As small business owners, we often start our journey as sole proprietors. However, there comes a time when this structure may no longer serve our best interests.

At our firm, we’ve guided numerous entrepreneurs through the transition from sole proprietorship to S corporation. This shift can offer significant tax benefits, enhanced liability protection, and improved growth opportunities for your business.

In this guide, we’ll explore the key indicators that signal it’s time to consider this change and provide a step-by-step roadmap for making the transition smoothly.

What Are Sole Proprietorships and S Corporations?

Sole Proprietorships: The Simplest Business Structure

A sole proprietorship represents the most basic form of business organization. It operates as a one-person enterprise where the owner bears personal responsibility for all business aspects. Out of the 33.3 million small businesses in the country, 27.1 million are managed solely by their owners and do not employ any additional staff.

In this structure, no legal distinction exists between the owner and the business. This grants complete control over decision-making but also imposes personal liability for all business debts and obligations. From a tax standpoint, all business income appears on the owner’s personal tax return, which can result in a higher tax burden as the business expands.

S Corporations: Balancing Personal and Business Interests

An S corporation functions as a separate legal entity from its owners. This structure offers liability protection, typically shielding personal assets from business debts and liabilities. According to the Internal Revenue Service, about 4.7 million S corporations existed in the United States as of 2018.

S corporations also present potential tax advantages. As an S corp owner, you can serve as both an employee and a shareholder. This allows you to pay yourself a reasonable salary (subject to payroll taxes) and receive additional profits as distributions, which avoid self-employment taxes.

Key Differences: Liability, Taxes, and Complexity

The primary distinctions between these structures involve liability protection, tax treatment, and operational complexity. Sole proprietorships offer simpler setup and maintenance but provide no liability protection. S corporations can still result in personal liability for the debts and obligations of the business, but require more paperwork and adherence to corporate formalities.

From a tax perspective, sole proprietors report all business income on their personal tax returns and pay self-employment taxes on the entire amount. S corporation owners, however, only pay self-employment taxes on their salary, not on distributions.

Choosing the Right Structure

The selection between a sole proprietorship and an S corporation depends on various factors (such as business size, growth plans, and risk tolerance). While sole proprietorships suit many small businesses, S corporations often become more attractive as businesses grow and seek additional protection and tax benefits.

As we move forward, we’ll explore the signs that indicate it’s time to consider transitioning from a sole proprietorship to an S corporation. This transition can mark a significant step in your business’s evolution, potentially offering enhanced protection and financial benefits.

When Should You Switch to an S Corp?

