Running a business is challenging, and financial pitfalls can sneak up on even the most vigilant entrepreneurs. At Bette Hochberger, CPA, CGMA, we’ve seen how overlooking key financial red flags can lead to serious consequences.

That’s why we’ve compiled a list of five critical warning signs every business owner should watch for. By identifying these issues early, you can take proactive steps to safeguard your company’s financial health and long-term success.

1. Cash Flow Crunch: The Silent Business Killer

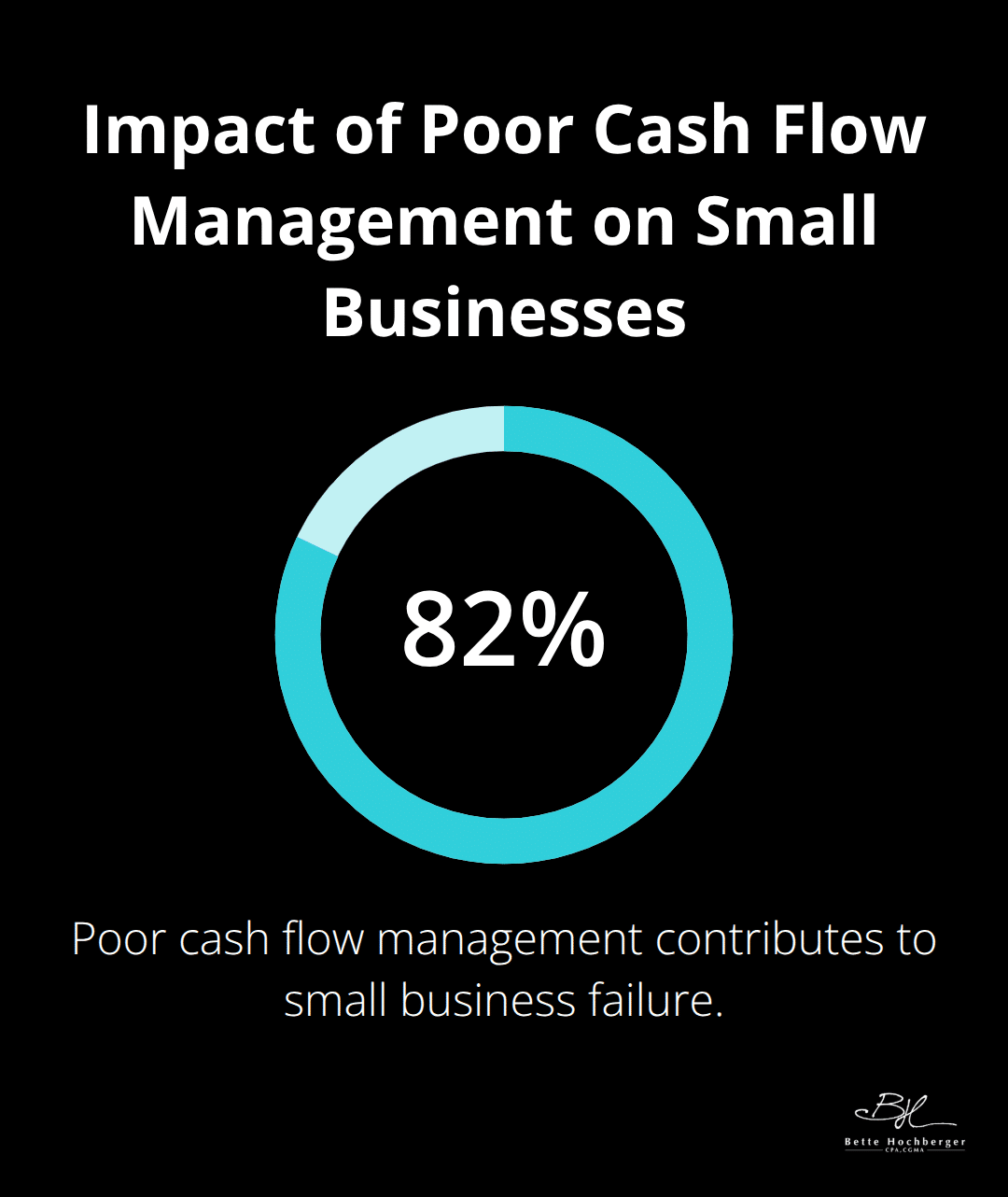

Cash flow problems often signal impending financial trouble for businesses. 82% of the time, poor cash flow management or poor understanding of cash flow contributes to the failure of a small business. This issue manifests as late supplier payments, payroll difficulties, or overreliance on credit lines for operational expenses. The impact on daily operations can limit a company’s ability to invest in growth or handle unexpected challenges.

