We’re going Longer and Deeper, focused on cash flow allocation strategies and how it helps you!

It’s the first day of 2021- who’s ready for a fantastic year of prosperity ahead of them? I know I am!

With the entire year ahead of us, what are some things we can do differently in 2021?

One thing that we started last year is to look at our tax deduction strategy. When the standard deduction was increased, we looked at our deductions. In a typical year we had deductions that were over the standard deduction, but not by much.

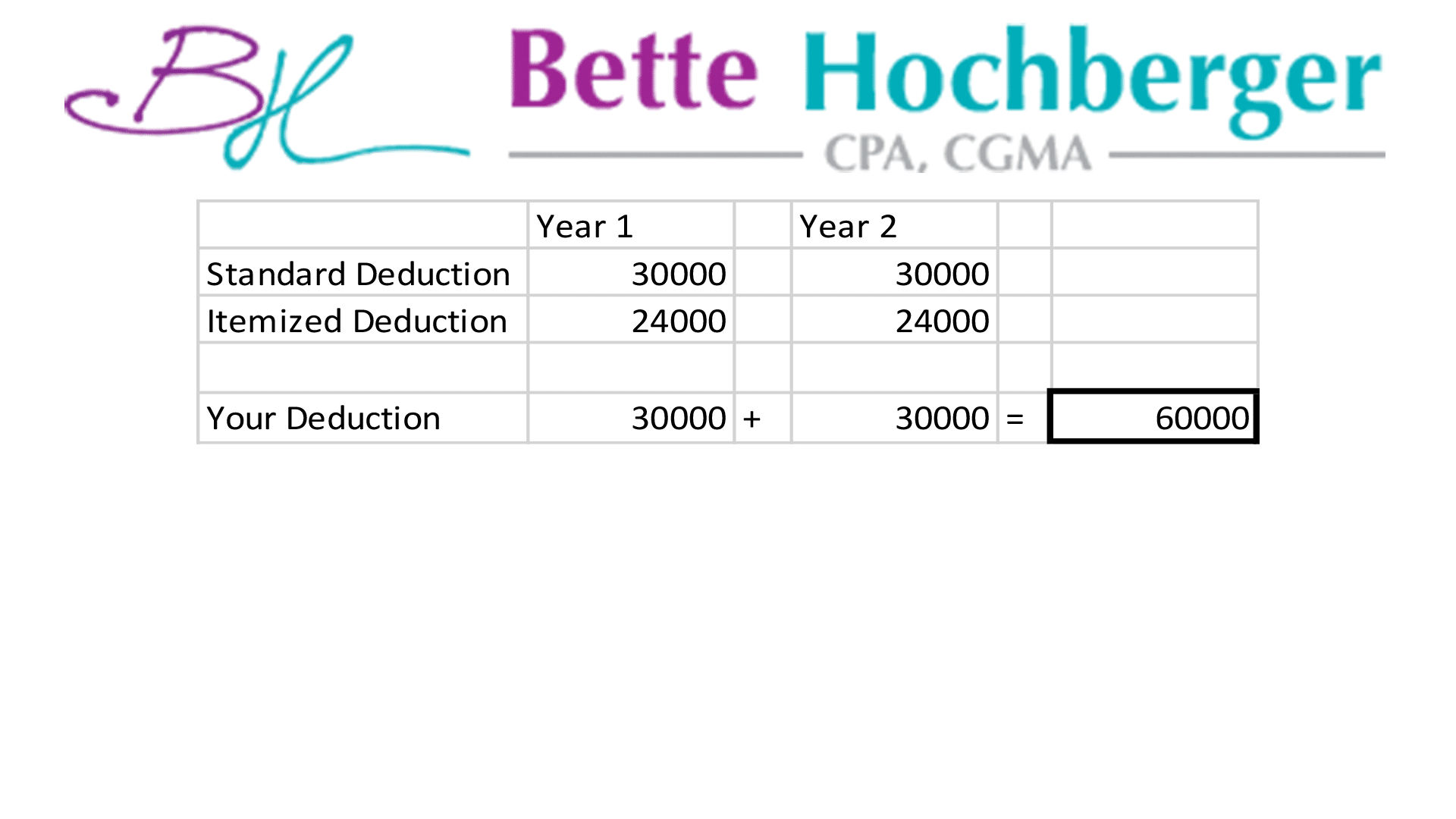

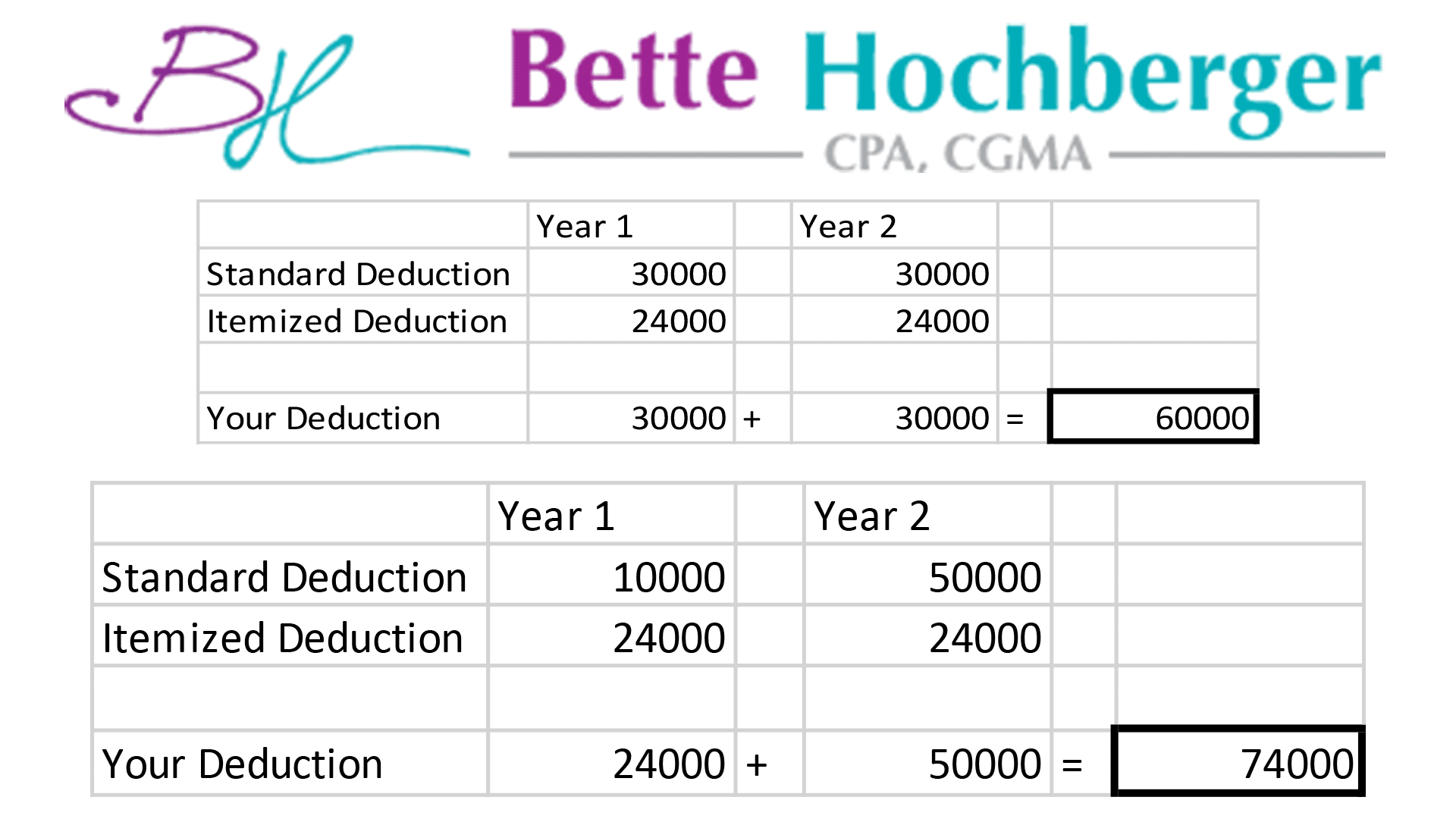

If you have $30,000 in deductions, it’s more than the $24,000 standard and worth itemizing, but only for $6,000. So we looked at deductions we had timing discretion on like charitable giving and property taxes. In that $30,000 example, if you can time things, and you can do $10,000 in one year and $50,000 the next, how does that matter?

Well, in the $10,000 year, you take the Standard Deduction, for $24,000. In the other year you take $50,000 and itemize. Over two years you now get $74,000 in deductions, a free deduction of $14,000. Now, it never works that way perfectly, local taxes are capped at $10,000 per year, and only some of our charitable giving is done “Year End” – so we can push it into January, but it’s still free money.

