Choosing the right accounting solution is a critical decision for any business. At Bette Hochberger, CPA, CGMA & Associates PLLC, we understand the impact this choice can have on your financial management and overall success.

In this post, we’ll explore the top ways to handle your accounting needs, from in-house teams to outsourced services and cloud-based software. We’ll weigh the pros and cons of each option to help you make an informed decision for your company’s future.

Is In-House Accounting Right for Your Business?

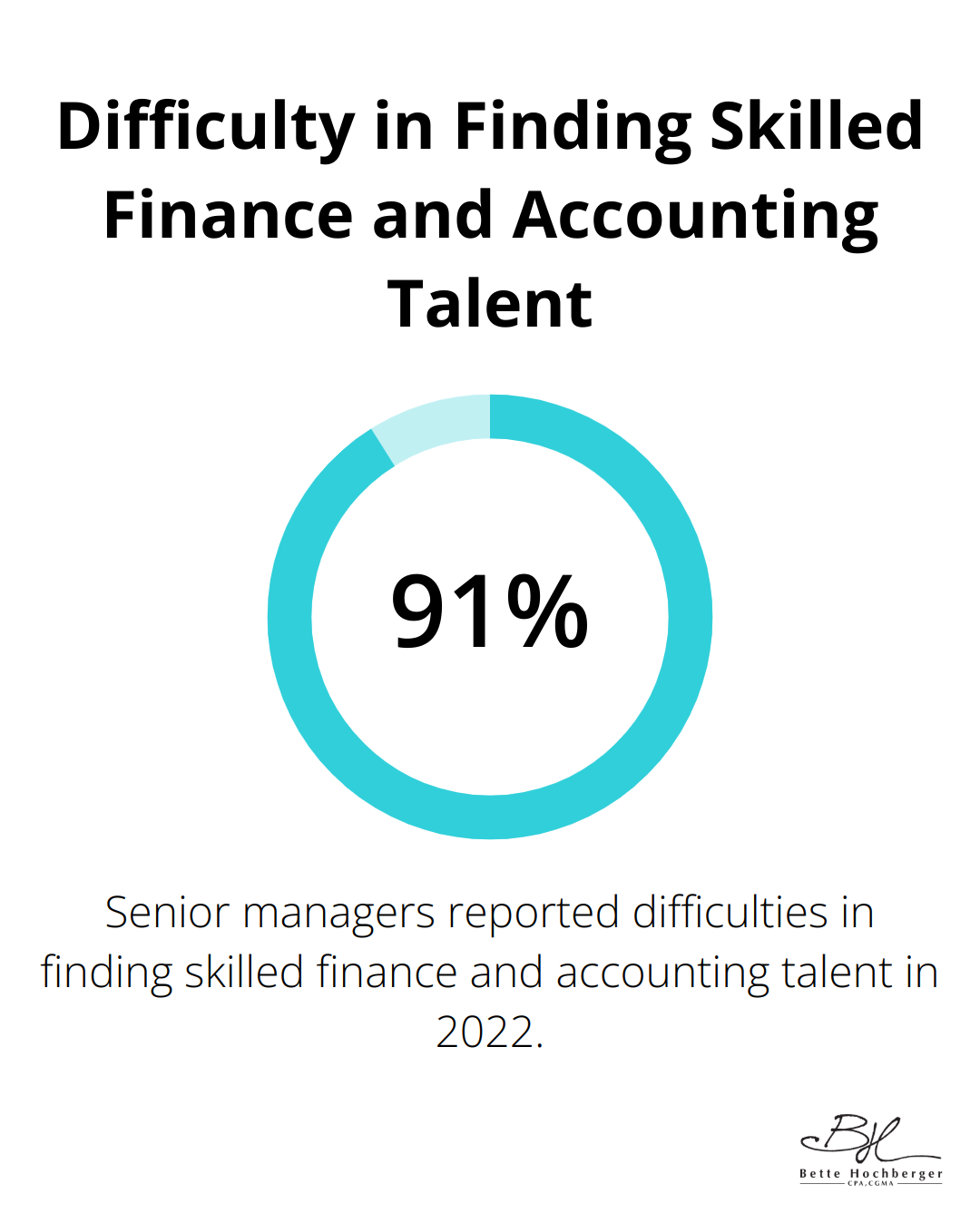

The Power of Direct Financial Control

In-house accounting offers businesses complete control over their financial processes. This approach involves the hiring of a dedicated team of accountants to manage all financial aspects internally. However, finding skilled finance and accounting talent can be challenging, with 91% of senior managers reporting difficulties in 2022 according to a study by Robert Half.

