High-net-worth individuals face IRS audit rates that are 5.8 times higher than average taxpayers, according to recent Treasury data. Complex financial structures and substantial assets create multiple audit triggers.

We at Bette Hochberger, CPA, CGMA understand that effective tax audit defense requires specialized expertise and strategic planning. Professional representation becomes essential when facing IRS scrutiny.

Understanding IRS Scrutiny for High-Net-Worth Individuals

The Numbers Behind Increased Audit Risk

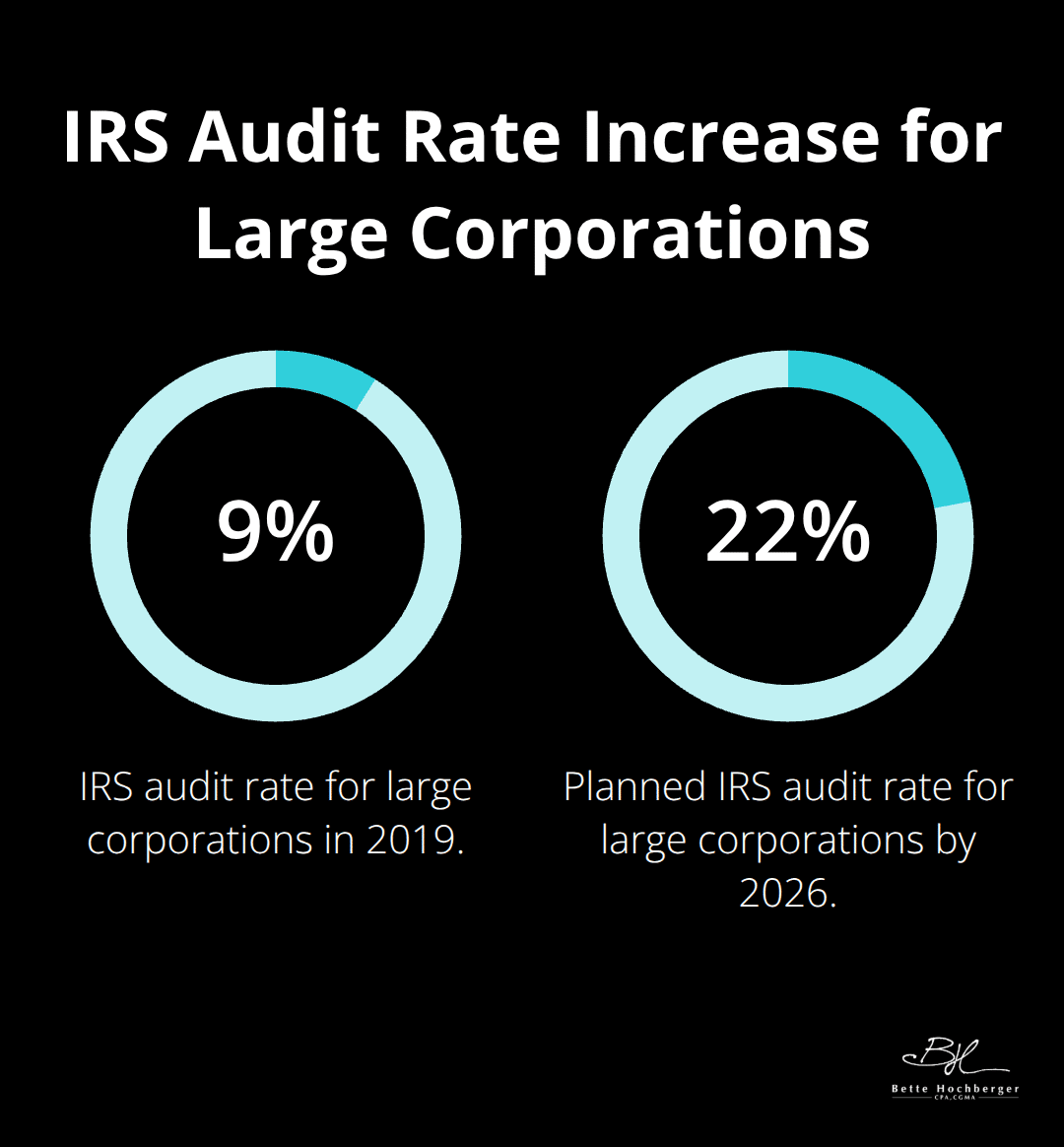

The IRS plans to nearly triple audits on corporations with assets over $250 million to 22.6% by 2026, up from 9% in 2019 according to Treasury data. Individuals who earn over $400,000 face significantly higher audit rates because even small errors can lead to substantial revenue loss for the government. The IRS prioritizes these cases due to their complexity and potential financial impact, which makes wealthy taxpayers natural targets for examination.

