Hi everyone! I’m Bette Hochberger, CPA, CGMA. Cash flow risk management is a critical skill for every business owner. Without proper control over your cash flow, your company could face serious financial troubles. We’ve seen firsthand how effective cash flow strategies can make or break a business. In this post, we’ll show you practical ways to manage your cash flow risk and keep your business financially healthy.

Understanding Cash Flow Risk

Defining Cash Flow Risk

Cash flow risk represents the potential for a business to face financial difficulties due to insufficient funds to meet its obligations. This risk can jeopardize a company’s ability to operate smoothly and grow effectively.

Common Causes of Cash Flow Problems

Several factors contribute to cash flow problems:

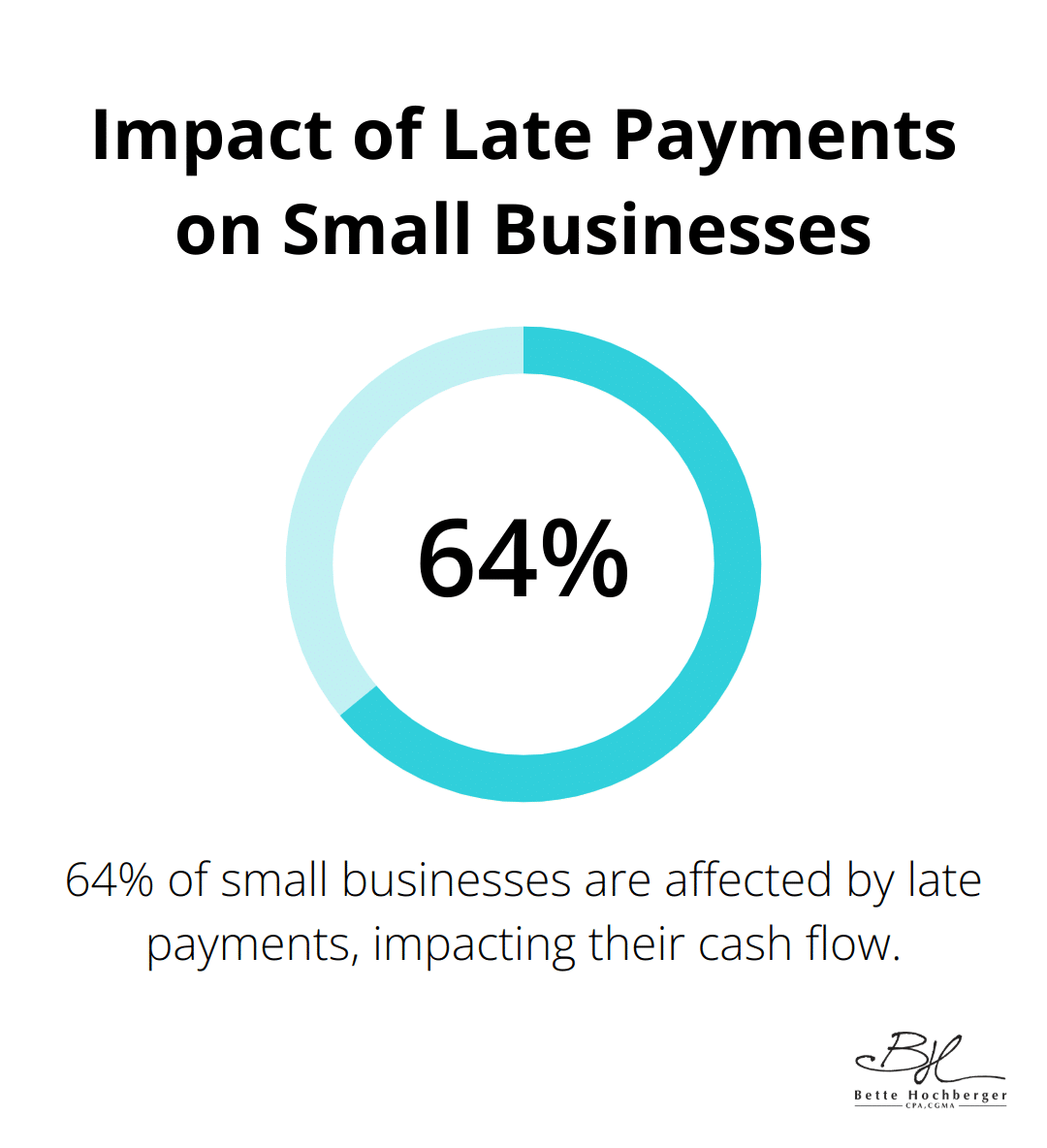

- Late-paying customers: A study by Fundbox reveals that 64% of small businesses are affected by late payments.

- Seasonal revenue fluctuations: Industries like retail or hospitality often experience this challenge.

