Real Estate Professional Status (REPS) is a game-changer for property investors looking to maximize their tax benefits. At Bette Hochberger, CPA, CGMA, we’ve seen how this designation can significantly impact our clients’ bottom lines.

REPS allows real estate professionals to deduct rental property losses against their other income, potentially leading to substantial tax savings. In this post, we’ll break down what REPS is, who qualifies, and how it can transform your real estate investment strategy.

What Is Real Estate Professional Status?

Defining REPS

Real Estate Professional Status (REPS) is a tax designation under IRC Sec. 469(c)(7) that allows real estate investors to treat rental losses as non-passive. The Internal Revenue Service (IRS) created this status to differentiate between passive real estate investors and active real estate professionals.

Qualification Criteria

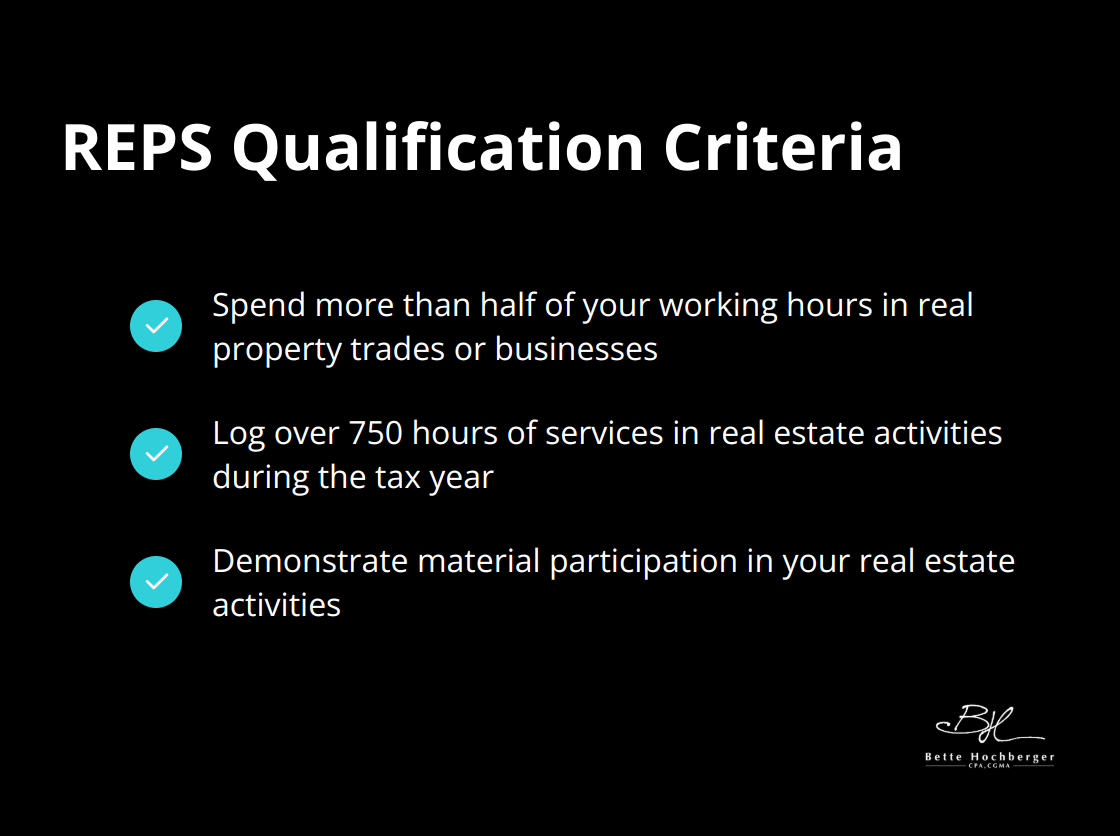

To qualify for REPS, you must meet two primary criteria set by the IRS:

- You need to spend more than half of your working hours in real property trades or businesses.

- You must log over 750 hours of services in these activities during the tax year.

These requirements ensure that only those truly dedicated to real estate can claim this status.

Tax Strategy Implications

The tax implications of REPS are substantial. Without this status, rental property losses are typically considered passive and can only offset passive income. However, with REPS, these losses can be used to offset any type of income (including wages and investment gains). This can lead to significant tax savings, especially for high-income earners.

Potential Beneficiaries

REPS can transform the financial landscape for real estate agents, property managers, developers, and investors who actively participate in their real estate businesses. Some clients save tens of thousands of dollars annually by qualifying for this status. It’s not just for full-time real estate professionals; even those with other careers can potentially qualify if they meet the stringent time requirements and prove material participation in their real estate activities.

