Hey everyone, I’m Bette Hochberger, CPA, CGMA. At our firm, we understand that navigating tax forms can be overwhelming for small business owners. Form 8995 is a crucial document for those looking to claim the Qualified Business Income (QBI) deduction.

This guide will break down the essentials of Form 8995 and the QBI deduction, helping you maximize your tax benefits. We’ll walk you through the calculation process, highlight common pitfalls, and explain who can take advantage of this potentially significant tax saving opportunity.

What is Form 8995? Understanding the QBI Deduction

Form 8995 is a tax document created by the IRS to help eligible small business owners calculate and claim the Qualified Business Income (QBI) deduction. This form allows taxpayers to potentially reduce their taxable income by up to 20 percent of their qualified business income, plus 20 percent of qualified real estate investment trust (REIT) dividends.

The QBI Deduction Explained

The QBI deduction was introduced as part of the Tax Cuts and Jobs Act in 2017. It provides a tax break for pass-through entities such as sole proprietorships, partnerships, and S corporations. This deduction can significantly lower the tax burden for many small business owners.

For the 2024 tax year, the income thresholds for claiming the full QBI deduction allow eligible taxpayers to deduct up to 20 percent of their QBI, plus 20 percent of qualified real estate investment trust (REIT) dividends.

Eligibility for Form 8995

Form 8995 is designed for taxpayers with straightforward QBI claims. You can likely use this simpler form if your taxable income falls below the thresholds mentioned above. However, if your income exceeds these limits (or you’re involved in a specified service trade or business), you might need to use the more complex Form 8995-A instead.

It’s worth noting that C corporations cannot claim the QBI deduction. Additionally, certain types of income (such as capital gains, dividends, and interest income not directly related to business operations) are excluded from QBI calculations.

Maximizing Your QBI Deduction

To optimize your QBI deduction, accurate record-keeping is essential. You must track your business income and expenses throughout the year. This includes maintaining detailed documentation of all revenue streams and categorizing expenses correctly.

We recommend reviewing your business structure and income sources regularly to ensure you optimize your tax position. For instance, strategic timing of income recognition or increasing retirement contributions could help keep your taxable income below the QBI thresholds.

The Importance of Professional Guidance

Given the complexities of tax law (and the potential for significant savings), many business owners find it beneficial to seek professional assistance when dealing with Form 8995 and the QBI deduction. A qualified tax professional can help you navigate the intricacies of the form, ensure compliance, and maximize your deduction.

As we move forward, let’s explore the step-by-step process of calculating your QBI deduction using Form 8995.

