At Bette Hochberger, CPA, CGMA, we often hear business owners ask, “Is a fractional CFO worth it?” This question is becoming increasingly relevant as companies seek flexible financial expertise without the commitment of a full-time executive.

In this post, we’ll explore the value proposition of fractional CFOs and help you determine if this strategic financial partnership could benefit your business. We’ll break down the role, advantages, and potential return on investment to give you a clear picture of what a fractional CFO can offer.

What Does a Fractional CFO Do?

Core Responsibilities of a Fractional CFO

A fractional CFO provides high-level financial strategy and management on a part-time or contract basis. These professionals bring the skills and experience of a full-time CFO without the substantial cost, making them an attractive option for small to medium-sized businesses.

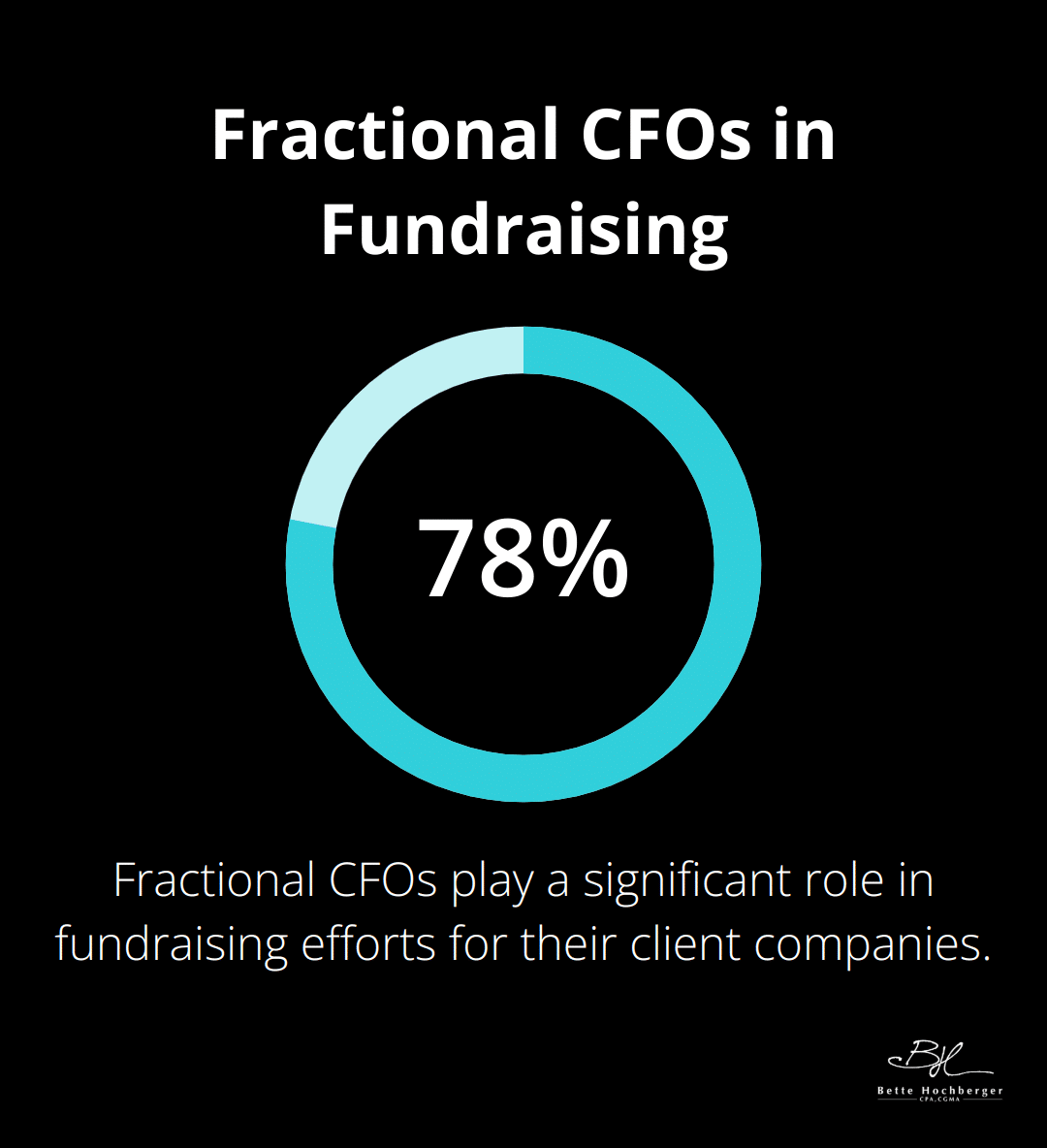

Fractional CFOs handle financial strategy, forecasting, risk management, and financial reporting for businesses on a part-time or temporary basis. They develop financial strategies, manage cash flow, create budgets, and oversee financial reporting. A recent survey by CFO.com revealed that 78% of fractional CFOs play a significant role in fundraising efforts for their client companies.

