Cash flow management is the lifeblood of any successful business. Without proper control over incoming and outgoing funds, companies risk financial instability and missed opportunities.

At Bette Hochberger, CPA, CGMA & Associates PLLC, we’ve seen firsthand how improving cash flow management can transform a struggling business into a thriving one. This post will explore key strategies to optimize your cash flow, helping you maintain financial health and seize growth opportunities.

What Is Cash Flow Management?

The Essence of Cash Flow Management

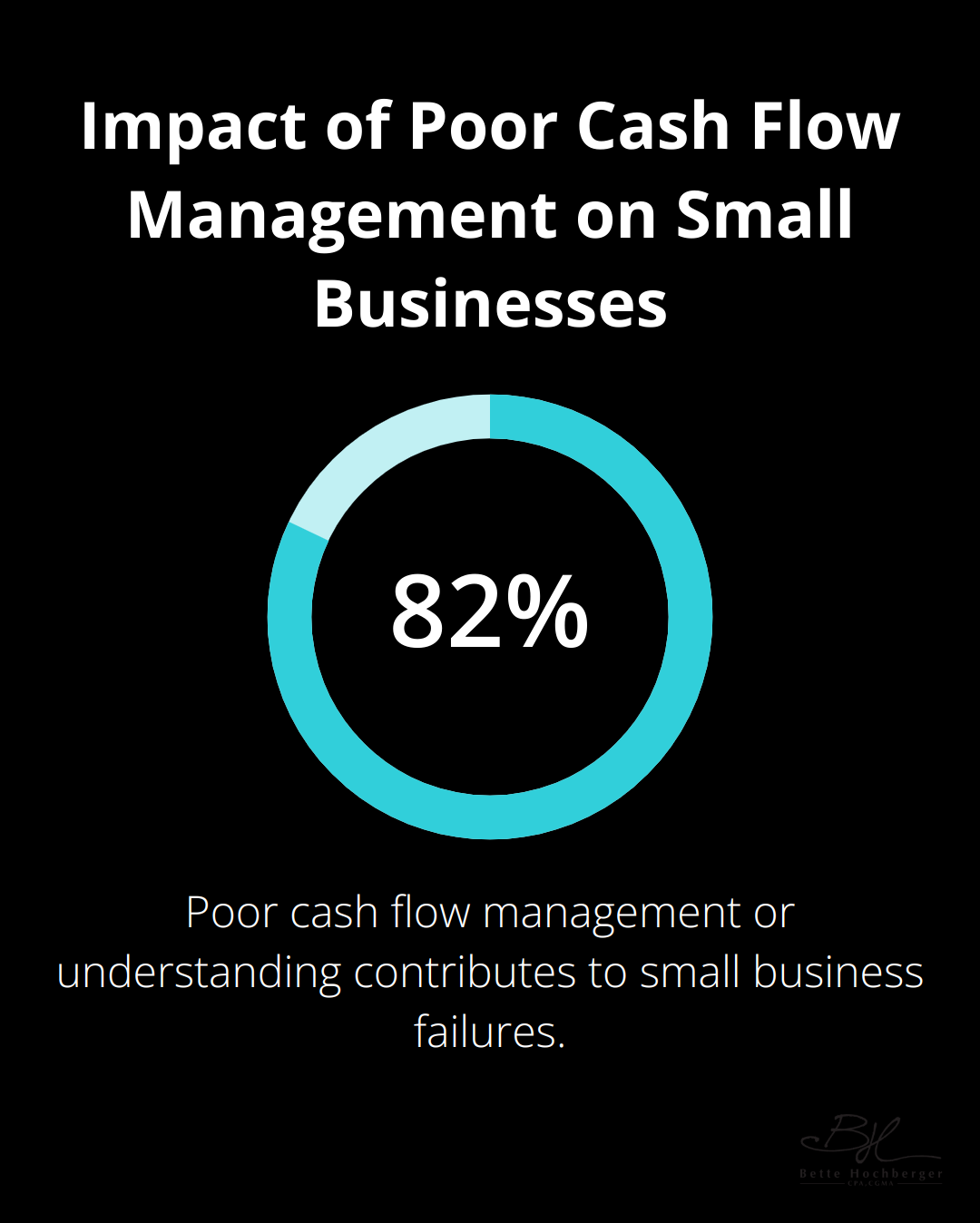

Cash flow management involves the tracking and controlling of money movement in and out of a business in order to accurately forecast cash flow needs. This skill can determine a company’s financial success or failure. A study found that 82% of the time, poor cash flow management or poor understanding of cash flow contributed to the failure of small businesses, underscoring its critical importance.

Key Components of Cash Flow

Cash flow management focuses on three primary areas: operating activities, investing activities, and financing activities. Operating activities encompass daily transactions, investing activities include long-term asset transactions, and financing activities involve debt or equity changes.

Effective management requires a thorough understanding of these components and their interactions. It’s not merely about having funds in the bank; it’s about ensuring the right amount of cash is available at the right time to meet business obligations and fuel growth.

Common Cash Flow Obstacles

Businesses often encounter similar cash flow challenges. Late customer payments present a significant issue. This delay can create a ripple effect, making it difficult for businesses to meet their own financial obligations on time.

Seasonal fluctuations also pose a challenge. Businesses with cyclical sales often struggle to maintain consistent cash flow throughout the year. For instance, a retail store might generate most of its revenue during the holiday season but still needs to cover expenses during slower months.

Unexpected expenses can derail even the most carefully planned budget. Equipment breakdowns, sudden market changes, or global events (like the recent pandemic) can quickly deplete cash reserves.

The Widespread Impact of Poor Cash Flow

Inadequate cash flow management can have far-reaching consequences. It can lead to missed opportunities, such as the inability to take advantage of bulk purchase discounts or invest in new technology. In severe cases, it can result in late payments to suppliers, damaging crucial business relationships.