To improve cash flow management, businesses should:

- Implement strict invoicing and collection policies

- Negotiate better terms with suppliers

- Consider offering discounts for early payments

- Conduct regular cash flow forecasting

A 13-week cash flow forecast cycle can help businesses anticipate and address potential shortfalls. Professional help can make a significant difference for businesses facing persistent cash flow issues. Experts can develop tailored strategies to optimize cash flow and ensure long-term financial stability. They identify inefficiencies in the cash cycle, implement robust financial reporting systems, and provide ongoing support to keep businesses on track. Addressing cash flow problems early protects businesses from financial strain and sets the stage for sustainable growth. The next critical red flag to watch for is the gradual erosion of profit margins, which can quietly undermine a company’s financial health.

2. Shrinking Profit Margins: A Silent Threat to Business Health

Profit margins form the core of business success, and their decline often signals trouble. A recent survey by the National Federation of Independent Business shows that small business optimism has improved slightly, with a decrease in uncertainty about financing expectations and planned capital expenditures. This improvement suggests that businesses are adapting to challenges and finding ways to maintain profitability. Businesses should compare their gross and net profit margins against industry benchmarks and historical performance regularly to detect trends early. Increased competition, higher supplier costs, or shifts in consumer behavior all contribute to margin compression.

Protecting and improving profitability demands decisive action. Businesses should start with a thorough cost analysis to identify areas of waste or inefficiency. A value-based pricing strategy helps maintain margins without alienating customers. This approach relies on customers’ perceived value of goods or services to determine cost. Diversifying product lines or exploring new markets can offset margin pressure in core offerings. Many businesses seek expert guidance to improve profitability (often from specialized accounting firms). These professionals analyze financial data, identify profit leaks, and develop strategies to boost margins and overall financial performance.

The next red flag to watch for involves the accumulation of debt, which can quickly spiral out of control if left unchecked.

3. The Debt Trap: Recognizing and Managing Excessive Borrowing

Excessive debt accumulation threatens business stability. A debt-to-equity ratio exceeding 2.0 often signals financial distress among small businesses. This high leverage increases interest expenses, reduces flexibility, and creates potential difficulties in securing additional financing. Businesses with mounting debt levels frequently struggle to invest in growth opportunities or weather economic downturns.

