Tax controversy cases can drain your finances and damage your reputation if handled poorly. The IRS collected $4.7 trillion in revenue during fiscal year 2023, with millions of taxpayers facing disputes.

We at Bette Hochberger, CPA, CGMA have seen how proper preparation and expert guidance transform outcomes. This guide provides the strategies you need to protect your rights and achieve favorable results.

Common Types of Tax Disputes with the IRS

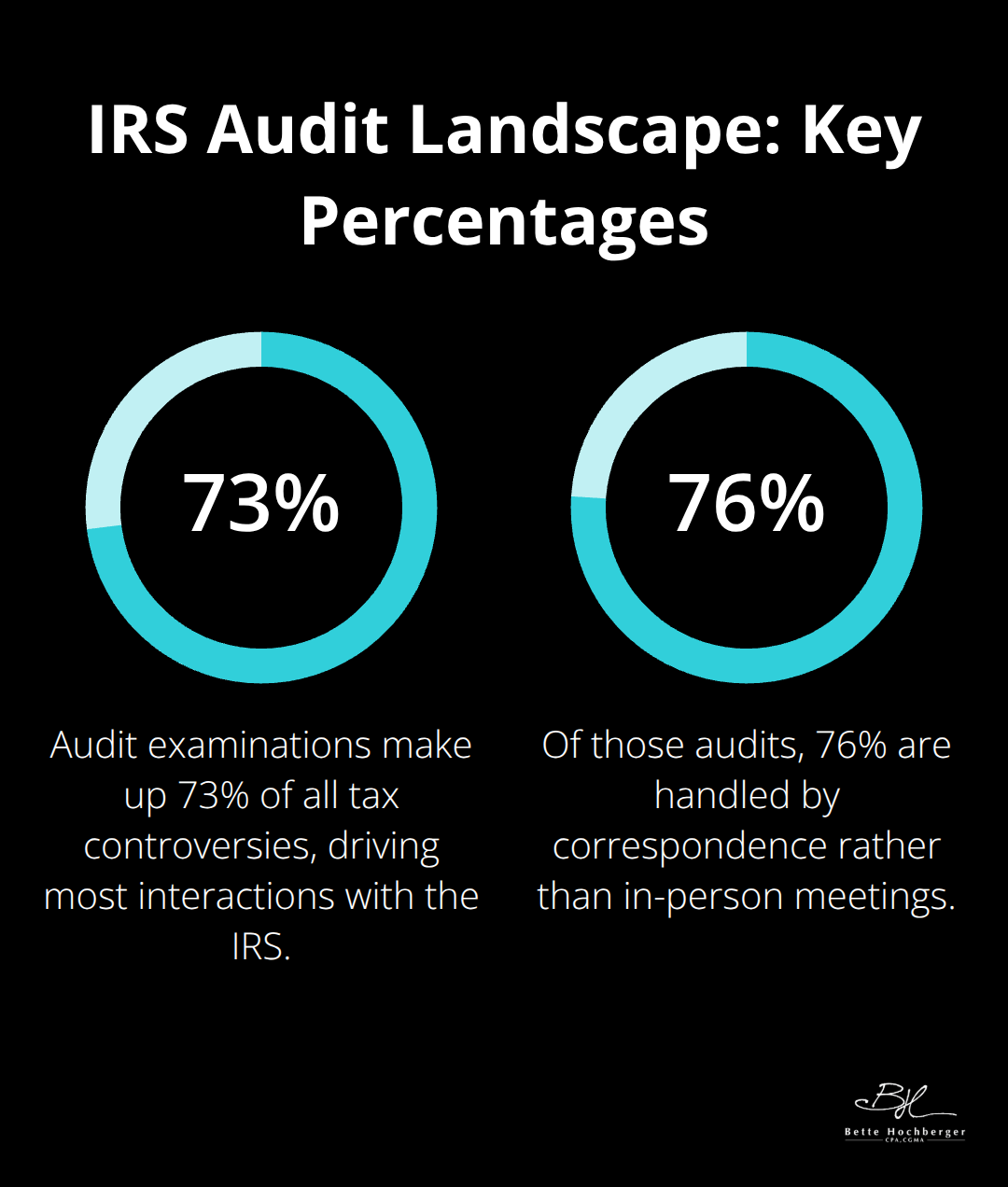

Tax disputes fall into distinct categories that demand different strategies. Audit examinations represent 73% of all tax controversies, but collection disputes create the most financial pressure for taxpayers. The IRS processes audits annually, with correspondence audits accounting for 76% of these cases.