Employee morale and productivity can also suffer. If a company struggles to meet payroll or delays investments in necessary resources, staff may become disengaged or seek employment elsewhere.

Furthermore, cash flow problems can hinder a company’s ability to secure financing. Banks and investors often view consistent, positive cash flow as a key indicator of a business’s health and potential for growth.

Proactive cash flow management can transform businesses. The implementation of robust tracking systems, creation of accurate forecasts, and development of strategic plans allow companies to navigate challenges more effectively and position themselves for sustainable growth. As we move forward, we’ll explore effective strategies to optimize your cash flow and maintain financial health.

How to Optimize Your Cash Flow Management

Cash flow management stands as a cornerstone of business success. Several key strategies can significantly improve your cash flow management.

Streamline Your Invoicing Process

Optimizing your invoicing process can dramatically improve cash flow. Send invoices immediately after delivering goods or services. A 2018 Xero study found that invoices with one-week payment terms are paid in about two weeks – that’s a week late but still better than voluntarily waiting longer to invoice. Implement automated invoicing systems to reduce errors and speed up the process.

Incentivize Early Payments

Accelerate cash inflow by offering discounts for early payments. The 2/10 net 30 terms (where customers receive a 2% discount if they pay within 10 days, otherwise the full amount is due in 30 days) can motivate customers to pay quickly, improving your cash position.

Negotiate with Suppliers

Don’t shy away from negotiating payment terms with your suppliers. Extending your payment period from 30 to 45 or 60 days can significantly improve your cash flow. However, maintain good relationships with your suppliers – they’re vital partners in your business success.

Implement Cash Flow Forecasting

Regular cash flow forecasting allows for proactive management. Use historical data and market trends to project your cash position for the next 3, 6, and 12 months. This practice helps you anticipate potential shortfalls and take corrective action before problems arise.

Optimize Inventory Management

Excess inventory ties up cash that could be used elsewhere in your business. Try to implement just-in-time inventory systems where possible to minimize the amount of cash tied up in stock. According to a study by the National Retail Federation, retailers can reduce storage costs by up to 25% with efficient inventory management.

These strategies, when implemented effectively, can transform your cash flow management. However, every business is unique, and the best approach often involves a combination of tactics tailored to your specific situation. A customized strategy can make all the difference in managing your cash flow effectively.

As we move forward, we’ll explore how technology can further enhance your cash flow management practices, providing real-time insights and automating key processes. Effective cash flow management is essential for ensuring financial stability and peace of mind for your business.

How Technology Revolutionizes Cash Flow Management

Technology plays a pivotal role in streamlining cash flow management in today’s digital age. Advanced software solutions offer real-time insights, automate tedious processes, and provide accurate forecasting capabilities. Let’s explore how leveraging these technological tools can transform your cash flow management practices.

Cloud-Based Accounting: Your Financial Command Center

Cloud-based accounting software serves as a centralized hub for all your financial data. These platforms offer automated forecasts, real-time cash flow projections, and accurate financial planning. A study by Sage found that 67% of accountants prefer cloud accounting solutions, citing improved efficiency and accessibility as key benefits.

QuickBooks Online and Xero provide comprehensive financial overviews, including cash flow statements, profit and loss reports, and balance sheets. These tools enable you to track expenses, monitor receivables, and identify cash flow trends at a glance.

Automated Invoicing: Accelerating Cash Inflows

Automated invoicing systems significantly reduce the time between service delivery and payment receipt. These tools generate and send invoices automatically, set up recurring billing, and even chase late payments. Decreased turnaround between service delivery and invoicing increases the frequency of timely payments, improving overall cash flow.

FreshBooks reports that their users get paid up to 11 days faster when using their automated invoicing features. This acceleration in cash inflows can make a substantial difference in your overall cash flow management.

Predictive Analytics: Forecasting with Precision

Advanced cash flow analysis tools harness the power of artificial intelligence and machine learning to provide accurate forecasts. These tools analyze historical data, market trends, and economic indicators to predict future cash positions.

Platforms like Float and Fluidly offer cash flow forecasting features that project your cash position weeks or months in advance. This foresight allows you to anticipate potential cash shortages and take preemptive action.

Bank Feed Integration: Real-Time Financial Pulse

Integrating your accounting software with your bank accounts provides a real-time view of your financial status. This integration eliminates manual data entry, reduces errors, and provides up-to-the-minute cash flow information.

Many accounting platforms (including QuickBooks and Xero) offer direct bank feed connections. This feature ensures that your financial data is always current, allowing for more accurate cash flow management and decision-making.

Implementing these technological solutions can dramatically improve your cash flow management practices. However, it’s important to choose tools that align with your specific business needs and integrate well with your existing systems.

Final Thoughts

Improving cash flow management is essential for the long-term success and stability of any business. Companies can enhance their financial health through robust invoicing processes, favorable payment terms, forecasting tools, and efficient inventory management. The integration of technology, such as cloud-based accounting software and automated invoicing systems, streamlines these processes and provides real-time insights for informed decision-making.

Proactive cash flow management allows businesses to navigate challenges, seize growth opportunities, and maintain financial stability. It ensures the right amount of cash is available at the right time to meet obligations and fuel growth. Businesses can avoid common pitfalls like late payments, seasonal fluctuations, and unexpected expenses that often lead to cash flow crises.

At Bette Hochberger, CPA, CGMA & Associates, we understand the critical role of effective cash flow management in business success. Our team of experts specializes in personalized financial services, including strategic tax planning and Fractional CFO services (leveraging advanced cloud technology). We help businesses minimize tax liabilities, manage cash flow, and ensure profitability.