Outsource Payroll Services

Payroll Taxes Are Critical for Compliance!

Payroll services are critical to most businesses. For owner-operated S-Corporations, payroll is required for IRS Compliance. While growing firms with many employees know the importance of a good payroll service, small business owners that want to avoid tax headaches should choose an easy to use software package. For small businesses, the cloud drastically simplifies the process. Our preferred Payroll Company is Gusto. We can work with your existing Payroll System, can convert your payroll system to Gusto, and for new businesses work to set you up with Gusto.

Payroll Required?

Who needs to run payroll?

Owner Operated S-Corporations need to run payroll by IRS guidelines. In an S-Corporation your status as “employee/officer” and “shareholder” are distinct and your working within the company must be tied to payroll. If your LLC has elected to take S-Corporation tax structure (which is very common), you must also run payroll for compliance. If you have other structures, including sole proprietorships, partnerships/LLCs, and C-Corporations, you need to run payroll when you have outside employees, whether full-time or part-time. While you can do the paperwork by hand, the penalties and fines for screwing up are unreasonably large, so it’s important to use an affordable payroll service.

Why Not Contractors?

IRS and States Crack Down

Various states are challenging the use of Contract Workers instead of employees. California is the most aggressive in this regard, but other states not far behind. Nationally, the IRS is cracking down on the use of 1099 Payments (formerly 1099-Misc, now 1099-NEC) payments to defacto employees, so if you are concerned if your team is contractors or employees, we can discuss. Failure to comply with IRS and State Employee guidelines is one of our leading sources for IRS Resolution Projects. We’ll help you setup your payroll service and stay in compliance.

Who Cannot Run Payroll?

Some entity types can’t run payroll

So if you have other employees, you obviously can run payroll with any business entity format. However, if you are a sole proprietorship or partnership, or an LLC being taxed as a partnership, your owner payments may not be run through payroll, owner profits are subject to self employment tax. You may still run payroll for your employees, and your retirement and health care benefits packages may be tied to the payroll system.