These financial experts don’t just crunch numbers; they provide actionable insights that drive business growth. They analyze financial data, identify trends, and make recommendations to improve profitability and efficiency.

Fractional CFOs vs. Full-Time CFOs

The main difference between fractional and full-time CFOs lies in the engagement model. A full-time CFO is a permanent employee, while a fractional CFO works on a flexible schedule, typically for multiple clients. This arrangement allows businesses to access top-tier financial expertise without committing to a full-time salary and benefits package.

Companies using fractional CFO services can benefit from the expertise of a CA or CPA with 10-15 years of post-designation experience. This cost-effectiveness doesn’t compromise quality – fractional CFOs often bring diverse industry experience (which can be invaluable for growing businesses).

Ideal Candidates for Fractional CFO Services

Fractional CFOs benefit certain types of businesses particularly well. Startups and scale-ups often lack the resources for a full-time CFO but need strategic financial guidance to navigate rapid growth. A report by CB Insights states that 29% of startups fail due to cash flow problems – a risk that a fractional CFO can help mitigate.

Established small to medium-sized businesses looking to optimize their financial operations or prepare for a major transition (like an acquisition or IPO) also stand to gain from fractional CFO services. Even larger corporations sometimes engage fractional CFOs for specific projects or to fill temporary gaps in their financial leadership.

The flexibility and expertise of fractional CFOs make them an attractive option for businesses at various stages of growth. As we move into the next section, we’ll explore the specific benefits that hiring a fractional CFO can bring to your organization.

