At Bette Hochberger, CPA, CGMA, we understand the unique financial challenges faced by funded startups. Proper bookkeeping is not just a necessity; it’s a strategic advantage for these high-growth companies.

Accurate financial records are the backbone of smart decision-making, investor confidence, and regulatory compliance. This post explores why meticulous bookkeeping is vital for funded startups and how it can significantly impact their success.

Why Funded Startups Need Solid Bookkeeping

Meeting Investor Expectations

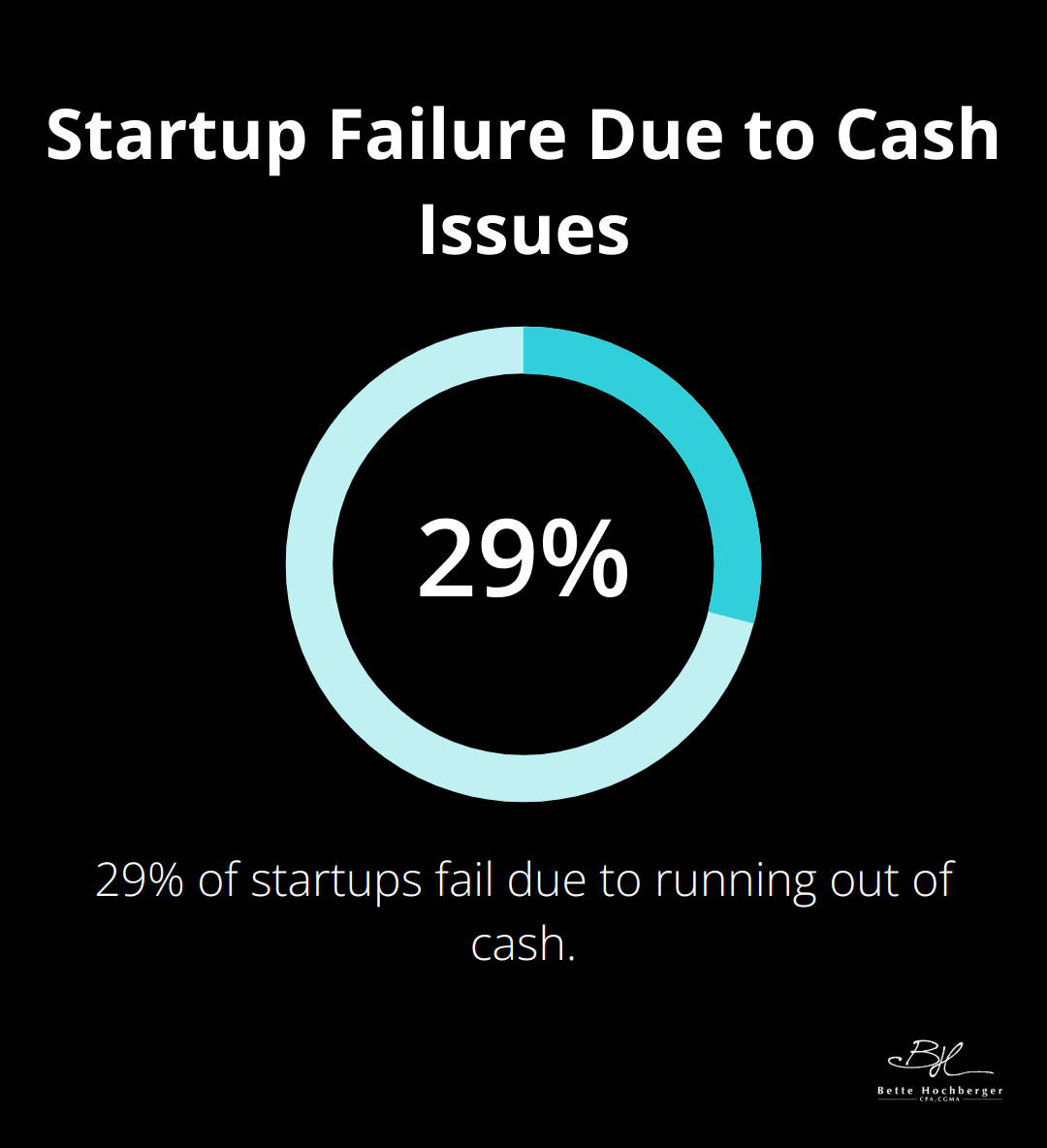

Investors who put their money into your startup expect transparency and accountability. Accurate bookkeeping provides the foundation for clear financial reports that showcase how you use their capital. Without this, you risk losing investor confidence and future funding opportunities. A study by CB Insights found that 29% of startups fail due to running out of cash, often because they couldn’t secure additional funding.

