Hi everyone, I’m Bette Hochberger, CPA, CGMA. SaaS companies face unique financial challenges that demand specialized expertise. From complex revenue recognition to managing subscription-based cash flows, these businesses require a strategic financial approach.

At Bette Hochberger, CPA, CGMA & Associates PLLC, we’ve seen how a SaaS fractional CFO can provide the tailored financial guidance these companies need. This post explores why SaaS businesses should consider bringing a fractional CFO on board and the benefits they can expect.

What Financial Hurdles Do SaaS Companies Face?

SaaS companies operate in a unique financial landscape that demands specialized knowledge and strategies. Several key challenges frequently confront SaaS businesses.

Revenue Recognition Complexities

SaaS companies often struggle with revenue recognition due to their subscription-based models. Software as a service (SaaS) and subscription businesses in particular can struggle to accurately recognize revenue, leading to faulty financial reporting. This complexity stems from factors such as multi-year contracts, varying service levels, and mid-contract changes. Proper revenue recognition plays a vital role in financial reporting and compliance with accounting standards like ASC 606.

Cash Flow Management Challenges

The subscription-based model presents unique cash flow management challenges. While SaaS companies benefit from recurring revenue, they often face high upfront costs for customer acquisition and product development. SaaS companies need to carefully calculate and optimize their Customer Acquisition Cost Payback Period. This gap between spending and revenue realization can create significant cash flow pressures (especially for rapidly growing companies).

Balancing Growth and Profitability

SaaS companies constantly grapple with the tension between investing in growth and maintaining profitability. Finding the right balance requires sophisticated financial modeling and strategic decision-making.

Metrics and KPI Tracking

SaaS businesses must track a unique set of metrics and Key Performance Indicators (KPIs) to gauge their financial health and growth trajectory. These include Customer Acquisition Cost (CAC), Lifetime Value (LTV), Monthly Recurring Revenue (MRR), and churn rate. Accurately calculating and interpreting these metrics requires specialized knowledge and tools.

Pricing Strategy Optimization

Determining the optimal pricing strategy presents another significant challenge for SaaS companies. Factors such as tiered pricing, freemium models, and value-based pricing all impact revenue and customer acquisition.

These challenges underscore the need for specialized financial expertise in the SaaS industry. A fractional CFO with experience in SaaS can provide valuable insights and strategies to navigate these complex financial waters. Let’s explore how a fractional CFO addresses these SaaS-specific needs in the next section.

How Fractional CFOs Address SaaS-Specific Needs

Fractional CFOs provide specialized expertise to tackle the unique financial challenges of SaaS companies. Their in-depth understanding of industry-specific metrics and growth strategies significantly impacts a company’s financial health and trajectory.

Expertise in SaaS Metrics and KPIs

Fractional CFOs excel at tracking and interpreting critical SaaS metrics. They focus on key indicators such as Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLV). A fractional CFO might implement a dashboard to track MRR growth rate, enabling quick identification of trends and potential issues. They also calculate and monitor the CAC payback period to ensure cost-effective customer acquisition strategies.

Strategic Financial Planning for Growth Stages

SaaS companies’ financial needs change dramatically as they evolve. Fractional CFOs adapt their strategies to each growth stage. In early stages, they prioritize cash flow management and fundraising (e.g., creating detailed financial models for venture capital pitches). As companies scale, fractional CFOs shift focus to optimize operational efficiency and prepare for potential mergers or acquisitions.

Optimization of Pricing and Packaging Strategies

Pricing in the SaaS world is complex and critical to success. Fractional CFOs use data analysis to fine-tune pricing models. They conduct cohort analyses to understand how different pricing tiers affect customer retention and lifetime value. This data-driven approach informs decisions on implementing strategies like value-based pricing or tiered subscription models.

Revenue Recognition and Compliance

Fractional CFOs navigate the complexities of revenue recognition in subscription-based models. They ensure compliance with accounting standards (such as ASC 606) and implement systems to accurately recognize revenue from multi-year contracts and varying service levels.

Cash Flow Management

To address the unique cash flow challenges of SaaS businesses, fractional CFOs develop strategies to balance high upfront costs with recurring revenue streams. They create forecasting models to predict cash flow needs and optimize working capital management.

The specialized skills of fractional CFOs can transform a SaaS company’s financial outlook. These professionals don’t just analyze numbers; they provide strategic insights that drive growth and profitability in the unique SaaS landscape. The next section will explore the key benefits SaaS companies can expect when they bring a fractional CFO on board.

Why Fractional CFOs Transform SaaS Companies

Cost-Effective Financial Leadership

SaaS startups and growing companies often find full-time CFO salaries prohibitively expensive. The average salary for a CFO in 2024 ranges from $150,000 to over $1 million, depending on company size. Fractional CFO services offer a compelling alternative, typically costing 30-50% less while still providing high-level financial expertise.

Scalable Financial Guidance

SaaS companies experience rapid evolution in their financial needs as they grow. Fractional CFOs excel at providing scalable solutions that adapt to these changing requirements. During a funding round, a fractional CFO might increase their involvement to 20-30 hours per week (preparing financial models and investor presentations). Once the round concludes, they can reduce their time to 10-15 hours weekly for ongoing financial management.

