Poor financial modeling costs businesses millions in lost revenue and missed opportunities every year. Companies that rely on flawed forecasts face cash flow crises and make strategic errors that damage long-term growth.

We at Bette Hochberger, CPA, CGMA see businesses struggle with inadequate models that fail to capture market realities. The difference between accurate and poor financial modeling often determines which companies thrive and which ones fail.

What Does Poor Financial Modeling Actually Cost Your Business

Inaccurate forecasts trigger a cascade of financial disasters that destroy business value. When revenue projections miss the mark, businesses face immediate cash shortages that force expensive emergency loans or missed payroll obligations. Companies fail to incorporate proper financial models in long-term plans, which leads to systematic underperformance and strategic failures.

Revenue Forecast Errors Create Immediate Problems

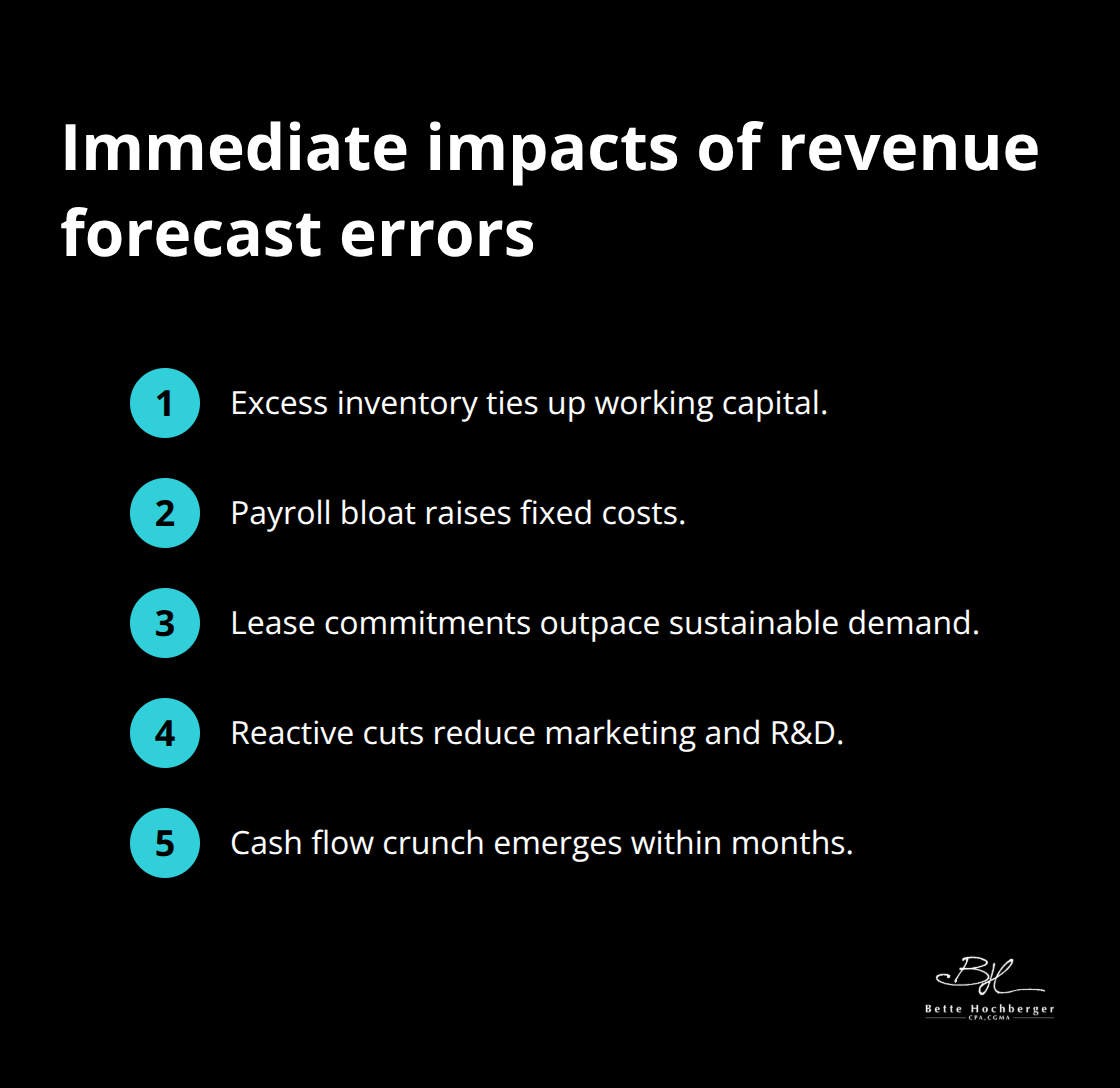

Revenue miscalculations produce ripple effects throughout operations. Companies that overestimate sales end up with excess inventory, bloated payroll costs, and lease commitments they cannot sustain.

