college aged kids this might happen to you.

There is a website that you can go to and check out your status. It is not the most easy to use form not because of the information you have to put in but the results that you get often are telling people that they can’t find you, it doesn’t know anything. I don’t know of anybody who’s used it who already got the stimulus if it tells you like, “Oh, you did get your stimulus.” I’m not sure. Yeah, it’s not perfect, not a perfect system. And the important part for me to explain is that it is not taxable and if you end up making a lot more money in 2020 because some people even when there’s a catastrophe going on still are in business and are still doing well it does not need to be paid back in 2021 when you file your 2020 taxes. So if your 2020 income is high it doesn’t matter. You’re not being taxed on this. I feel like we have to caveat everything like this is what we know right now. It’s not supposed to be taxed, according to the CARES Act that governs COVID-19 Stimulus.

All right, before I go into unemployment I’m going to hop in and see if there’s a couple of questions. “Which banks are still taking applications.” Helen, I will try to get to you on that when we get into that section. “What is the threshold income for stimulus checks?” Hold on. I will back that up. It is married filing joint. The phase out starts after $150,000 and after $198,000 you don’t qualify anymore. Single at $75,000 when you’re over $99,000 and you don’t qualify anymore. And in between it goes through a little math calculation to figure out how much they’re going to send you. “I heard if dependents didn’t get paid out properly it would include 2020 income tax return.” Yes. That is correct as far as I know. Whatever they’re not catching by, I think they have a deadline of they have to have these payments sent out by December 31st and if it didn’t happen then you can pick it up in 2020. I don’t know if that will include those college aged dependents. The media really has oversimplified their explanations of COVID-19 Stimulus.

I’m going to move on to unemployment. By the way, in case anyone doesn’t know this in Florida we call it reemployment for whatever reason. I guess it sounds better. This is the recap portion. You can apply for unemployment. Every state is different with their calculations. The thing that was really special is that the federal government is adding an additional $600 per week on to of whatever you qualify for from the state. And that is retroactive back to when you became unemployed. And it is tacking on a 13 week extension past what states cover. We would all like to think at 13 weeks we’re not in this situation but who knows.

So, some of the specific things that I’ve been getting a lot of questions on, I’ve had so many people come to me and say, “But I’m self-employed,” or, “I’m an independent contractor,” or, “I’m an Uber driver,” “I’m this, I’m that.” “I don’t qualify.” All those normal rules for unemployment are out the window. It is an unemployment free for all. So even if normally you have your own business, you’re on your own payroll, or you just file a schedule C or you’re a gig worker, or you just get a 1099, all of these things that normally you wouldn’t qualify you can go and file for unemployment. Even if you don’t qualify for the state portion you still are supposed to get the federal portion of it. So $600 a week is $600 a week especially if you’re not working. That’s fantastic.

Go try to get it. If you can’t get through the website, I know Florida’s website is a dinosaur. I mean, that thing has been a nightmare for years and years. It has not gotten better. They claim that they’re trying to update on the backend and make it work. I was actually able to log into it for the first time yesterday So that was exciting. But if you are not able to log into your state’s unemployment website most of them have paper forms. So, I know I filled in the paper form the day they released it in Florida, it was four pages long.

Then they went and revised that same form to being like 10 or 12 pages long. Filled it in again, sent it in. Yes, it’s a duplicate. Yes, it’s probably going to cause a delay but so would having the wrong form. Nothing is moving very quickly as we can all see. but they are working through it So if there’s progress it’s just not as fast as we would hope it would be. And yeah, the unemployment system has never seen anything like this before in terms of volume So it’s causing delays in every state.

