Educational Video

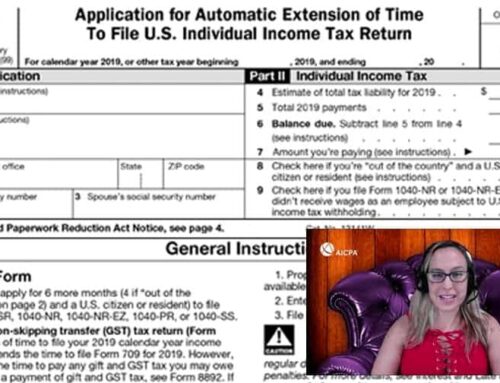

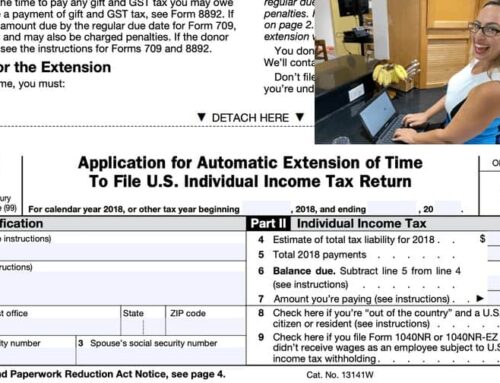

Hey there! I’m Bette Hochberger, CPA, CGMA. If you’re feeling a bit overwhelmed by tax season, you’re not alone. Understanding tax forms can be tricky, but I’m here to simplify the process for you. Today, we’re diving into Form 4868, the application for an automatic extension of time to file your individual income tax return (Form 1040). Let’s get started!

What Is Form 4868?

Form 4868 is your ticket to an automatic six-month extension for filing your federal income tax return. This means you can push back your filing deadline from April 15 to October 15. However, it’s important to remember that this extension is for filing your return, not for paying any tax owed. You still need to estimate and pay any taxes by the original due date to avoid penalties!

Who Should Use It?

If you find yourself needing extra time to prepare your tax return, this form is perfect for you. Whether you’re dealing with complex investments, waiting on documents, or simply need more time to gather your information, this form can help ease your stress.

How to Fill Out and Submitting Form 4868

Filling out and filing Form 4868 is pretty straightforward! Check out my video above for a step-by-step guide.

Filing for an extension can relieve some of the pressure during tax season. Just remember, it’s always important to pay any taxes owed by the original deadline. With this guide, you should feel more confident in tackling Form 4868.

Don’t hesitate to reach out if you have more questions about taxes, and as always, stay safe, and I’ll see you next time!