Navigating Regulatory Waters

As your startup grows, so does regulatory scrutiny. The Securities and Exchange Commission (SEC) has specific reporting requirements for companies that have raised significant capital. Failure to comply can result in hefty fines or legal troubles. In 2022, the SEC charged several companies for improper accounting practices, with penalties reaching millions of dollars.

Making Data-Driven Decisions

Accurate financial data allows you to make informed choices about resource allocation, hiring, and expansion. It is crucial for startups as it provides a clear roadmap for future growth by predicting revenues, expenses, and cash flows based on market conditions. For example, knowing your customer acquisition cost (CAC) and lifetime value (LTV) ratio helps determine if your growth strategy is sustainable. A report by ProfitWell indicates that companies which regularly monitor these metrics grow 2-3 times faster than those who don’t.

Tracking Burn Rate and Runway

For funded startups, understanding your burn rate (how quickly you spend money) is critical. It directly impacts your runway, which is how long you can operate before needing additional funding. Burn rate is calculated by subtracting any new funding from total cash on hand, then dividing by total monthly expenses. A CB Insights report revealed that 38% of startups fail because they run out of cash or fail to raise new capital. Precise bookkeeping helps you forecast these metrics accurately, giving you time to adjust strategies or seek funding before it’s too late.

Implementing Robust Bookkeeping Practices

Proper bookkeeping isn’t just about keeping records; it provides a clear financial landscape for your startup’s journey. You should implement a comprehensive accounting system that tracks all financial transactions, reconciles accounts regularly, and categorizes expenses accurately. This level of detail not only satisfies investors and regulators but also sets your startup up for long-term success and sustainable growth.

As we move forward, let’s explore the key bookkeeping practices that funded startups should adopt to maintain financial health and transparency.