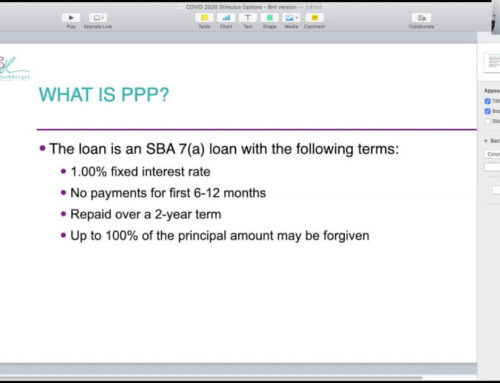

All right. Now for the fun PPP, this is our recap here. Oh, hold on I got a question. “Self-employed, does reduction in hours, income qualify for unemployment?” It can. I don’t know the specifics. I know that because you can work part-time even and still be on unemployment. I don’t know what proof they need but I’m pretty sure at this point if you just go fill out the forms you’ll probably get something. So you might as well throw it in. All right PPP. This has been in the news. If you haven’t heard about it you’re maybe living under a rock. I’m not sure. But we’re going to say it’s for small businesses and that gets quoted because we’ve all heard the stories of Harvard and Shake Shack and Ruth Chris Steakhouse that are these enormous companies with way over 500 employees managing to get millions of dollars of this money. The loan is capped at 250% of your payroll and you have to go through SBA approved lenders so that’s banks, there’s some other lenders. I think even QuickBooks is able to do these now. Some payroll companies became SBA lenders. It’s the crazy world of COVID-19 Stimulus.

So, what makes PPP super special is that it’s forgivable which we have a concept of forgivable loans normally when we had the 2008 financial crisis people were getting foreclosed on left and right. If you had a mortgage and they forgave your mortgage normally it’s taxable income in the year that the bank files that form, that 1099 C or A and sometimes it would happen years later. What’s completely different about this loan forgiveness is that it’s not taxable ever. It basically turns into a grant more or less.

But there are some teeth on it. You have to use at least 75% for payroll costs. And not only that, within your payroll you have to maintain the level of payroll you are at. So, if you have a decrease in your head count that can reduce the amount that’s forgiven. If you reduce your salaries maybe you say, “Okay I can bring people back with this loan but I can’t bring everyone back and I can’t bring them all back at the same rate.” Well, that can also reduce the amount that’s forgiven. And you have to have people back in place by June 30th So if you were like, “Well, let me see when we’re fully functional again,” And that’s not until July. You’re going to still have a problem where this loan won’t be forgiven.

Here is the new fun part, PPP for self-employed and independent contractors. So originally they were not accepting these PPP loans for anyone who is self-employed or an independent contractor. How do we know if we’re self-employed? In the terms of the PPP they’re using a very tax focused description. So like working for yourself, if your self files a schedule C on your 1040 then you’re self-employed. If you’ve got your own S corporation you are not self-employed for this. You are a regular employer. You should be on payroll. I said this last time, I have said this a million times, if you run an S-corporation, if you are the owner you must run payroll, you have to. And if you haven’t been then you’re just getting screwed for one more thing with the PPP loans part of COVID-19 Stimulus.

But the self-employed independent contractor is very specific, it’s for schedule C filers. How do you know if you’re a schedule C filer? You would have to look at your tax return. All right. If you normally file your business files a whole separate return you’re not a schedule C filer. It goes on your personal return. And again, there’s a bunch of rules as to who’s actually eligible. So you had to be in operation on February 15th of this year. You have to have 1099 income or if you don’t receive 1099s, I know that’s not a perfect system. If you generate your own clients and they pay you directly that’s fine. It’s just self-employed income or 1099 miscellaneous income. You have to be a principal place of residence in the U.S. and you have to file a schedule C for 2019. So that means if you started your business on January 1st of 2020 you don’t qualify for this because you’re not going to have a schedule C filed for last year.So you had to be in business last year still operating February 15th of this year and be self-employed.

Now the other question before they came out with a clarification is what were they actually going to base these loans on and this is nuanced, detailed accounting jargon. Was it going to be net profit? Which would be when you look at schedule C it’s the income less the expenses is your net profit. Or was it going to include equity draws which is money that you take out of the business? A lot of time for small businesses those numbers are more or less the same thing. There are some things that can make that different. For example, if you tend to leave money in your business and not take draws, your cash draws and your profit won’t be the same. But they put out the guidance very specifically we are looking at self-employed profits for the PPP loan calculations.

So, there’s actually two ways of calculating and it depends on whether or not you have other employees. So if it’s just you and nobody is on payroll this is how you would calculate your PPP loan amount. So you’re going to start with whatever your net income is on your schedule C for 2019. It’s the total income less all of your allowable expenses that reaches the what we call bottom line number or your profit. If you’ve made more than $100,000 on your schedule C it’s capped at $100,000. Why do they do that? Well, for the other piece of PPP for the other businesses they’re excluding payroll over $100,000 so this is falling in line with that.