Advanced Technology Identifies Audit Candidates

The IRS now uses artificial intelligence to identify potential audit candidates based on patterns and discrepancies in tax filings. This technology analyzes changes in tax residency, income inconsistencies, and lifestyle mismatches with reported income. High-net-worth individuals who move from high-tax states to low-tax states face particular scrutiny about the legitimacy of their residency claims. The agency’s advanced systems immediately flag income sources that taxpayers fail to report (such as unreported 1099 forms or stock sales).

Complex Financial Structures Attract IRS Attention

Wealthy taxpayers often possess complex portfolios that increase their audit risk, which include multiple business interests and foreign income sources. Large charitable donations that appear inconsistent with reported income commonly trigger IRS scrutiny. Excessive business deductions related to meals, entertainment, or personal travel can raise red flags for the agency. Filers who use round numbers often come under scrutiny, as these figures can suggest estimates rather than accurate documentation.

Severe Financial Consequences of IRS Investigations

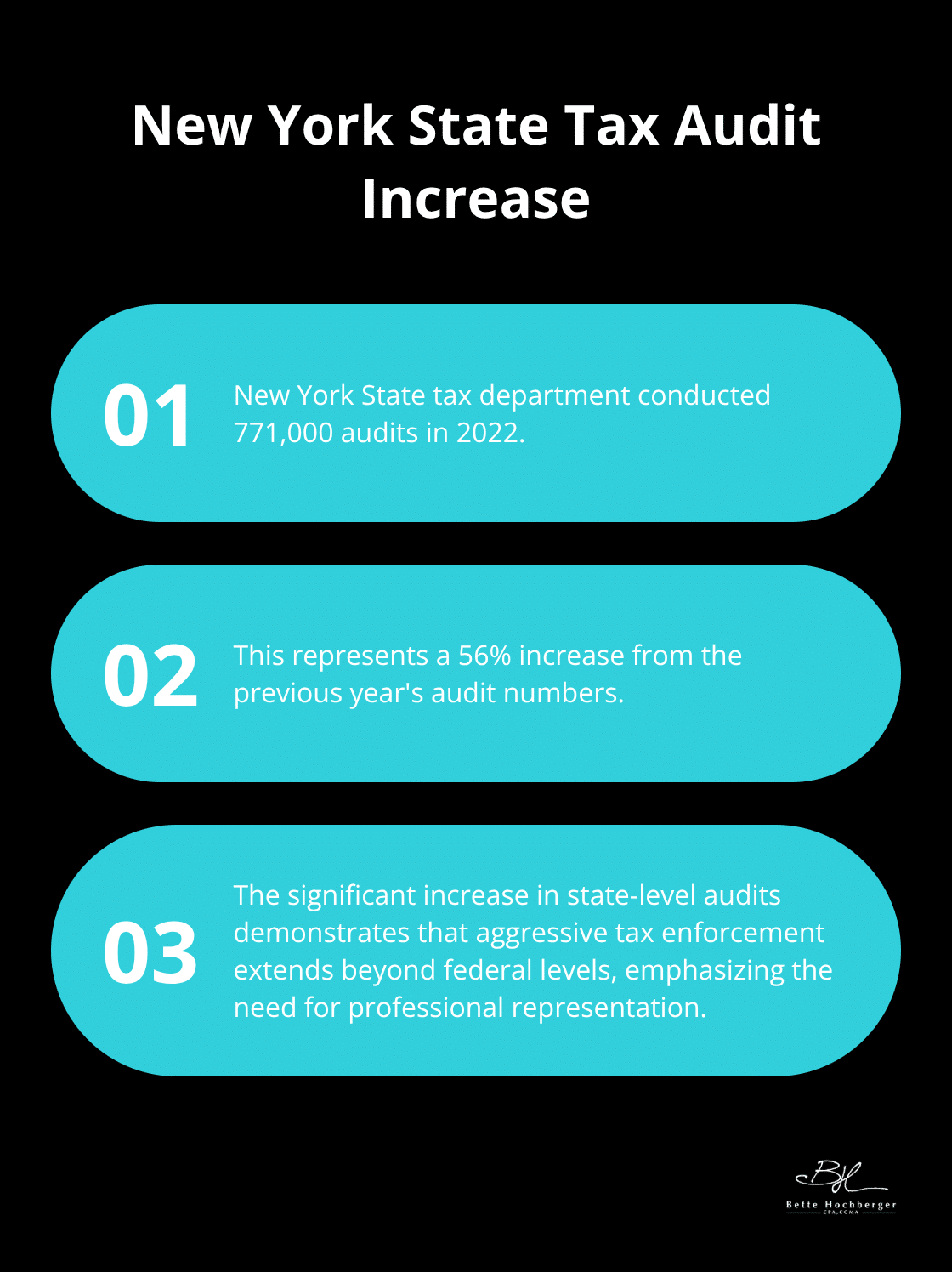

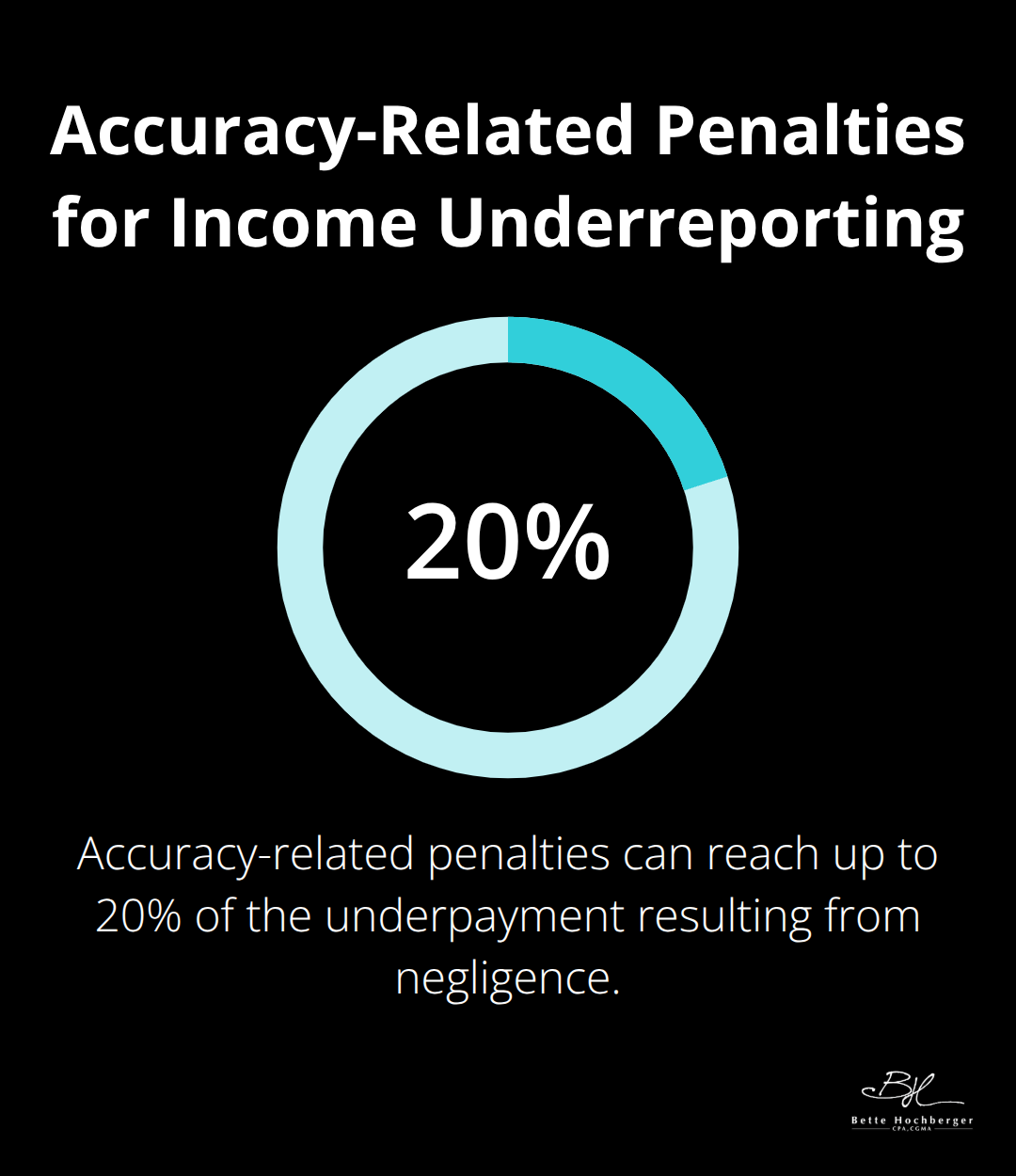

Accuracy-related penalties for income underreporting can reach 20% of the underpayment that results from negligence. A substantial understatement penalty applies if tax liability falls short by 10% or $5,000 (whichever amount is greater). Taxpayers who fail to report foreign financial assets face hefty penalties under FATCA and FBAR regulations. New York State tax department conducted 771,000 audits in 2022, a 56% increase from the prior year, which shows that aggressive enforcement extends beyond federal levels.

Professional representation becomes essential when these complex audit situations arise, as qualified tax professionals can navigate the intricate procedures and protect taxpayer rights throughout the examination process.

Why Professional Tax Representation Saves Money

Professional IRS representation provides immediate financial protection through specialized knowledge that most taxpayers lack. Tax professionals understand complex IRS procedures, documentation requirements, and negotiation strategies that can reduce penalties by thousands of dollars. The IRS Taxpayer Advocate Service reports that taxpayers with professional representation receive more favorable audit outcomes, including acceptance of returns as filed or potential refunds. Without qualified representation, taxpayers risk hefty fines, increased scrutiny, and potential criminal prosecution during audit examinations.

