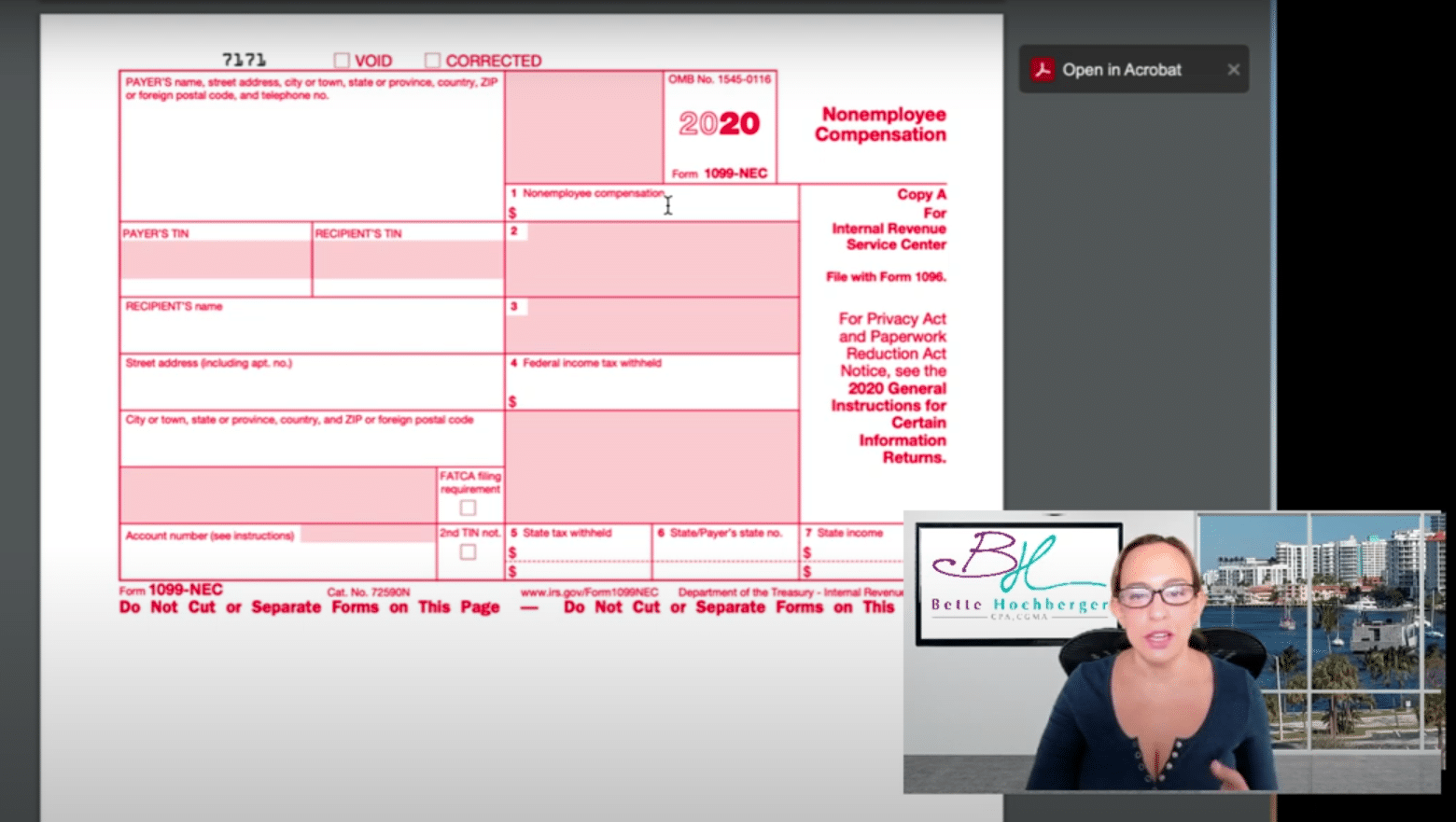

The 1099 Family of forms includes 21 variations at last count, some of which are extremely common and others are more obscure. Form 1099 exists to report income and payments to the IRS so they can track who owes money. Prior to the reintroduction of the 1099-NEC, the 1099-MISC form was the most common version.