- Overexpansion: Businesses may invest heavily in growth without considering the immediate impact on their cash reserves.

- Poor inventory management: The National Retail Federation found that inventory distortion costs retailers $1.1 trillion globally each year.

Impact of Poor Cash Flow Management

The consequences of inadequate cash flow management can be severe:

- Missed opportunities: Lack of funds prevents investment in growth or taking advantage of bulk purchase discounts.

- Damaged supplier relationships: Late payments can lead to higher costs or loss of credit terms.

- Business failure: According to the U.S. Bureau of Labor Statistics, the 1-year survival rate for new business establishments varies by location, with the lowest rate being 71.4% in the South Atlantic division for establishments born in 2008.

Proactive Measures for Cash Flow Health

To mitigate these risks, businesses should implement proactive strategies:

- Regular cash flow forecasting: Project future income and expenses to anticipate potential shortfalls.

- Improved invoicing processes: Implementing electronic invoicing can speed up payment times by up to 14 days (according to a Billentis study).

- Negotiation of payment terms: Work with suppliers for better terms and offer incentives (such as a 1-2% discount) for early customer payments.

These strategies form the foundation of effective cash flow management. In the next section, we’ll explore specific techniques to optimize your cash flow and minimize risk.

Proven Strategies to Boost Cash Flow

Effective cash flow management forms the foundation of any successful business. This chapter explores key strategies that can significantly improve your company’s financial health.