Businesses with inadequate financial reporting see cash flow problems within months of implementation. These errors force companies into reactive mode, where they cut essential investments in marketing, research, or talent acquisition just when growth momentum matters most.

Strategic Investment Decisions Suffer Without Accurate Models

Poor models lead to catastrophic investment choices that waste resources and miss market opportunities. Companies make expansion decisions based on flawed assumptions and enter markets without understanding true profitability potential or customer acquisition costs. Without proper scenario analysis, businesses commit capital to projects with negative returns while competitors capture market share through data-driven decisions.

Cash Flow Crises Emerge from Model Failures

Flawed financial models create liquidity disasters that threaten business survival. Companies that rely on inaccurate cash flow projections often find themselves unable to meet basic operational expenses or debt obligations. These cash shortages force businesses to accept unfavorable financing terms or liquidate assets at below-market prices. The resulting financial stress damages vendor relationships and employee morale while competitors gain market advantages.

The foundation of effective financial models starts with accurate historical data and proper trend analysis, which forms the backbone of reliable business forecasts.

What Makes Financial Models Actually Work

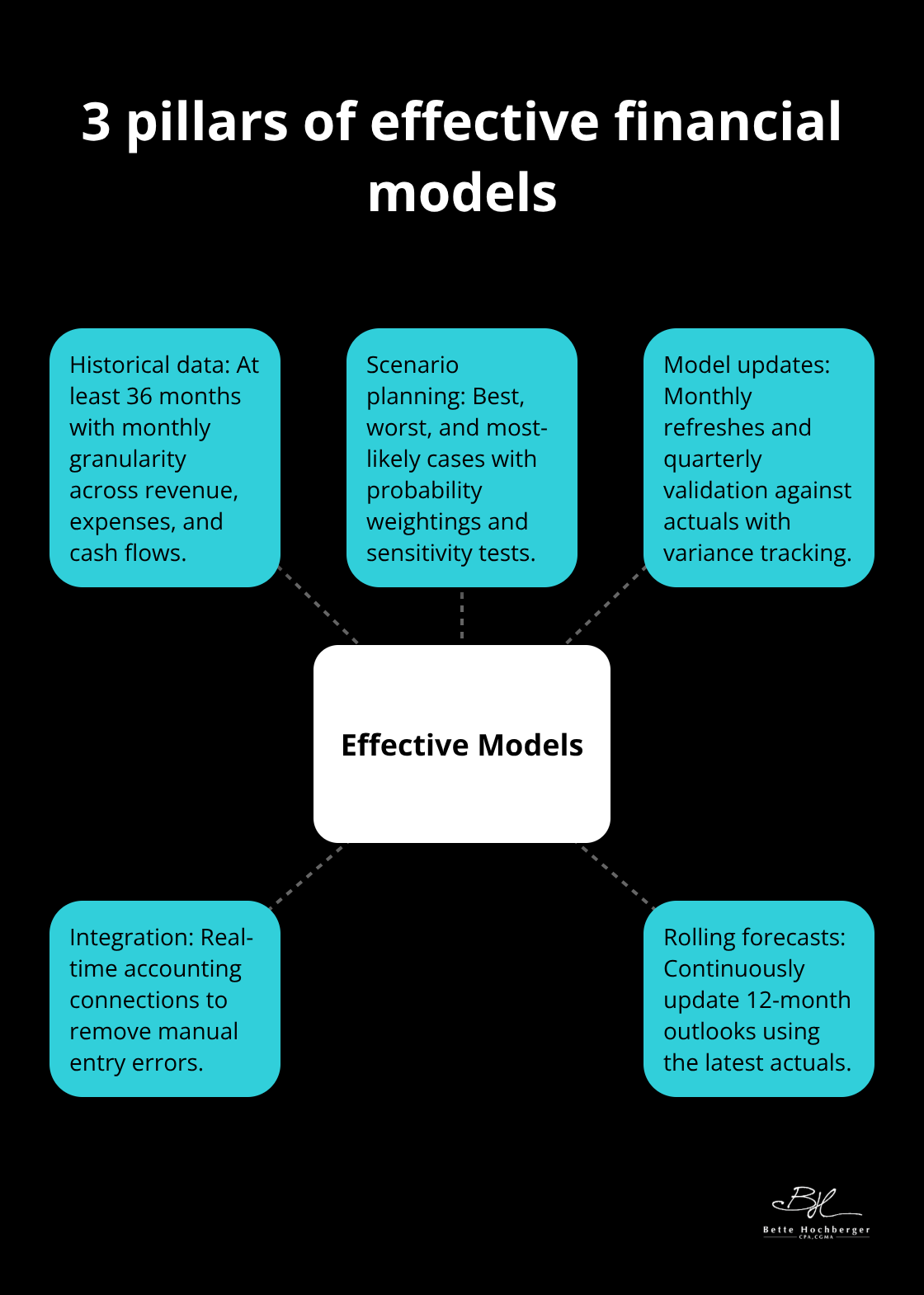

Effective financial models require three non-negotiable elements that separate successful businesses from those that fail. Your historical data must span at least three years and include monthly granularity across all revenue streams, expense categories, and cash flow patterns. Companies that use less than 36 months of data see forecast accuracy drop significantly. Your trend analysis should identify seasonal patterns, growth rates, and cyclical behaviors that influence future performance.

Historical Data Forms Your Foundation

