Hey everyone! I’m Bette Hochberger, CPA, CGMA. Small business taxes can be a complex and daunting aspect of entrepreneurship. Many business owners struggle to determine how much money they should set aside for their tax obligations.

At our firm, we understand the challenges of managing your tax responsibilities while running a successful enterprise. This guide will help you navigate the process of calculating and saving for your small business taxes, ensuring you’re prepared when tax season arrives.

What Taxes Do Small Businesses Pay?

Small businesses face a complex web of tax obligations that significantly impact their bottom line. Understanding these obligations is essential for financial success and legal compliance.

Federal Tax Requirements

At the federal level, small businesses typically pay income tax on their profits. However, the specific tax rates vary based on business structure and income levels. According to the Tax Foundation, businesses with adjusted gross income between $3,309,589 and $5,647,825 million account for 22.4% to 38.3% of total adjusted gross income.

Self-employment tax is another federal obligation for many small business owners. This tax covers Social Security and Medicare contributions (typically split between employers and employees in larger companies). As of 2025, the self-employment tax rate stands at 15.3% of net earnings.

State and Local Tax Considerations

State and local taxes add another layer of complexity. These can include state income tax, sales tax, and property tax. The rates and requirements vary widely depending on location. For example, states like Wyoming, South Dakota, and Florida have no state income tax, while California and New York have some of the highest rates in the country.

Local taxes can also apply, such as city business taxes or county property taxes. These are often overlooked but can add up quickly. In some municipalities, businesses may face additional taxes on gross receipts or payroll.

Importance of Tax Compliance

Staying compliant with tax laws is not just about avoiding penalties; it’s about maintaining the financial health of your business. The IRS reports that about 40% of small businesses incur an average penalty of $5,000 for payroll tax errors. This highlights the importance of accurate record-keeping and timely filing.

Many clients miss out on valuable deductions or credits simply because they aren’t aware of them. Proper tax planning can lead to significant savings. For example, the home office deduction can save eligible businesses thousands of dollars annually (when used correctly and in compliance with IRS guidelines).

The Role of Professional Tax Advice

Understanding and managing these various tax obligations can overwhelm many small business owners. That’s why it’s often beneficial to work with a tax professional who can provide tailored advice and ensure you’re not leaving money on the table. Effective tax management isn’t just about paying what you owe – it’s about strategically minimizing your tax burden while staying fully compliant with all applicable laws.

Now that we’ve covered the types of taxes small businesses need to consider, let’s move on to how you can calculate your specific tax liability.

How to Calculate Your Small Business Tax Liability

Estimating Annual Income

The first step in calculating your tax liability requires an estimate of your annual income. This process involves more than just looking at your gross revenue. You must consider your net profit, which is your total income minus allowable business expenses. The National Federation of Independent Business reports that the average small business owner has a net profit margin of 7-10% (though this can vary widely depending on industry and business model).

To obtain an accurate estimate, review your financial statements from the previous year and consider any projected growth or changes in your business. New businesses can use industry benchmarks as a starting point, but should remain conservative in their estimates to avoid underpaying.

Impact of Business Structure

Your business structure significantly influences your tax liability. Sole proprietorships, partnerships, and S corporations are pass-through entities, which means the business income passes through to the owners’ personal tax returns. C corporations, however, are taxed separately from their owners.

For instance, a sole proprietor with a net profit of $100,000 will pay self-employment tax on this amount, plus income tax based on their personal tax bracket. A C corporation, on the other hand, would pay a flat 21% corporate tax rate on its profits, with shareholders paying additional taxes on dividends received.