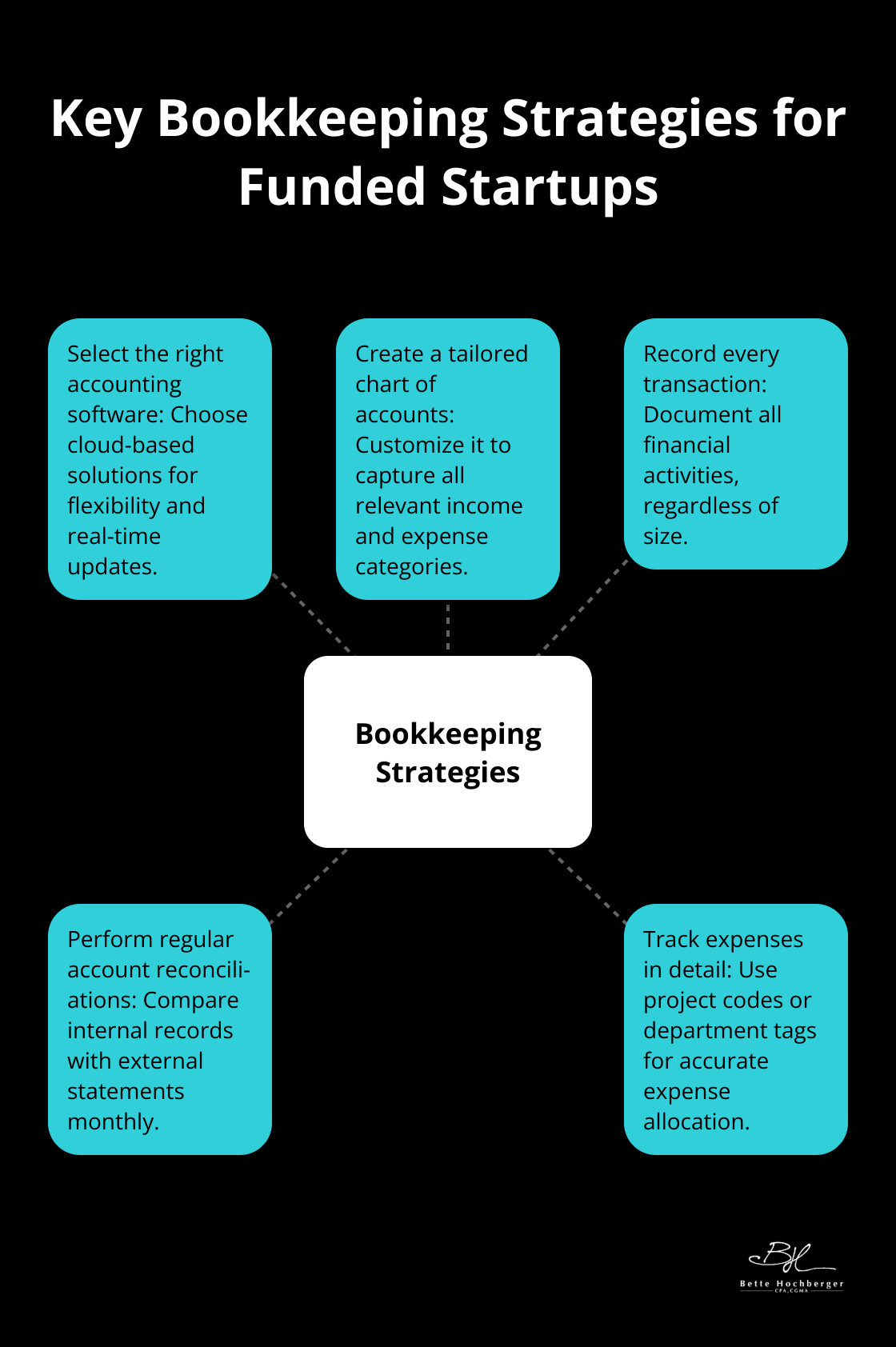

Essential Bookkeeping Strategies for Funded Startups

At Bette Hochberger, CPA, CGMA, we’ve observed how proper bookkeeping impacts funded startups. Let’s explore key strategies that can set your startup on the path to financial success.

Select the Right Accounting Software

Cloud-based solutions like QuickBooks Online or Xero offer flexibility, real-time updates, scalability, and cost efficiency compared to traditional accounting software. These features enable multi-user collaboration and integration with other business tools.

Create a Tailored Chart of Accounts

A well-structured chart of accounts forms the foundation of your financial reporting. Customize it to your startup’s specific needs, ensuring it captures all relevant income and expense categories. This structure will facilitate meaningful financial reports and performance tracking over time.

Record Every Transaction

Document all financial transactions, regardless of size. This includes all income, expenses, assets, and liabilities. Use bank feeds to automatically import transactions into your accounting software (reducing manual entry errors).

Perform Regular Account Reconciliations

Reconcile your accounts at least monthly. Compare your internal financial records with external statements from banks and credit card companies. This process helps catch discrepancies early and ensures the accuracy of your financial data.

Track Expenses in Detail

For funded startups, granular expense tracking is essential. Use project codes or department tags to allocate expenses accurately. This level of detail satisfies investor scrutiny and provides insights for cost management. These measures help control costs, reduce administrative overhead, and provide valuable data for analysis.

As we move forward, we’ll examine common bookkeeping challenges that funded startups often face and how to overcome them effectively.

Navigating Financial Complexities in Funded Startups

At Bette Hochberger, CPA, CGMA, we understand the financial hurdles that funded startups face. This chapter explores some of these challenges and provides effective strategies to tackle them.