Real-Time Financial Insights

An in-house team provides instant access to financial data. This immediate insight proves essential for informed business decisions. Your accountants can deliver up-to-the-minute reports on cash flow, profitability, and other key financial metrics. Such immediacy holds particular value during periods of rapid growth or economic uncertainty.

The Cost Consideration

The benefits of in-house accounting come with a price tag. Hiring a full-time accounting team involves significant costs. These expenses extend beyond salaries to include benefits, training, and overhead costs for additional office space and equipment. The Bureau of Labor Statistics reports that the median annual wage for accountants and auditors was $81,680 in May 2024, with benefits often adding 30-40% to this figure.

Scaling Challenges

As businesses grow, so do their accounting needs. Scaling an in-house accounting department presents challenges. The need to hire additional staff, invest in more sophisticated accounting software, and manage a larger team can arise. This process often consumes time and resources (potentially diverting them from other areas of the business).

Alternatives to Consider

While in-house accounting offers many benefits, it’s important to weigh these against potential drawbacks. Businesses should consider alternatives that might better suit their unique needs and growth trajectory. Outsourced accounting services can provide specialized expertise without the overhead costs of an in-house team. These services often offer scalability to meet changing business needs, making them an attractive option for companies in various stages of growth.

Why Outsourced Accounting Services Are Gaining Popularity

Access to Specialized Expertise

Outsourced accounting services provide businesses with access to a pool of seasoned and qualified accountants with diverse specializations. These professionals stay up-to-date with the latest accounting practices and regulations, offering enhanced expertise to their clients. This expertise often surpasses what a single in-house accountant can offer.

Cost-Effective Financial Management

For small to medium-sized businesses, outsourcing can significantly reduce costs compared to maintaining an in-house team. The average annual salary for an in-house accountant in the United States is around $73,560, according to the Bureau of Labor Statistics. In contrast, outsourced accounting services can cost as little as $500 to $2,500 per month (depending on the complexity of the business and the services required). This cost difference allows businesses to allocate resources more efficiently and invest in other growth areas.

