Nonprofits face unique financial challenges that require expert guidance. At Bette Hochberger, CPA, CGMA, we’ve seen how a Fractional CFO for nonprofits can provide valuable financial expertise without the cost of a full-time executive.

These part-time financial leaders offer strategic planning, improved donor transparency, and assistance with grant management. In this post, we’ll explore the benefits and challenges of hiring a Fractional CFO for your nonprofit organization.

What Is a Fractional CFO for Nonprofits?

Defining the Role

A Fractional CFO provides strategic management services and fiscal expertise to charitable and tax-exempt organizations on a part-time or contract basis. For nonprofits, this role offers access to top-tier financial expertise without the commitment of a full-time salary. These professionals bring a wealth of experience from various sectors, applying best practices to streamline operations and improve financial health.

Addressing Unique Nonprofit Challenges

Nonprofits face distinct financial challenges that set them apart from for-profit entities. These organizations must manage multiple funding streams, comply with strict grant requirements, and maintain transparency for donors and stakeholders. The majority (59%) of U.S. nonprofits are “very small” with annual budgets less than $50,000, and 97% have budgets of less than $5 million, making it difficult to justify a full-time CFO salary.

Tailored Financial Strategies

Fractional CFOs create targeted financial strategies for nonprofits. They develop detailed budgets that align with programmatic priorities and funding restrictions. For example, a Fractional CFO can implement a rolling forecast that accounts for seasonal donations and grant disbursements, allowing nonprofits to anticipate and mitigate cash flow issues.

Improving Financial Reporting and Compliance

Fractional CFOs excel in enhancing financial reporting and compliance. They implement systems to track restricted and unrestricted funds separately, which ensures that donor intentions are honored and grant requirements are met. This level of detail is essential for nonprofits, as mismanagement of funds can result in legal issues and loss of donor trust.

Transforming Nonprofit Financial Management

Fractional CFOs have the potential to transform nonprofit financial management. Their expertise allows organizations to focus on their mission while ensuring a solid and sustainable financial foundation. These professionals bring innovative solutions to complex financial challenges, often drawing from their diverse experiences across multiple sectors.

As we explore the benefits of hiring a Fractional CFO for nonprofits, it becomes clear that their role extends far beyond basic financial management. Let’s examine how these professionals can drive strategic growth and enhance operational efficiency in nonprofit organizations.

Why Nonprofits Need Fractional CFOs

Nonprofits face unique financial challenges that require expert guidance. Fractional CFOs can revolutionize nonprofit financial management without breaking the bank. These professionals bring a wealth of experience and strategic insight that can transform an organization’s financial health.

Maximizing Financial Resources

Fractional CFOs offer a cost-effective solution for nonprofits seeking high-level financial expertise. A study by the Nonprofit Finance Fund reveals that 62% of nonprofits report financial sustainability as their top challenge. Fractional CFOs address this by implementing sophisticated financial strategies typically reserved for larger organizations with full-time CFOs. They develop multi-year financial projections that account for various funding scenarios, which helps nonprofits make informed decisions about program expansion or contraction.

Elevating Financial Reporting

One of the most significant benefits of hiring a Fractional CFO is the improvement in financial reporting and analysis. These professionals create board-ready financial dashboards that provide clear, actionable insights. BoardSource provides year-round, on-demand access to educational nonprofit board resources, support from BoardSource experts, and a comprehensive board self-assessment. Fractional CFOs can leverage these resources to produce reports that highlight key performance indicators, trend analysis, and benchmarking against similar organizations.

Enhancing Donor Confidence

Transparency is key for maintaining donor trust. Fractional CFOs play a vital role in enhancing financial transparency through improved reporting and communication. They help nonprofits develop detailed program cost analyses, providing donors with a clear understanding of how their contributions are used. This level of transparency can lead to increased donor retention rates.

Streamlining Grant Management

Grant management is a complex and time-consuming process for many nonprofits. Fractional CFOs streamline this process by implementing robust tracking systems and ensuring compliance with grant requirements. They also assist in developing comprehensive budgets for grant applications, increasing the likelihood of securing funding. With their expertise, nonprofits can avoid common pitfalls such as cost overruns or misallocation of funds, which can jeopardize future funding opportunities.

The impact of a Fractional CFO extends beyond financial management. These professionals become strategic partners, helping nonprofits navigate complex financial landscapes and achieve their missions more effectively. As we explore the specific benefits of hiring a Fractional CFO, it becomes clear that their role is integral to the success and sustainability of nonprofit organizations.