Field audits target high-income taxpayers and complex business structures, while office audits focus on specific deduction questions.

Audit Types and Their Impact

Correspondence audits arrive by mail and request documentation for specific items on your return. These audits typically resolve within 3-6 months if you respond promptly with proper records. Office audits require you to visit an IRS office with your documentation, often focusing on itemized deductions or business expenses. Field audits occur at your home or business location and involve the most comprehensive examination of your financial records (lasting 6-12 months on average).

Collection Actions That Escalate Quickly

Collection enforcement actions escalate when taxpayers ignore initial notices or fail to respond within required timeframes. The IRS can file federal tax liens within 10 days of assessment and initiate wage garnishments within 30 days of final notice. Trust Fund Recovery Penalties hit business owners personally for unpaid payroll taxes, with the IRS pursuing individual assets regardless of corporate protection. Bank levies can freeze your accounts immediately, while asset seizures target valuable property to satisfy tax debts.

Civil vs Criminal Tax Cases

Criminal referrals occur when the IRS suspects willful tax evasion, with conviction rates exceeding 90% once charges are filed. The key difference lies in intent – civil cases focus on tax collection, while criminal cases pursue imprisonment for deliberate fraud. Penalties in civil matters typically range from 20% to 75% of taxes owed, whereas criminal convictions can result in five years imprisonment plus substantial fines.

Your Defense Options Against IRS Actions

Appeals provide your strongest defense against unfavorable IRS determinations. The U.S. Tax Court handles more than 30,000 cases a year, with 85% of cases settling before trial. Tax Court petitions filed within 90 days of receiving a Notice of Deficiency stop collection activities during litigation. Collection Due Process hearings offer another avenue to challenge liens and levies, but you must request these within 30 days of notice.

The success of your defense depends heavily on the strategy you develop and the documentation you gather to support your position. Proper bookkeeping becomes crucial when facing any tax controversy, as organized financial records strengthen your case significantly.

Building a Strong Defense Strategy

Documentation forms the backbone of every successful tax controversy defense. Taxpayers with proper records achieve better outcomes in IRS examinations, while organized documentation significantly increases favorable results according to Tax Court statistics. You must gather bank statements, receipts, contracts, and correspondence immediately when you face any IRS action. Create separate folders for each tax year under dispute and organize documents chronologically within each folder. Digital copies provide backup protection, but the IRS accepts original paper documents as primary evidence during examinations.

Professional Representation Changes Everything

Tax attorneys and enrolled agents who specialize in controversy work achieve settlement rates significantly higher than self-represented taxpayers. Professional representation reduces average penalties compared to cases handled without expert guidance. Choose representatives with specific IRS controversy experience rather than general tax preparers. Enrolled agents can represent you before the IRS at all levels, while tax attorneys provide additional protection through attorney-client privilege (which protects your communications from disclosure).

Settlement Options Require Strategic Timing

Offers in Compromise succeed in approximately 42% of submitted cases, but proper preparation dramatically improves approval odds. The IRS accepted offers from thousands of submissions in 2023, with settlement amounts varying based on individual circumstances. Submit financial documentation that demonstrates genuine inability to pay rather than convenience-based requests. Installment agreements offer more predictable outcomes, with high approval rates for taxpayers who meet income and debt thresholds (making them the preferred option for most taxpayers).

Documentation Standards That Win Cases

The IRS requires specific documentation standards that many taxpayers overlook. Business expense deductions need receipts showing date, amount, business purpose, and parties involved. Travel expenses require detailed logs with destinations, dates, and business reasons. Bank statements must reconcile with reported income and claimed deductions. Missing documentation weakens your position significantly, while comprehensive records demonstrate compliance and good faith efforts. How strong your defense is depends on how you handle your business finances and operations.