But we did do something a little special in 2019, we opened a Donor Advised Fund, which we contributed funds to in 2019. Since 2020 was our “standard deduction” year, our charitable contributions were set aside in a checking account throughout the year, and during the year giving was mostly from the donor advised fund.

When the banks and brokerages open Monday, January 4th, we’ll be moving that money into the donor advised fund, to be distributed throughout the year. Then as we set aside our charitable giving money in 2021, it will all go into the fund, for distribution during 2022.

It feels great knowing that you have a stash of money for charitable giving. It feels even better when you know you’ve fully tax optimized it.

This is just one example of prosperity through cash allocation. What are some other things you can do? A few years back, I read the book Profit First by Mike Michalowicz and was inspired, but didn’t do much with it as analysis paralysis over allocation percentages crept it. When I worked with Billie Anne from Profit First to learn to help others implement the system, I really implemented it well for myself.

One thing that worked better with an advisor was a reality check on what to do when things go wrong, and I assure you that they have and they will in the future. For months my allocation schedule was messy, the money was in the wrong account, and I even paid the occasional overdraft fee.

But over the years that I’ve been doing Profit First, I’ve doubled my business, and really figured out what niche I want to focus on. I realized that while I’m good at doing tax returns, I really love working with clients to grow their businesses and build their wealth.

As my business got bigger and more complicated, Profit First has really helped me stay focused on that growth. I know that several payrolls are set aside, my operating expenses are covered, and profits are set aside to reinvest in growing the business, it’s been Rocket Fuel for my business.

I’m thrilled that I became a Profit First Professional, and love helping my clients grow their businesses.

Over the years working with business owners, the consistent problems I hear are that they have no books, could never stay on top of Quickbooks, and hated doing it. The other things that they hated were surprise bills, not knowing how much they owe in taxes, anxiety around April 15th, and other chaos in their life.

So for 2021, I decided to help my clients even more, by developing a business model that solves their problems.

This year, I’m launching four new monthly accounting packages to help all my clients achieve a more prosperous future.

