Cash flow management is the lifeblood of any successful business. At Bette Hochberger, CPA, CGMA, we’ve seen firsthand how proper cash flow management can make or break a company.

Consider this cash flow management example: a thriving retail store that nearly went bankrupt due to poor cash flow practices, despite strong sales. By implementing effective strategies, they turned their finances around and achieved sustainable growth.

In this post, we’ll show you how to create a robust cash flow management plan that will keep your business financially healthy and primed for success.

What Is Cash Flow Management?

Definition and Importance

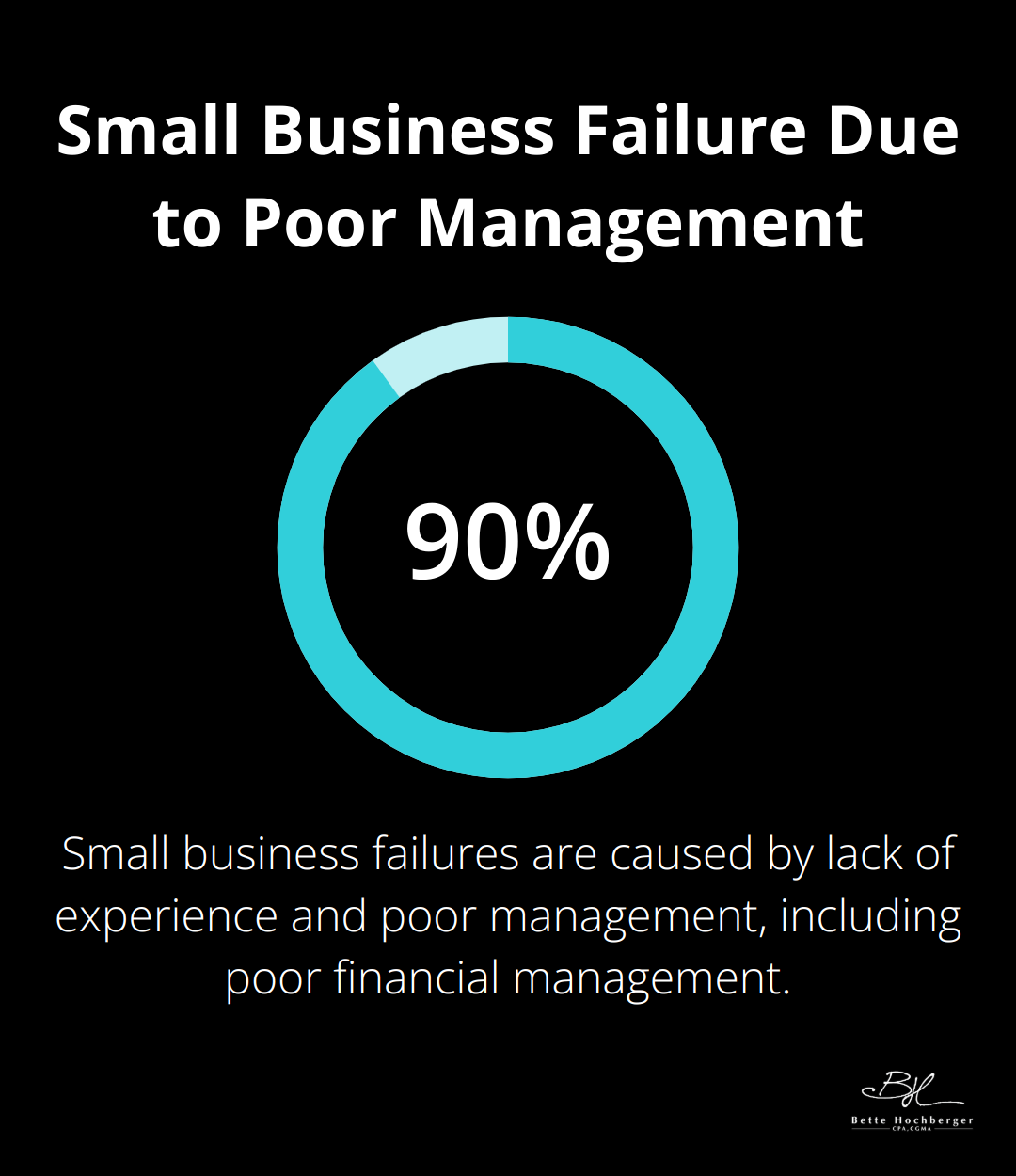

Cash flow management involves tracking, analyzing, and optimizing the movement of money in and out of your business. It requires understanding the sources of your cash, its destinations, and methods to maintain a smooth flow. This process proves vital for business survival and growth. A recent study reveals that 90% of small business failures are due to a lack of experience and poor management, including issues like poor financial management. We’ve observed businesses with strong sales struggle due to cash flow issues, while others with lower revenue thrive thanks to smart cash management.

Key Components of a Cash Flow Plan

A robust cash flow management plan includes several essential elements:

- Accurate Financial Records: Implement a reliable accounting system and reconcile your accounts regularly.