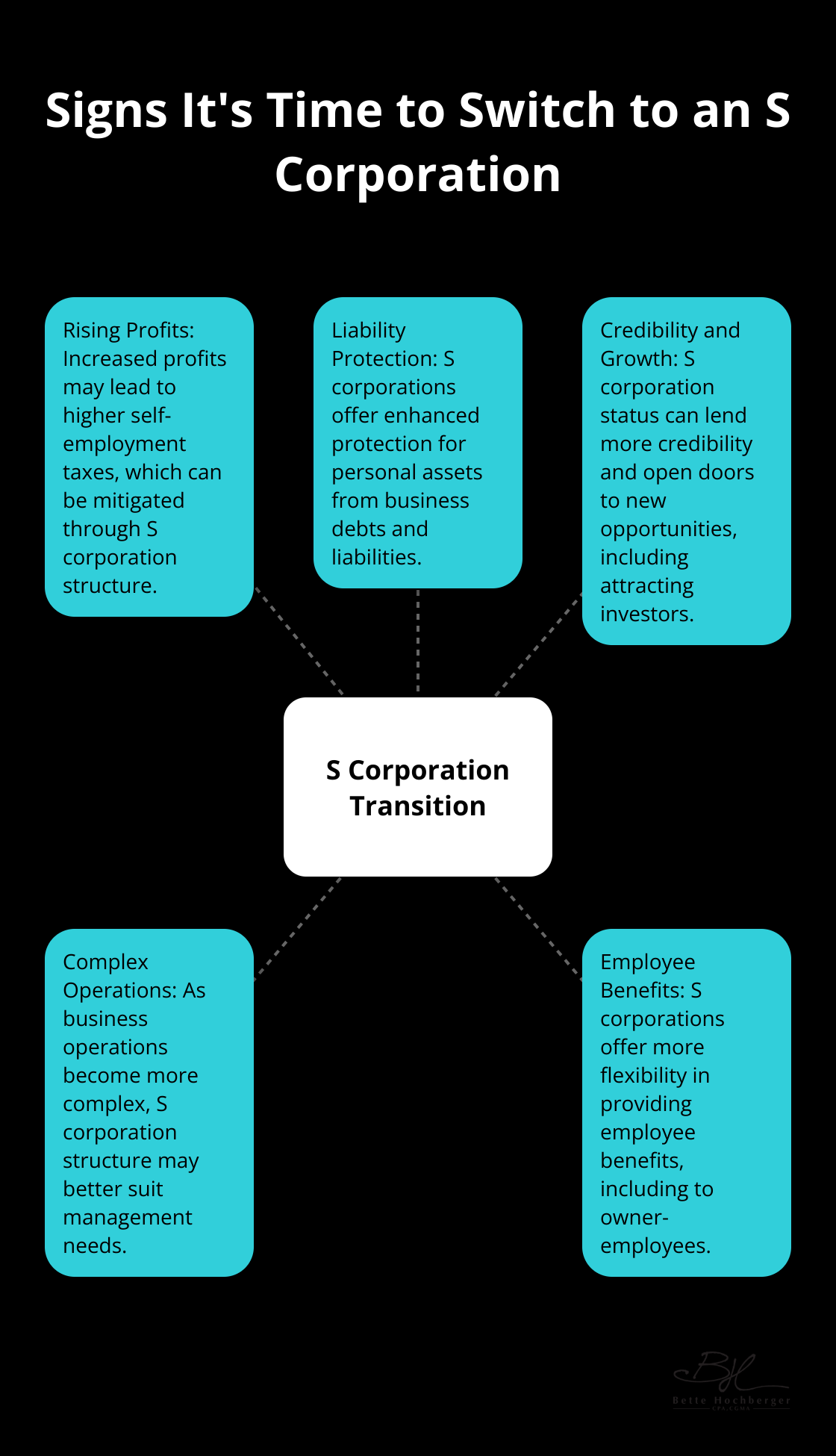

As your business expands, you might find yourself at a crossroads where your current sole proprietorship structure no longer meets your needs. Here are key indicators that suggest it’s time to consider switching to an S corporation.

Rising Profits and Tax Implications

If your business profits increase significantly, you might pay more in self-employment taxes than necessary. S corporation owners are eligible for the 20% pass-through tax deduction established under the Tax Cuts and Jobs Act for pass-through entities. This can result in substantial tax savings compared to sole proprietorships.

Increased Need for Liability Protection

As your business grows, so does your potential liability. S corporations protect the personal assets of its shareholders. Absent an express personal guarantee, a shareholder is not personally responsible for the debts and liabilities of the business.

Seeking Credibility and Growth Opportunities

S corporation status can lend more credibility to your business, potentially opening doors to new opportunities. Many larger companies and government contracts prefer (or require) working with incorporated entities. Additionally, a corporate structure can make it easier to attract investors or sell your business in the future.

Complexity of Business Operations

As your business operations become more complex, an S corporation structure might better suit your needs. This structure allows for a more formal management hierarchy, which can be beneficial as you add employees or expand into new markets.

Desire for Employee Benefits

S corporations offer more flexibility in providing employee benefits, including to owner-employees. This can include health insurance, retirement plans, and other perks that can be deducted as business expenses.

The transition from a sole proprietorship to an S corporation represents a significant step in your business’s evolution. While the benefits can be substantial, it’s important to weigh them against the increased paperwork and compliance requirements. The next section will guide you through the steps to make this transition smoothly and effectively.

