At Bette Hochberger, CPA, CGMA, we know that staying on top of tax deadlines is essential for business owners.

Missing these crucial dates can lead to costly IRS penalties, impacting your bottom line and causing unnecessary stress.

This guide will walk you through the key tax deadlines and provide strategies on how to avoid IRS penalties, helping you maintain compliance and financial stability.

Key Tax Deadlines for Businesses

Quarterly Estimated Tax Payments

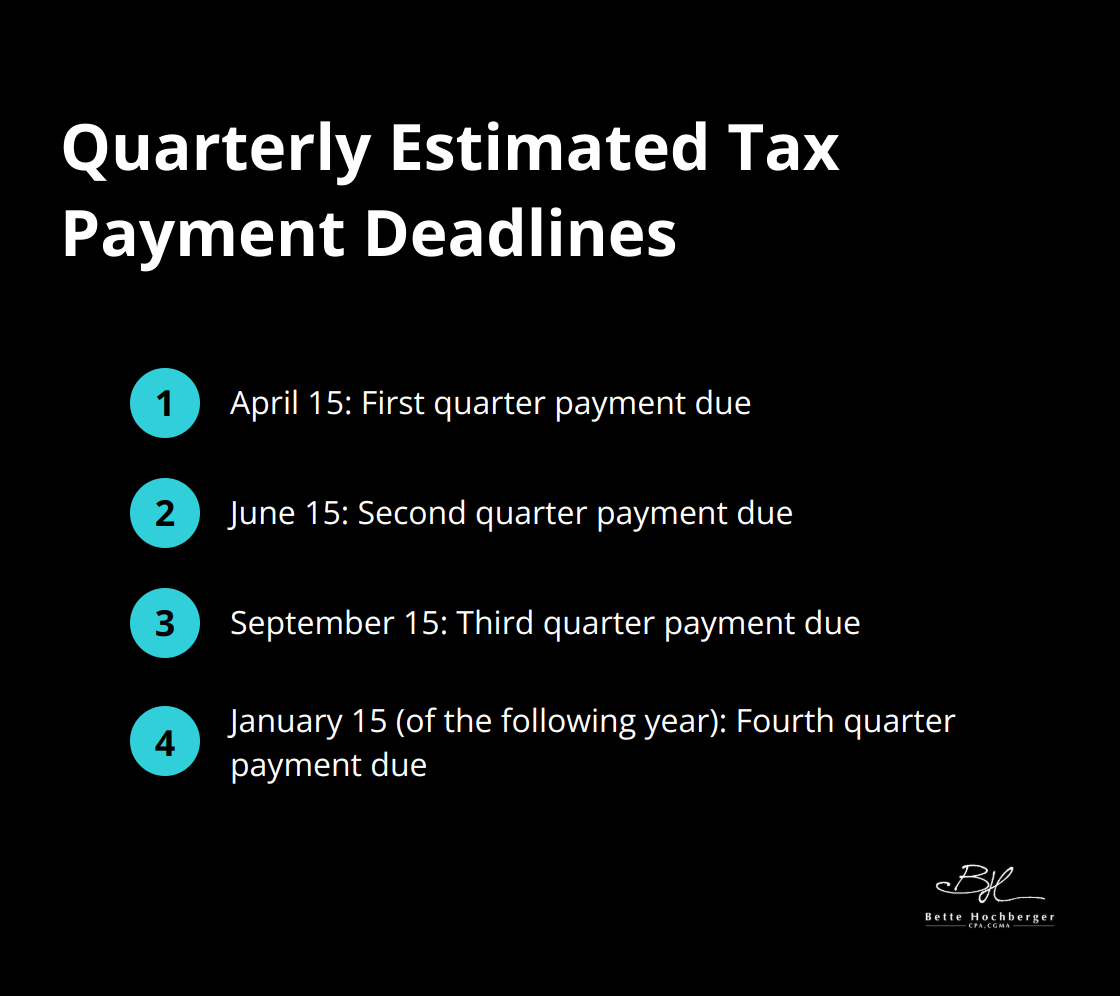

Individuals, including sole proprietors, partners, and S corporation shareholders, generally use Form 1040-ES, to figure estimated tax. Businesses must mark these dates for quarterly estimated tax payments:

The IRS moves the deadline to the next business day if any of these dates fall on a weekend or holiday. Timely payments help businesses avoid underpayment penalties and maintain good standing with the IRS.