- Cash Flow Projections: Develop forecasts to anticipate future cash needs and potential shortfalls. Many businesses use a 13-week cash flow forecast for a detailed quarterly view of expected cash inflows and outflows.

- Regular Monitoring: Track key metrics such as your cash conversion cycle (the length of time, in days, that it takes for a company to convert resources into cash flows). A faster cycle typically benefits your cash flow.

- Financial Statement Analysis: Examine your cash flow statement at least monthly. This document illustrates how changes in balance sheet accounts and income affect your cash and cash equivalents, providing insights into operating activities, investing activities, and financing activities.

Optimization Strategies

An effective cash flow management plan incorporates strategies for optimization:

- Supplier Negotiations: Try to secure better payment terms with suppliers (e.g., 45 or 60-day payment terms).

- Customer Incentives: Encourage early payments from customers (for instance, offering a 2% discount for payments within 10 days).

- Inventory Management: Manage inventory more efficiently to free up cash.

These strategies focus not just on increasing cash, but on ensuring its availability when needed. A well-structured plan equips your business to weather financial challenges and capitalize on growth opportunities.

As we move forward, let’s explore specific strategies to improve your cash flow and take your financial management to new heights.

Proven Strategies to Boost Your Cash Flow

Cash flow management involves more than tracking money; it requires active improvement of your financial position. Several effective strategies can significantly enhance your cash flow.

Accelerate Your Accounts Receivable

One of the quickest ways to improve cash flow is to speed up your accounts receivable process. Automate and consolidate receivables to get paid faster. Implement processes that automatically send invoice reminders and follow up on overdue payments. This can motivate customers to pay faster, improving your cash position.

Implement a clear follow-up process for overdue payments. Send friendly reminders a few days before the due date, and follow up consistently if payment is late. Some businesses find success in offering multiple payment options, including credit cards and online payments, to make it easier for customers to pay quickly.

Smart Management of Accounts Payable

While it’s tempting to delay payments to vendors, this strategy can backfire if not handled carefully. Instead, focus on negotiating better payment terms. Many suppliers are open to extending payment periods from 30 to 45 or even 60 days, especially for reliable customers.

Take advantage of early payment discounts when your cash flow allows. A 2% discount for paying within 10 days often translates to an annualized return of over 36% – far better than most investment opportunities.

Optimize Your Inventory Levels

Excess inventory ties up cash that could be used elsewhere in your business. Implement a just-in-time inventory system to reduce storage costs and improve cash flow. This method of inventory management aims to keep your stock levels as low as possible.

Consider negotiating consignment arrangements with suppliers for slow-moving items. This allows you to stock products without paying for them until they sell, reducing your upfront cash investment.

Negotiate Win-Win Terms

Improving cash flow isn’t just about internal processes; it often involves renegotiating terms with both suppliers and customers. With suppliers, seek volume discounts or longer payment terms. For customers, consider offering small discounts for upfront payments or deposits on large orders.

Don’t hesitate to review and adjust prices regularly. Many businesses undercharge for their products or services, especially when costs increase. A small price increase can significantly impact your cash flow without necessarily affecting demand.

These strategies have the potential to transform businesses from cash-strapped to cash-rich. Effective cash flow management requires ongoing effort and smart planning. As we move forward, let’s explore the tools and technologies that can support and enhance your cash flow management efforts.