And a sidebar, if you have a schedule C company that’s making over $100,000 you need someone to talk to you about tax planning because you are not optimized for your taxes. And then if you’re running at a loss or if you’ve totally broken even you’re not eligible. Because if you’re losing money in your business and you’re out of money right now you might lose more but I guess they figure it doesn’t harm you that much more. So you’re going to take the amount of your net profit or $100,000 and you divide it by 12. That gives you the average for last year. And then you’re going to take that average and multiply it by 2.5 or a 250%. So, that’s how they’re equating the schedule C method to the business method. It’s as close as they could do to make it to be roughly the same thing.

Now, if you have employees you’re in a slightly different situation, you’ve gotta do a couple more steps here. You’re going to start again with that net profit or loss from schedule C. That can’t be more than $100,000 and if it’s zero you’re not eligible. Now you’re going to add in your Medicare wages. So this is really the payroll. You’re gonna add in the wages of your employees that you’re paying that show up on your quarterly payroll tax form 941. You can also add in health insurance, profit contributions. You take that total, divide it by 12 and multiply it by two and a half and that’s how they’re coming up with your loan calculation. So, it’s an extra step in there if you’ve got employees on payroll because you need to include them along with yourself.

So that’s that part for the self-employed. That didn’t come out right away at the beginning. My update on what’s going on with PPP, They ran out of funding in 13 days which is crazy. Yesterday the Senate approved phase 3.5 for relief with $300 billion going to PPP funding, which is fantastic.The SBA should resume handing out loans. Now this is supposed to be first come first serve, there is all a lot of questions, I think there’s even some lawsuits now about did the big banks like your Wells Fargo, Chase, did they actually hand these out first come first serve or did they go to their enormous clients and say, “Hey, we think you qualify. Come give us your application and we’ll get you $10 million.” I don’t know. I don’t know when we’ll know, if we’ll ever know.

What I can tell you is that while there’s lots of outrage on social media towards those businesses like Ruth Chris and Shake Shack the thing you have to understand is they actually qualified under the rules as they were written. Now you might say, “Well, if you think about it, logically the SBA, the Small Business Administration, you shouldn’t be able to apply if you’re a publicly traded company.”That seems like it should just be common sense but that’s not anywhere in any of the rules. They put specific waivers in for restaurants that have multiple locations and that’s how these big, big companies managed to swoop in and grab all that money. Fair no, but that is the price of unintended consequences sadly.

Let me see a question, “All my subs are 1099, I applied, received SBA loan. What’s the process? What docs need to be kept for the loan to be forgiven?” Everything. You’re going to have to document the crap out of that. My suggestion on the loan forgiveness documentation is to put the money, the funding into a separate bank account, and only use that funding for the forgiveness. So, if you’re running payroll do a transfer from that to your payroll account, document the hell out of it, put memos notes, whatever you can so that when you need to justify it you’ll have that in there. Also, the 1099s are not going to qualify for loan forgiveness. Initially they said that they were going to count them and in the end they said, “Nope, only payroll.” So yeah 1099 people you are going to have no forgiveness. In fact, the bank should not have granted you even the loan based on 1099s because that’s not the qualified wages for PPP. So, I’m impressed that they did that or terrified not sure which. And once you get to the actual forgiveness it seems like it’s going to be the up to the lenders. So, maybe that particular lender will be okay with it and then it’s their problem, who knows, but document, document, document.

Okay, EIDL. I’m going to move onto the next part. EIDL is the free $10,000 that hardly anybody actually got. It was supposed to be an advance on the EIDL emergency disaster loan.It was written in the bill to say that it was an advance of $10,000. The SBA went on their own and said, “Well, we are not going to give you that. We’re going to give you $1,000 per employee up to $10,000.” So that sucks. I don’t know if there’s anything to be done. You can try and contact your Senator. If you’re in Florida contact Senator Rubio who is on the committee that oversees that program and maybe they can help. I’m not sure.

