Educational Video

1099-Misc forms, the bane of every January. There are many 1099 forms, but the most common business one is the 1099-MISC form. The IRS has really been cracking down on these forms and the reason is because their matching system lets them track who isn’t paying taxes if they’re being paid under the table. It’s becoming more important that businesses take a look at these forms, take a look at these vendors and see what their filing requirements are. The IRS publishes the 1099-Misc Instructions – but if that isn’t clear, this video should help.

So the first objection I usually get to filing 1099s from business owners is I don’t use subcontractors and that’s kind of a misconception as to who needs to receive a 1099-Misc Form. It’s not just some contractors. It’s really any vendor that you pay over $600 and is a certain entity type. So if you’re using someone who’s a sole proprietor and you pay them over $600 during the year, they would need to receive a 1099. If you have a vendor that’s a partnership and you paid them more than $600 during the year, you would have to give them a 1099.

For LLCs, it’s trickier because it really depends on how they file their own taxes. You need to get a Form W9 from them, and that will tell you if you need to file.

Some special rules: if you pay a lawyer or a law firm more than $600 during the year, form doesn’t matter, you have to file. Your landlord – rents have to be reported.

You are better off filing a 1099-Misc Form for someone that you don’t need to than to not file one that you do need to. If you’re not sure, just file one. It’s not a lot of work. It’s not that hard and can you save yourself some headaches down the line from the IRS if they come looking for it and you’ll save yourself penalties as well.

The best practice is anytime you work with a new vendor, ask them for a W9. They should know what this is. If not, you can send them a blank form and they can fill it out. It’s not that complicated and you’ll save yourself headaches at the end of the year and definitely save yourself headaches in January.

These are due January 31st. So if you haven’t done bookkeeping, if you don’t know how much money you’ve paid out to individual vendors, if you haven’t been keeping good records, you need to get that together really fast because January, it comes and goes quickly and you can get extensions for filing these, but you’re supposed to hand them to the recipients by January 31st. So you don’t have a lot of time if you haven’t been keeping good records.

We’re going to look at some filled in W9s. So if you received these from your vendors, you’ll be able to figure out if you need to give them a 1099 at the end of the year or not. In this example, we’re looking at an LLC and you can see that because the name says ABC LLC. And in this particular instance, this is an individual or a sole proprietor or a single member LLC, which means that it’s an individual person who set up an LLC, but they’re the only owner. Because this box is checked right here, you’re going to actually have to file a 1099 for that person. You would use the name and the address, and then you would use the employer identification number that they provide, or if they provided a social security number, you would use that instead. And you could get either one of those.

Another LLC, as you can see by the name XYZ LLC, but they checked a different box. They checked the limited liability company and it says enter tax classification. Earlier I said, you would need to determine if you have to give them a 1099-Misc form based on how they filed their taxes and this is what I was talking about. So if there was a C, it would be a C corporation, an S it would be an S corporation, and for either of those, you would not. It’s only if they choose to file as a partnership and be taxed as a partnership and they have to put that indication here.

If you get a W9 from a vendor that says LLC, that has this box checked, and they don’t fill anything in here, you need to go back to that vendor and say, “Hey, you got to fill out the whole form,” because without that letter right there, you don’t know if you need to give them a 1099 or not. If you don’t feel like going back to them, just issue the 1099 regardless.

LMN Partners – they checked off the appropriate, box partnership box, which means yes, once again, they need a 1099. So you would put in their street address and their EIN, and you would give them a 1099, if you needed to.

If you get one that has a C Corp checked or an S-corporation, or estate and trust, you don’t have to file 1099s. It’s just for your information. So you verified whether or not you need to file for them.

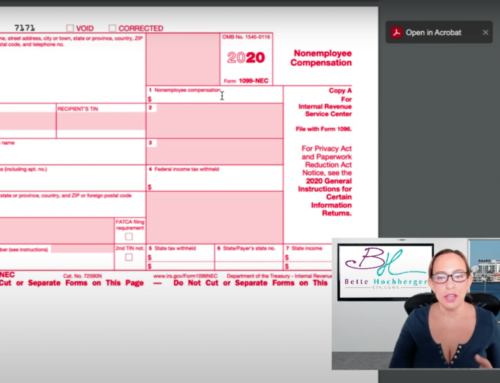

So now that you’ve got the information and hopefully you know who you need to file for, you’re going to go ahead and you’re going to file a form 1099. Now you can get the form from the internet. However, if you read through this, you’re not supposed to use these. You’re supposed to go either buy the forms or file them electronically. There’s services out there that make it very easy. This is actually a little bit of a cumbersome process if you have a lot of 1099s that you need to file. It can be a challenge.