Annual Tax Return Due Dates

Different business structures have varying deadlines for annual tax returns:

- Sole proprietorships and single-member LLCs: File Form 1040 by April 15

- Partnerships and multi-member LLCs: File Form 1065 by March 15

- S Corporations: File Form 1120-S by March 15

- C Corporations: File Form 1120 by April 15 (for calendar year filers)

Payroll Tax Deadlines

Businesses with employees must adhere to these payroll tax deadlines:

- January 31: Provide W-2 forms to employees and file Forms W-2 and W-3 with the Social Security Administration

- April 30, July 31, October 31, and January 31: File Form 941 for quarterly payroll taxes

- Monthly or semi-weekly deposits: Make federal tax deposits based on your deposit schedule

Information Return Filing Deadlines

Information returns (which report various types of income other than wages, salaries, and tips) typically have a January 31 deadline. This includes forms such as 1099-MISC and 1099-NEC.

Strategies for Meeting Deadlines

To stay on top of these deadlines, businesses can:

- Set up a tax calendar (digital or physical)

- Use accounting software with built-in reminders

- Work with a professional tax advisor

These proactive steps can prevent missed deadlines and potential penalties. Organization and forward planning are essential for meeting tax obligations promptly.

The IRS imposes various penalties for missed deadlines and late payments. Understanding these consequences can motivate businesses to prioritize timely compliance. Let’s explore common IRS penalties and how to avoid them in the next section.

Common IRS Penalties and How to Avoid Them

The IRS imposes several penalties on businesses that fail to meet their tax obligations. Understanding these penalties can help you avoid costly mistakes and maintain good standing with the tax authorities.