How to Transform Your Sole Proprietorship into an S Corporation

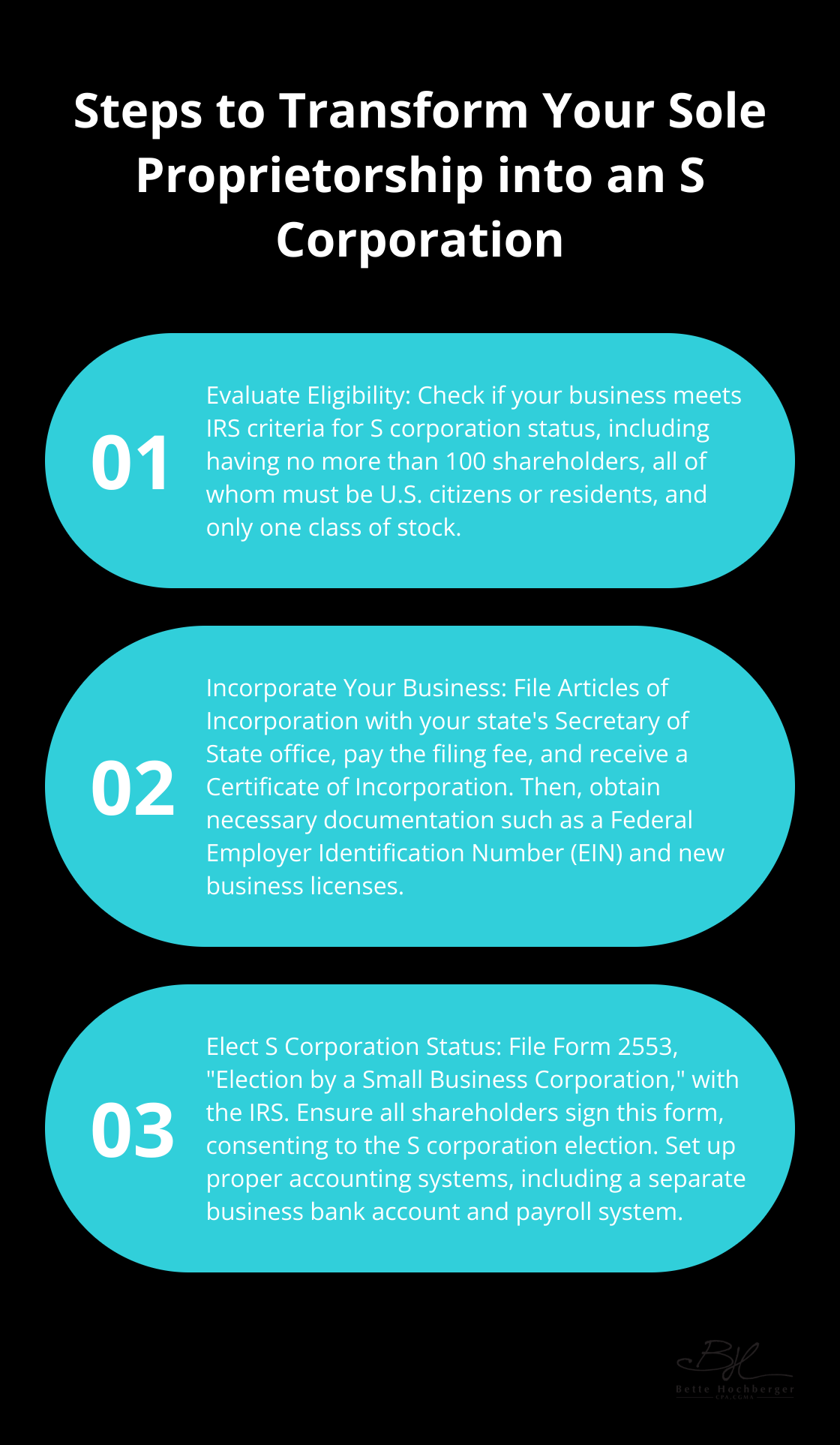

Evaluate Your Eligibility

Before you start the transition, check if your business meets the IRS criteria for S corporation status. These requirements include:

- No more than 100 shareholders

- All shareholders must be U.S. citizens or residents

- Only one class of stock

- Certain types of businesses (e.g., insurance companies and domestic international sales corporations) are ineligible

Incorporate Your Business

The first concrete step in the transition is to incorporate your business. This process involves:

- Select a unique business name

- File Articles of Incorporation with your state’s Secretary of State office

- Pay the filing fee (which ranges from $100 to $800, depending on the state)

- Receive a Certificate of Incorporation, which officially establishes your business as a corporation

Obtain Necessary Documentation

After incorporation, you need to acquire several essential documents:

- Federal Employer Identification Number (EIN) from the IRS (This serves as your business’s tax ID)

- New business licenses and permits (Your previous sole proprietorship licenses may no longer be valid under the new corporate structure)

Elect S Corporation Status

The final step is to file Form 2553, “Election by a Small Business Corporation,” with the IRS. Important points to note:

- To be an S corporation beginning with its short tax year, the corporation must file Form 2553 during the period that begins November 8 and ends January 22

- All shareholders must sign this form, consenting to the S corporation election

Set Up Proper Accounting Systems

Transitioning to an S corporation requires more complex accounting practices:

- Establish a separate business bank account

- Set up a payroll system to pay yourself a reasonable salary

- Implement a robust bookkeeping system to track income, expenses, and distributions

This transition process may seem complex, but the potential benefits of S corporation status often outweigh the initial challenges. It’s important to approach this transition with a clear understanding of the implications for your specific business situation. Consider consulting with a tax professional to guide you through this process and ensure compliance with all legal and tax requirements. For a step-by-step guide on tax compliance for S Corporations, you can refer to expert resources.

Final Thoughts

The transition from a sole proprietorship to an S corporation represents a significant milestone for your business. This shift offers numerous advantages, including enhanced liability protection, potential tax savings, and increased credibility. However, it also brings additional responsibilities and compliance requirements that you must consider carefully.

Your decision to make this transition should depend on your business’s current state and future goals. The benefits can be substantial, but the increased paperwork and operational complexity may not suit every business owner. We at Bette Hochberger, CPA, CGMA & Associates PLLC specialize in helping businesses navigate these important decisions.

Our team can provide personalized advice tailored to your specific situation, ensuring you make the most informed choice for your business’s future. Whether you maintain your sole proprietorship or transition to an S corporation, the key is to align your business structure with your long-term objectives and financial goals.

I’ll see you next time!