Beyond the Basics

While the core concept of REPS seems straightforward, its application can be complex. The IRS scrutinizes REPS claims closely, so proper documentation is essential. Real estate professionals must track their hours meticulously and be prepared to defend their status if audited. Additionally, the definition of “real property trades or businesses” is broad (including development, construction, acquisition, conversion, rental, operation, management, leasing, and brokerage), which provides flexibility but also requires careful interpretation.

As we move forward, let’s explore the specific qualifications for REPS in more detail, including the material participation tests and documentation requirements that can make or break your claim to this valuable tax status.

How to Qualify for Real Estate Professional Status

Understanding the Hours Requirement

The IRS sets strict guidelines for Real Estate Professional Status (REPS) qualification. You must dedicate more than half of your personal services hours to real property trades or businesses. For example, if you work 2,000 hours annually, at least 1,001 hours must involve real estate activities. Additionally, you need to log a minimum of 750 hours per year in these pursuits.

Not all real estate-related tasks count towards these hours. Time spent studying for a real estate exam or traveling to rental properties typically doesn’t qualify. You should focus on activities directly related to your real estate business (such as property management, renovations, or client meetings).

Demonstrating Material Participation

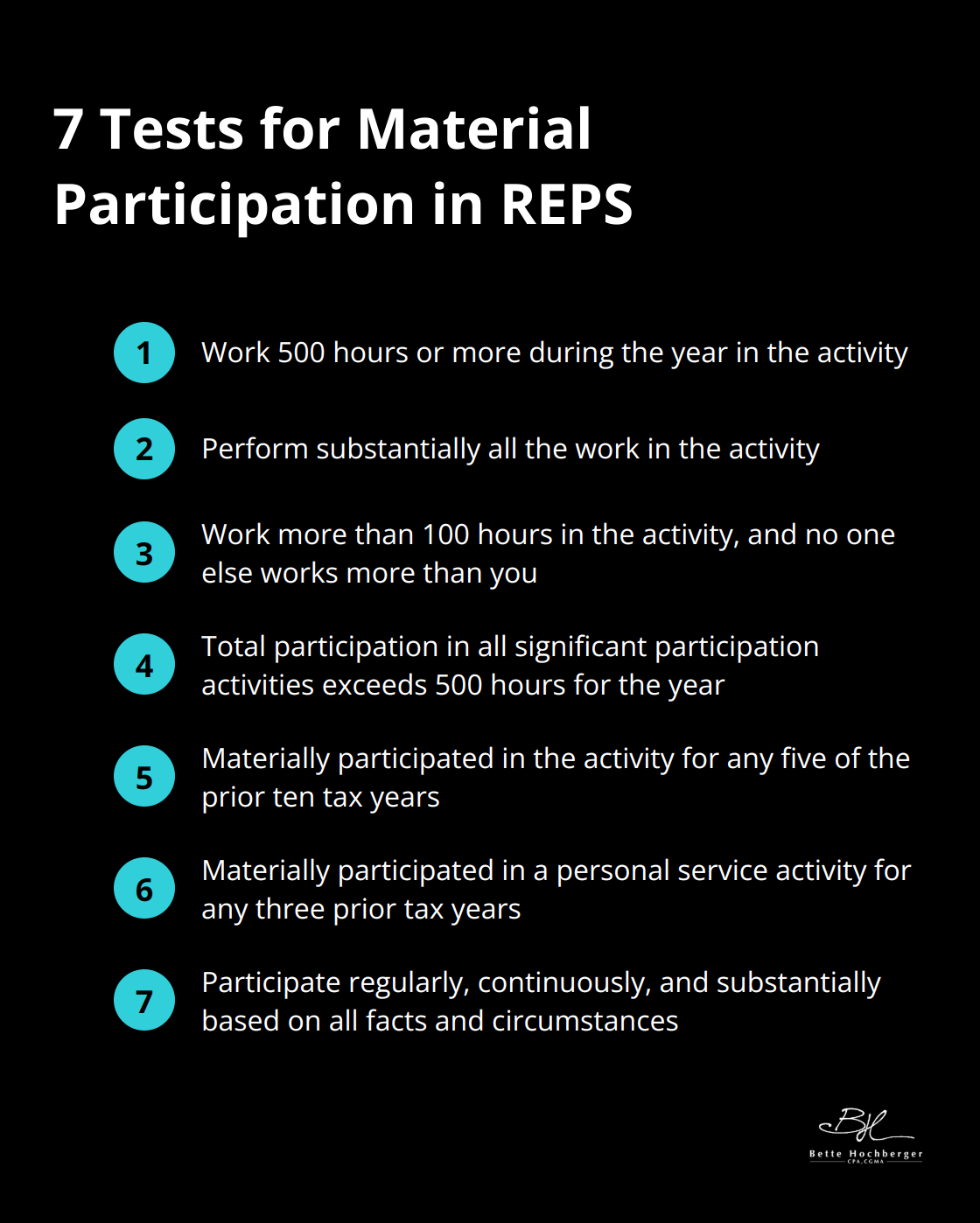

Meeting the hours requirement is just the first step. You must also prove material participation in your real estate activities. The IRS outlines seven tests for material participation, and you only need to meet one:

