Educational Video

Venture Capital and Angel investment are the most well known sources of capital for new businesses. Despite the presence of angel investor networks, most small businesses operate on their owners savings and money from friends and families. Business owners with an established track record, new technology, or other justifications for a high growth strategy may have access to outside capital. The most common terms for these early stage sources of capital are angel investment and venture capital.

Venture Capitalists

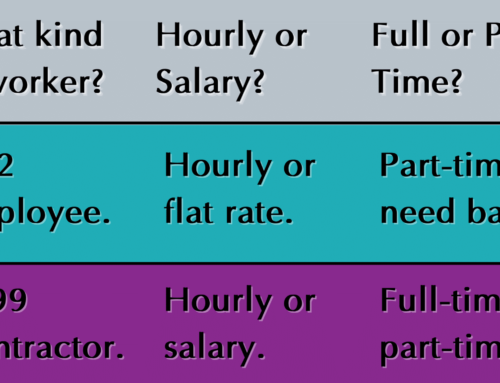

Venture Capitalists are established firms that raise one or more funds to invest in early stage business. They operate on established models, which according to Harvard Business Review, involves around a 40% preferred-equity ownership position. These firms have pooled investments from a variety of larger investments, including pensions, family offices, and actively managed mutual funds. These funds means that venture capitalists can invest large sums of money than individual angel investors, but it also means that your business may need to be more established to justify the larger raise. Venture Capitalists will often take one or more board seats, provide advice and connections, but require certain business structures. Venture Capitalists invest more money than angel investors, averaging $11.7 million.

Miami’s recent economic growth has attracted some of the biggest names in venture capital. This #MiamiTech movement started with a well publicized move by Founders Fund, but has since grown to include other firms.

Angel Investors

Angel Investors, unlike VCs, are accredited individuals who use their own money to invest in small businesses and start-ups. Typically, angel investors take on more risk than VCs and invest earlier. As a start-up founder without a proven track record, angel investors may be your only soure of outside capital. These investors are investors, this is not a bank loan; they will want equity in your business. The average angel investment amount is $333,000, so their equity is likely to be less than a VC. However, because angel investors are individuals, they often act as mentors to the entrepreneurs they assist.