Welcome to Finance Friday. It is tax season. I can’t get away from it. I’m still a tax accountant. But one of the things I want to talk about is how you can be excited about paying your taxes. And no, I have not gone crazy, I promise. But what I’ve learned over the years is that the problem isn’t actually paying the taxes, right? Because as crazy as that sounds, if you’re paying taxes, that means you made money that year. And that’s a good thing. Especially if you’re a business owner, you should be super happy if you made money.

Now, what I do see many, many, many times over many years, is when I have to make that dreaded phone call to the business owner of, “By the way, you owe 30, $40,000…” And they usually freak out a little bit. Because why would you not freak out a lot, maybe, about that? But the reality is, they didn’t have a problem paying the taxes. They had a problem because they weren’t prepared to pay their taxes.

So it’s a little bit different. You have to change how you are thinking about your taxes. And the thing you have to understand is, there’s a certain amount of money that you make that isn’t yours. It’s the government’s money. And if you understand that, and you plan for that throughout the year, you A, aren’t caught off guard in April when you owe a ton of money. And B, you’ve already taken care of it through the year.

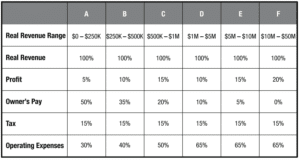

So one of the services that I offer is Profit First. And Profit First, it’s too complicated to just go through on a little Finance Friday like this. But I wanted to talk about one aspect, which is how you make sure your business is covering your taxes. So, we have in Profit First this idea, we call it TAPS. Target allocation percentages.

And here’s a little picture of what TAPS means. I don’t want to get too deep into the details here, but if you take a look at this chart… A lot of small businesses are going to generally fall in that A or B category. So you see that first column. Let’s ignore everything except where it says Real Revenue Range and Tax. Real Revenue, it’s a little nuanced. For our purposes, it’s just your revenue in your business.

So if you’re a pretty small business, you’d be in Column A. Means you’re making 0 to 250,000 in total revenue. That’s all the sales, or what have you, coming in. If you take a look at that Tax line, it says 15%. So what this means is that, if you’re in the 0 to $250,000 revenue range for your business, you should take 15% of that revenue that comes in and set that aside for your taxes.

Now actually, if you take a look across, all the way across the board, and actually, they’re all 15%. But I work mostly with smaller businesses, so we’re usually in the A, B, C range, sometimes the D range. But it’s one of those things where sometimes it feels like a struggle to make sure those taxes are taken care of.

But if you’re doing this throughout the year… If every time you make a sale, every time you have a deposit, you took 15% and you stuck it in a separate bank account. And you went ahead and you made your quarterly estimated payments with that 15% that you’ve already squirreled away… When April comes, you’re going to be pleasantly surprised because you most likely are not going to owe any taxes. It’s not a guarantee. I can’t guarantee you that you won’t sometimes owe something. But very likely, your business has taken care of your personal taxes for you.

And then you don’t care. You don’t care it’s April. You’re not going to have a $30,000 bill show up out of nowhere that you don’t know how to handle. You know what to do because you’ve been doing it all year long. So this is something that I like to work with my clients, whether you fully implement Profit First, and we can talk about different aspects of that in future Finance Fridays.

But I just wanted to touch on that because it is tax season, and I know there are going to be people out there who are going to be a little bit shocked when they get their tax bill this year because it happens all the time. So, just wanted to touch on that a little bit. If you have questions about Profit First, or about taxes… Hit me up. You can always leave a message here. Shoot me an email. We’ll get back to you one way or another, and have a good one.