Part of the COVID-19 Webinar series, advising on how to maximize your COVID-19 Stimulus benefits.

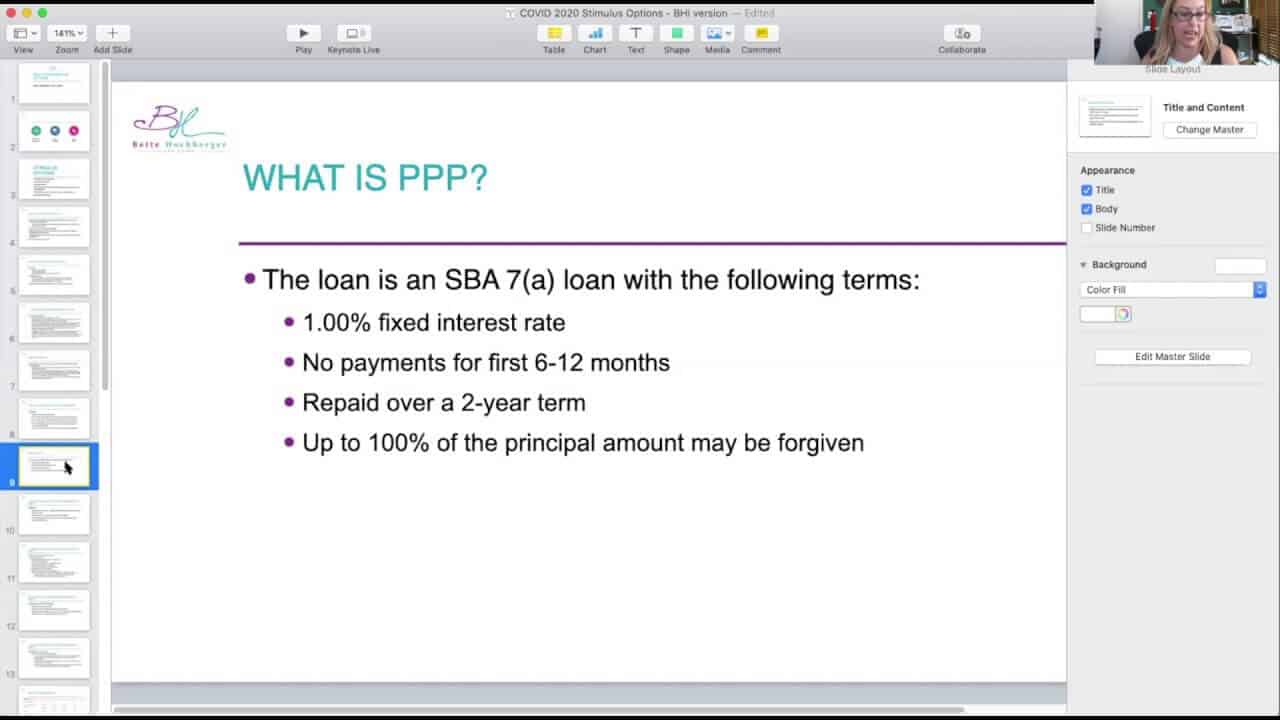

2020 COVID Stimulus Options

Bette Hochberger, CPA, CGMA2020-12-01T02:55:39-05:00April 3rd CARES Act / COVID-19 Stimulus options. Reviewing the PPP - Paycheck Protection Program, EIDL - Emergency Injury Disaster Loan, and more.

The Difference between Income and Cash

Bette Hochberger, CPA, CGMA2020-12-01T01:30:15-05:00One of the biggest challenges for small business owners is understanding the difference between Income, an Accounting Concept, and Cash, the money that they actually take out of their business. https://www.youtube.com/watch?v=UD5-cYWwa3o One particular thing that I had a discussion about multiple times in the last two months is income versus cash. Now most of my [...]