Negotiation Tactics That Work

Successful negotiations focus on facts rather than emotions or hardship stories. Present your case with organized evidence that supports your position clearly. The IRS responds better to taxpayers who demonstrate cooperation and transparency throughout the process. Request these agreements before the IRS initiates collection enforcement, as post-levy negotiations become significantly more expensive and time-consuming. Understanding IRS procedures and timelines becomes essential for effective communication with revenue agents and appeals officers.

Navigating the Tax Controversy Process

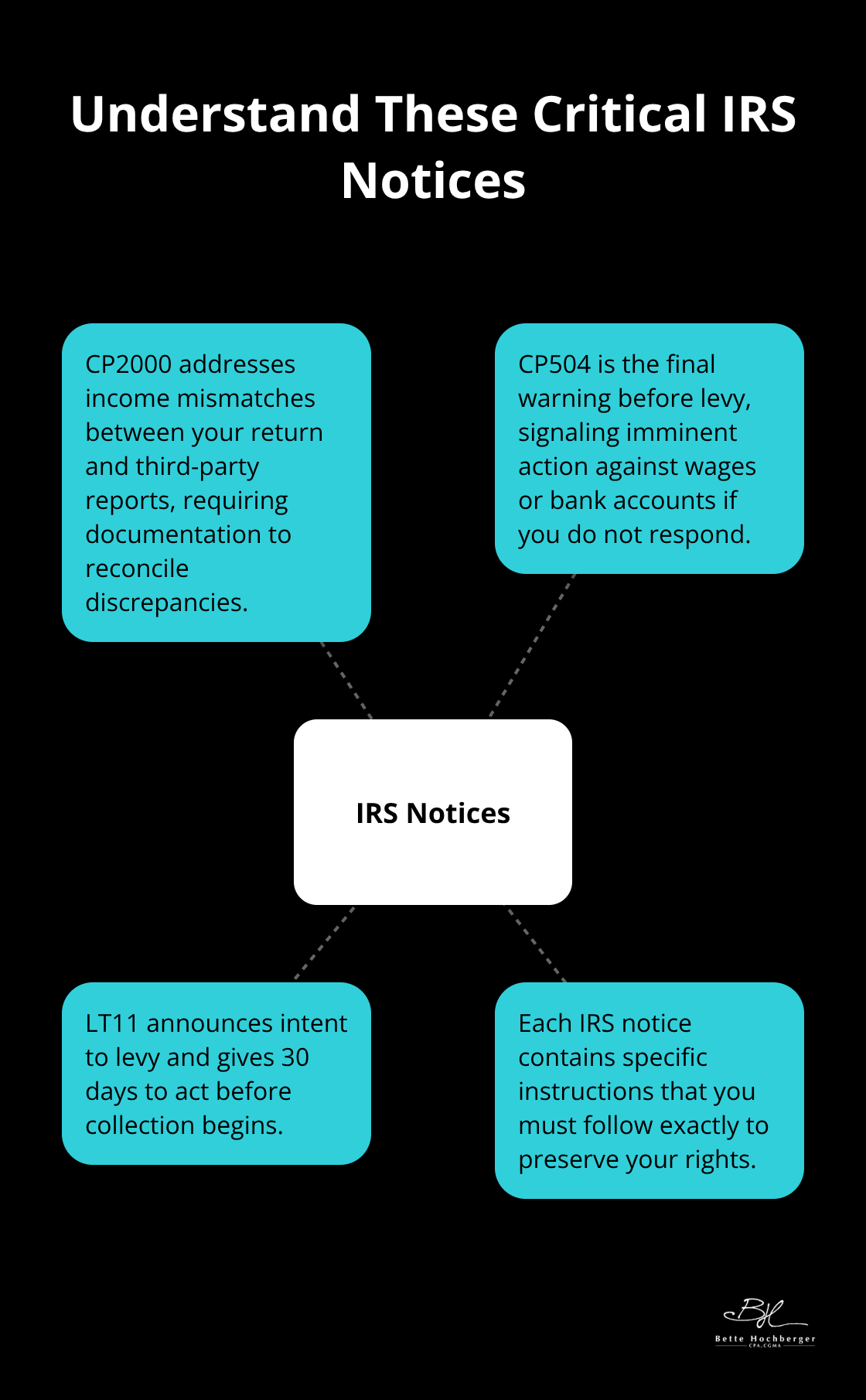

IRS procedures operate on strict timelines that leave no room for error. Taxpayers receive exactly 30 days to respond to most IRS notices, with the clock starting from the notice date rather than when you receive it. Missing these deadlines automatically triggers collection enforcement actions that become exponentially more expensive to resolve. The IRS processes over 200 million notices annually, but fewer than 15% of taxpayers respond within required timeframes according to Treasury Inspector General reports. Each notice type demands specific responses – Notice CP2000 requires documentation of reported income discrepancies, while Notice CP504 warns of impending levy action within 10 days.

Understanding IRS Notice Requirements

Revenue agents follow standardized procedures that prioritize compliance over taxpayer convenience, making prompt response your only protection against escalating enforcement. Notice CP2000 addresses income discrepancies between your return and third-party reports (like W-2s or 1099s). Notice CP504 serves as your final warning before the IRS initiates levy procedures against your wages or bank accounts. Notice LT11 announces the IRS intent to levy, giving you 30 days to respond before collection begins.

Each notice contains specific instructions that you must follow exactly to preserve your rights.