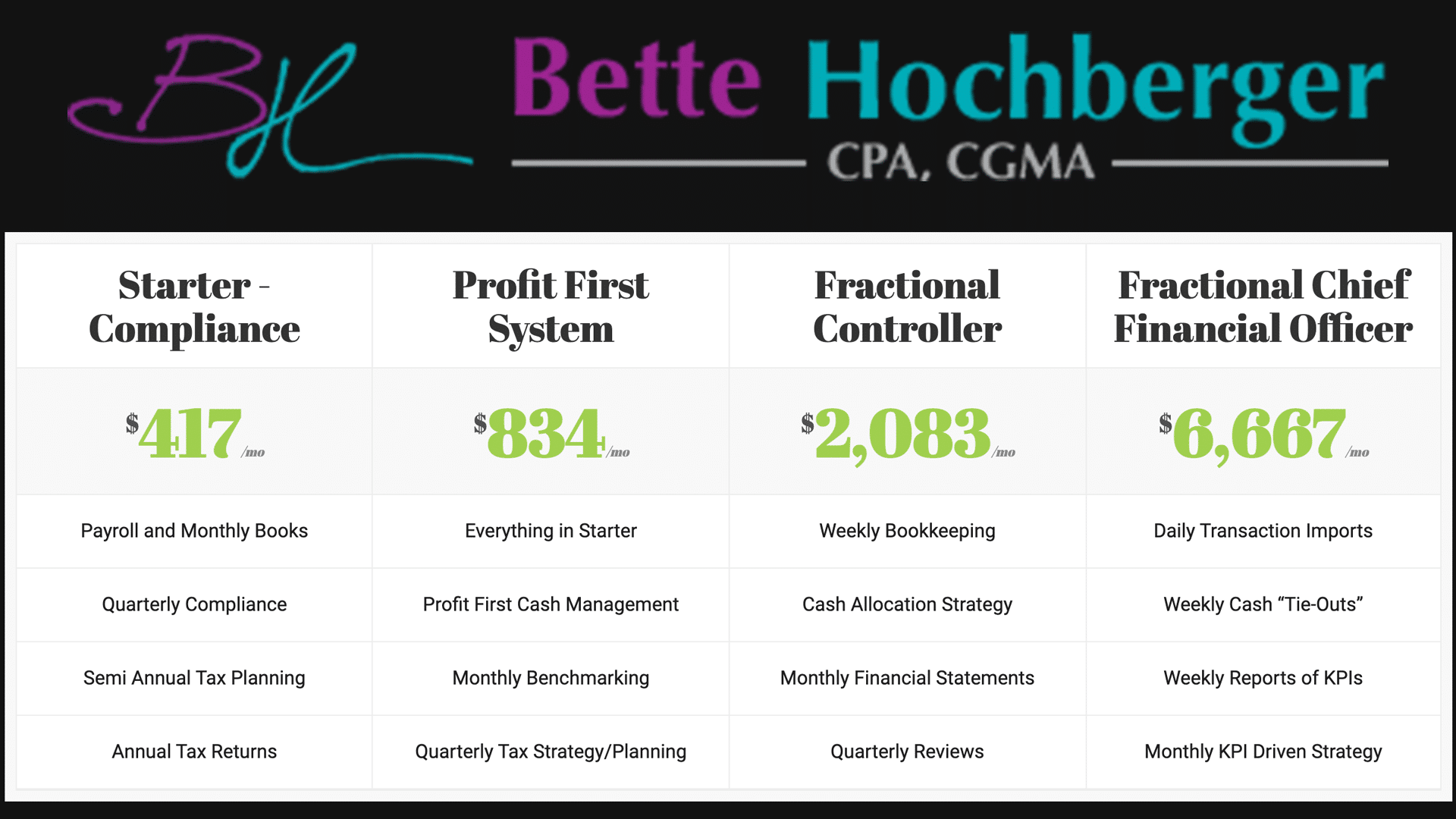

These packages are: Starter, Profit First, Fractional Controller, and Fractional CFO Services for businesses of all sizes.

Here is our 2021 pricing, but you can always find our most up to date pricing at our Outsource Accounting Prices page.

The first two, Starter and Profit First are oriented around Owner-Operated businesses, where all the financial decisions are made by the owner. The latter two are geared towards slightly larger businesses, where you have managers making decisions, and you need to monitor how it all works.

Starter is my new compliance package. Each month, we update your books, make sure your payroll is setup and running smoothly, and use elements of Profit First for cash flow allocation to manage taxes and operating expenses. We have a quarterly compliance review to verify that all your estimated tax payments are in. We meet twice a year to review your tax planning strategies, and when tax season rolls around, we prepare your return and send it to you to review and then off to the IRS.

The Starter Package is designed to bring order to your financial chaos.

Profit First is my stepped up package for those Owner-Operated businesses ready to get more strategic than the Starter Package permits. We use more cash flow allocations with the full Profit First implementation, designed to adapt to growing your business. Each month we’ll have a short call to review how you’re doing with the business, adjust your allocations as needed, and review your business compared to benchmarks. The goal is to improve profitability each month, while you grow your business and we handle your back office books.

Our Fractional Controller service is focused on businesses where you have managers that are now making financial decisions, and you need structure to monitor everything. Instead of using the Profit First envelope style cash flow allocation, we set up budgets and processes for your departments. We take care of the bookkeeping each week, with reports of anything unusual. Then we prepare monthly financials for you so you see how your business is doing, and each quarter we have a Strategy session, where we discuss where your business is and what we can do next. Think of this as a fully outsourced accounting department at a much lower cost.

Our top tier package, Fractional CFO, is for businesses ready to really take off like a rocket. At the Fractional CFO level, we’re truly a full accounting department for you. The transactions are entered daily, and we tie everything out each week. We set up KPIs – Key Performance Indicators, that are updated from your systems. We’ll send you a weekly report on those KPIs, and we’ll review them with you monthly in our monthly Strategy Session. Think of Fractional CFO as having all the tools available to you that your larger competitors have, but at a cost you can afford.

By offering packages for different sized businesses, we aim to give all our clients the consistency and sanity they are looking for. Instead of being scared of tax returns and our fees, you pay a consistent monthly bill. Tax season becomes the straight-forward process of preparing the documents for you. You’ll collect any tax refund due, and you’ll keep focusing on growing your business. By offering these tiers, we’re prepared to grow with you, as your growing business’s needs change.

So that’s what we’re doing at Bette Hochberger, CPA, CGMA. What are you going to do to improve your finances in 2021? Leave a comment and let me know.