Maximizing Deductions and Credits

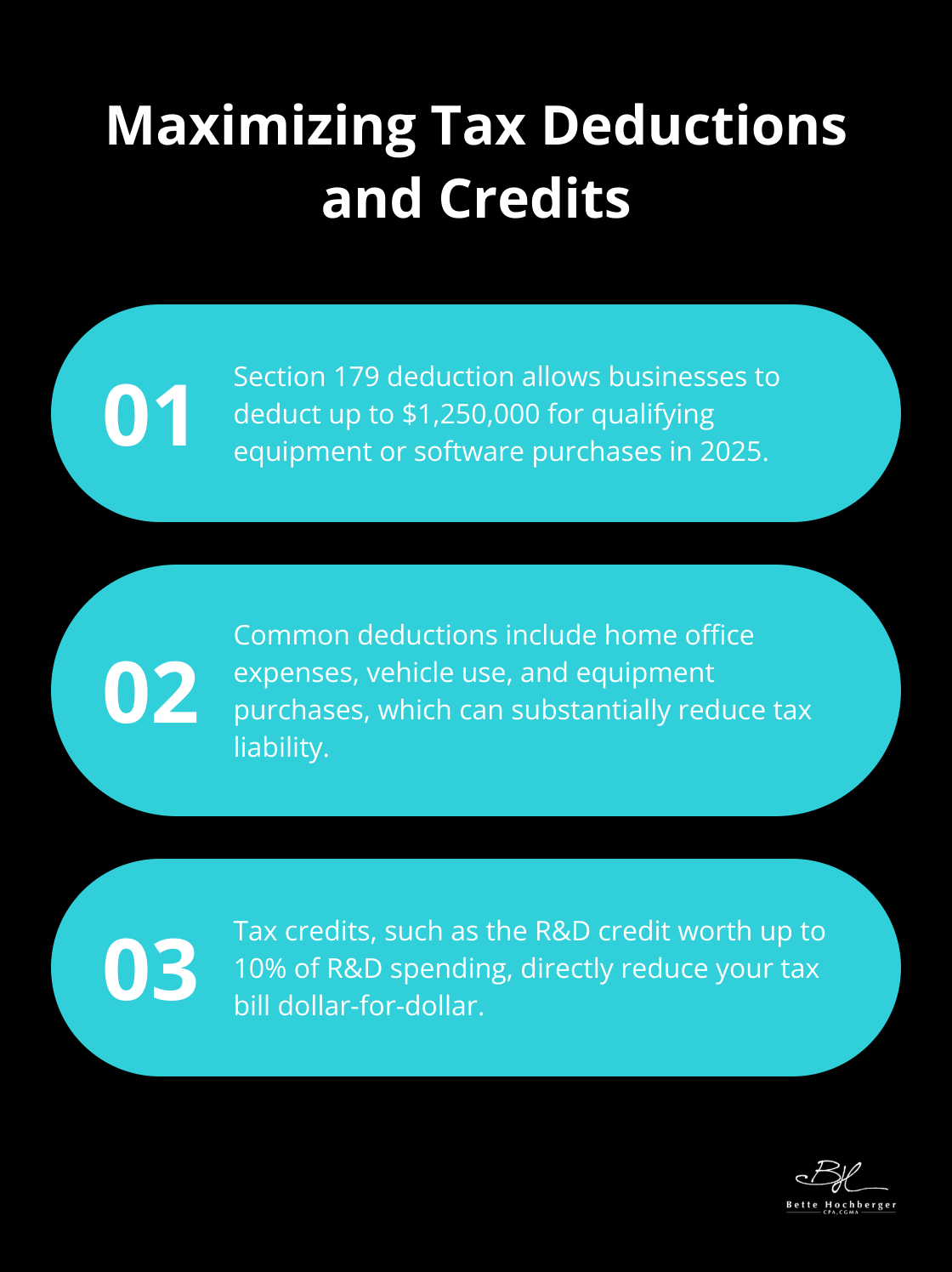

Deductions and credits can substantially reduce your tax liability. Common deductions for small businesses include home office expenses, vehicle use, and equipment purchases. The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment or software purchased or financed during the tax year (up to $1,250,000 for 2025).

Tax credits directly reduce your tax bill dollar-for-dollar and can provide significant savings. The Research and Development (R&D) tax credit, for example, can be worth up to 10% of your R&D spending. Many small businesses overlook this credit, mistakenly believing it’s only for large corporations or tech companies.

Ongoing Review and Adjustment

Calculating your tax liability isn’t a one-time event. It requires regular review and adjustment. As your business grows and changes, so too will your tax obligations. Staying on top of these changes and working with a knowledgeable tax professional can help ensure you’re not overpaying or underpaying your taxes.

With a clear understanding of how to calculate your tax liability, the next step involves developing strategies to set aside the right amount of money for your tax obligations. Let’s explore effective methods to ensure you’re prepared when tax season arrives.

How Much Should You Save for Taxes?