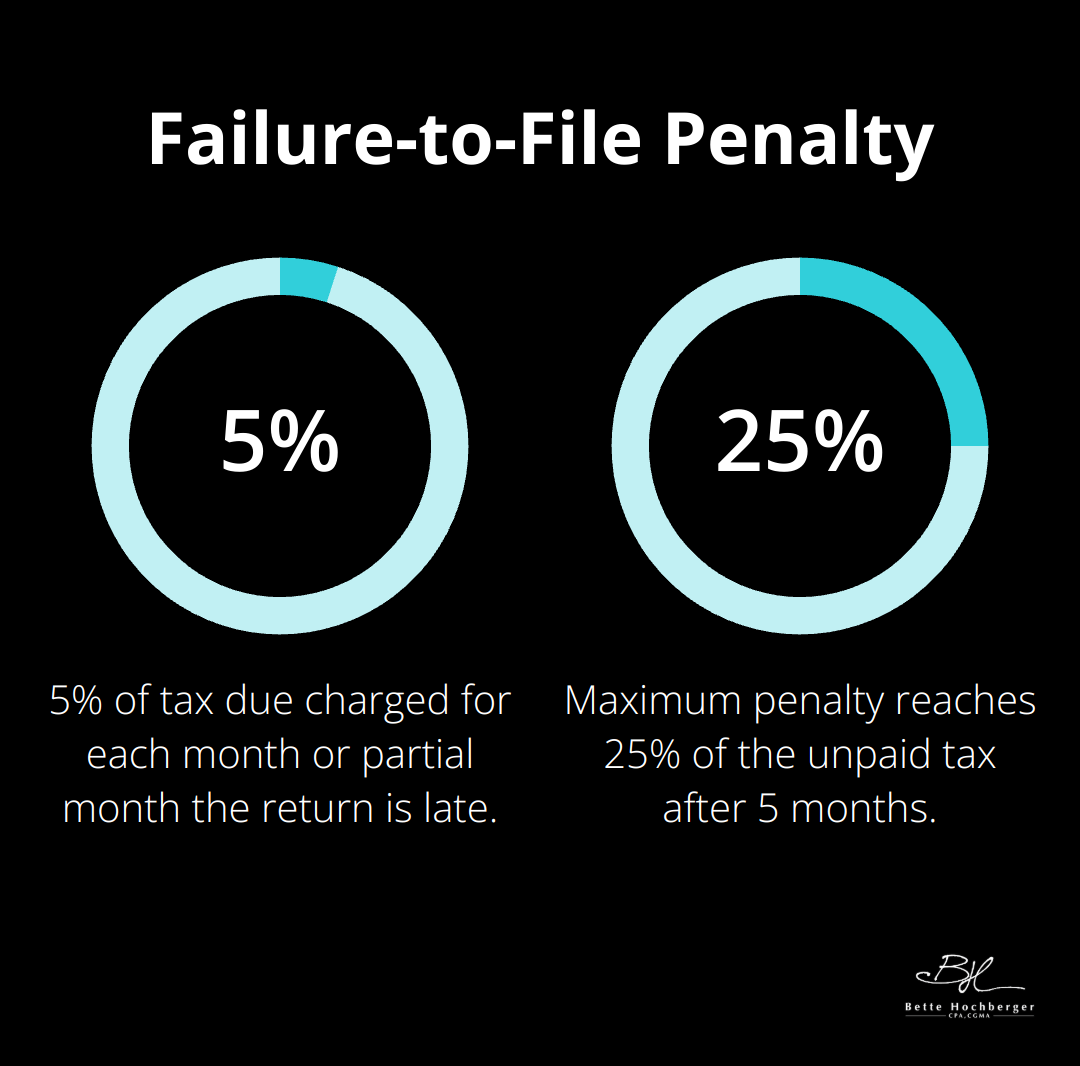

Failure-to-File Penalty

The IRS charges this penalty when you don’t file your tax return by the due date. The penalty is 5% of the tax due (less any tax paid on time and available credits) for each month or partial month the return is late, up to a maximum of 25% of the unpaid tax.

To avoid this penalty:

- File your return on time, even if you can’t pay the full amount due

- Request a filing extension (but note that this doesn’t extend the time to pay taxes)

Failure-to-Pay Penalty

If you don’t pay your taxes by the due date, the IRS will charge a failure-to-pay penalty. This penalty is 0.5% of your unpaid taxes for each month or part of a month you’re late (up to 25% of your unpaid taxes).

To avoid this penalty:

- Pay your taxes in full by the due date

- If you can’t pay the full amount, pay as much as you can and consider setting up an installment agreement with the IRS

Estimated Tax Penalty

This penalty applies if you didn’t pay enough estimated tax throughout the year or if you didn’t have enough tax withheld from your paycheck. The IRS calculates the underpayment of estimated tax by corporations penalty when you don’t pay estimated tax accurately or on time.

To avoid this penalty:

- Pay enough estimated taxes throughout the year

- Try to pay at least 90% of your current year’s tax liability or 100% of your previous year’s tax liability (whichever is smaller)

Payroll Tax Penalties

Payroll tax penalties can be severe. If you fail to deposit payroll taxes, you could face a penalty of up to 15% of the unpaid tax, depending on how late the deposit is. The IRS also imposes penalties for failing to file Form 941 (Employer’s Quarterly Federal Tax Return) and for late payments.

To avoid these penalties:

- Set up a reliable system for tracking and paying payroll taxes

- Consider using a payroll service or working with a tax professional to ensure you meet all your obligations

These penalties can significantly impact businesses, which is why proactive tax planning and compliance are essential. The next section will explore effective strategies for meeting tax deadlines and avoiding these costly penalties.

How to Stay on Top of Tax Deadlines

Use Technology for Deadline Management

Digital tools can help you manage tax deadlines effectively. Many accounting software packages include tax calendars and reminder systems. QuickBooks Online, for example, allows you to set up custom reminders for various tax deadlines. This feature can significantly improve your deadline management, especially if you’re a small business owner with multiple responsibilities.

Tax calendar apps offer another solution. The IRS2Go app (available for iOS and Android) provides tax deadline reminders and allows direct payments from your mobile device. Setting up these digital reminders reduces the likelihood of missing important dates.

Set Up a Robust Accounting System

Accurate record-keeping forms the basis of timely tax compliance. A comprehensive accounting system can streamline your tax preparation process and help you avoid last-minute rushes.

Cloud-based accounting software (such as Xero or FreshBooks) can automatically categorize your expenses and generate financial reports. This real-time financial data allows you to estimate your tax liability throughout the year, making it easier to meet quarterly estimated tax payment deadlines.

Work with a Tax Professional

While technology helps, the expertise of a seasoned tax professional is invaluable. A qualified CPA can provide personalized advice tailored to your business structure and industry. They can help you navigate complex tax laws, identify potential deductions, and ensure you meet all your tax obligations.

A Certified Public Accountant is more than just a number cruncher; they are a strategic partner in tax planning and compliance. We at Bette Hochberger, CPA, CGMA work closely with our clients to create tax strategies that align with their business goals. This proactive approach not only helps in meeting deadlines but also in optimizing overall tax positions.