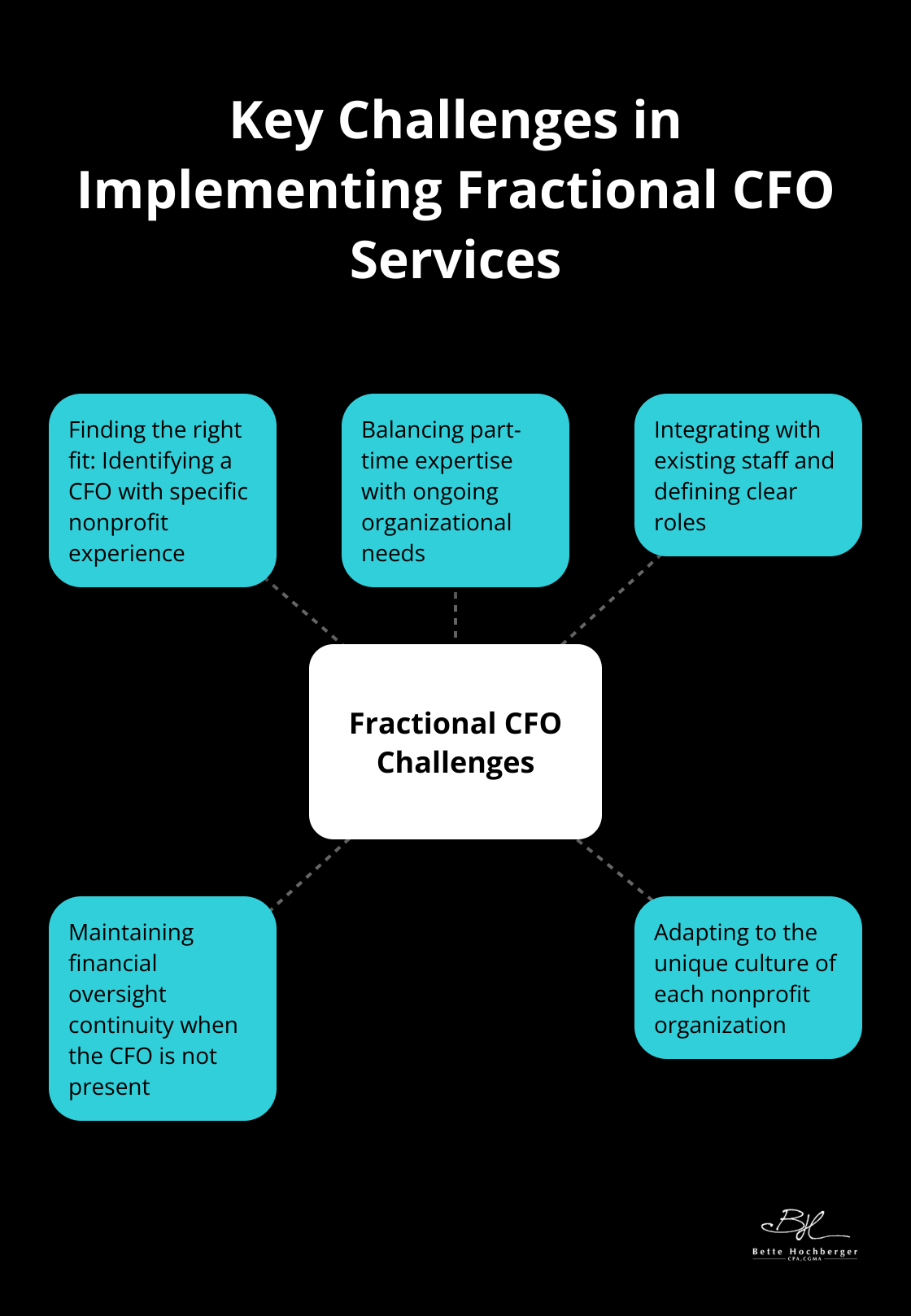

Navigating Fractional CFO Challenges

Finding the Right Fit

Nonprofits must identify a Fractional CFO with specific nonprofit experience. The nonprofit sector presents unique financial complexities that differ from for-profit entities. When selecting a Fractional CFO, organizations should prioritize professionals with a proven track record in the sector, knowledge of fund accounting, and expertise in grant management.

Balancing Part-Time Expertise with Organizational Needs

A primary challenge involves aligning the part-time availability of a Fractional CFO with the ongoing financial needs of the organization. Nonprofits often encounter unexpected financial challenges or opportunities that require prompt attention. To address this issue, organizations should establish clear communication protocols and set realistic expectations about response times. Some nonprofits find success by scheduling regular check-ins and creating a prioritization system for financial tasks.

Integrating with Existing Staff

Smooth integration of a Fractional CFO with existing staff can prove difficult. To mitigate this challenge, organizations should consider a phased approach to introducing the Fractional CFO’s role. They can start with key financial processes and gradually expand their involvement. It’s also important to clearly define roles and responsibilities to avoid overlap or gaps in financial management.

Maintaining Financial Oversight Continuity

Continuity of financial oversight presents another significant challenge. Nonprofits should establish robust documentation practices and knowledge transfer protocols. These measures ensure that financial strategies and insights remain accessible when the Fractional CFO is not present. The implementation of cloud-based financial management systems (such as QuickBooks Online or Xero) can facilitate real-time collaboration and maintain a consistent flow of financial information.

Adapting to Organizational Culture

Fractional CFOs must quickly adapt to the unique culture of each nonprofit they serve. This adaptation includes understanding the organization’s mission, values, and operational style. Nonprofits can help by providing a comprehensive onboarding process that includes introductions to key stakeholders, an overview of current financial processes, and insights into the organization’s strategic goals. This cultural alignment ensures that the Fractional CFO can provide relevant and effective financial guidance.

Final Thoughts

Fractional CFOs offer nonprofits a powerful solution to navigate complex financial landscapes without the burden of a full-time executive salary. These professionals bring strategic insights, improve financial reporting, enhance donor trust, and streamline grant management processes. Nonprofits that successfully integrate a Fractional CFO often see improved operational efficiency, better financial decision-making, and increased capacity for long-term planning.

The importance of financial expertise in nonprofit success cannot be overstated. In an era of increased scrutiny and competition for funding, having a seasoned financial professional can make the difference between thriving and merely surviving. Fractional CFOs for nonprofits provide the strategic guidance necessary to navigate economic uncertainties, comply with complex regulations, and maximize the impact of every dollar received.

We at Bette Hochberger, CPA, CGMA encourage nonprofit organizations to explore the potential of Fractional CFO services. Our team specializes in providing tailored financial solutions, including Fractional CFO services, designed to help nonprofits manage cash flow and ensure long-term profitability. Fractional CFO services can help nonprofits access top-tier financial expertise and transform their financial management practices.