Gusto Payroll Service

Our Preferred Payroll Service

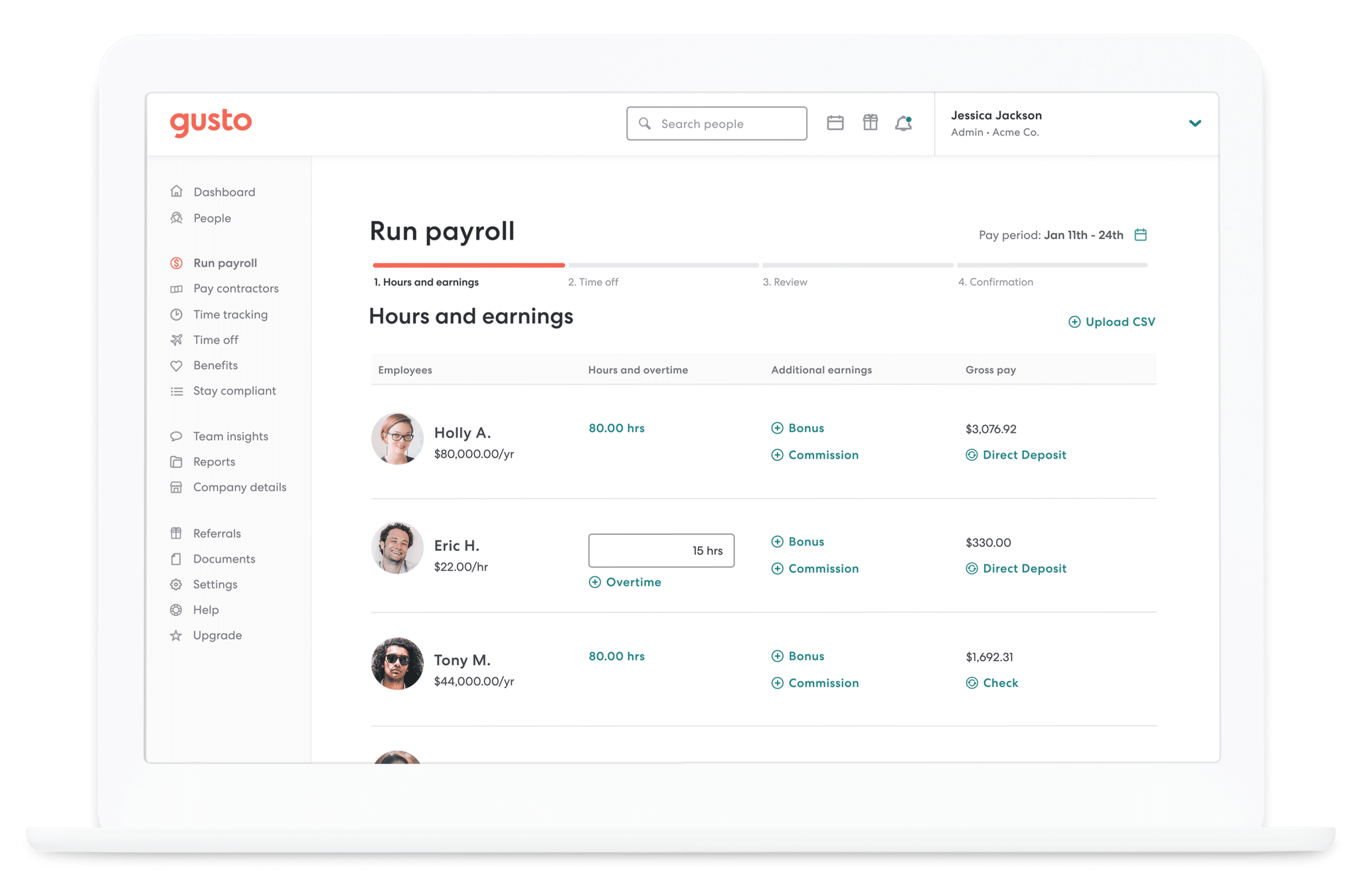

Our preferred Cloud Payroll service, Gusto, can simplify your Payroll life and handle basic HR needs for most businesses. Easy integrations with Quickbooks Online and Xero keep your systems up to date, and Gusto will handle your quarterly and annual filings with the appropriate tax authorities. We prefer Gusto’s payroll service, because it’s strong user-interface makes it easy for business owners to setup and it’s “set-and-forget” most prevents the chronic forgetting to confirm problem that causes non-compliance. Gusto allows employees to “self onboard” and obtain their tax documents without your involvement… you’ll never spend April 14th re-sending W-2s to employees that quit over a year ago.

Other Payroll Services

Using other Payroll Services

We can work with your existing payroll system if your HR Process is already working. We have clients that are happy and successfully using Intuit’s Quickbooks Payroll Service, JustWorks, as well as legacy payroll systems like ADP and Payroll Systems provided by national and regional banks like Bank of America, Wells Fargo, and Suntrust. Whatever system you choose, we can make certain that your records are accurate. If you haven’t selected a payroll provider, we think that most small businesses will be best served by Gusto, but each business is unique and your needs may be different.

Payroll Services FAQs

Who needs to run payroll?

Owner operated S corporations must run payroll for working owners to meet IRS reasonable compensation rules. Any entity with employees must run payroll, including LLCs taxed as S corps, C corporations, partnerships, and sole props with staff.

Can an LLC owner be on payroll?

Yes if the LLC elected S corporation or C corporation status. Members of an LLC taxed as a partnership are not on payroll, they usually take draws or guaranteed payments subject to self employment tax.

What happens if I do not run payroll for my S corporation?

The IRS can reclassify owner distributions as wages, assess payroll tax, penalties, and interest, and may trigger an audit. Running reasonable payroll keeps you compliant.

Should I use contractors instead of employees?

Use contractors only when they meet IRS and state tests for independence. Misclassification can lead to back payroll taxes, penalties, interest, and state fines. We review roles and clean up issues.

What payroll taxes and filings are required?

Typical filings include Form 941 quarterly, Form 940 annually, state unemployment and withholding returns, W 2s and W 3 in January, and 1099 NEC for eligible contractors. We register and file for all applicable jurisdictions.

How often should payroll run?

Most small businesses pay semi monthly, biweekly, or monthly for owners. Your state may restrict monthly payroll. We set a schedule that fits cash flow and compliance.

How is reasonable compensation for S corp owners calculated?

We consider role, industry, revenue, profit, time spent, and comparable wages. Documentation supports the chosen salary and reduces audit risk.

Can you convert my current payroll to Gusto?

Yes. We migrate historical data, tax IDs, and employee profiles, set up bank links and schedules, and run a parallel pay cycle to verify accuracy before switching.

Do you work with other payroll systems?

Yes. We support Gusto, QuickBooks Payroll, ADP, Paychex, Justworks, Rippling, and bank provided systems. We reconcile payroll to your general ledger each month.

What are the penalties for late payroll tax deposits?

The IRS charges escalating penalties and interest for late deposits and late returns. States add their own penalties. Automated deposits and calendars prevent missed deadlines.

Can you run retroactive payroll for prior periods?

Often yes. We calculate back wages, taxes, and late deposit penalties, then file amended returns. Fast action limits additional interest.

Do owner only S corporations still need payroll?

Yes, if the owner provides services. Reasonable wages are required even with no other employees. We set a simple monthly payroll to satisfy the rule.

How do multi state payroll and remote employees work?

You may need withholding, unemployment, and local registrations in each work state. We assess nexus, register accounts, and file new hire reports and returns.

What payroll items affect retirement and health benefits?

401(k) deferrals, employer matches, HSA, FSA, and fringe benefits must be set up and reported correctly. We coordinate plan setup and payroll codes to keep deductions compliant.

Can you handle new hire onboarding and year end forms?

Yes. With Gusto, employees self onboard, e sign forms, and access W 2s without your help. We also manage I 9, E Verify if needed, and state new hire reporting.

What records do I need to start payroll?

EIN, state tax IDs, bank info, prior payroll reports, employee I 9 and W 4, officer details for S corp owners, and benefit plan documents. We provide a checklist.

How fast can payroll be set up?

Many setups complete in a few business days once IDs and documents are ready. Conversions from other systems typically take one to two cycles.

Do you offer payroll as part of accounting packages?

Yes. Payroll is included in our packages, and we also offer one time setup and standalone payroll services for owner operated and small businesses.