Data driven companies use information to make better informed decisions. A company with a strong finance department learns to calculate these using their actual data from throughout the company. In other companies, departments gather their own data, leaving marketing KPIs to be limited to the data available in their systems. One common scenario is a digital media department having precise data, and other departments operating on assumptions and delayed data from finance.

If you look at the world of digital media, you’ll see a number of metrics that are popular but extremely limited. One way finance departments add value is integrating data from all your systems, including your CRM, ERP, and Accounting packages. We help our clients understand their business as part of our fractional CFO program, where we develop real time KPI metrics using business intelligence tools to monitor the business.

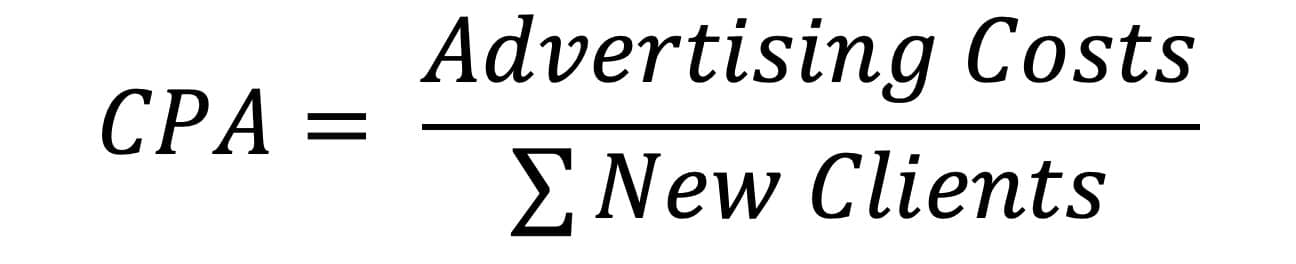

The Venerable CPA

One of the oldest and most popular metrics tracked by marketing departments is the CPA, or Cost Per Acquisition. This is the advertising cost of acquiring whatever you are measuring, often a lead or a sale. This is a popular metric because the native advertising platforms can easily calculate it. If you fire a conversion pixel on the Lead or Sale/Signup, you can calculate the CPL (Cost Per Lead) or the CPA (Cost Per Acquisition). The Simplicity of this metric is that the advertising platform has all the data needed, so you can compare your campaigns based upon it.

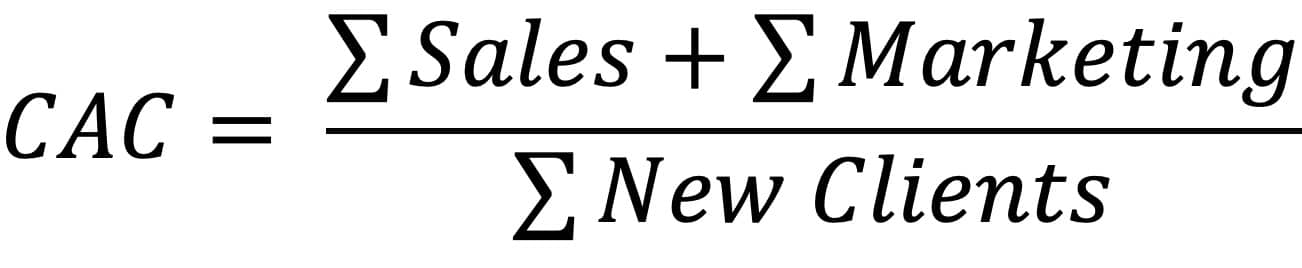

CAC – A Better Metric for Profitability

Why is CPA an inadequate cost? Because it ignores every cost of acquiring the client except the advertising dollars. In the early days of the Internet, when ads were all text, re-marketing didn’t exist, and most sites were owner operated, CPA was a reasonable approximation. CAC, the Cost of Acquiring a Customer, adds all the costs of selling, plus all the costs of marketing, and divides it by the new clients.

These costs of selling can include a variety of expenses that go beyond paying for digital media.

- Sales Commissions and Salaries

- Pre-Sales Support Personnel

- Marketing Content Creation Team

- Digital Agency Fees

This is important because often different channels have different expenses attached to them. The selling costs are very different between commissioned sales representatives or an online shopping cart. Creating elaborate video advertisements are much more expensive than writing search engine ads.