Expert Navigation Through Complex Tax Laws

Tax representatives possess deep knowledge of ever-changing federal and state tax regulations that affect high-net-worth individuals. They understand which documentation the IRS requires for specific deductions, how to properly substantiate charitable contributions that involve noncash assets, and the precise requirements for foreign accounts under FATCA and FBAR regulations. Professional representatives can identify legitimate tax strategies while they avoid aggressive positions that trigger additional scrutiny. This expertise becomes invaluable when taxpayers deal with accuracy-related penalties (which can reach 20% of underpayments) or substantial understatement penalties that apply when tax liability falls short by significant amounts.

Strategic Communication and Settlement Authority

Qualified tax professionals handle all IRS communications directly and protect taxpayers from statements that could worsen their situation. They possess the authority to negotiate payment plans, penalty abatements, and settlement agreements that individual taxpayers cannot access. Professional representatives can dispute penalties when they provide proper justification and documentation, often with significant penalty reductions or complete elimination as the result. This strategic approach proves essential when taxpayers face the IRS’s advanced artificial intelligence systems that flag discrepancies and inconsistencies in tax filings.

Protection Against Escalated Enforcement Actions

Professional representation becomes even more valuable as the IRS increases its enforcement capabilities and audit rates for wealthy taxpayers. Representatives can prevent minor issues from escalating into major investigations that consume months of time and thousands of dollars in additional costs. They understand how to respond to IRS notices properly and can often resolve matters before they require formal audit procedures. This protection extends beyond federal issues, as state tax departments also ramp up their enforcement efforts against high-income individuals.

Common IRS Issues Facing High-Net-Worth Taxpayers

Estate and Gift Tax Complications

Estate tax compliance creates immediate challenges that the IRS monitors with intense focus. The federal estate tax exemption stands at $12.92 million for 2023, but many wealthy taxpayers face state estate taxes with much lower thresholds that create dual compliance requirements. Gift tax reports become complex when taxpayers transfer assets through family limited partnerships or grantor trusts, which require detailed valuations and proper documentation.

The IRS scrutinizes these transactions because improper valuation discounts can reduce gift and estate tax liability by millions of dollars. Charitable remainder trusts and donor-advised funds face particular attention when taxpayers claim large deductions without proper substantiation. The IRS also examines cases where the contribution schedule appears to manipulate tax obligations across multiple years.

Business Income and Deduction Challenges

Business owners with multiple entities face heightened scrutiny when the IRS questions whether deductions represent legitimate business expenses or personal expenditures that taxpayers disguise as business costs. The agency examines home office deductions, travel expenses, and entertainment costs with particular intensity for high-income taxpayers.

Passive activity loss rules create additional complications for real estate investors and limited partners who must prove material participation to claim losses against ordinary income. The IRS requires detailed documentation that shows active involvement in business operations (not just financial investment). Many wealthy taxpayers fail to maintain adequate records that demonstrate the required level of participation.

International Tax Compliance Requirements

International tax compliance presents the most severe penalty exposure for wealthy taxpayers who own foreign assets or conduct business overseas. Foreign Account Tax Compliance Act requirements and Report of Foreign Bank and Financial Accounts filings carry penalties that can exceed the account balances themselves when taxpayers fail to report properly.

The IRS now receives automatic reports from foreign financial institutions, which makes unreported foreign income nearly impossible to hide. This creates substantial criminal exposure for willful non-compliance. Taxpayers who move assets offshore without proper reporting face penalties that start at $10,000 per account and can reach $50,000 for additional penalties when willful violations occur.

Final Thoughts

Professional IRS representation delivers measurable financial protection that far exceeds its cost for high-net-worth individuals. The data reveals clear patterns: wealthy taxpayers face audit rates 5.8 times higher than average earners, while the IRS plans to triple corporate audits by 2026. These statistics prove that professional tax audit defense has become a necessity rather than a luxury.

We at Bette Hochberger, CPA, CGMA focus on strategic tax planning and preparation that minimizes tax liabilities for high-net-worth clients. Our firm combines advanced technology with personalized financial services to protect wealth through proactive compliance strategies. The financial stakes continue to rise as artificial intelligence systems flag discrepancies and state departments increase enforcement by 56% annually.

Accuracy-related penalties reach 20% of underpayments, while foreign account violations carry penalties that exceed $50,000 per violation (making professional representation essential for penalty avoidance). Professional representation prevents these costly mistakes before they occur. The investment in qualified tax professionals pays dividends through reduced audit risk, penalty avoidance, and strategic tax planning that wealthy individuals cannot achieve alone.