“Has anyone received it yet?” Yes. EIDL, I actually got my EIDL, I got a whopping $1,000 for me who is the only person on payroll. A small nonprofit that I applied for also got $1,000 and I have one client that got $10,000 but he’s got a bunch of employees. So, that’s how he got it. They are giving it out, it’s again supposed to be first come first serve so if you put it in right away you got it eventually. It wasn’t within the three days that they said but it happened eventually. So this is supposed to be a loan with an interest rate of 3.75 up to two million with principal interest deferment up to four years. The grants have gone out. I have not seen anything about the actual loan. I personally have not heard a thing about the loan itself. So, I’m not even convinced that there is loan money available. I think they might’ve used it all with the grants. And this was to be able to to be used towards any operating expenses. You could use it to payroll but it could be for anything.

So the update here is that the Senate approved another $60 billion in loans and $10 billion of that would come in the form of the direct grant. So that’s that magical $10,000 or $1,000 per employee as it’s been re defined. But who is going to get it? When I looked yesterday on the website the SBA took down the application website and they actually said that they’re not taking any loans because they’re out of funding. And they again are supposed to be processed first come first serve. Who knows? I don’t know if once the funding gets fully approved by the house, president, everyone, if they will put that back up. I don’t know. I’ll try to keep an eye on it and see because it’s a free grant so that if you do get that grant it does not need to be repaid which is what is so nice about it.

I see question, “Can you still apply for EIDL only and not PPP?” As of right now no. That is what I’m saying. The SBA is no longer taking applications for it. That might change with this additional funding. I will try to keep an eye on it and see. Hopefully we find out the answer will be yes, it would be great.

Into the new stuff, employee retention credit. So this is supposed to be to keep businesses with their employees on their payroll even if you have to reduce. Anyone who can stay open this would be I guess a huge benefit if you are able to stay open and keep employees on. So, the refundable credit is up to, it’s 50% up to $10,000 in wages. But you had to have a financial impact by COVID-19. I would think probably just about every business has been financially impacted by COVID-19. Even those that are still open are not open to the full capacity that they used to be.

Now, this is available for any size employer so you’re not going to hear those screaming and yelling about big public companies taking it when small businesses couldn’t because it’s a tax credit. This is not a loan, it’s not money that’s being doled out by any government agency. However, if you take an SBA PPP loan you do not qualify for the retention credit, it’s one or the other. So you have to think about that before you go and take a PPP loan. And it’s not even taking it and using the money. Once it’s granted to you, you no longer qualify for the employee retention credit. So it’s one or the other, it’s not a both, you cannot combine them. That has to be totally clear. It’s a decision you have to make.

Now you’re a qualifying employer if your business is fully partially suspended due to government in relation to COVID-19.So, a local grocery store could be someone like that like everybody’s partially at least suspended. I don’t think anything’s fully operational at this point. And your gross receipts have to be down 50% of the comparable quarter from the previous year. And if you go above 80%, so if you’re in an industry that’s booming right now you might not qualify. The other important thing, self-employed independent contractor, schedule C people, you do not qualify because you don’t file payroll taxes and this is a payroll tax credit.

So hang with me here. It’s a little dense but it’s worth it if it’s worth it to you. So how do we calculate it? Half of your qualifying wages up to $10,000. So for example, if I pay somebody $10,000 a month or I guess it’s really, I think it’s in a quarter, I don’t think it’s a month, I think it’s a quarter, $10,000, half of that $5,000 would come as a credit. Which is a huge amount for a payroll tax credit. And this is good on wages that are paid after March 12th, before the end of the year basically which is pretty cool. So, it can go on for the rest of the year and you can also include healthcare on that. And then I’m only including employers with less than 100 employees because that’s mostly who’s going to be seeing this. If you had 100 or fewer on average in 2019 the credit is based on all the wages that are paid on the period, the March through the end of the year period.

So, how do you actually claim this credit? Well, it’s going to be claimed on your form 941 starting with the second quarter. So second quarter ends in June and that would be the first time that you can claim it. And it specifically is offsetting the social security portion of your payroll taxes. Even though you can start counting wages for this on March 13th you cannot go backwards and amend your first quarter 941. You can only take that credit and apply it to your second quarter. And as of yesterday when I went to go look at it they have not updated the forms yet. So, hopefully by the time June comes around they’ll update the 941 forms. Those 941s you only file quarterly. They’re not so fast on updating this stuff, it’s a bit of an ordeal, but there is a note.If you go Google that the form 941 there’s a note on it that says basically all the information I just said. You can’t claim it all the first quarter, it’s only starting the second quarter, et cetera.