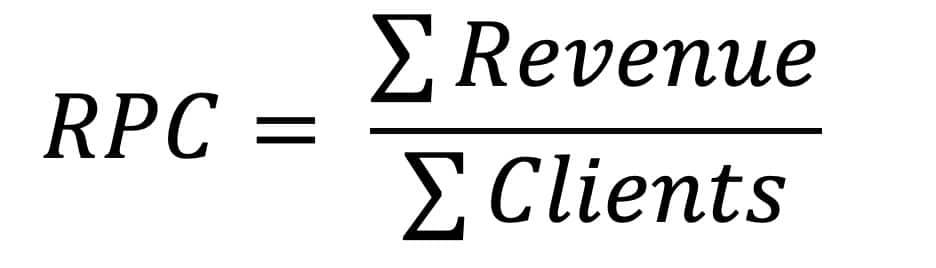

The Revenue Side, RPC Explained

Revenue per Client is the revenue side of this same calculation. We calculate the revenue and divide it by the total number of clients. This is another popular statistic because of the ease of calculations, and you can make it campaign or source specific depending on the granularity of your tracking. Ideally, you’d get the actual Revenue number from your accounting department or accounting firm, but usually it is simply pulled from the CRM based on month to date and prior month sales reports. It’s important to calculate the number of clients correctly, because if you simply look in your general ledger software it might include “clients” like your bank supplying you with $0.19 in interest or other non-client revenue sources. Additionally, your marketing department really wants to focus on the revenue from clients, if you have non client revenue events (those interest payments and similar), those need not be included.

Profitability – A Marketers View

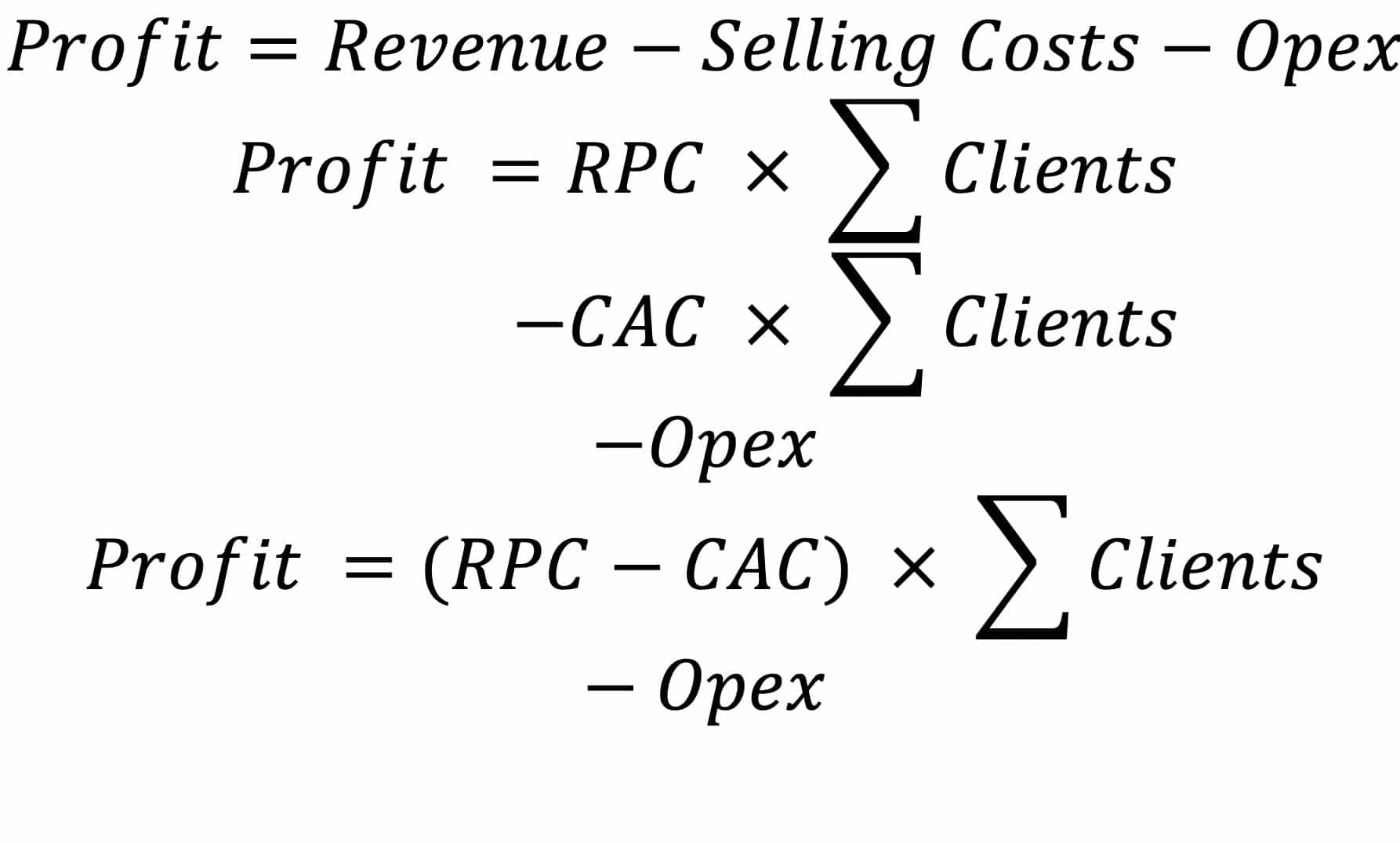

So the basic equation is, Profits = Revenue – Expenses. From the Marketing view of the universe, expenses fall into two categories, Selling Costs, that are managed by Sales and Marketing, and “everything else” which we will call Operating Expenses, or Opex. So we can look at our profitability from this perspective. So we can start to understand how we can drive profitability with KPIs.