Why Fractional CFOs Are Game-Changers

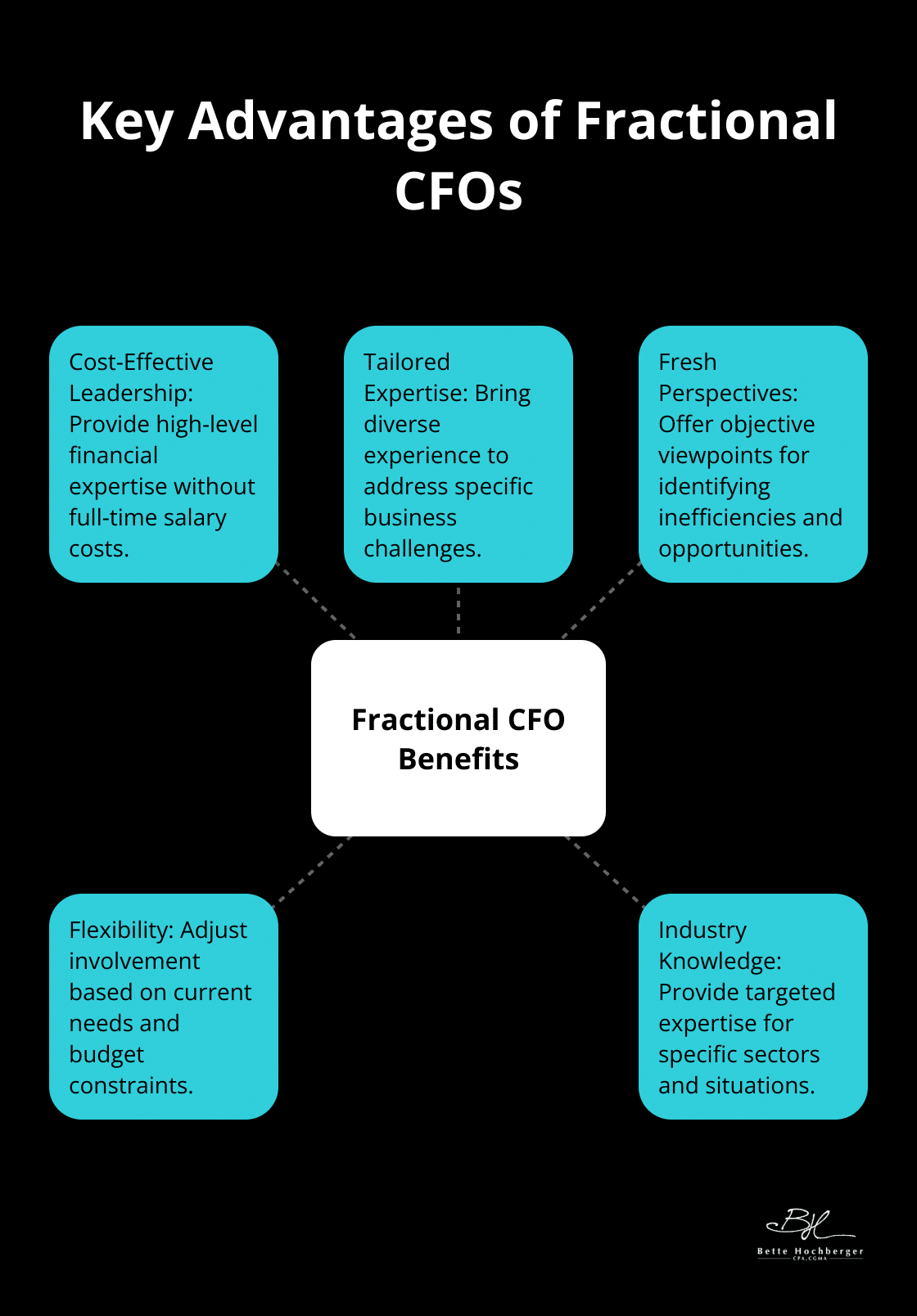

Cost-Effective Financial Leadership

Fractional CFOs revolutionize financial management for businesses of all sizes. Their unique blend of expertise and flexibility makes them invaluable assets in today’s competitive landscape. According to a Stanford University research, 56% of businesses who used contract or fractional CFOs claimed cost reductions of 10% to 30%. This allows companies to allocate resources more efficiently, investing in growth opportunities without compromising on financial guidance.

Tailored Expertise on Demand

Fractional CFOs bring a wealth of experience from various industries. This diverse background enables them to provide unique insights and solutions tailored to specific business challenges. Whether a company needs to scale its startup or prepare for an acquisition, fractional CFOs possess the specialized knowledge to guide them through every step.

Fresh Perspectives for Strategic Growth

An external CFO introduces an objective viewpoint to financial strategy. They aren’t constrained by internal politics or long-standing assumptions, which allows them to identify inefficiencies and opportunities that might otherwise go unnoticed. This fresh perspective can catalyze transformative change in an organization.

Flexibility in Engagement

One of the key advantages of fractional CFOs is their flexible engagement model. Companies can adjust the level of involvement based on their current needs and budget constraints. This flexibility proves particularly valuable for businesses experiencing seasonal fluctuations or undergoing rapid growth phases. (It’s like having a financial expert on speed dial, ready to step in when you need them most.)

Industry-Specific Knowledge

Fractional CFOs often specialize in specific industries, bringing targeted expertise to the table. For example, a fractional CFO with experience in the tech sector can provide invaluable insights for a startup navigating the complexities of venture capital funding. Similarly, those with backgrounds in manufacturing can help optimize supply chain finances. This industry-specific knowledge (coupled with broad financial acumen) positions fractional CFOs as powerful assets for businesses seeking to gain a competitive edge.

As we explore the potential return on investment of engaging a fractional CFO, it becomes clear that their impact extends far beyond mere cost savings. These financial experts serve as strategic partners, shaping the future of businesses through expert guidance and innovative solutions.

Measuring the Impact of a Fractional CFO

Quantifiable Financial Improvements

Research from the Corporate Executive Board found that fractional executive engagements reduced hiring risks by 25%. This statistic underscores the significant impact these professionals can have on a business’s bottom line.

Enhanced Financial Decision-Making

Fractional CFOs elevate financial decision-making processes through their expertise. Their accurate financial modeling and scenario planning skills lead to tangible results. For example, a manufacturing company reduced inventory costs by 15% through improved forecasting and just-in-time inventory management (a direct result of their fractional CFO’s input).