So this red one is what it tells you over here in this box. This one goes with, to the IRS. So what you would do is, say we had paid a thousand dollars to LMN Partners, right? We would put in here… Oh, maybe I can’t even type on it. Maybe we won’t put in there. Oh, this one will let you do it. This is a different copy. So there’s multiple copies. The form comes for Copy A for the IRS copy. Copy 1 goes to the state if you’re in a state that you need to file these with. B goes to the recipient here, or the vendor name. And then you get one more, because they might possibly have to attach it to their tax return as well. So they get two copies.

So yeah, the IRS doesn’t want you to use this PDF of 1099-Misc form and that’s why you can’t type on this part because you’re not supposed to send that to them. But just for demonstration purpose, I’m going to show you here. So you would type in here the recipient’s name, right? LMN Partners. And then I forgot what the street address was. 100 State Street, any town, Florida because I’m in Florida. And then now where do you put the number? So I said it was a thousand dollars. Almost always it’s going to go in box seven. Almost always, not actually always, but almost always.

If this was your landlord, say for example you rented from LMN Partners and they were the ones you sent your rent and rent checks to, you would put it up here in rent so you could put it there. And then sometimes you’ll see it in this other income box three. Times I have used that is if I had to reimburse somebody. Say for an example, you had a vendor that you paid them a service. Maybe you paid them $700 as a service, but you had to reimburse them for some kind of travel costs, you had 300 in travel costs. You could put the $300 reimbursement here, but the actual payment for the service would go under non-employee compensation. So if in doubt, use box seven, instead of box three. It’s easier for the recipient to deal with that on their end, than you necessarily figure out what box you should put it in. But most of the time you’re going to end up in box seven. So I would say, you’re going to fill it in like that.

Now, if you use software, it will automatically generate all those different copies, including this red one for you for the IRS. And the basics is here, this is where I would put my information on the 1099-Misc form. Oh, and the important part, we forgot the EIN. So here, this would be mine. Whatever mine is and this would be the recipients off of the W9. So 109731684 whatever it was. 684. And then once you have all of them put together, the next piece is… see it says here file with form 1096. The 1096 is actually a summary form that adds up all of the 1099s that you’re filing.

If you use software, you’re not doing any of this. This would all be handled. The software would generate it for you or electronically file it. And now this is another red form that you’re not supposed to print and use off the internet. You’re supposed to go to a Staples or office supply place and buy them pre-printed and either hand write it. Sometimes they have software that you can use that will fill it out for you. That software is not so easy to use. I use Track1099 at my firm to generate the 1099-Misc forms and the 1096 forms, but I do Tax Forms all day. It’s pretty straightforward. You basically fill everything in and they’ll mail it for you. They’ll electronically file it for you. But this is a summary transmittal form and you would go through and add up all of your 1099s and you would put the total number of forms here in this box. And then the total dollar amount that you’re reporting on all those box sevens and ones and threes you would put here, and then you would check the appropriate box.

Now, the thing that’s important here, there’s a lot of different 1099s. We are only talking about 1099-Misc Forms. So if you also need to file a 1099 INT, which is for interest or, or div for dividends, you would have to do a separate form or 1099A. Anything that you had to file separately, you would need a separate 1096 form for that, but save yourself a lot of time. It’s 2018, right now we have lots of internet options that make this much faster than trying to print it and do it manually. I really don’t suggest that, but I do suggest you make sure you figure out if you need to file 1099s and get the information the sooner, the better so that you can file everything on time and avoid all those unnecessary penalties. So you don’t have the IRS on your back and you’re not wasting money on penalties.

So if you have any questions, you can always reach out here or on YouTube. You can call the office, shoot me an email and if you liked the video, please give it a thumbs up, share it, leave me a comment.