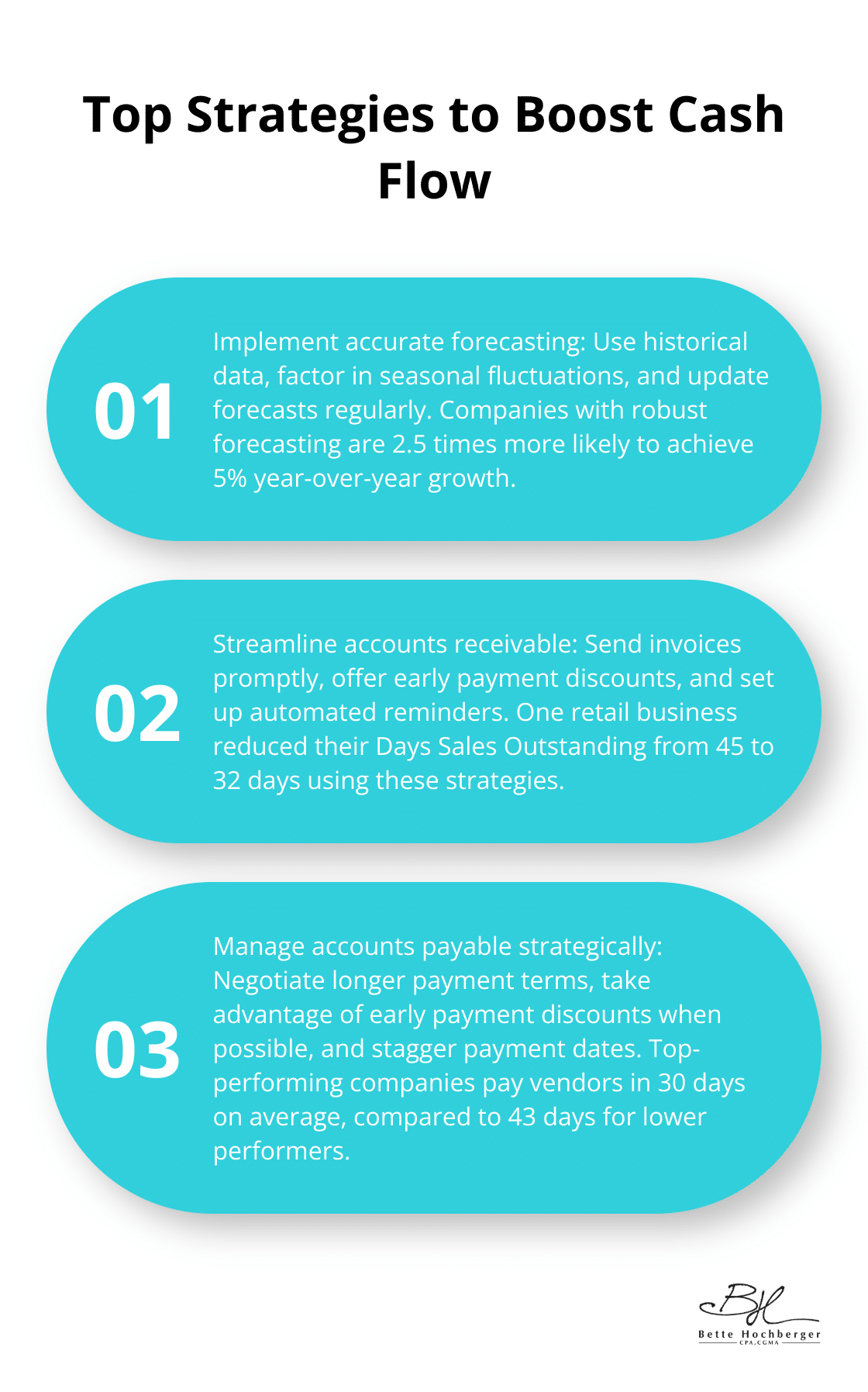

Implement Accurate Forecasting

Accurate cash flow forecasting allows businesses to anticipate potential shortfalls and surpluses. A study by PwC found that companies with robust forecasting processes are 2.5 times more likely to achieve 5% growth year-over-year. To enhance your forecasting:

- Use historical data to identify patterns and trends

- Factor in seasonal fluctuations specific to your industry

- Update your forecasts regularly based on actual performance

Many businesses find success using rolling 13-week cash flow forecasts, which provide a detailed short-term view while still offering insights into longer-term trends.

Streamline Accounts Receivable

Optimization of the accounts receivable process can dramatically improve cash flow. Days sales outstanding (DSO) measures the average number of days it takes a company to convert its accounts receivable into cash. Lesser days are better for cash flow. Here are some effective tactics:

- Send invoices immediately after goods or services delivery

- Offer early payment discounts (e.g., 2% if paid within 10 days)

- Set up automated reminders for overdue payments

One retail business reduced their DSO from 45 to 32 days by implementing these strategies, resulting in a significant boost to their working capital.

Manage Accounts Payable Strategically

While delaying payments to vendors might seem tempting, strategic management of accounts payable can yield better results. A survey by APQC found that top-performing companies pay their vendors in 30 days on average, compared to 43 days for lower-performing ones. Consider these approaches:

- Negotiate longer payment terms with suppliers

- Take advantage of early payment discounts when cash flow allows

- Stagger payment dates to align with cash inflows

Some businesses improve their cash position by up to 15% through careful AP management, without straining vendor relationships.

Build a Cash Reserve

Maintaining adequate cash reserves is essential for weathering unexpected financial storms. The JP Morgan Chase Institute recommends that small businesses keep at least 27 days of cash buffer. To manage your cash flow effectively:

- Set aside a percentage of monthly revenue

- Reinvest a portion of profits back into the business

- Consider a line of credit as a backup (this can provide additional financial flexibility)

One manufacturing company weathered a significant market downturn by maintaining a 60-day cash reserve, allowing them to continue operations and even capitalize on competitors’ weaknesses.

These strategies can significantly enhance your cash flow management. However, every business is unique, and tailoring these approaches to your specific needs is key for optimal results. In the next section, we’ll explore the tools and technologies that can support and streamline these cash flow management strategies.

Tech Tools for Cash Flow Mastery

Modern technology offers a range of tools that can significantly enhance your cash flow management. Let’s explore some of the most effective options available:

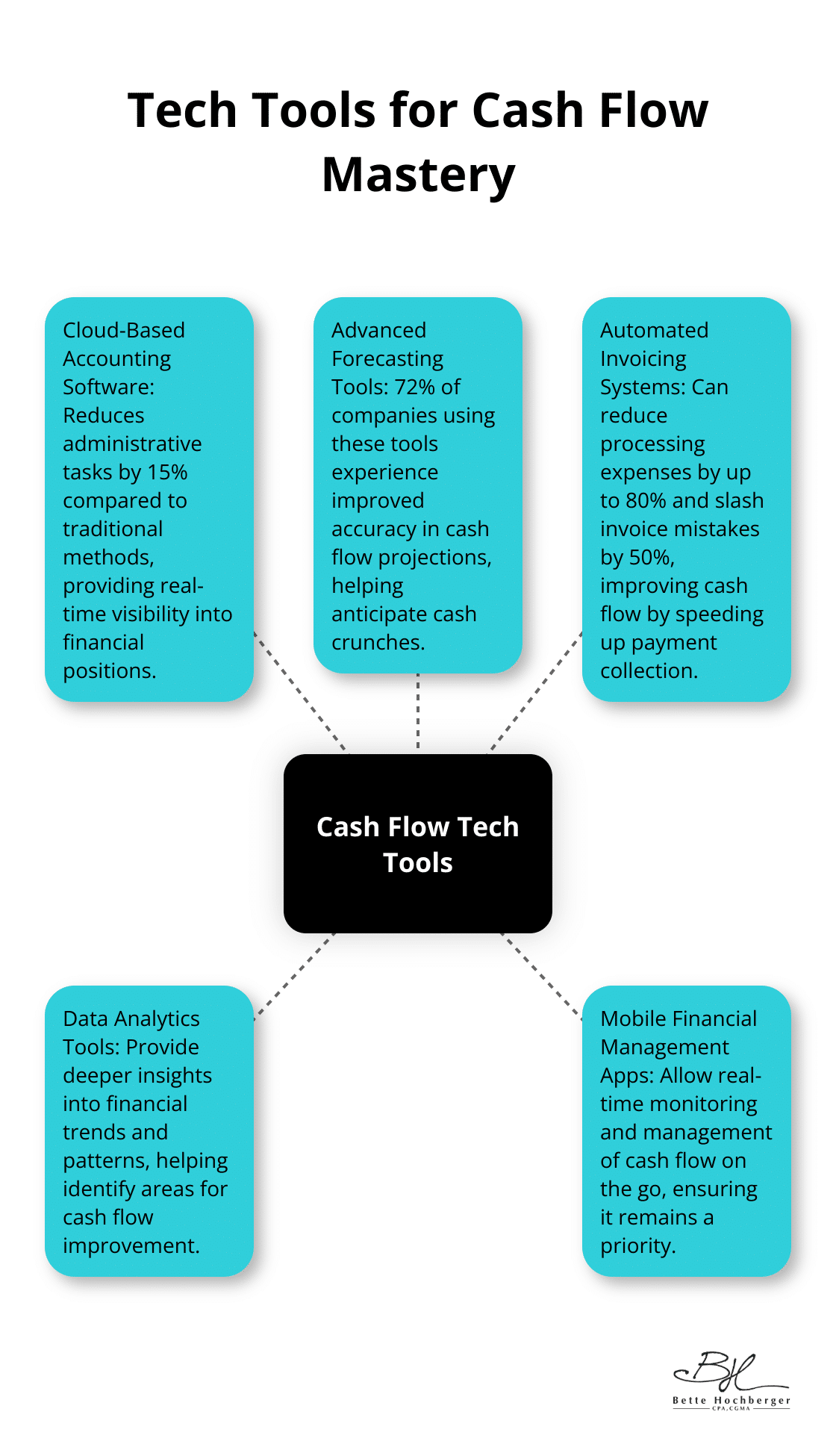

Cloud-Based Accounting Software

Modern cloud-based accounting platforms transform financial management for businesses. These systems provide real-time visibility into financial positions, enabling quick, informed decisions. QuickBooks Online and Xero offer features like automatic bank reconciliation, customizable invoicing, and detailed financial reporting.

A Sage study found that businesses using cloud accounting software reduce administrative tasks by 15% compared to traditional methods. This time reduction directly improves cash flow management and allows more focus on strategic financial planning.

Advanced Forecasting Tools

Sophisticated forecasting software elevates cash flow predictions. These tools use historical data and advanced algorithms to create accurate projections. Float and Dryrun (specialized cash flow forecasting applications) integrate with accounting software to provide detailed, visual forecasts.

The Association for Financial Professionals reports that 72% of companies using automated forecasting tools experience improved accuracy in cash flow projections. This increased accuracy can help anticipate cash crunches before they occur.

Automated Invoicing and Payment Systems

Streamlined invoicing and payment processes significantly accelerate cash inflows. Platforms like Bill.com or Stripe offer automated invoicing, recurring billing, and multiple payment options for customers. These systems reduce payment times and minimize human error in the invoicing process.

Companies using automated invoicing systems can reduce processing expenses by up to 80%, slash invoice mistakes by 50%, and improve cash flow by speeding up payment collection.

Data Analytics for Financial Insights

Advanced data analytics tools provide deeper insights into financial trends and patterns. These tools can analyze large volumes of financial data to identify areas for cash flow improvement. Platforms like Tableau or Power BI can create visual representations of financial data, making it easier to spot trends and make informed decisions.

Mobile Financial Management

Mobile apps for financial management allow business owners to monitor and manage cash flow on the go. These apps provide real-time updates on financial positions, allow for quick invoice approvals, and offer instant access to important financial data. This mobility ensures that cash flow management remains a priority, even when business owners are away from their desks.

Final Thoughts

Cash flow risk management forms the foundation of business success. Companies that prioritize this aspect of financial management position themselves to weather economic uncertainties and outperform competitors. Proactive cash flow management creates opportunities for growth and stability, not just avoids financial pitfalls.

Bette Hochberger, CPA, CGMA & Associates understands the critical role of cash flow in business success. Our team of experienced professionals provides personalized financial services tailored to unique business needs. We offer strategic tax planning, Fractional CFO services, and comprehensive tax preparation to optimize cash flow and ensure long-term profitability.

Our expertise extends beyond traditional accounting services (we excel in helping businesses relocate to Florida with tax strategy and domicile establishment). We empower our clients to make informed decisions about their financial future through advanced cloud technology and continuous education. Partner with us to transform your financial strategy and secure a prosperous future for your business.