Educational Video

One of the biggest challenges for small business owners is understanding the difference between Income, an Accounting Concept, and Cash, the money that they actually take out of their business.

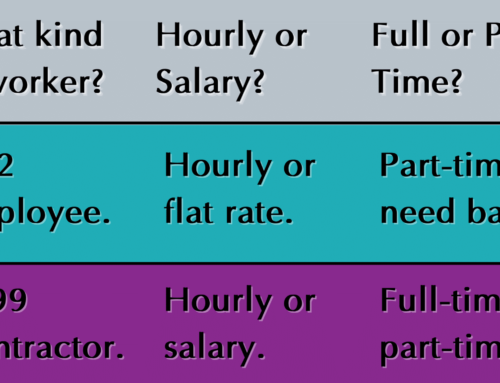

One particular thing that I had a discussion about multiple times in the last two months is income versus cash. Now most of my clients are small businesses or they’re professional organizations like law firms or engineers or other professional services. So for most of those folks, cash and income are going to be very closely related, but they are not always the same. And this really blows people’s minds for some reason. If you’re not an accountant or a CPA or you don’t do taxes or bookkeeping, it’s harder to understand.

I explain it this way: In tax world, income isn’t just money that comes in – it’s usually really net income or net taxable income. Your income less your expenses is your net income or profit. In a bad year it might be a loss, but generally it’s net income. Income is what is used, or net income, taxable income, net taxable income, taxable net income, is what we’re using to calculate your taxes. This is different from cash.

How are they different? In a small business where they’re usually very close? For example- you made $100 of revenue. You have one sale that’s $100 for the year and your expenses are $25. So your net business income is $75. That’s straightforward.

Now, if you take that $75 that your business earned and you take that cash out and you go and you put it in your own personal bank account or you put it in your pocket, that is both your net business income and it’s going to be your cash distribution. When your net income and your cash align, so you have that net income, $75, you pull out the cash of $75, your cash and your income, your net income, are going hand in hand. They’re the same.

But what you could also do is have a scenario where you make that same $75, and you say, I’m going to keep that $75 from my business earnings. I’m going to leave it in my business bank account. I’m not going to touch it. I’m going to leave it there, see what happens. Maybe I need it later. Now, in that case, your taxable net income is still $75. Your cash now that you’ve taken out is zero, but the taxable income is still $75. So that’s why the cash and the income piece aren’t the same.

So a little bit accounting lesson I’m going to do for you. I like to explain things a little bit more visual to people so they understand. So if you’ve ever done this in Accounting 101, I apologize and I also apologize for my terrible handwriting. Profit and loss, or an income statement. You’re going to have your revenue or your sales, it’s kind of the same-ish thing. You start with your revenue or your sales and you subtract out expenses.

That’s your profit, that’s your net business income.

Look at this balance sheet. So my little trick for remembering balance sheet is we call it an ALOE. It’s asset equals liabilities plus equity. If you can read my horrendous handwriting and I apologize and the lighting’s not so good. It’s a whole bunch.

Under assets, you’re going to have things like cash, accounts receivable, which kind of gets out of the cash situation we’re talking about but that’s where that goes. Fixed assets, et cetera, that kind of… Fixed assets are like computers, buildings, big things. And then the neat thing here. This is how everything relates. Your net income is actually part of equity. So that’s why you can have cash and net income can be the same thing because if you had the $75 here, okay, it’s still sitting in the bank and it equals my net income was $75. That’s a legitimate balance sheet. $75 equals $75.

If you’re going to take it out, though, you’re going to have zero assets. This is if I take the cash out of the business and put it to myself personally. Distribution is going to be a $75 and you’re going to have the net income of $75. See a negative and positive – balancing out to 0 = 0.

That’s how we get to a situation where you’re just having a disconnect because in a lot of business owners’ minds, the cash is the cash. It doesn’t matter. But that’s just not how the tax code works, not how accounting works.

A similarly related situation is phantom income – this can be a killer for people when they’re not expecting it. Phantom income is when you are in an LLC or Partnership that makes a profit, and you get a K-1, but the money was retained in the business. Say you get a K-1 with $10,000. That $10,000 gets added into the rest of your personal taxes on your 1040 and that becomes taxable income to you. So you received no cash, but you got “income” and you pay taxes on it. We are back to the income and the cash not being in alignment – the income on the form K-1 is taxable to you regardless of what cash you received.

Sometimes you have a well-managed business, they’ll say, “Oh, if we’re giving you $100 as your share of income, here’s $25 in cash to cover your taxes from it” or some kind of estimate like that. It doesn’t always happen, but I have seen it.

Don’t conflate business income and cash. They are two separate things. They are related, but they don’t have to be. Your cash flow and your profit are not the same.