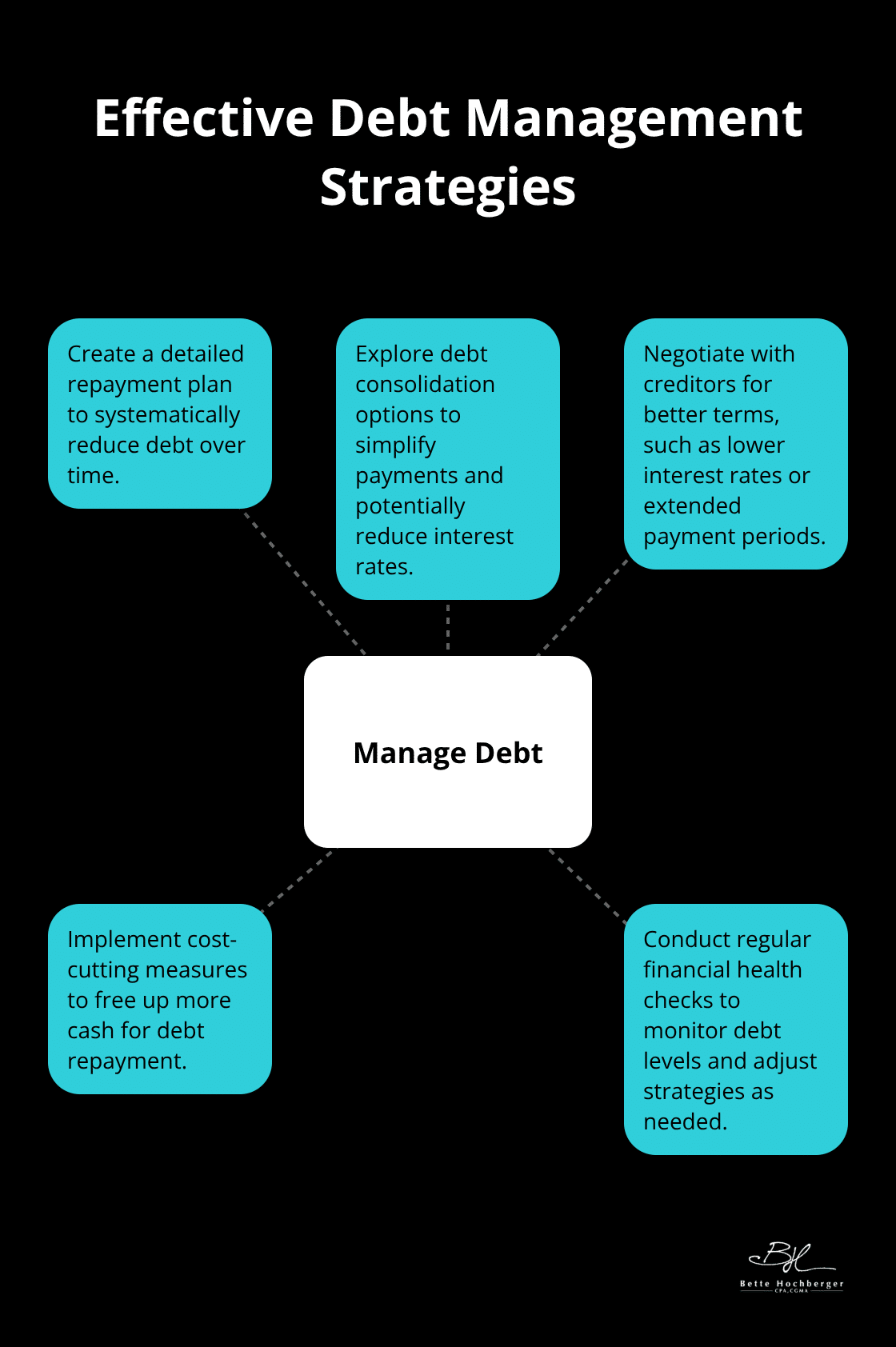

To manage debt effectively, businesses should:

- Create a detailed repayment plan

- Explore debt consolidation options

- Negotiate with creditors for better terms

- Implement cost-cutting measures

- Conduct regular financial health checks

These strategies free up cash for debt reduction and maintain a balanced financial structure. Professional guidance provides tailored strategies to improve financial stability and paves the way for sustainable growth. As businesses address their debt concerns, they must also remain vigilant about another critical financial red flag: unexpected fluctuations in revenue streams.

4. Revenue Rollercoaster: Spotting and Stabilizing Fluctuations

Revenue fluctuations often signal underlying business issues. Cash flow problems can develop when a business doesn’t have enough cash coming in. The company can look financially healthy on paper. To combat this, we recommend the implementation of a robust financial forecasting system that accounts for historical data and market trends. This approach allows businesses to anticipate potential fluctuations and adjust their strategies accordingly.

Diversifying income sources proves crucial for stabilizing revenue streams. The Bureau of Labor Statistics is the principal fact-finding agency for the Federal Government in the broad field of labor economics and statistics. We advise our clients to:

- Explore new markets

- Develop complementary products or services

- Consider recurring revenue models (like subscriptions or retainers)

Additionally, regular reviews and adjustments of pricing strategies can help maintain consistent revenue. Close monitoring of these factors and seeking professional guidance when needed enables businesses to navigate revenue fluctuations more effectively. As businesses work to stabilize their income, they must also pay attention to another critical aspect of financial health: the quality and consistency of their financial reporting practices.

5. Inadequate Financial Reporting: A Recipe for Disaster

Inadequate financial reporting poses a significant risk to business health. Poor review processes can result in errors slipping through, such as imbalances in intercompany accounts. This is often the result of poor record-keeping, which obscures the true financial picture, leading to misguided decisions and potential legal issues. Businesses often struggle with incomplete transaction records, inconsistent expense categorization, and delayed reconciliations (all of which can result in inaccurate financial statements).