Strategic Response Methods

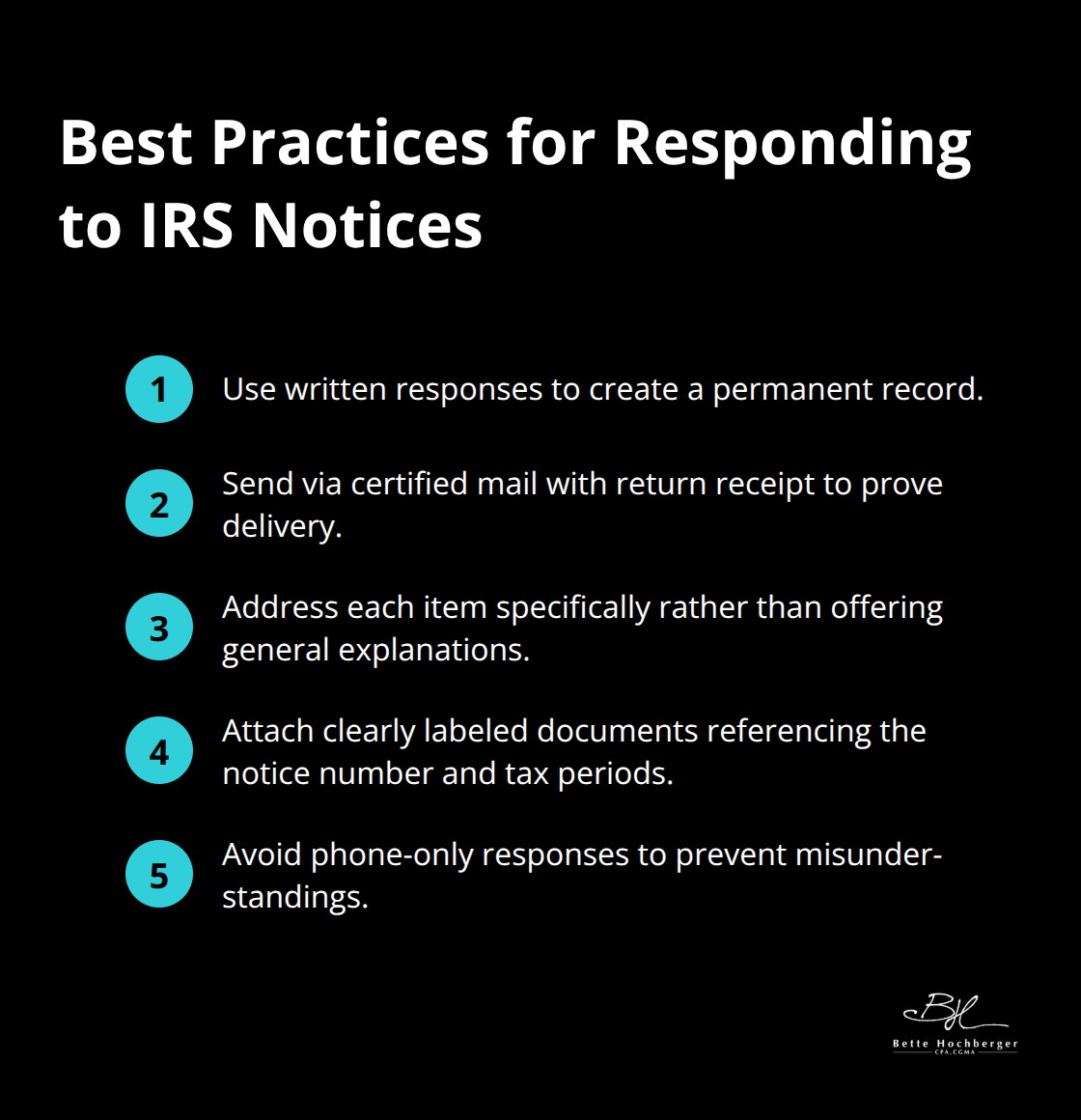

Written responses prove more effective than phone calls because they create permanent records of your position. Send all correspondence via certified mail with return receipt to establish delivery dates that protect your appeal rights. Address each item mentioned in IRS notices specifically rather than providing general explanations or hardship stories. Include supporting documentation with clear labels that reference the notice number and tax periods under examination.

Phone responses often result in misunderstandings that hurt your case later, while written communication forces IRS personnel to document their positions accurately.

Extension Requests and Deadlines

Request extensions immediately if you need additional time to gather documentation – the IRS grants automatic 30-day extensions for most examination requests when submitted before original deadlines expire. Submit extension requests in writing with specific reasons for needing additional time. The IRS typically approves reasonable extension requests, but you must request them before your original deadline passes. Extensions apply only to response deadlines, not to payment due dates or statute of limitations periods.

Appeals Process Strategy

Appeals officers possess more settlement authority than examination staff, making appeals your strongest tool for reducing tax liabilities. File appeals within 30 days of receiving examination reports to maintain your rights to Tax Court petition. The Appeals office resolves approximately 85% of cases without litigation, but success depends on presenting new evidence or legal arguments that examination staff