So, what are the problems here? As I said before you cannot combine this with the PPP loan or the EIDL loan if you get it. Now, what do we not know? What if you got the EIDL credit, does that count? No idea. I would venture to guess no because that’s not a loan, it was just an advance or a grant. Hopefully that doesn’t preclude you from being able to get this. The other thing is that the earliest you can claim is for the second quarter which usually you’re dealing with the taxes as you go but you might not be able to claim it until July.

So, something you have to take your crystal ball out and see is do you have the cashflow to keep running payroll all the way through June if we stay in this locked down situation? Which we might not be. You’re starting to see the economy open up in various places, but even with things opening up I don’t know how long it’ll take for businesses to really return. Because I think even if things open up you’re going to have a lot of people staying home and they might not open everything. They might not open the restaurants, the bars, all that kind of stuff, maybe not all retail. So, this is really a, I like to think of this as a bright light if you’re managing to stay open and stay with people on payroll. I would not count on this to keep you going. I think that’s the bottom line.

More pitfalls. Well, so they put out a great form, form 7200 advanced payment of employer credits due to COVID-19. Holy moly this sounds great. However, can you calculate what your anticipated tax credit on payroll is going to be in June? I don’t know. And I think even if you thought, “Okay, I have enough money I can keep everything going until then,” there are so many unknowns in the world right now that this is maybe not the most advisable way to get cash. if you asked me I would say, “Don’t even look at this form, ignore it.” I put it up there with the ability to push off paying your payroll taxes to later in the year that the government passed. I wouldn’t do that either because at some point you’re going to owe it. What happens if your calculation is wrong?

These payroll taxes are serious business. If you don’t pay your payroll taxes there is no faster way to get an IRS agent on your door than to not pay your payroll taxes. So what if you screw up your calculation? Are they going to charge you interest, penalties? Is there going to be extra fines? Is it fraud? Who the hell knows? And if you file this what is the government going to do? Is the IRS going to send you a check for this request? No idea. I would avoid using this form. I think it’s just more headaches and trouble than it’s worth and payroll tax trouble is the worst tax trouble. All right. So that is that. Let me hop over and take a look at some of the questions.

“How can you trace EIDL loan confirmation number?” As far as I know, you cannot. You can’t trace it. You can contact your senator and they can try to on your behalf if you give them permission, you fill out a form, you give them permission, they can supposedly talk to the SBA for you. But as far as I know there’s no way to track with a confirmation number. You just have it.

All right other question, this is about the unemployment, “Did you mail in the new form or do it on the website?” I mailed in the new form. After I mailed it in I was able to log into the website and I have been contemplating filing it on the website and haven’t really decided if I want to really screw up my account and try and do that also.

“If I already applied and got zero do I reapply?” That I don’t know. I have heard this from a few people that they applied, they were told they didn’t qualify. I think that’s a system error. I don’t know what you’re supposed to do. You might have to get ahold of a human. Because even if you don’t qualify you’re supposed to get the $600 federal portion of it. So, I don’t know. Sorry, I don’t have that information at this point. Let me back up here and hop back over. Okay so the options you have available, go apply for unemployment if you haven’t. That’s probably the easiest one to actually get. PPP loans, the banks and lenders are still taking those applications. They should be opening up money.

“Do self-employed file on the Florida unemployment website?” I don’t know that it will let you know. I would mail in the paper form if I was self-employed because they’ll probably just tell you you don’t qualify in the computer system and you’re going to answer the questions wrong, wrong for getting it not wrong for what your situation. The paper form is on their website. If you go to the unemployment website there’s a link that’s like print the paper form or something like that.

Okay so back to what we can do. Unemployment, PPP loan. You can go put in the application, still the sooner the better. The EIDL grants, if the open that website back up with the funding being approved there you go, you can get that. There’s paid family leave employer credits available. This again is if you have the cash to keep employees on you can eventually get these credits. And get cash wherever possible and hold onto it. Just about every credit card company that I have heard of is doing some kind of COVID-19 forbearance of some sort. Call your mortgage company. Call anyone you can that you normally pay and see what you can do. I have heard that some of the credit card companies are even doing rate negotiations. You’ve just got to sit on hold for a long time but it’s probably worthwhile.