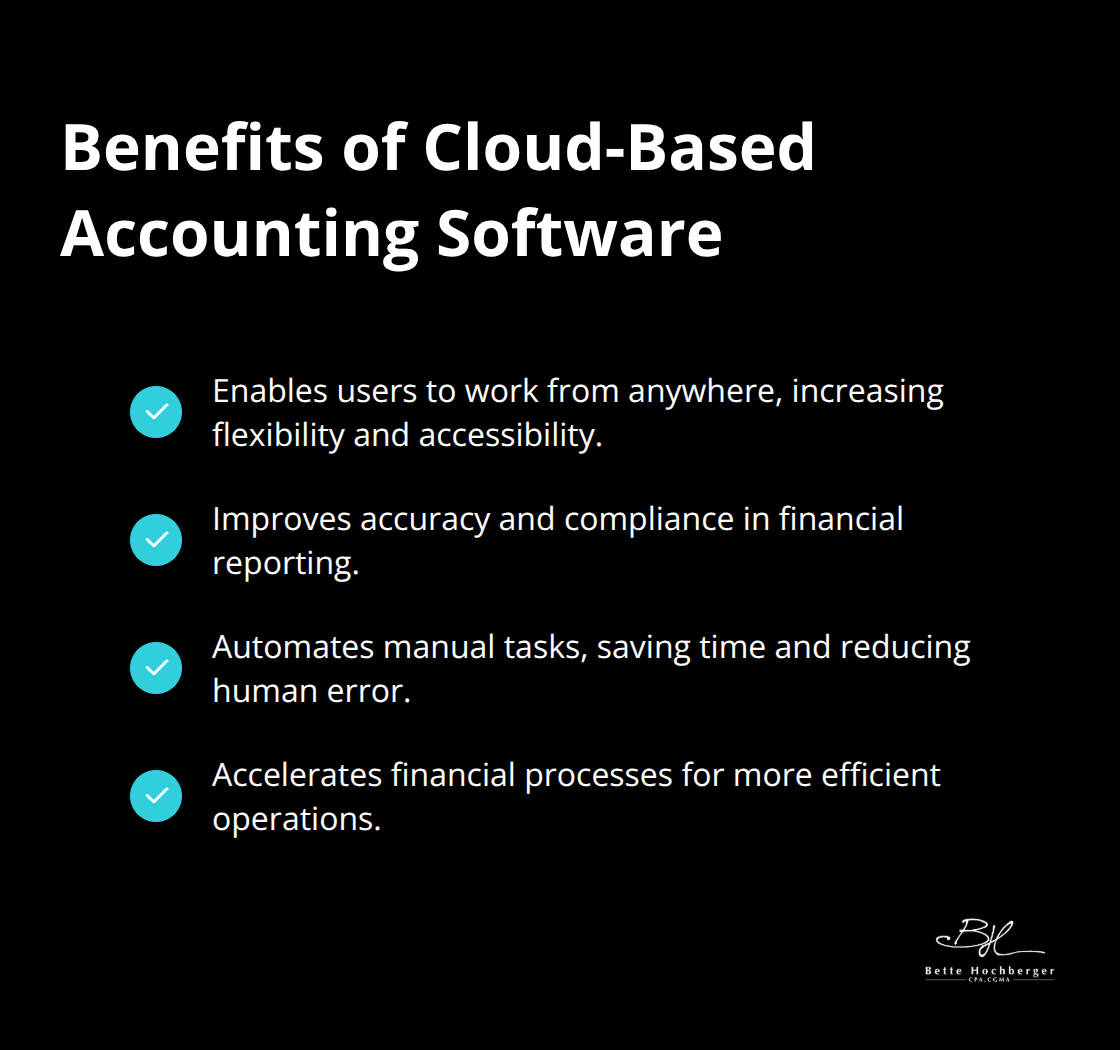

To address these challenges, businesses should implement robust financial reporting systems. Cloud-based accounting software like QuickBooks Online or Xero can automate data entry, reduce errors, and provide real-time financial insights. Cloud accounting software lets users work from anywhere, improves accuracy and compliance, automates manual tasks, and accelerates financial processes.

Regular financial audits help identify reporting gaps and ensure compliance with accounting standards. Training staff on proper financial documentation and establishing clear reporting procedures are essential steps in maintaining accurate records. Prioritizing comprehensive financial reporting allows businesses to make informed decisions, detect issues early, and build a solid foundation for growth. As businesses strengthen their financial reporting practices, they must also focus on proactive financial management to ensure long-term success and stability.

Final Thoughts

Financial red flags demand constant vigilance from business owners. We explored five critical warning signs that serve as early alert systems for potential financial crises. Regular financial health checks prove necessary for long-term stability and growth. Consistent monitoring of key areas allows businesses to maintain a clear picture of their financial standing and make informed decisions.

Bette Hochberger, CPA, CGMA specializes in helping businesses identify and address these financial red flags. Our team of experts provides personalized financial services tailored to specific needs. We offer comprehensive solutions to minimize tax liabilities, manage cash flow, and ensure profitability (from strategic tax planning to Fractional CFO services).

Don’t wait for financial issues to become insurmountable. Take control of your business’s financial future today. With the right expertise and tools, you can turn potential red flags into opportunities for improvement and success. Let us help you build a strong financial foundation for your business.