overlooked. Appeals conferences allow face-to-face negotiations that often produce better results than written submissions alone. Request appeals conferences in major metropolitan areas where officers handle more complex cases and possess greater settlement experience. Appeals decisions become final unless you petition Tax Court within 90 days, making this your last opportunity for independent review of IRS determinations.

Final Thoughts

Tax controversy cases demand immediate action and strategic planning to protect your financial future. Statistics show that taxpayers who respond promptly to IRS notices and maintain organized documentation achieve significantly better outcomes than those who delay or ignore correspondence. Professional representation transforms your chances of success in these disputes.

Tax attorneys and enrolled agents with controversy experience achieve settlement rates far exceeding self-represented taxpayers. The complexity of IRS procedures and the high stakes involved make expert guidance worth the investment. Attorney-client privilege provides additional protection that proves invaluable during examinations and appeals (especially when criminal referral risks exist).

Prevention remains your strongest defense against future tax controversy situations. Maintain detailed financial records throughout the year rather than scramble during audits. We at Bette Hochberger, CPA, CGMA help businesses implement systems that prevent controversies through proper financial management and documentation.

![Winning Your Tax Controversy Case [Complete Guide]](https://bettehochberger.com/wp-content/uploads/emplibot/Winning-Your-Tax-Controversy-Case-_Complete-Guide__1764677421.jpeg)