The 30% Rule

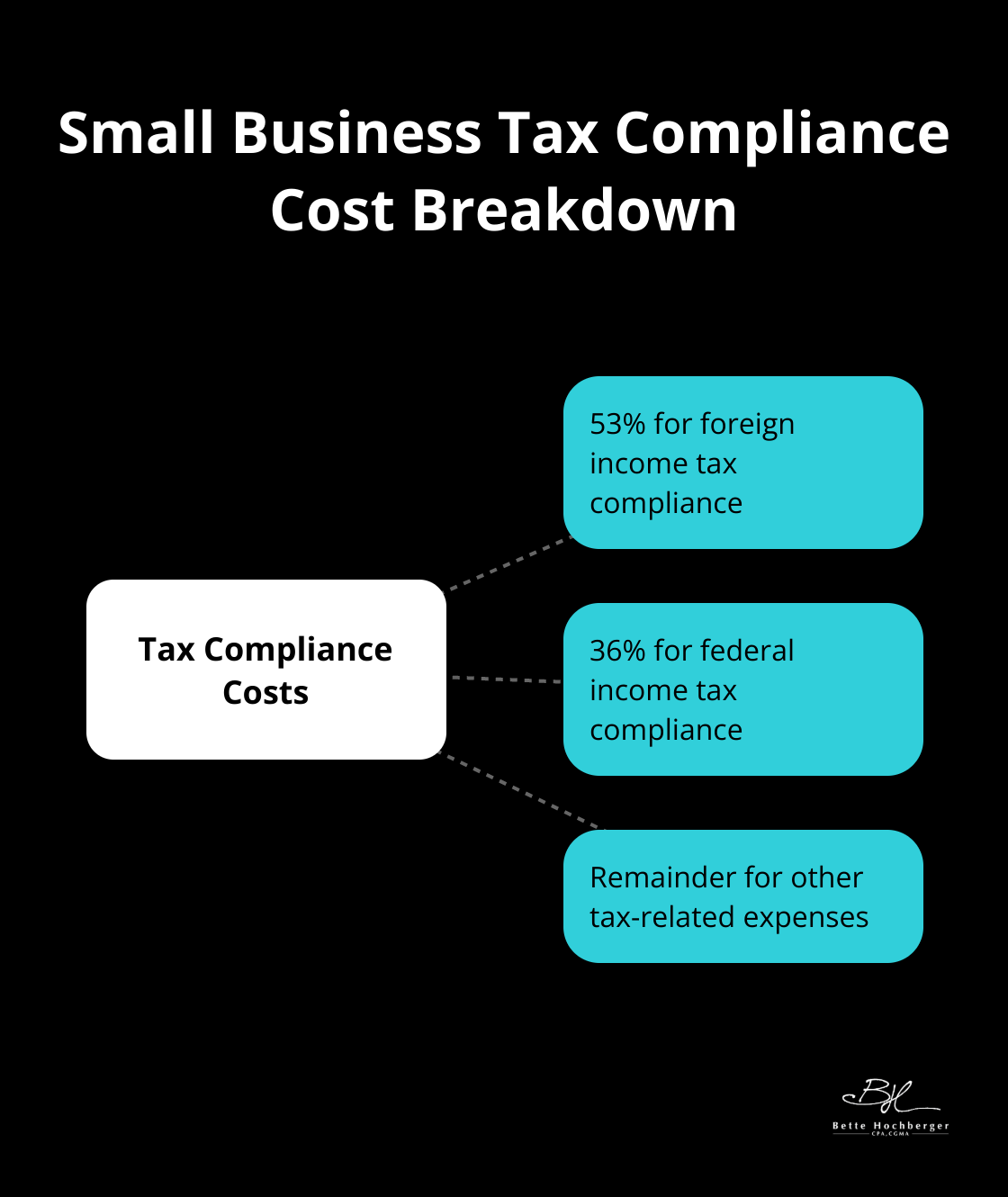

Small business owners should set aside 53% of their tax compliance costs for foreign income tax compliance, 36% for federal income tax compliance, and the remainder for other tax-related expenses. This approach ensures you have enough funds to cover your tax obligations and avoid penalties for underpayment.

Create a Separate Tax Savings Account

To manage your tax savings effectively, create a dedicated tax savings account. This strategy helps you avoid using these funds for other business expenses. Transfer the designated percentage to this account each time you receive payment for your services or products.

Many banks offer business savings accounts with competitive interest rates. While the interest earned may not be substantial, it can provide a small buffer against inflation as you save for your tax payments.

Implement a Percentage-Based System

A percentage-based savings system ensures you consistently set aside enough for taxes. Here’s how to implement this system:

- Calculate your effective tax rate from the previous year.

- Add 5-10% to this rate to account for potential increases in income or tax rates.

- Apply this percentage to each payment you receive.

For example, if your effective tax rate last year was 22%, you might decide to save 27% of each payment. If you receive a $1,000 payment, immediately transfer $270 to your tax savings account.

This system works well for businesses with fluctuating income, as it automatically adjusts your savings based on your earnings. During high-income months, you’ll save more, while in leaner months, you’ll save less.

Adjust Your Savings Strategy

Your tax savings strategy should evolve with your business. Regularly review and adjust your savings percentage based on changes in your income, business structure, or tax laws. Consider ways to reduce your tax liability and consult with a tax professional (such as Bette Hochberger, CPA, CGMA) to ensure your strategy aligns with your specific situation and goals.

Final Thoughts

Small business taxes require careful planning and consistent effort. You can navigate tax season confidently when you understand your obligations, calculate your liability accurately, and implement effective saving strategies. Proactive tax management helps you avoid penalties and make informed financial decisions throughout the year.

The 30% rule provides a solid starting point for setting aside money for taxes. You should adjust this percentage based on your specific circumstances. A dedicated tax savings account and a percentage-based system can help you stay on track with your tax obligations, even when your income fluctuates.

Your tax strategy needs regular review and adjustment as your business grows and evolves. Bette Hochberger, CPA, CGMA specializes in helping small businesses navigate the complexities of tax planning and preparation. Our team can provide personalized guidance to minimize your tax liabilities, manage cash flow, and ensure profitability.