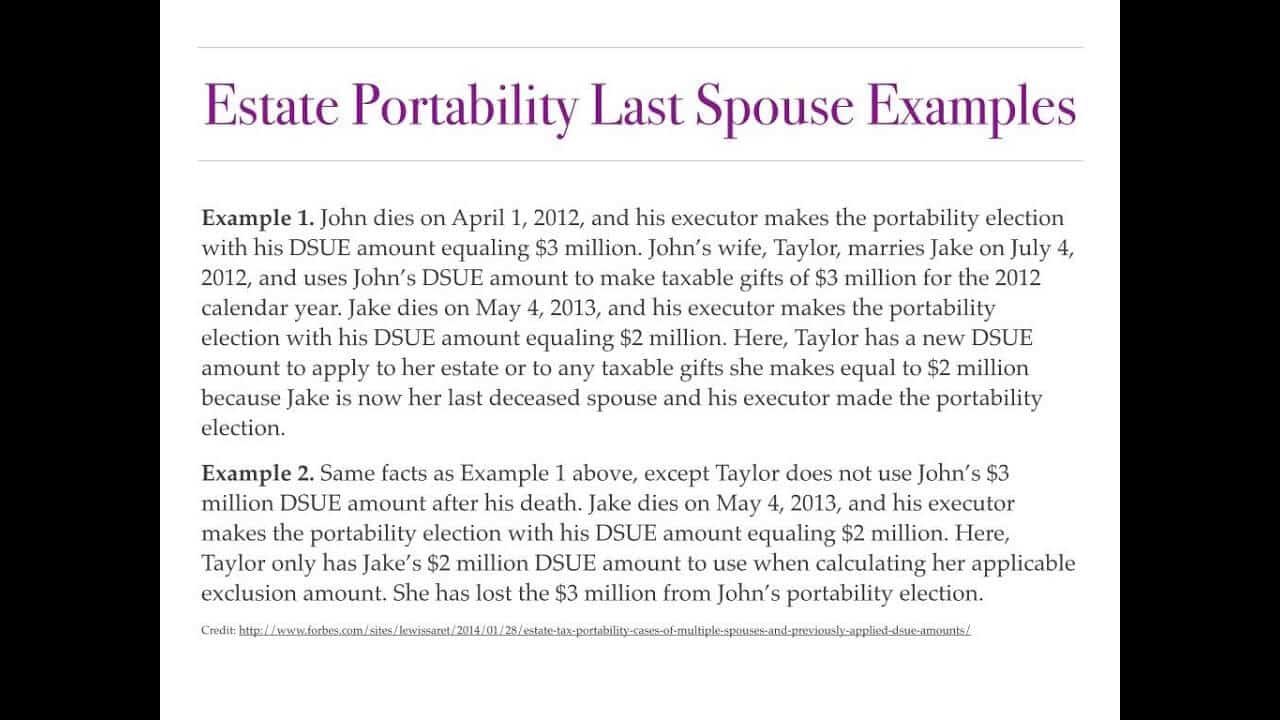

Estate and trust matters involve the area of the tax code related to death, inheritance, and gifts. An estate is a common law construct created when a person dies, whereby the “estate” conducts business to settle the deceased final affairs. Trusts are legal entities created, often upon death but sometimes earlier, to control assets that will ultimately pass to the heirs. Some estates are long living, often involving authors and artists with longstanding copyrights, and certain trusts may be long lasting if their beneficiary is the community as a whole, like art trusts.

Our area of interests in Estate and Trust is how it relates to maintaining your financial affairs, minimizing taxes to maximize the wealth that passes to your heirs, and how the tax filings are handled for these entities that are separate from a business and from an individual.

Estates and trust file their own tax returns, which is a unique area of the tax code that not all small tax firms are familiar with. The 1041 Form filed by estates and trusts superficially looks similar to the common 1040 Form filed by individuals, particularly on the front page, but actually follows the processes and procedures normally used for business returns.

Because these entities have unusual rules, if you have tax, legal, or accounting issues matters, it is extremely important that you engage the services of competent professionals, or the estate may find itself subject to unreasonably large penalties, and the trust may lose some of its protections if the rules are not all followed. Maintaining compliance with the tax and financial rules is important to maintain the rights and protections that these entities possess.