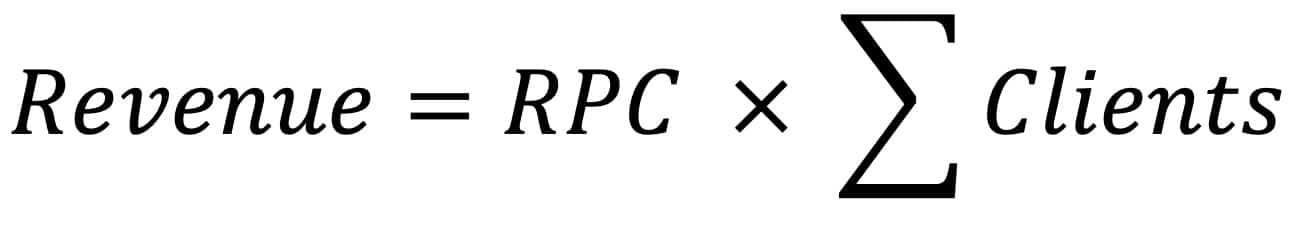

CAC and RPC and Profits – Marketing KPIs combined

From the marketing department’s point of view, CAC and RPC can be used to calculate the entire profitability of the business. That’s because with the magic of cross multiplication we can recalculate our Revenue based on RPC. So we can restate the previous lines as:

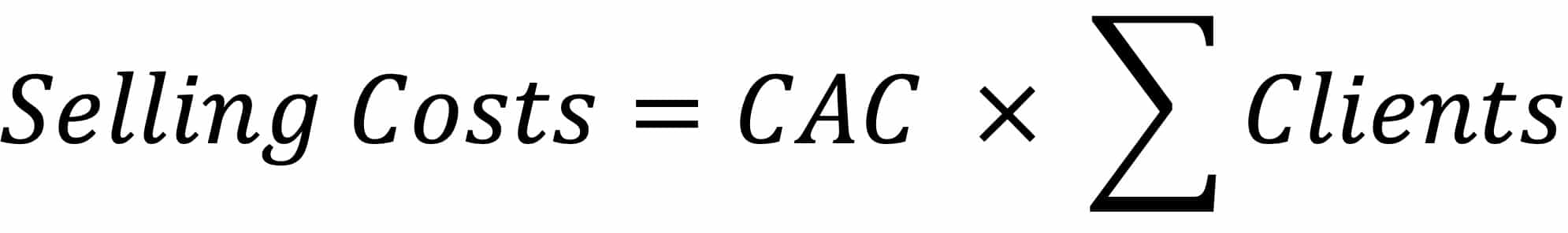

Obviously, we can do the same bit of arithmetic for the CAC equation, and get Selling Costs in Terms of CAC.

Which means we can actually calculate profitability virtually entirely from the marketing department.

Which means, if we know the differential between our RPC and our CAC, we just multiply it by the Clients and subtract our operating expenses. If your costs scale with the number of clients, you can break your Operating Expenses into Per-Sale costs and Overhead and really drill into your profitability.

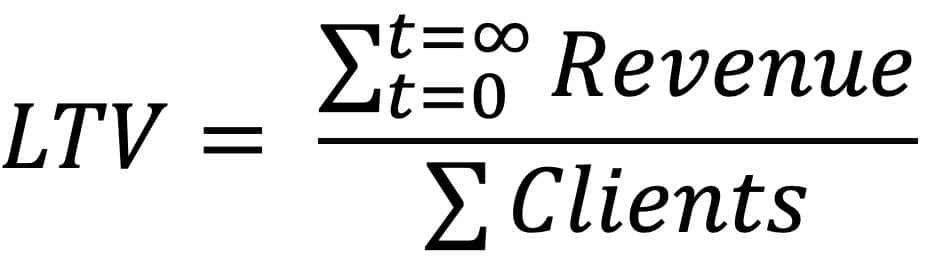

LTV, or how RPC and CAC drive Business Value

But the marketing department knows that if they can increase the RPC by selling more to each client, that will directly impact profitability. Similarly, anything that drives down the CAC drives profitability. Revenue Per Client may also understate the value of clients if your business relies on repeat business and your business is growing. Revenue will reflect our current marketing, and our previous marketing, but it will ignore our future revenues. So we have the calculation of LTV, Life Time Value of the Client. So if we look at the LTV instead of the RPC, we see how increasing the lifespan of the client, or learning to up-sell clients drives profitability as well. This is why retention and churn rate become so important.

Conclusion – Know your Marketing KPIs: RPC and CAC

To understand your profitability, you need to understand your marketing KPIs: RPC and CAC. By tracking KPIs, you get a forward looking understanding of your profitability. In a future post, we’ll evaluate using other KPIs like Churn Rate to calcuate LTV in Real Time and really optimize business value. Most marketing departments focus on CPA, a data driven organization will look at all selling costs, to evaluate their true CAC. Most sales departments just look at the current sales, but a data driven organization will look at all the revenues, including those from prior sales, to compare RPC to CAC, as you let marketing KPIs drive your profitability.