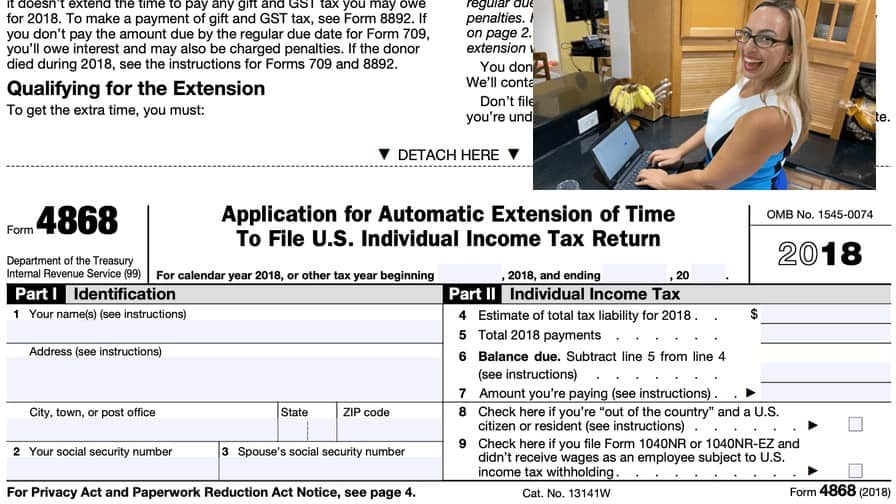

Form 4868 – Filing an Individual Extension

Bette Hochberger, CPA, CGMA2020-12-01T01:34:47-05:00Tax Extensions are a safe, legal, and reasonable way to get more time to file without paying penalties. You can quickly fill out Form 4868 and get a tax extension. Note, in 2020, because of COVID-19, the deadline was shifted, which had some implications. IRS Form 4868 - 2019 Addition. https://www.youtube.com/watch?v=BSOsxGfHEA0 We're getting close to [...]

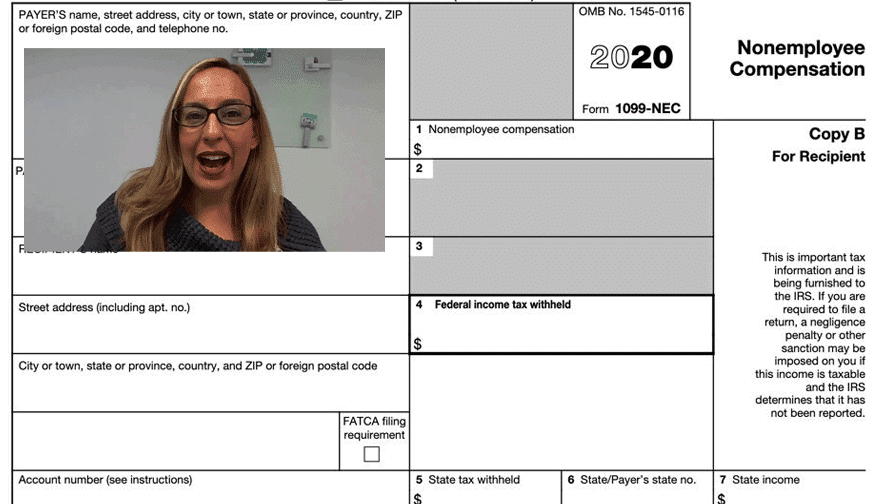

How to fill out 1099-Misc Forms

Bette Hochberger, CPA, CGMA2020-12-03T23:29:45-05:001099-Misc forms, the bane of every January. There are many 1099 forms, but the most common business one is the 1099-MISC form. The IRS has really been cracking down on these forms and the reason is because their matching system lets them track who isn't paying taxes if they're being paid under the table. It's [...]

S-Corporation Owner Payroll

Bette Hochberger, CPA, CGMA2020-12-01T01:57:27-05:00The IRS is clear, you must run S-Corporation owner payroll. How you run it, what you pay yourself, and how this should work is explained in this video on S-Corporation owner payroll.