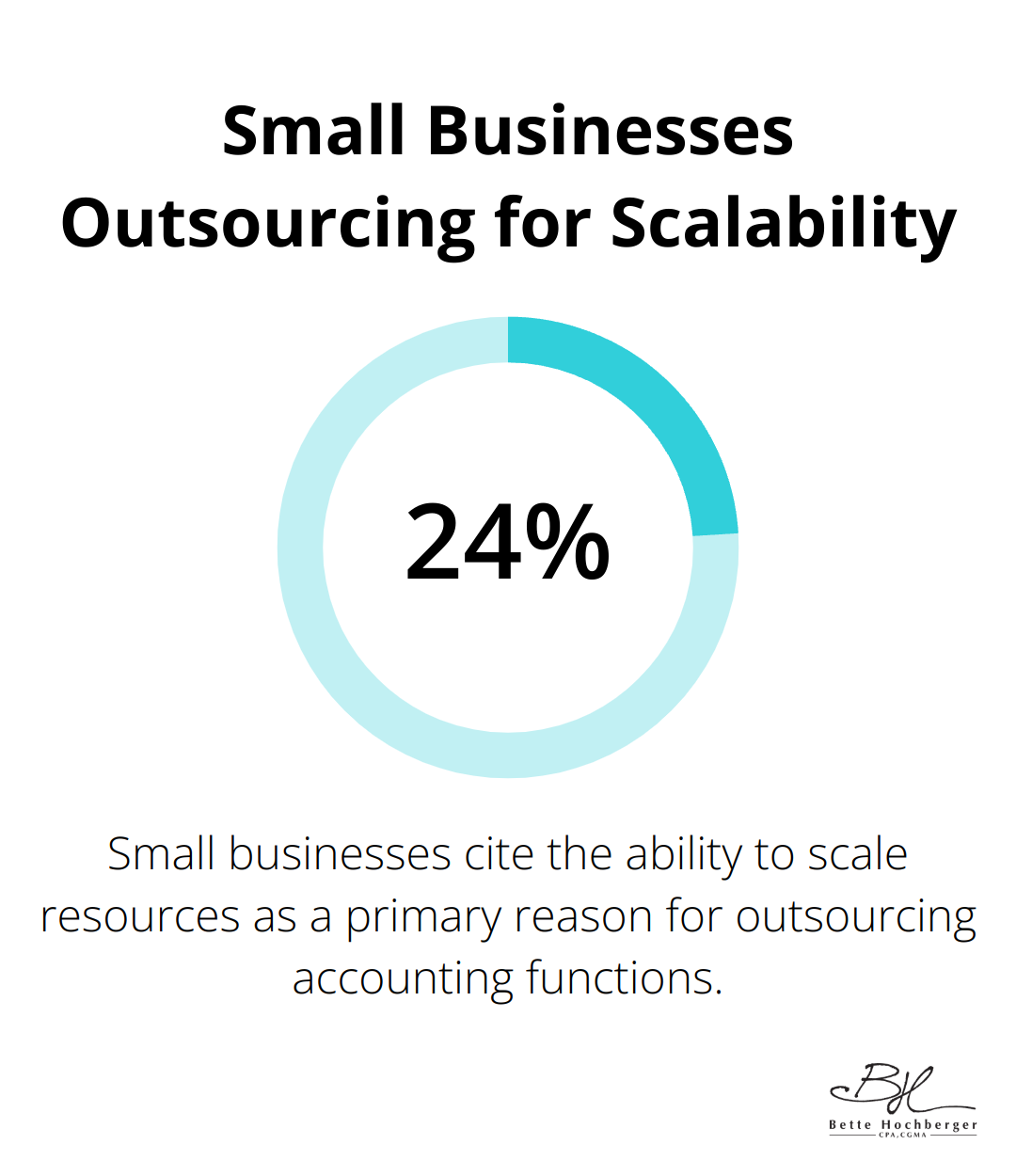

Scalability and Flexibility

As businesses grow and evolve, their accounting needs change. Outsourced services offer the flexibility to scale up or down as needed. This adaptability proves particularly valuable for seasonal businesses or those experiencing rapid growth. A survey by Clutch found that 24% of small businesses cite the ability to scale resources as a primary reason for outsourcing their accounting functions. This scalability ensures that businesses always have the right level of support, without the need to hire or lay off staff as their needs fluctuate.

Enhanced Focus on Core Business Activities

Outsourcing accounting functions allows business owners and managers to focus on their core competencies and strategic initiatives. By delegating financial tasks to experts, companies can dedicate more time and energy to product development, customer service, and other critical business areas. This shift in focus often leads to improved overall performance and competitiveness in the market.

Technological Advantages

Reputable outsourced accounting firms invest in the latest accounting software and technologies. This investment provides their clients with access to advanced tools and systems without the need for significant upfront costs. These technologies often include cloud-based platforms, which enable real-time financial reporting and seamless collaboration between the outsourced team and the client. As we move forward, let’s explore how cloud-based accounting software is revolutionizing financial management for businesses of all sizes.

Cloud Accounting Revolution: The Future of Financial Management

Real-Time Financial Insights

Cloud accounting platforms provide instant access to financial data, allowing business owners to make informed decisions quickly. Real-time data analysis empowers businesses to monitor revenue, expenses, cash flow, and other critical financial metrics. This immediacy proves essential for cash flow management and strategic planning in today’s fast-paced business environment.