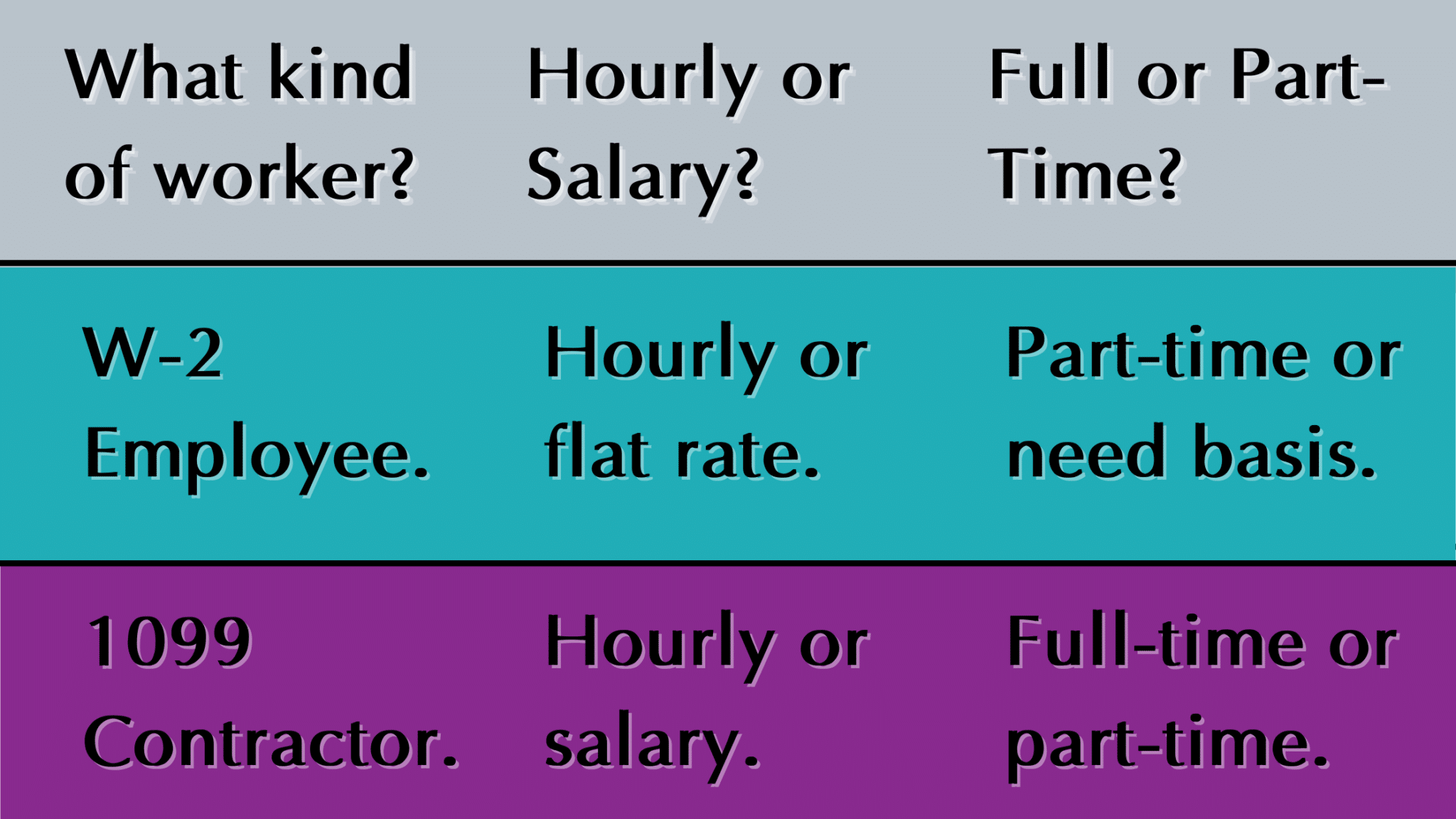

Contract workers received the common 1099-NEC, while many other business payments are reported on a 1099-MISC or 1099-K (electronic payments). Taxpayers often receive other forms in this family, including the following: health care accounts (1099-SA), brokerage and investment returns (1099-B and 1099-DIV), and interest payments (1099-INT).

Each version of the report is slightly different. You may receive a variety of forms, but most businesses only need to worry about generating 1099-NEC and 1099-MISC documents.

When you get a 1099-Form in the mail, scan or photograph it and store it for tax time. You can provide it to your tax preparer, who will need to ensure that and deviations from the numbers on these forms is documented to avoid an IRS Audit.

Like all IRS Documents, these items look terrifying, are confusingly written, and often have a massive explanation document called instructions. In all circumstances, these are simply numerical reportings, documenting the income or expenses that will tie back the the underlying tax returns. Popular versions of these documents can be submitted electronically, but a paper copy often needs to be transmitted to your business partner or associate. For the commonly sent forms, they often need to be filed on specially printed paper.