Importance of Proper Documentation

Accurate record-keeping is essential when claiming REPS. The IRS scrutinizes these claims closely, so you must maintain detailed logs of your activities. We recommend using digital tools or apps to track your hours in real-time. Document specific tasks performed, dates, and duration. Keep supporting evidence such as emails, receipts, and contracts to corroborate your involvement.

The burden of proof lies with you as the taxpayer. In case of an audit, you’ll need to present clear, contemporaneous records of your real estate activities. Vague or after-the-fact estimates often don’t hold up under IRS scrutiny.

Navigating Complex Scenarios

Qualifying for REPS can become more complex in certain situations. For instance, if you’re married, you and your spouse can’t combine hours for REPS qualification. However, you can combine hours for meeting material participation requirements on rentals. Additionally, if you own multiple properties, you might benefit from the grouping election, which allows you to treat all rental properties as a single activity (simplifying the material participation requirements).

The path to REPS qualification is rigorous, but the potential tax benefits make it a worthwhile pursuit for many real estate professionals. In the next section, we’ll explore these benefits in detail, showcasing how REPS can significantly impact your tax strategy and overall financial picture.

How REPS Can Supercharge Your Tax Strategy

Unleash the Power of Rental Losses

Real Estate Professional Status (REPS) transforms your tax strategy. The most significant advantage of REPS is the ability to offset rental losses against other types of income. Without REPS, rental losses are typically considered passive and can only offset passive income. However, with REPS, these losses can reduce your overall taxable income, including wages, business income, and investment gains.

Consider this scenario: You have a $50,000 rental loss and $200,000 in W-2 income. REPS could potentially reduce your taxable income to $150,000. This reduction can result in substantial tax savings, depending on your tax bracket.

Break Free from Passive Activity Loss Limitations

The IRS imposes strict limitations on passive activity losses, which can restrict your ability to deduct rental losses. REPS effectively removes these limitations, allowing you to fully deduct your real estate losses in the year they occur.

This benefit can particularly help real estate investors who are in the early stages of building their portfolio or those who are renovating properties. The ability to claim these losses immediately can improve cash flow and accelerate your investment strategy.

Maximize Depreciation Benefits

REPS opens the door to accelerated depreciation strategies that can further reduce your tax burden. You may take advantage of bonus depreciation or Section 179 expensing on your rental properties. These methods allow you to front-load deductions, potentially creating substantial paper losses that can offset other income.

A real-world example illustrates this point: A client (using REPS in combination with cost segregation) generated over $100,000 in additional deductions in a single year. This strategic approach not only reduced their current tax liability but also provided a buffer for future years.

Navigate IRS Scrutiny

The benefits of REPS come with increased scrutiny from the IRS. Proper documentation and adherence to the qualification criteria are essential. Working with a knowledgeable tax professional can help you navigate these complexities and maximize your tax savings while staying compliant.

Optimize Your Real Estate Investment Strategy

REPS can significantly impact your overall real estate investment strategy. The tax benefits can free up capital for reinvestment, allow for more aggressive property acquisition, or provide flexibility in your portfolio management. Try to align your real estate activities with REPS requirements to maximize these benefits.

Final Thoughts

Real Estate Professional Status (REPS) provides a powerful tax strategy for real estate investors and professionals. It unlocks significant tax benefits, including the ability to offset rental losses against other income types. The potential impact on your real estate investment strategy is substantial, as REPS can free up capital for reinvestment and allow for more aggressive property acquisition.

The complexities of qualifying for and maintaining REPS status require careful attention. The IRS scrutinizes REPS claims closely, making proper documentation and adherence to qualification criteria essential. Working with a knowledgeable tax professional can help you navigate these complexities and maximize your tax savings while staying compliant.

At Bette Hochberger, CPA, CGMA, we offer strategic tax planning and preparation for real estate professionals. Our team uses advanced cloud technology to help clients minimize tax liabilities and manage cash flow (while ensuring profitability). We can assist you in exploring REPS or optimizing your existing strategy to make the most of this potentially rewarding tax designation.