Educational Video

An LLC Tax Extension is obtained by filling out IRS Form 7004. If your small business is an S-Corporation, it’s the same IRS Form 7004, but filled a little different, so watch the video, Form 7004: S-Corporation Tax Extensions. The IRS has more information About Form 7004 on their website.

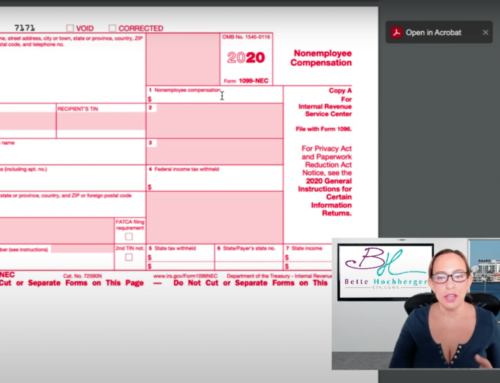

I am still going to show you how to fill out the Application For Automatic Extension of Time To File, which is a wordy and official name for obtaining an LLC Tax Extension. This is a form 7004. It is due March 15 and I’m going to walk you through box by box how we fill this out. So first, we start with the name, right? So we’re just going to make up a name here. XYZ LLC. Now this is for a multi-member LLC that has not made any elections. So by default, it is going to file a partnership tax return which is the 1065.

So we’re going to make up our identifying number. That would be your EIN of your actual business. We’re going to make up an address here. And we’re going to put it in Florida where I am. Now remember we said it’s an LLC. Didn’t make any elections, plain old boring LLC with more than one member. So if you come down here, you’ll see where it says Form 1065. That is the partnership return. So next to that, there’s this little number 09 over here, this form code. So if you pop back up to this box, you’re going to type in that code and that is what’s going to tell the IRS what kind of form that you are eventually going to submit when you need to submit it, which is required for an LLC Tax Extension

So now we move down to part two and you might need to fill some of these things out if you’re foreign or if you’re part of a consolidated return. For most people, this is not going to really affect you. Then you’re going to put the calendar year. So if you’ve been in operations the whole year, you can just put it for that year. If it maybe was your first year. Maybe you started sometime at the end of the year, you’re going to put in this what we call short year information because that just means it wasn’t a full year. Right? So that would be okay, I only was in business from September through December. In that case, it’s probably an initial year and you would check that button otherwise you don’t have to worry about those initial or the final check boxes.

Now generally LLCs do not pay tax. So you can put zeros here or you can just leave it blank. LLC is a pass through entity. So it generally doesn’t pay its own income tax. And then after you’ve filled out whatever you need to fill out here, you’re going to print that and send it off to the IRS. I highly, highly recommend sending it certified return receipt so that if the IRS says, “Hey, we didn’t get your LLC tax extension in on time.” You can say, “Oh, but I stuck it in the mail in time. Here’s my proof.” That’s that green card, hold on to that. And that’s it.

I hope you’re finding this video helpful. Please check out my other videos and subscribe to see future ones. If you have any questions, put them down in the comments on Youtube or to reach out. Thank you so much.