Quality data collection starts with comprehensive records that capture every financial transaction and operational metric. Your database needs monthly breakdowns of revenue by product line, customer segment, and geographic region to reveal hidden patterns.

Expense tracking must include both fixed and variable costs with clear attribution to specific business activities. Companies that maintain detailed historical records achieve better forecast accuracy than those with incomplete data sets.

Scenario Planning Tests Your Assumptions

Scenario planning must include best-case, worst-case, and most-likely outcomes with specific probability weightings for each scenario. Organizations that conduct regular sensitivity testing on key variables like pricing, volume, and costs outperform competitors in profitability. Your scenarios should stress-test assumptions about market conditions, competitive responses, and economic factors that could impact performance. Each scenario requires different resource allocation strategies and contingency plans.

Model Updates Drive Forecast Accuracy

Your financial model becomes worthless without monthly updates and quarterly validation against actual results. Companies that refresh their models quarterly maintain strong forecast accuracy, while those that update annually see reduced accuracy rates. Validation requires comparison of projected versus actual performance across every major metric, identification of variance causes, and immediate adjustment of assumptions. Your model should flag deviations that exceed 10% from projections and trigger automatic reviews of underlying assumptions.

Integration with real-time accounting systems eliminates manual data entry errors that plague many financial models. Advanced businesses use rolling forecasts that continuously update 12-month projections based on the most recent three months of actual performance data.

However, even the most sophisticated models fail when businesses make fundamental errors in their construction and application. Fractional CFO services help companies avoid these pitfalls by providing expert guidance on model development and implementation.