Enhanced Investor Relations

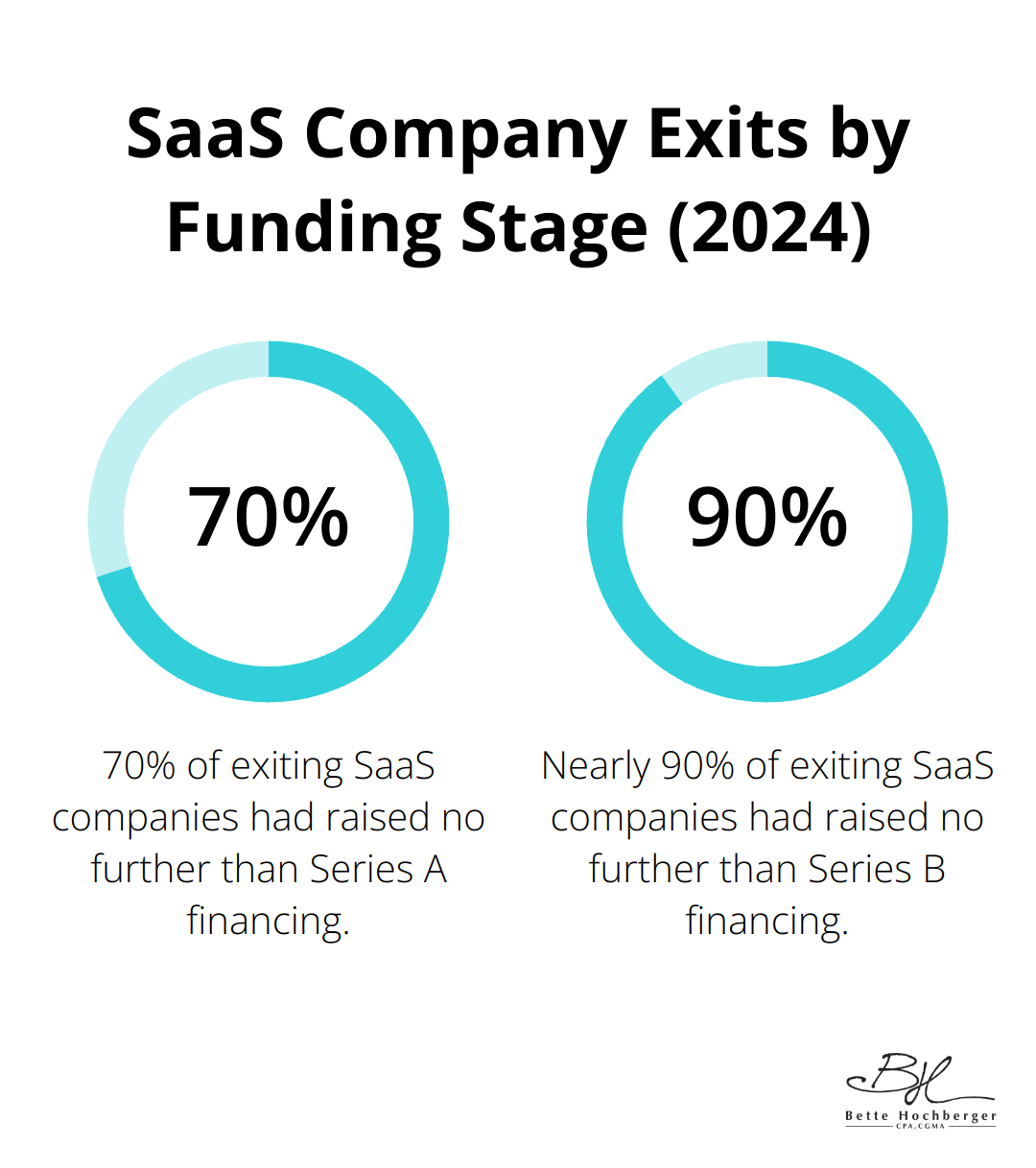

Fractional CFOs significantly improve investor relations and funding opportunities. Their experience in crafting investor-ready financial statements and projections boosts a company’s credibility with potential investors. In 2024, more than 70% of the exiting companies had raised no further than Series A financing. Extending that to Series B, nearly 90% of the companies were in this category.

Specialized SaaS Expertise

Fractional CFOs bring deep knowledge of SaaS-specific metrics and growth strategies. They focus on key indicators such as Monthly Recurring Revenue (MRR), Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLV). This specialized understanding allows them to implement effective dashboards for tracking MRR growth rates and calculating CAC payback periods, ensuring cost-effective customer acquisition strategies.

Strategic Financial Planning

As SaaS companies progress through different growth stages, fractional CFOs adapt their strategies accordingly. In early stages, they prioritize cash flow management and fundraising efforts. As companies scale, the focus shifts to optimizing operational efficiency and preparing for potential mergers or acquisitions. This strategic approach helps SaaS businesses navigate each phase of growth with tailored financial guidance.

Final Thoughts

SaaS companies face unique financial challenges that require specialized expertise. A SaaS fractional CFO brings the necessary knowledge to navigate these complexities, providing tailored financial guidance that can drive growth. They offer cost-effective access to high-level financial expertise without the overhead of a full-time executive.

Fractional CFOs enhance investor relations and improve chances of securing funding crucial for expansion. These professionals master SaaS metrics and develop pricing strategies that maximize revenue. Their industry-specific knowledge helps SaaS businesses optimize financial strategies and propel growth.

At Bette Hochberger, CPA, CGMA & Associates PLLC, we provide fractional CFO services tailored to SaaS companies’ unique needs. Our team combines advanced cloud technology with personalized financial services to help SaaS businesses manage cash flow effectively. A fractional CFO can be the catalyst that elevates your financial strategy and unlocks your company’s full potential.