Educational Video

LLC vs S-Corporation – what’s the difference, and why should you pick one as your business structure?

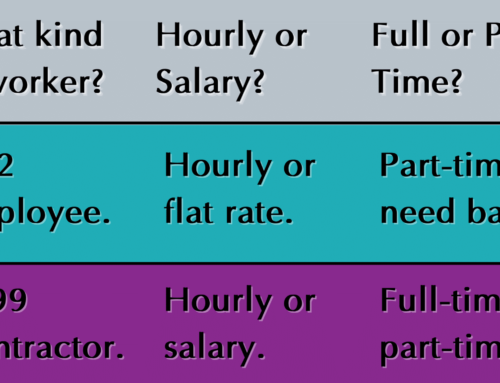

A lot of times, people come to me and they won’t know if they want to be an LLC or an S corporation, and they really don’t know what the difference between these two popular business structures is. And the reality is, in a lot of ways, they function very similarly. For example, both are considered a pass-through entity. And what that means is neither an LLC nor an S corp pays its own income taxes. If you are the only owner of the company and you’re an LLC, you’re going to file your taxes on your personal tax return on a Schedule C, just like a sole proprietor would. If you are an S corp owner, you’re going to also have to file on your personal tax return, but the S corporation is going to have a Form K-1 that you get, and that information is going to go on your personal return on the Schedule E on the second page. LLC vs Corporation: tie

Now, the reason this is significant is that if you’re filing as an LLC, and you’re the only owner and you’re filing on Schedule C, you are going to have to pay self-employment tax in addition to income tax on all of the net income. So you’re going to take the income, you’re going to subtract out all the expenses, and what remains is the net income. And that net income is subject to both self-employment tax and income tax. Now, when you have the S corporation, you’re going to have that same income less expenses is going to be your net income, but that net income on your personal tax return is only subject to income tax and not self-employment tax. LLC vs Corporation: S Corporation

Now, there’s a scenario if you have an LLC and more than one owner, by default, an LLC is treated as a partnership as far as the IRS is concerned. So it’s similar to the S corporation in that you will get a K-1, and that K-1 information will go on your Schedule E. However, just like the LLC when you’re the only owner, all of that net income is subject to self-employment tax in addition to your regular income tax. And the self-employment tax is not insignificant, it’s about 15% additional tax that you’re going to pay. LLC vs Corporation: S Corporation

So then, a lot of times I get the question, “Well, why would you bother being an LLC if you can go right to the S Corporation and save on those self-employment taxes?” The IRS knows that this difference exists, and they noticed when suddenly lots of companies were becoming S Corporations instead of LLCs just to avoid paying those self-employment taxes. So the thing that makes a S Corporation more complicated is that you need to run S Corporation Owner Payroll, even when you’re just the owner. And the reason is when you run payroll, you’re paying in payroll taxes, which are effectively the same as self-employment taxes. LLC vs Corporation: LLC

So the IRS knows that there’s this kind of loophole in the S corporation structure, and they expect you… It’s not even that, “Well, we would like you to run payroll.” You have to run payroll if you’re an S Corporation owner. Now, how you decide what your payroll is is a more complicated situation and discussion for another video, but just realize that you’re going to pay the tax this way or that way, it’s a matter of the degree that you’re going to pay. In a year you lose money, the S Corporation owner will still need to run payroll. LLC vs Corporation: S Corporation

So just to recap, LLC, when you’re the only owner, you pay self-employment on your net income and you pay income tax on your net income. LLC, multiple owners, that it’s taxed as a partnership, you’re going to pay income tax on the net income, you’re going to pay self-employment tax on the net income. S corporation, you’re not going to pay self-employment tax, but you do need to run payroll and, of course, you’re going to pay net income on that. If you have any questions about choosing an LLC versus an S corp or any other entity structures, please feel free to reach out and contact me or leave a message on Youtube. I hope you enjoyed LLC vs S Corporation, the small business smackdown.