Which Financial Modeling Errors Kill Business Value

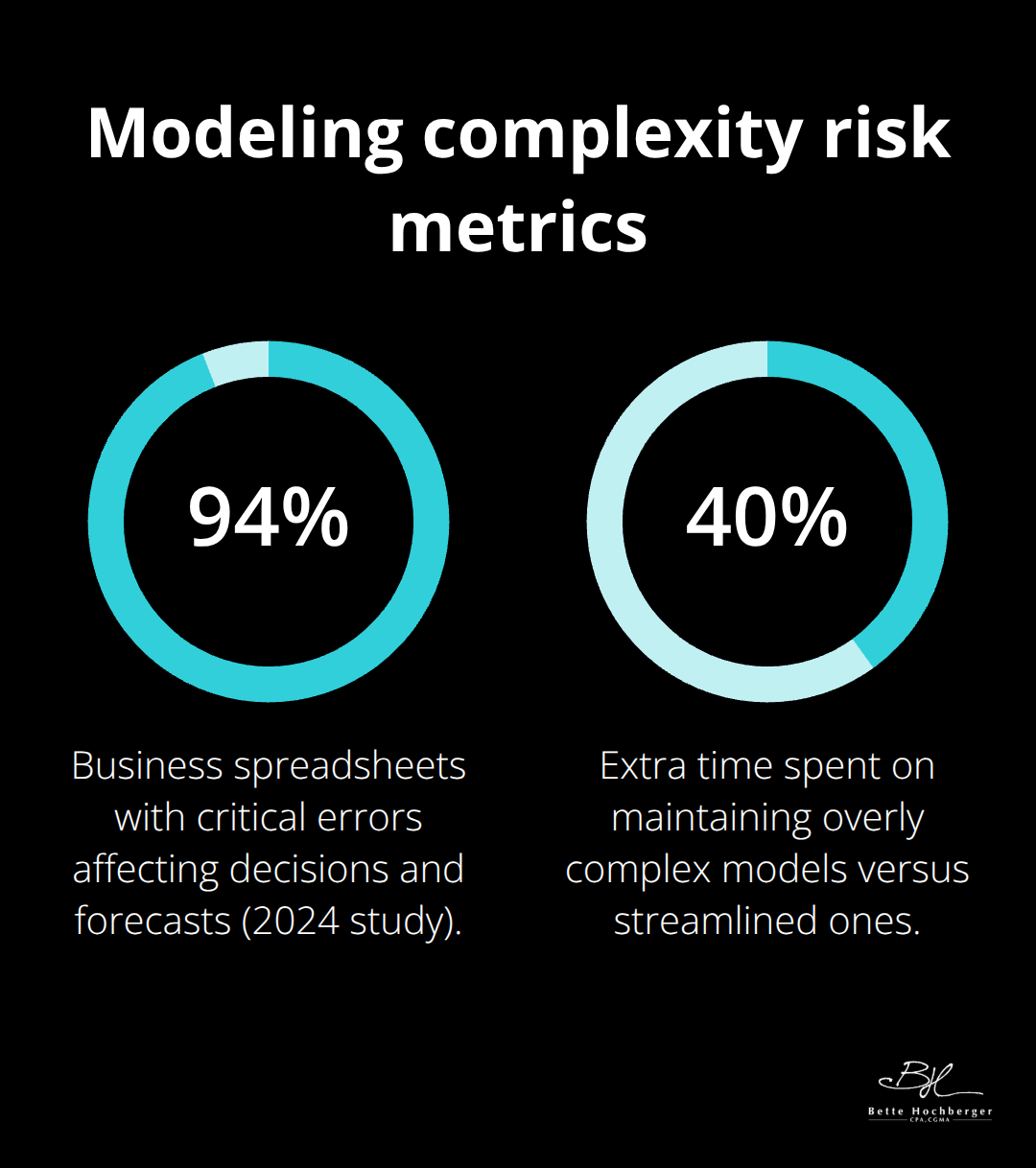

Complex spreadsheets with hundreds of linked formulas create more problems than they solve for most businesses. A 2024 study examining business spreadsheets found that 94% contain critical errors that can affect decision-making and financial forecasts, and complexity multiplies these risks exponentially. Models with more than 50 assumption cells become virtually impossible to audit properly, which leads to hidden calculation errors that compound over time. McKinsey research shows that companies with overly complex models spend 40% more time on model maintenance while they achieve worse forecast accuracy than businesses with streamlined approaches.

Complexity Creates Costly Errors

Financial models fail when they require advanced Excel skills to understand basic assumptions or modify key variables. Models that link across multiple workbooks or use complex macro functions break down when team members need quick updates during budget cycles. Simple models with clear assumption tables and direct calculations outperform elaborate systems because stakeholders can validate inputs and trace calculation logic. Companies that limit their models to three core statements and five key scenarios achieve better decision outcomes than those with comprehensive but incomprehensible systems.

Market Blindness Destroys Forecast Value

Models that ignore competitive dynamics, regulatory changes, or economic indicators produce dangerous blind spots in strategic plans. Businesses that build models without market data (industry benchmarks, growth rates, competitive prices) make decisions based on internal assumptions rather than market realities. Companies must integrate external data sources like industry reports, economic forecasts, and competitor performance metrics into their model assumptions. Organizations that update market assumptions quarterly rather than annually see forecast accuracy improve significantly.

Validation Gaps Create Strategic Disasters

Models become worthless when companies fail to compare projected results against actual performance on a monthly basis. Businesses that skip variance analysis miss early warning signals about market conditions, operational inefficiencies, or flawed assumptions. Monthly model validation should include percentage variance calculations for every major line item, root cause analysis for deviations that exceed 15%, and immediate assumption updates based on new data. Companies that maintain rolling 12-month forecasts with monthly actuals integration make better strategic decisions than those that rely on static annual budgets (which often become obsolete within months).

Final Thoughts

Financial modeling determines whether businesses make profitable decisions or costly mistakes that damage long-term growth. Companies with accurate models achieve 15% higher profitability than those that rely on flawed forecasts. Organizations that skip proper financial modeling face cash flow crises and strategic failures that threaten their survival.

Effective models require comprehensive historical data that spans at least 36 months, regular scenario tests with quarterly updates, and monthly validation against actual results. Businesses must avoid complexity traps that hide assumptions and integrate market conditions into their projections. The most successful companies maintain simple models with clear assumption tables and conduct monthly variance analysis.

Organizations that implement rolling 12-month forecasts with integrated actuals make better strategic decisions than those that use static annual budgets (which become obsolete within months). We at Bette Hochberger, CPA, CGMA help businesses implement robust financial plans through strategic tax services and expert guidance. Our approach provides the expertise needed to build accurate models that drive profitable growth and minimize financial risks.