I recently made a presentation to financial industry professionals regarding tax issues for Estate & Trusts gifts. Here is a movie of the slideshow presentation. Have questions? Feel free to contact me!

Youtube video: Estate, Trust & Gift Taxation 2014

Presented by Bette Hochberger, CPA, CGMA

Definitions

- Estate Tax

- Tax on transferring of property at your death, based on an accounting of everything you own or have interest in

- Gift Tax

- Tax on money or property given to someone

- Trust

- fiduciary arrangement that allows a third party – trustee – to hold assets on behalf of 1+ beneficiaries

- Income Exclusion

- Certain types of Income set aside as non taxable

- Unified Credit

- tax credit given to each individual, allowing them to gift that amount of assets without gift, estate, or generation-skipping taxes

Explanations

- Estate consists of an accounting of everything you own or have an interest in

- Fair Market value is used (not cost)

- Total of these items is the gross estate

- Gross estate can consist of cash, securities, real estate, insurance, trusts, annuities, business interest, and other assets.

- Taxable estate is portion subject to taxation: gross estate – deductions

- Deductions may include mortgages and other debts, estate expenses, and property that goes to spouses and charities

- Lifetime taxable gifts is added to estate

- Tax is computed based off this amount

- Tax is reduced by available unified credit

History of Exception – See Chart

Exception was $600,000 and Tax Rate 55% in 1997. It went to $5,000,000 with a 35% Gift and 0% Estate in 2010. It has then gone back to 40%, but up to $5,340,000.

Changes

- American Taxpayer Relief Act of 2012 (ATRA 2012) included provisions for estate and gift taxes

- Made permanent transfer tax exclusions of $5 Million, with inflation adjustments

- Highest transfer rate – 40%

- Currently $5.34M for an individual, $10.68M for a couple

- Portability originally enacted with Tax Relief Act of 2010

- Surviving spouse may utilize unused portion of estate tax exclusion from last predeceased spouse

- To qualify, first spouse must die after 2010

- Application Exclusion Amount for Surviving Spouse is Sum of:

- Basic Exclusion Amount

- Aggregate decreased spousal unused exclusion (DSUE) amount.

Estate Tax Scenarios

Basic Examples

Example:

Spouse 1 dies after 2010 with $2M in assets. Under exclusion ($5.34M), the $2M is not taxable.

Spouse 2’s exclusion is now sum of their exclusion plus remaining from Spouse 1, if Spouse 2 dies in 2010, it’ll be $5.34M + ($5.34M – $2M) = $8.68M

Note: Portability only applies if the executor of their estate filed an estate tax return calculating DSUE and made an election that that amount may be taken into account. Election is irrevocable, but not allowed if not timely filed. Note, 40% of $5.34M amounts to a $2.136M late file penalty.

