Educational Video

Business structures include sole proprietorships, partnerships, limited liability companies, and corporations. Within those categories, there are various tax statuses, but they largely resolve into S Corporations, C Corporations, Partnerships, Disregarded Entities, and some less popular and highly specialized entities like professional corporations.

One of the areas that I get asked about most frequently from clients or potential clients is what type of business structure should I choose. There’s not really a one size fits all answer for this, but what I will say is if you’re going to start a business, please pick some kind of structure. The reason is being a sole proprietor puts you at a ton of risk, and it’s really not necessary. A sole proprietorship means that anything that could possibly go wrong with the business and could put you in a lawsuit situation, everything that you own from your house to your car, to any other assets are at risk for being part of a lawsuit. There’s not really a reason to go through that heartache, especially in today’s day and age when society is so litigious that people like to sue over practically anything.

I say at a very minimum, if you want something simple set up an LLC. If you’re the only owner, the LLC is basically like the cheapest insurance policy you could possibly get. For a couple hundred dollars, you register with the state and you now have limited liability, you have protection. Your personal assets are no longer at risk. When it comes to filing your taxes, it has zero impact. If you don’t have an LLC and you’re a sole proprietor, you’re filing what we call a schedule C. When you have the LLC, you’re still filing the schedule C. In that regard, there’s absolutely no reason to not at a minimum, be an LLC if you’re setting up a business on your own. Now, I’m a big proponent of form follows function. If you are otherwise unable to make a decision, the LLC is the right business structure.

Usually the first thing I’ll ask a potential client is what are you going to do with the business? Do you need to raise capital and get investors? Are you a professional who’s just going to offer their professional services? Are there other owners involved? Who are the other owners? All of these questions help determine what type of entity you should be. Another situation that comes up is somebody will tell me, “Oh, I didn’t incorporate,” or “I didn’t form an LLC, but I have a DBA.” Having a DBA is kind of a waste of money, unless you just don’t like your own name because it gives you absolutely no protection in any way as a business. It’s just saying, instead of using my own name, I’m using this other trade name. A DBA if you need to rebrand or you have a operating name, that’s different than the name you want to be known as in the marketplace, sure, but don’t rely on a DBA to protect yourself or your business because it doesn’t offer any protection. A DBA isn’t a business structure.

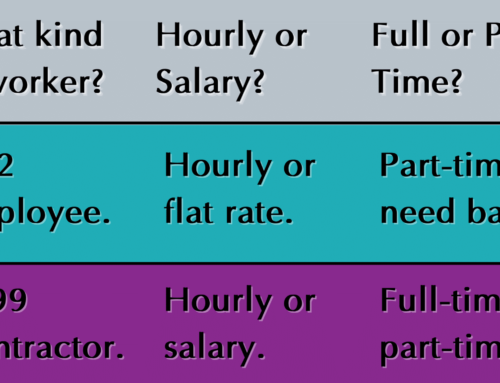

Now, the other reason I like an LLC is because it’s really flexible. So maybe you’re starting out small, you’re not really sure, and you’re doing an LLC and you find out oh, I need to take on a partner. Well, when you take on a partner as an LLC, you go from filing your schedule C like similar to a sole proprietor to filing a partnership return. Not everybody wants to file partnership returns for tax reasons that I’ll discuss at a later time, but with doing a check the box election, we can turn that LLC into a corporation and then turn it to an S corporation, which is probably one of the most popular, if not the most popular business structures for small business in this day. There are some rules to qualify as an S Corporation

The LLC provides you a ton of protection. It’s super flexible. It is really, really cheap. Like I said before, the cheapest business insurance you could possibly have. So make sure if you’re starting a business at a minimum file the LLC, and there’s many changes you can make from there, but don’t form a sole proprietorship. Don’t put yourself at risk and your family and all of your assets. It’s very easy. You can either file in your home state. You can file in Delaware. It doesn’t really matter. Just make sure you file it somewhere.