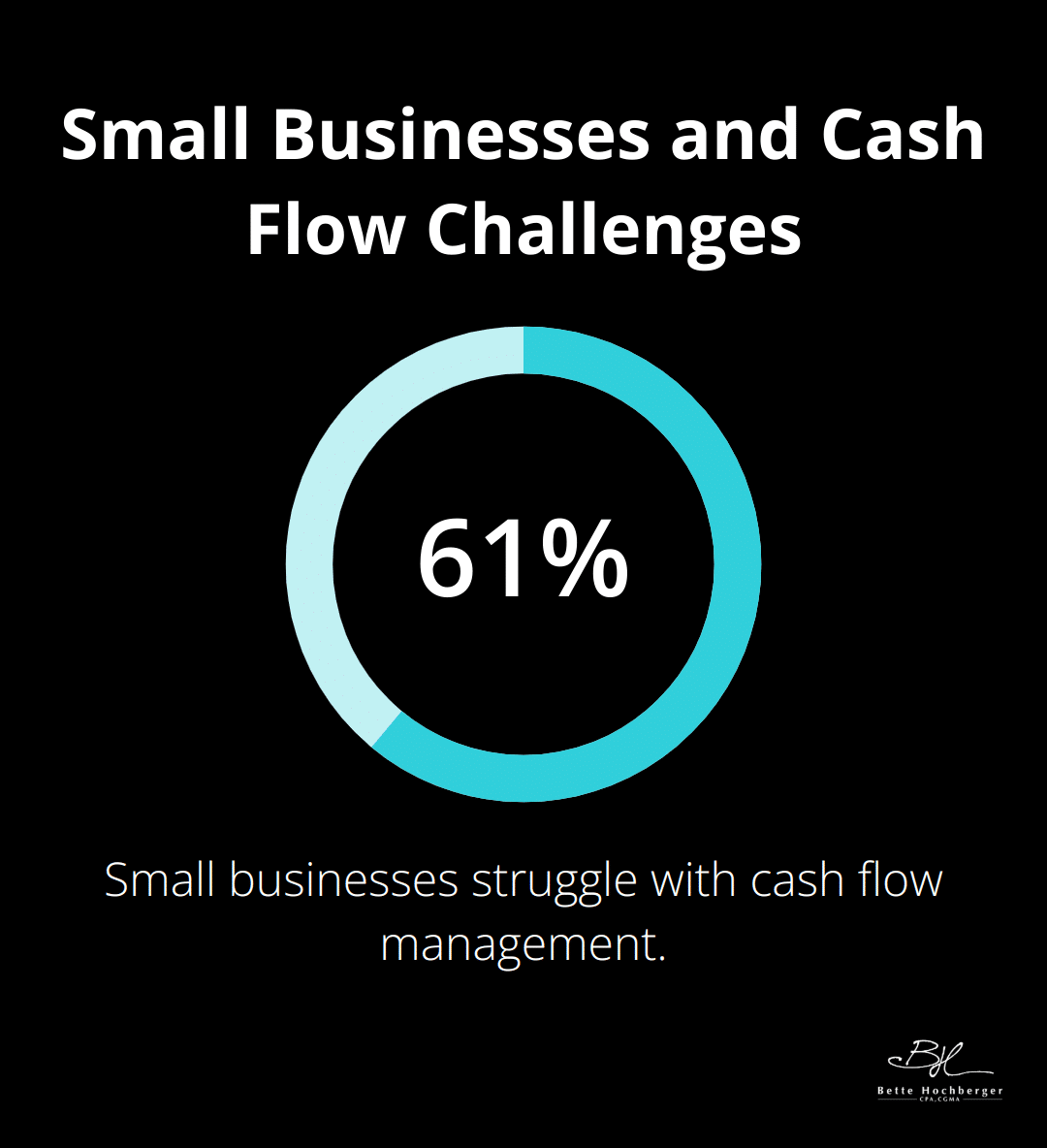

Optimized Cash Flow Management

Cash flow management stands out as a critical area where fractional CFOs excel. An Intuit QuickBooks survey revealed that 61% of small businesses struggle with cash flow. Fractional CFOs address this issue by implementing robust forecasting tools and strategies. One tech startup improved their cash flow by 30% within six months of engaging a fractional CFO, which allowed them to extend their runway and secure additional funding.

Streamlined Financial Operations

Fractional CFOs often identify and eliminate inefficiencies in financial processes, leading to significant time and cost savings. A retail chain reduced their month-end close process from 15 days to 5 days after working with a fractional CFO. This improvement freed up resources for more strategic activities.

Long-Term Growth and Profitability

The impact of a fractional CFO extends beyond immediate financial gains. Their strategic input drives long-term growth and profitability. A McKinsey & Company report found that companies with strong financial leadership were 1.7 times more likely to outperform their peers in terms of organic revenue growth.

Setting Clear Goals and Metrics

To maximize the value of a fractional CFO partnership, businesses should set clear goals and metrics for measuring success. These might include improvements in gross margin, reduction in operating expenses, or acceleration of accounts receivable. Regular reviews and open communication with your fractional CFO will help ensure you’re getting the most out of this strategic relationship.

Final Thoughts

The question “Is a fractional CFO worth it?” depends on your business’s unique needs and goals. Fractional CFOs offer cost-effective financial leadership, providing high-level expertise without the commitment of a full-time executive salary. They bring fresh perspectives, industry-specific knowledge, and the ability to tackle complex financial challenges.

When you consider a fractional CFO, assess your current financial needs, growth goals, and budget constraints. You should evaluate if you need help with cash flow issues, financial forecasting, strategic planning, or preparation for major transitions like acquisitions or IPOs. Setting clear goals, establishing success metrics, and maintaining open communication will maximize the value of a fractional CFO partnership.

At Bette Hochberger, CPA, CGMA, we understand the unique financial challenges businesses face. Our team of experts (including fractional CFOs) can provide the strategic financial guidance your company needs to thrive. We have the expertise to help you achieve your financial goals, whether you want to optimize your tax strategy, improve cash flow management, or scale your business.