And what else? Cut and reduce expenses. I talked about this last time, definitely cut expenses but think about it. Be a little bit forward looking. Like I had a service that I didn’t use very often, $25 a month. It’s not a lot of money but I’m not using it. I got rid of it. I went through subscriptions, things that I didn’t need anymore, got rid of those. But think about if you’re going to cut things that in the future you will need you might not want to, for example marketing costs, effective marketing. If you have ineffective marketing you can cut that. But effective marketing, SEO, things like that you probably don’t want to get rid of unless you think you’re really going out of business. That might be the only caveat to that one.

So, what’s next? Go file for unemployment. You can hop on to… Oh my God. Somebody sent me a question, “Can I get rid of my husband? He’s a major expense.” I did hear that divorce rates were way up right now so if you need a good divorce attorney I know a few I can probably help you with that. Thank you Marilyn that was very funny. Anyways, what we should do next, file for unemployment, file for the EIDL grant if they put that back up, get your loan docs together for PPP. Even if you don’t have everything together start the process so you can get into the system. Everyone that I have spoken to had to go back and forth to the bank a few times to make sure they had everything the way they needed it. And if you got your funding make sure your bookkeeping is set up so that you can track this stuff because holy moly that’s going to be a nightmare trying to track what COVID-19 Stimulus dollars went to where after the fact to make sure that you get that forgiven.

And then calculate your potential employee retention credit. I have spoken to a few people who said it wasn’t worth it to stop paying people for various reasons and they’re still running their payroll. Well, you might qualify for an employee retention credit and we can help you calculate those things. Now, here’s the real question with employee retention credit. If you use a payroll service like Gusto, I love Gusto, or QuickBooks or anything else I don’t know how any of those payroll providers are going to handle the employee retention credit until we know more about it. Because right now you can’t even put it on a form. So, you might want to contact your payroll company if you fall into that category of wanting to claim those credits and start talking to them early. And just make sure it’s on their radar and make sure you know what you’re going to have to do to claim those COVID-19 Stimulus credits as soon as you can.

I’ve been fielding phone calls and text messages and trying to help people putting out a lot of information on Facebook. I have on my website the main page is going right to COVID-19 stimulus because that is mostly what’s happening right now. Some people want their tax returns I know but most people are really worried about just cash right now. And then, you’ve got free time so I would encourage you to hop on my business book club. I did this last year. It was a lot of fun. We read some really great books. So, we’re going to do Good to Great, which might be backwards I don’t know. You might see it backwards or upside down. Good to Great is a fantastic book. The author’s got free tools and things. Even if you don’t read the book you can hop on the Zoom call. A couple of us avid readers will have dug through it. I actually listened to it before so I’m going to read it this time and do… The perils of webinar’ing from home.

That’s going to be in May. And I’m going to have some other webinars coming up for people who are starting new businesses, making sure you’re documenting things properly. So, you’re audit proofing your business, profit-first, make your business wildly profitable. I’m working with my friend Leslie Oppenheimer. We’re going to see if we can also get a book and maybe do something to help people get their business online and set up recurring revenue programs. So, that was a very preliminary discussion we had yesterday but trying to put information to get everybody money that they need now and help them with their business in the going forward so that we all survive.

Questions, I’ve been answering them as we went. If anyone’s got more throw them in there now. We’re going to finish a little early even. Hopefully I wasn’t speaking too much at the speed of light. So, and I found this quote yesterday I liked it. “Crisis and deadlocks when they occur have at least this advantage, they force us to think.” So, put your thinking caps on, get creative, try not to panic. It’s hard sometimes but try. And I’m here if you need help so shoot me questions.

“Which banks are still taking applications?” I think all of them. I mean, all of them that are SBA lenders. I know a couple people specifically reached out to me from banks that if you’re still looking for a bank to apply to some are faster than others. I’ve heard the smaller banks are getting the loans out faster. I did my own Bank of America and they stalled and stalled and then told me, “Oops sorry we’re out of money.” So, hopefully that changes and Congress authorizes more COVID-19 Stimulus.