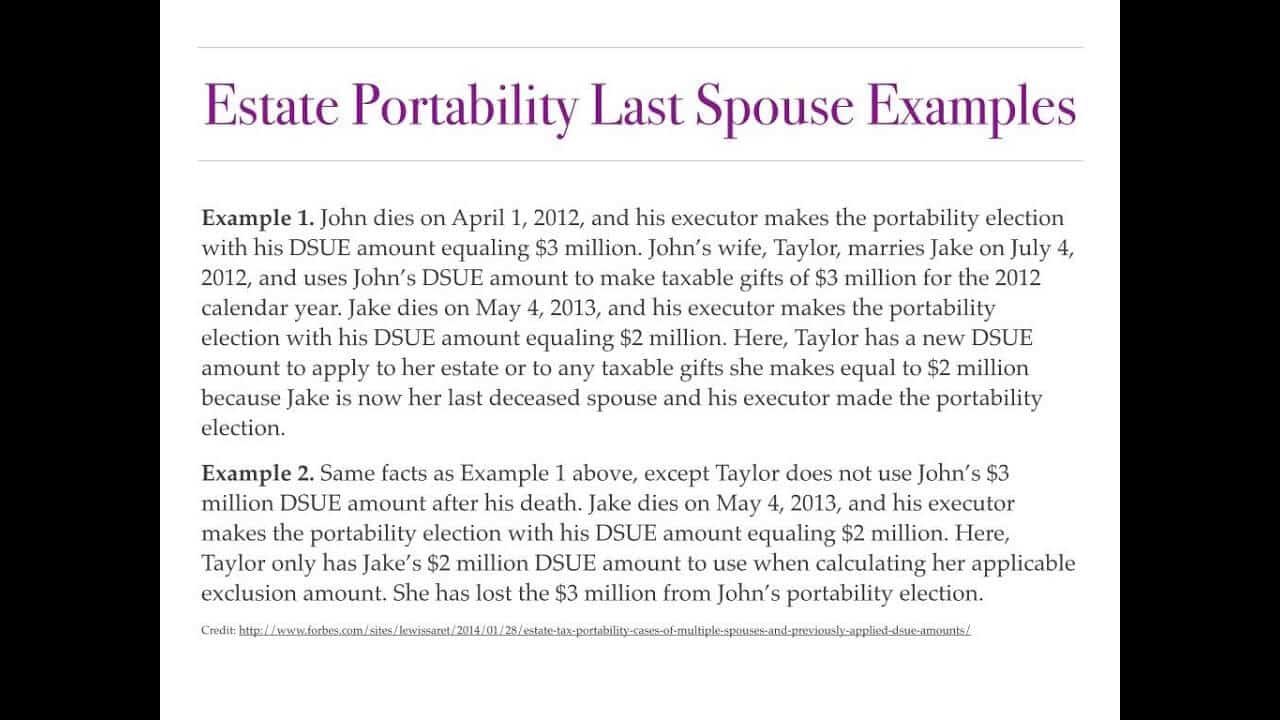

Forbes Example: Estate Tax Portability – Last Deceased Spouse Limitation On DSUE Amount Available To Surviving Spouse

Further note: Surviving spouse may not use remaining DSUE from prior deceased spouse if they are no longer the last deceased spouse, it’s gone.

Black Widow Scenario

- Scenario: surviving spouse makes gifts between the death of two spouses, each of whom is the last deceased spouse.

- Ordering rule: DSUE of last deceased spouse is used before their own exclusion

- They are allowed to use DSUE of multiple “last deceased spouse” – but they cannot use the sum

- Can use spouse 1’s exclusion for gifts before spouse 2 dies. Once spouse 2 dies, and DSUE from spouse 1 is gone, but they can use DSUE from spouse 2.

Forbes Example: Estate Tax Portability – Cases of Multiple Spouses and Previously Applied DSUE Amounts

Reducing Estate Taxes

- Credit Shelter (AB) trust – creased when a spouse dies, surviving spouse has rights to assets and income, assets then pass tax-free to beneficiaries

- Using the portability election – Trust needs a competent CPA!

- Annual Gifting – in 2014 you and spouse can each give $14,000 tax free, that’s $56,000 to a child and spouse

- Life insurance – it’s estate taxable if the deceased owned the policy, but if beneficiaries own the policy, it’s free from estate and income tax

Reducing Estate Taxes via Trusts

- Irrevocable lift insurance trust – trust owns the policy, distributed per trust

- Charitable remainder trust – gift assets to trust, trust makes payments to tax payer, then remainder goes to charity

- Charitable lead trust – gift assets to charitable trust, which makes payments to charity, and remainder goes to family or another trust

Gift Tax

Gift Tax Basics

- Gift tax applies to the transfer by gift of any property

- It is a gift if the property or use is given without expectation of receiving something in return

- Tax is paid by the giver, not recipient

- Annual exclusion for gifts in 2014 is $14,000 per person, or $28,000 for married couples

- Unlimited number of gifts up to $14,000 can be given

- Unlimited amount can be given to a US citizen spouse by using the unlimited gift tax marital deduction

- If spouse is not a US Citizen, gift is limited to $143,000

- Gift tax return Form 709 must be filed when gifts over the annual limits are made

- Elect to use part of the lifetime estate exclusion to cover overages to avoid gift taxes

Gifts to Organizations

- Gifts to charities are unlimited – gift tax free

- Gifts to charities create deductions on individual income tax Form 1040, Schedule A

- Gifts to political organizations are also tax-free, but not deductible

Gifts-Special Situations

- Direct payments of tuition to educational institutions made on behalf of another are not subject to gift tax. This does not include room & board, books, or supplies

- Direct payments of medical care to providers made on behalf of another are not subject gift tax

- If reimbursements to the individual they become “taxable” gifts

Gifts – Special Situations 529 Plans

- Section 529 Plans are a tax-advantaged method of saving for future college expenses, including tuition, room and board, mandatory fees, and required books and computers

- Special 5-year lump sum contributions of $70000 ($140,000 for married couples) are allowed