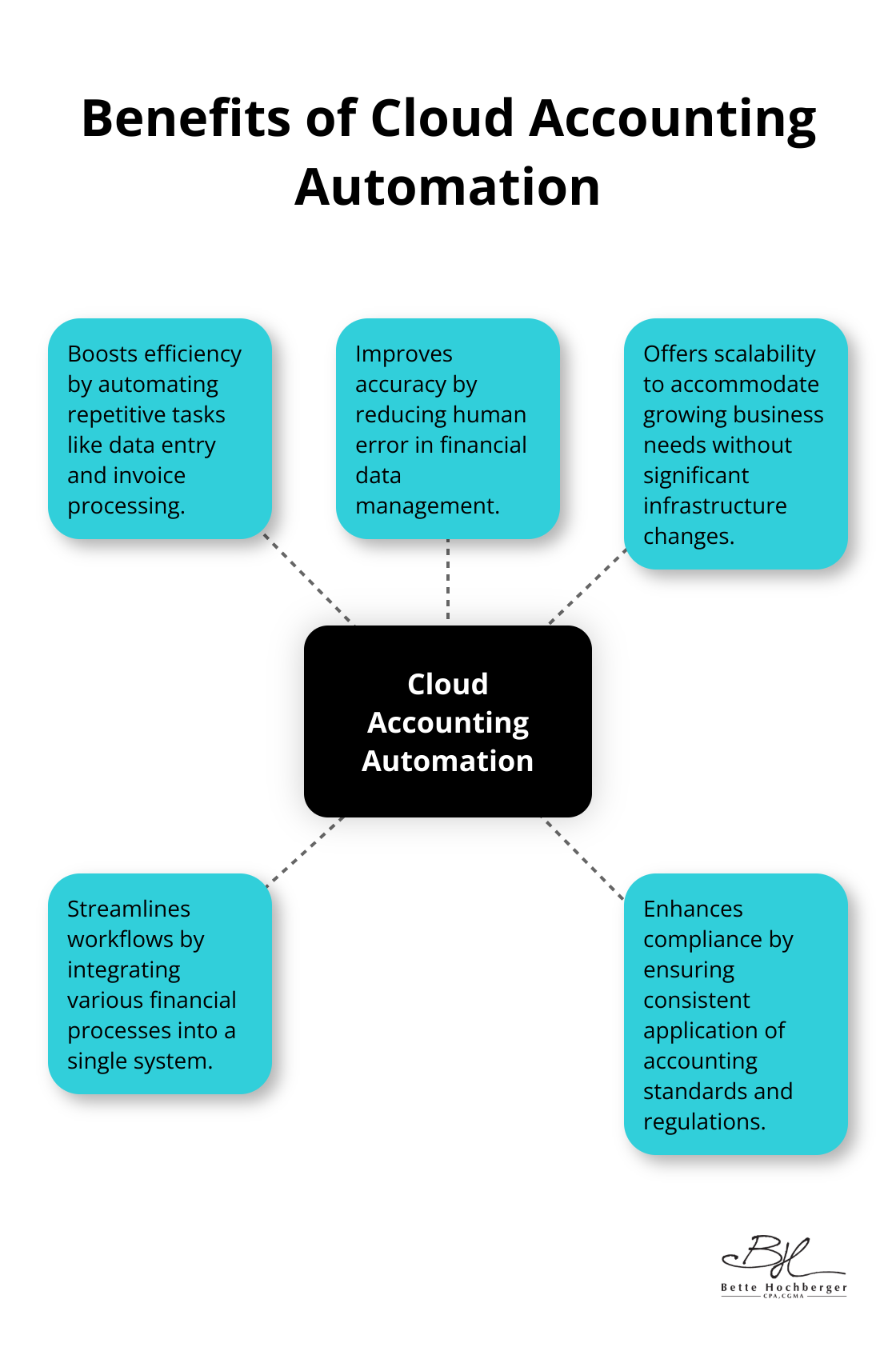

Automation of Routine Tasks

One of the most significant advantages of cloud accounting is its ability to automate repetitive tasks. Cloud accounting automation boosts efficiency, accuracy, and scalability while streamlining workflows and compliance. This includes tasks like data entry, invoice processing, and bank reconciliations. Accounting professionals can now focus on more value-added services such as financial analysis and strategic advisory.

Seamless Integration Capabilities

Modern cloud accounting software doesn’t operate in isolation. It integrates seamlessly with other business systems, creating a cohesive ecosystem of financial management. Many platforms connect directly with point-of-sale systems, inventory management tools, and customer relationship management software. This integration eliminates data silos and provides a holistic view of business operations.

Security Considerations

Data security is paramount in cloud accounting, and reputable cloud providers invest heavily in robust security measures. However, businesses must have contingency plans for potential internet outages, as cloud systems rely on connectivity.

The Evolving Role of Accounting Professionals

The shift to cloud accounting represents more than just a trend; it fundamentally changes how businesses manage their finances. As technology advances, the role of accounting professionals evolves. They now focus more on interpretation and strategic guidance rather than data entry and calculations (tasks which are increasingly automated).

Final Thoughts

Each accounting solution offers unique advantages for businesses. In-house accounting provides direct control, outsourced services offer specialized expertise, and cloud-based software delivers real-time insights. The right choice depends on your company’s size, industry, and growth trajectory. We at Bette Hochberger, CPA, CGMA & Associates PLLC understand the complexities of modern accounting and the challenges businesses face.

Our boutique accounting firm specializes in personalized financial services, including strategic tax planning and Fractional CFO services. We use advanced cloud technology to help clients minimize tax liabilities, manage cash flow, and ensure profitability across diverse industries. Our skilled team supports businesses considering a shift in their accounting approach or seeking expert guidance on tax strategy.

We commit to keeping our clients informed through education, webinars, and workshops (enhancing their financial knowledge). Our partnership offers more than just accounting services; it provides a strategic ally dedicated to your financial success. Contact us today to explore how we can support your business’s accounting needs and financial goals.