Educational Video

This video is about what kinds of businesses can be S Corporations. There are some very specific rules on what businesses can elect s-corp status:

- The business must be domestic – ie formed in the US.

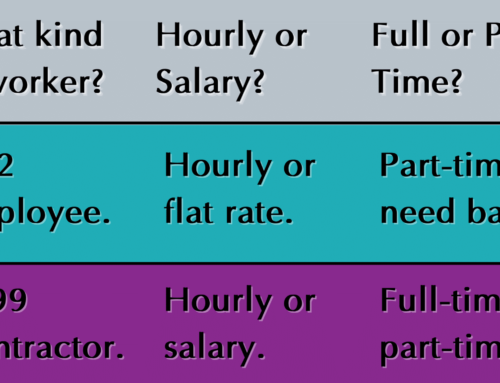

- The owners maybe be American citizen or resident individuals, certain types of trusts, and single member LLCs.

- The owners may NOT be partnerships, corporations, and non-resident aliens.

- There is a limit of 100 shareholders.

- There can be only one type of stock. Meaning, you cannot have common and preferred, voting and non-voting stock.

S corporation is a really popular business structure, and it’s great for a number of reasons. If you were otherwise a C corporation or maybe a PA, the S corporation is really going to reduce your taxes. And the reason for that is instead of being taxed at the corporate rates, you’re electing to have all of the income and expenses of the business be reported on the owner’s tax return at the lower personal rates. You also are avoiding the double taxation of C-corps, where if you want to take out cash as dividends, you get taxed on the corporate side and the personal side. So they get you coming and going there. And it’s a much easier to understand business structure for most small businesses.

Now, that being said, not all companies can become S corporations. There are very specific rules as to who can and cannot elect S status. And the IRS is pretty serious about these. So don’t even try to do it if you don’t qualify. So to qualify, you need to make sure you can check off all of these boxes. The corporation needs to be domestic. If you have a corporation that’s set up in the British Virgin Islands or somewhere overseas, it will not qualify as an S-corp. The owners are only allowed to be American individuals or residents, certain kinds of trusts and single member LLCs, which is an LLC with only one owner. And the reason for that is it’s kind of disregarded for this purpose. So we ignore the LLC and treat it as though the individual who owns the LLC is the owner in the S-corp.

So if you’re a partnership, if you’re another corporation, and if you’re non-resident alien, you are not allowed to be an owner of an S corporation. And it actually will prevent you from getting that S status. There is a limit on the number of shareholders, you can only have a hundred, although there’s a small exception to that rule, and that’s counting members of the same family, but general keep in mind, you can’t have more than a hundred owners. And you can also have only one class of stock.

In a C corporation, you could have common stock. You can have preferred stock, voting, non-voting. S corporations don’t have that, you have one class of stock only. So just to recap, you have to be a domestic company, the owners have to be American individuals or residents, certain types of trusts and single member LLCs. You can only have up to a hundred shareholders and only one class of stock.

So that pretty much sums up who can elect to be an S corporation. Now, the mechanics of how do you become an S corporation is actually not that complicated, but for a non-CPA person, it might seem a little complicated. You need to file the Form 2553, which is the election by a small business. Don’t worry, I have a video: How to Fill in Form 2553 Election by a Small Business Corporation S Election. It asks you for a bunch of information about the owners and about the business itself. And I’m going to actually walk you through how to fill out one of those forms in another video.

So if you like what you’re seeing on the videos, please subscribe. If you have any questions or comments, leave them on Youtube, or reach right out on my website.