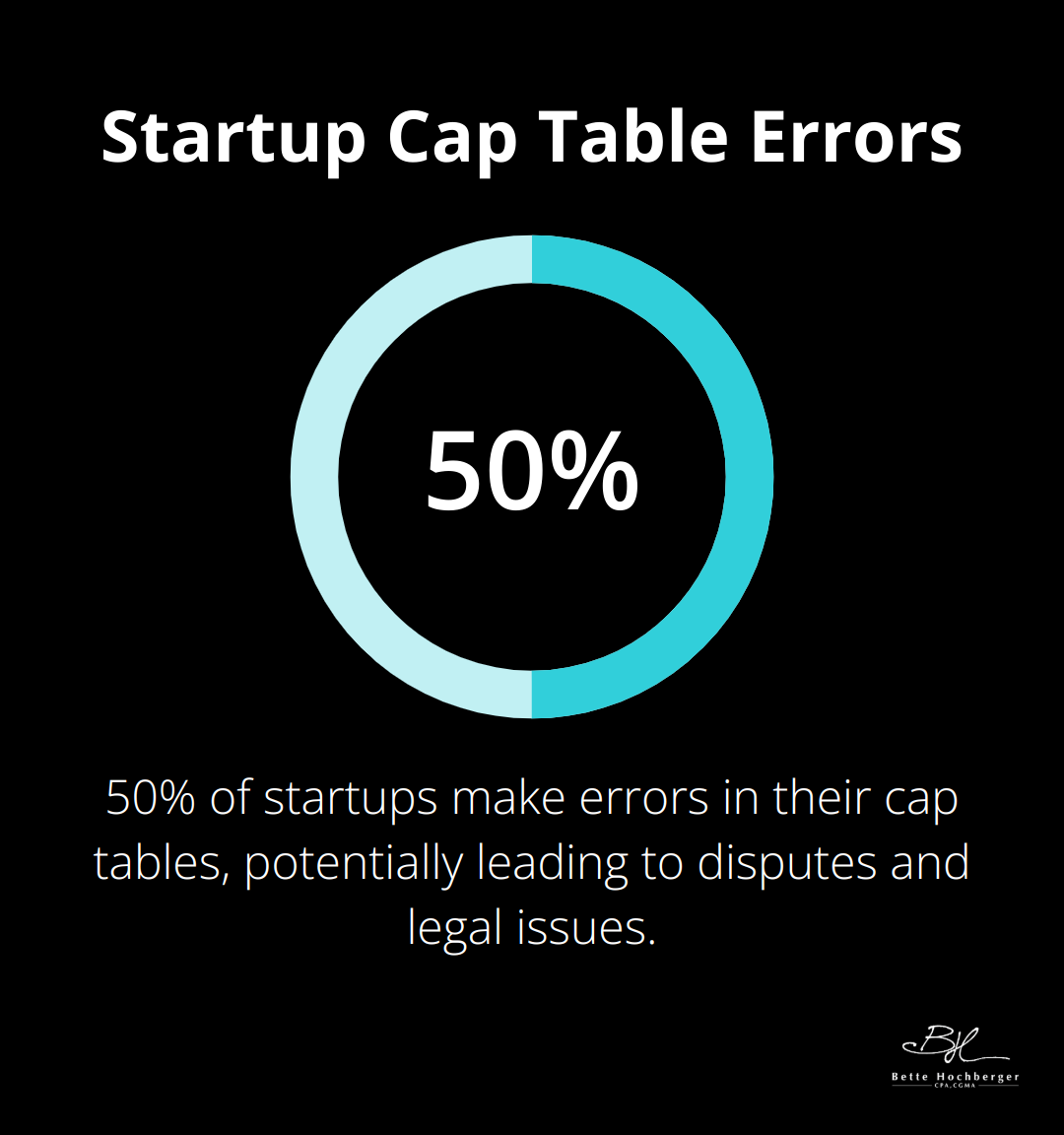

Equity Structure Management

Funded startups often have intricate equity structures involving multiple shareholders, vesting schedules, and stock option plans. This complexity can lead to bookkeeping problems if not managed properly. A study by Carta reveals that 50% of startups make errors in their cap tables, which can result in disputes and legal issues.

To avoid these pitfalls:

- Implement a robust equity management system from day one

- Use tools like Carta or Pulley to track ownership, vesting schedules, and option grants accurately

- Conduct regular audits of your cap table, especially before each funding round

Scaling Financial Operations

Rapid growth excites but can strain your financial systems. A survey by Sage found that 32% of startups struggle to scale their financial processes as they grow. This often results in data inaccuracies and delayed reporting.

The solution? Invest in scalable financial software early. Cloud-based systems like NetSuite or Sage Intacct (designed to grow with your business) offer features such as multi-entity consolidation and automated revenue recognition, which become essential as you scale.

Managing Multiple Funding Rounds

Each funding round brings new financial complexities. You need to track different share classes, handle convertible notes, and manage investor reporting requirements. A report by PitchBook shows that the average time between funding rounds has decreased to 15 months, meaning startups deal with these challenges more frequently.

To handle this:

- Create a standardized process for each funding round

- Update your financial model

- Revise your cap table

- Prepare comprehensive investor reports

- Consider working with a fractional CFO who has experience with multiple funding rounds

Cash Flow Management

Balancing growth initiatives with cash flow challenges funded startups constantly. The Startup Genome Project found that 29% of startups fail because they run out of cash. This often happens because founders focus on growth at the expense of financial stability.

To avoid this:

- Implement a rolling 13-week cash flow forecast (this tool helps predict short-term cash needs and identify potential shortfalls)

- Negotiate extended payment terms with vendors

- Offer early payment discounts to customers to improve your cash position

Final Thoughts

Proper bookkeeping forms the foundation of financial success for funded startups. It creates a solid base for growth, investor confidence, and long-term sustainability. Meticulous financial management directly impacts a startup’s ability to thrive in a competitive landscape.

Professional bookkeeping services can transform funded startups. These services free up valuable time and resources, allowing founders to focus on core business activities while ensuring financial accuracy and compliance. Accurate financial data enables informed decision-making, maintains regulatory compliance, and provides the transparency that investors demand.

Bette Hochberger, CPA, CGMA offers tailored financial services for businesses, including funded startups. Our team understands the unique challenges these companies face and provides strategic tax planning, Fractional CFO services, and comprehensive accounting solutions (designed to support startup growth and success).