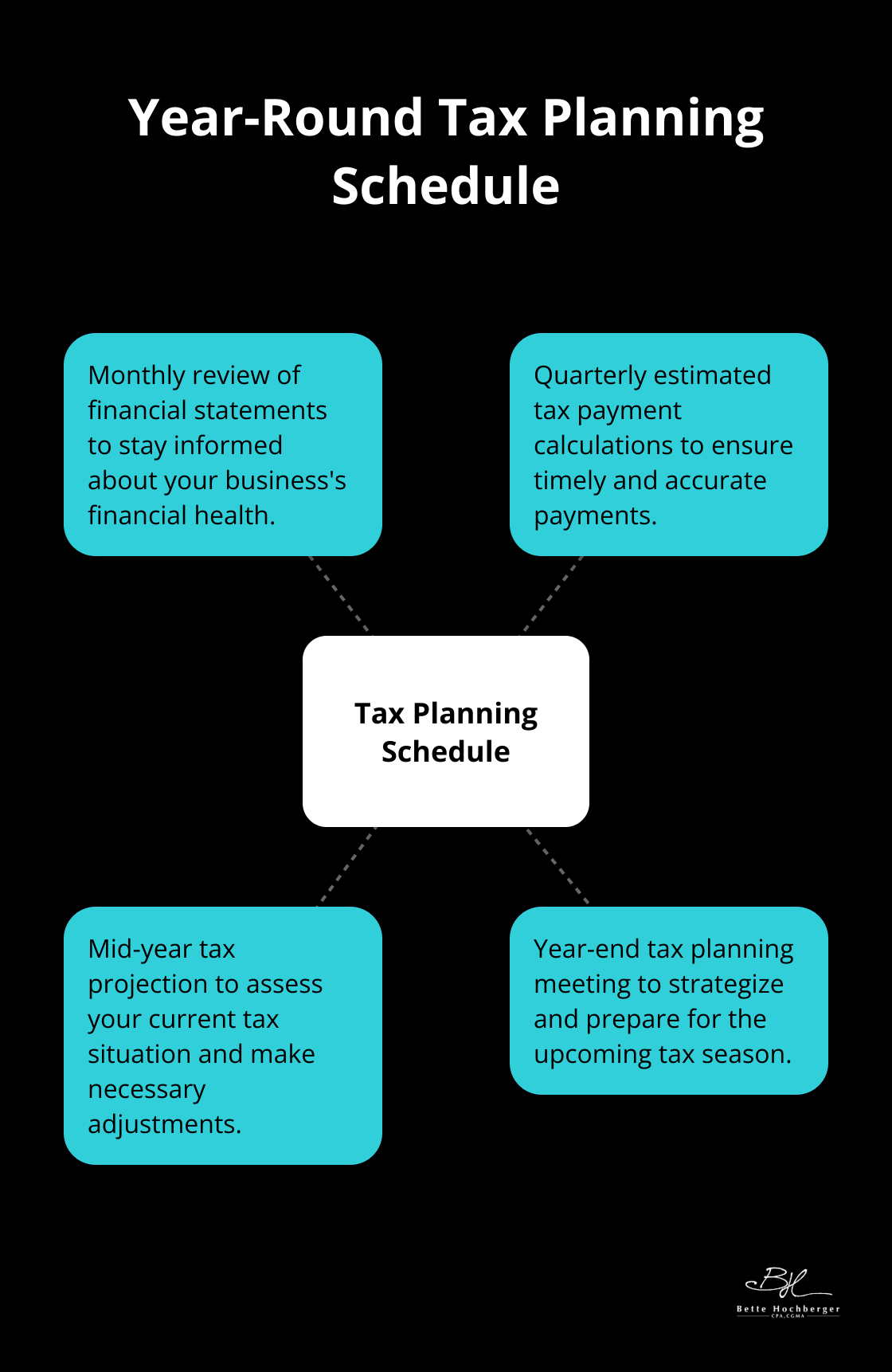

Create a Year-Round Tax Planning Schedule

Tax planning should not be a once-a-year event. Create a schedule for regular tax-related activities throughout the year. This approach might include:

Regular check-ins with your tax advisor can help you stay on track and make necessary adjustments as your business evolves.

Establish a Filing System

An organized filing system (physical or digital) can save you time and stress when tax deadlines approach. Keep all tax-related documents in one place, sorted by tax year and category. This system should include:

- Income statements

- Expense receipts

- Bank statements

- Previous tax returns

- Correspondence with tax authorities

A well-organized filing system allows quick access to necessary documents, speeding up the tax preparation process and reducing the risk of missed deadlines.

Final Thoughts

Staying ahead of tax deadlines protects your business from costly IRS penalties and maintains financial stability. Understanding and adhering to key dates for various tax obligations allows you to focus on growing your business rather than dealing with IRS issues. Implementing effective strategies, such as utilizing technology and setting up robust accounting systems, streamlines your tax preparation process and helps you meet your obligations promptly.

Professional guidance often proves invaluable when navigating the complex world of business taxes. A qualified tax advisor can provide personalized advice tailored to your specific business structure and industry. They can help you develop strategic tax plans, manage cash flow, and ensure compliance with all tax deadlines.

We at Bette Hochberger, CPA, CGMA specialize in providing personalized financial services for businesses and professionals. Our team can assist you in developing a proactive approach to tax planning and compliance, setting you up for long-term financial success. Don’t wait until tax season to start thinking about how to avoid IRS penalties-take action today to protect your business and optimize your tax position.