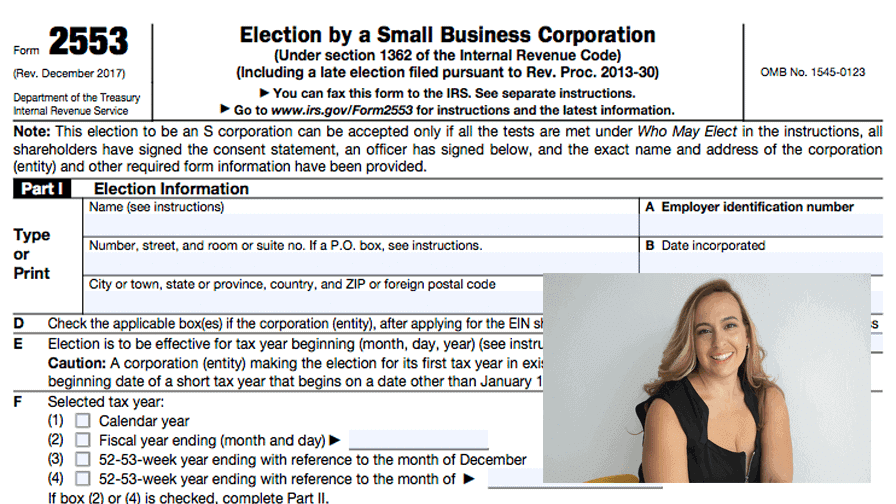

How to Fill in Form 2553 Election by a Small Business Corporation S Election

Bette Hochberger, CPA, CGMA2020-12-01T02:03:48-05:00S Corporations are popular and have many tax advantages. If you wish you make your new (or existing) corporation an S Corporation, you need to fill our Form 2553 for the S Corporation Election.

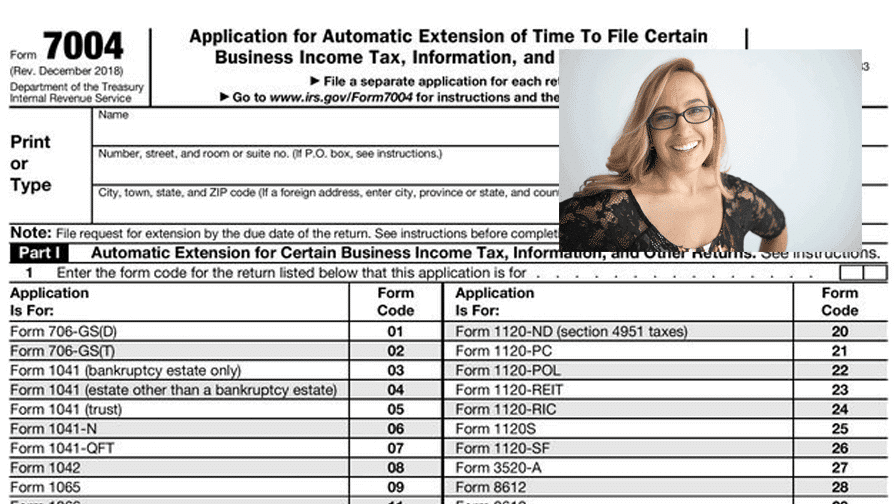

Form 7004: S Corporation Tax Extensions

Bette Hochberger, CPA, CGMA2020-12-01T02:13:29-05:00S Corporations can request a tax extension with Form 7004. It is quick, easy, and costless, so if your taxes won't be filed on time, fill out form 7004 for an automatic s corporation tax extension.

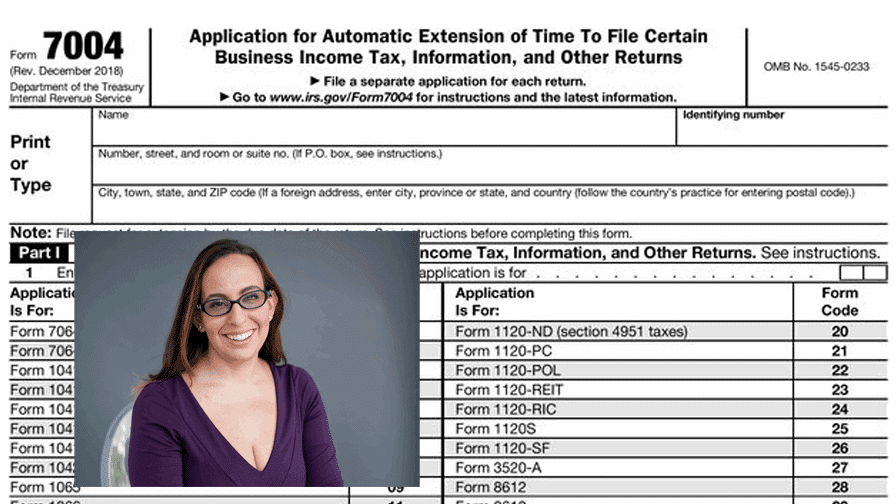

How to file an LLC Tax extension Form 7004

Bette Hochberger, CPA, CGMA2020-12-01T02:24:40-05:00An LLC Tax Extension can be quickly obtained by getting IRS Form 7004, filling it out, mailing it in, and then filing your LLC Tax return later.