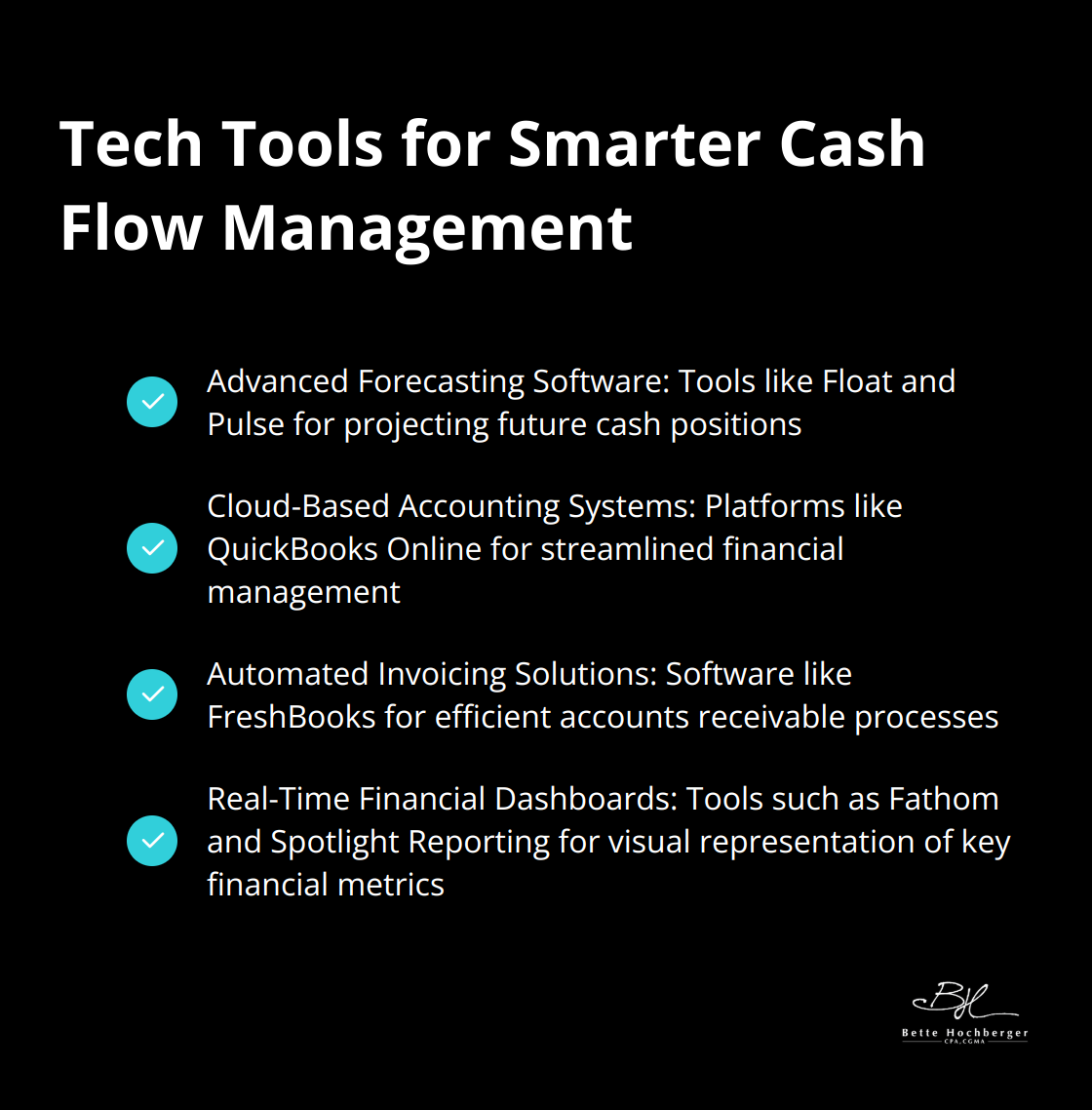

Tech Tools for Smarter Cash Flow Management

In today’s digital age, technology plays a vital role in effective cash flow management. The right tools streamline processes, provide real-time insights, and help you make informed financial decisions. Let’s explore some game-changing technologies that can revolutionize your cash flow management.

Advanced Forecasting Software

Cash flow forecasting software has evolved significantly. These tools use historical data and predictive analytics to project future cash positions. Float and Pulse offer intuitive interfaces and integrate with popular accounting software. They allow you to create multiple scenarios, helping you prepare for various financial outcomes.

Cloud-Based Accounting Systems

Cloud-based accounting systems like QuickBooks Online offer a user-friendly interface and a comprehensive suite of tools. These platforms streamline tasks like invoicing, expense tracking, and reporting, giving you a more efficient way to manage your finances.

Automated Invoicing Solutions

Automated invoicing solutions like FreshBooks can significantly speed up your accounts receivable process. As of January 7, 2025, FreshBooks is recognized as a user-friendly, cloud-based accounts receivable software for small businesses and freelancers. It helps users send invoices and manage their accounts receivable process more efficiently.

Real-Time Financial Dashboards

Financial dashboards provide a visual representation of your key financial metrics. Tools like Fathom and Spotlight Reporting pull data from your accounting software to create customizable dashboards. These give you an at-a-glance view of your cash position, receivables, payables, and other important metrics.

Choosing the Right Tools

When selecting technology for your cash flow management, consider your specific business needs, the size of your operation, and your growth plans. The right combination of tools can provide the insights you need to keep your cash flow healthy and your business thriving. Technology is just a tool; the real power lies in how you use these tools to inform your decision-making and strategy. Accounting tips and tricks can help simplify processes and save money in your financial life.

Final Thoughts

Effective cash flow management forms the foundation of business success. The cash flow management example we mentioned earlier demonstrates how a retail store turned its finances around through strategic planning. Companies can improve their financial health by accelerating accounts receivable, optimizing inventory levels, and leveraging technology. Regular monitoring and adjustments help businesses stay ahead of potential cash flow issues.

Complex cash flow management often benefits from professional assistance. Bette Hochberger, CPA, CGMA specializes in helping businesses optimize their cash flow. Our team uses advanced cloud technology and industry expertise to provide personalized financial services. We work closely with clients to minimize tax liabilities, manage cash flow effectively, and ensure long-term profitability.

Cash flow management requires constant attention and regular reviews. It demands a willingness to adapt to changing circumstances. Proactive management and the right tools and expertise can build a robust financial foundation that supports business objectives and sets the stage for long-term success.