How to Calculate Your QBI Deduction with Form 8995

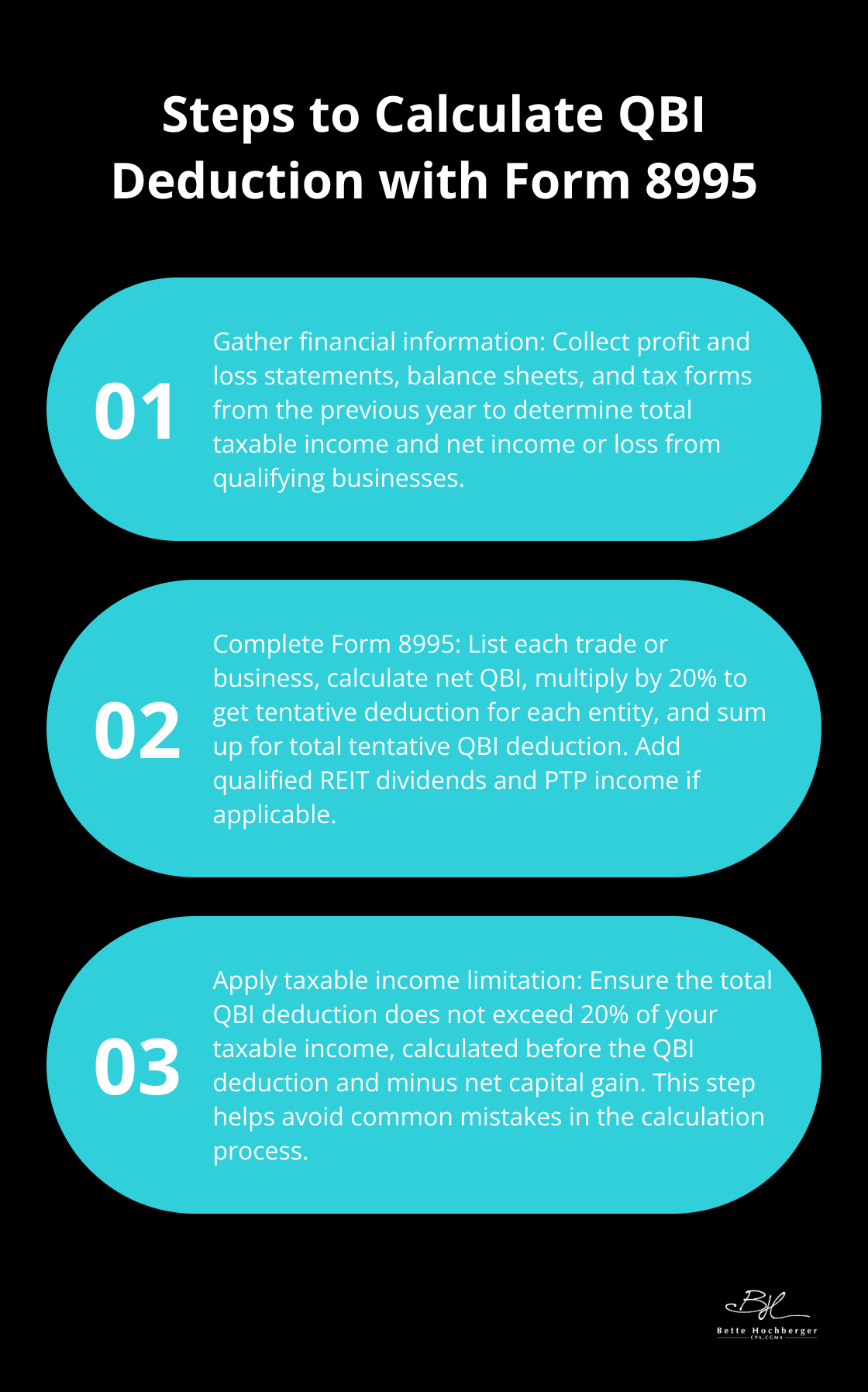

Gather Your Financial Information

The first step in calculating your Qualified Business Income (QBI) deduction involves collecting all relevant financial documents. You’ll need profit and loss statements, balance sheets, and tax forms from the previous year. These documents will provide your total taxable income and the net income or loss from each of your qualifying businesses.

Complete Form 8995

Start with Part I of Form 8995. List each of your trades or businesses, including their Taxpayer Identification Numbers (TIN). Calculate the net QBI for each business by subtracting losses from profits.

Next, multiply each business’s QBI by 20%. This calculation gives you the tentative deduction for each entity. Add these figures to get your total tentative QBI deduction.

In Part II, calculate your total QBI deduction. Add your qualified REIT dividends and PTP income (if applicable). The sum of these amounts, combined with your tentative QBI deduction from Part I, becomes your total QBI deduction.

Avoid Common Mistakes

Many taxpayers include non-qualifying income in their QBI calculations. Capital gains, dividends, and interest income not related to business operations don’t count as QBI. (This mistake can lead to incorrect deductions and potential IRS scrutiny.)

Another error involves the taxable income limitation. Your total QBI deduction is limited to 20% of your taxable income, calculated before the QBI deduction, minus net capital gain.

Apply to Real-World Scenarios

Consider a sole proprietor with a consulting business earning $100,000 in QBI and a taxable income of $80,000 after deductions. Their tentative QBI deduction would be $20,000 (20% of $100,000). However, the actual deduction is limited to $16,000 (20% of $80,000) due to the taxable income limitation.

This example illustrates the importance of considering all aspects of your financial situation when calculating your QBI deduction. Proper planning and accurate calculations can lead to significant tax savings.

Seek Professional Guidance

While Form 8995 simplifies the QBI deduction process for many business owners, complex situations may require additional expertise. If you’re unsure about any aspect of your QBI deduction calculation, professional guidance can help maximize your tax benefits while ensuring compliance with IRS regulations.

Now that we’ve covered the calculation process, let’s explore the benefits and limitations of Form 8995 in the next section.

How Form 8995 Benefits Small Business Owners

Form 8995 provides significant advantages for small business owners, especially those with straightforward tax situations. This simplified form allows eligible taxpayers to claim the Qualified Business Income (QBI) deduction without the complexities of Form 8995-A.

Tax Savings Potential

The primary benefit of Form 8995 is the potential for substantial tax savings. Small business owners can deduct up to 20% of their qualified business income, which directly reduces their taxable income. A business with $100,000 in qualified business income could potentially deduct $20,000, resulting in significant tax savings.

The IRS reports that many small business owners have benefited from the QBI deduction since its introduction.

Simplified Process

Form 8995 simplifies the QBI deduction process for eligible taxpayers. Unlike Form 8995-A, this form doesn’t require detailed calculations related to W-2 wages or qualified property. This streamlined approach saves time and reduces the likelihood of errors, making it easier for small business owners to claim their rightful deductions.

Income Thresholds and Limitations

While Form 8995 offers simplicity, it comes with limitations. It’s only available to taxpayers whose taxable income falls below certain thresholds. For the 2024 tax year, these thresholds are $383,900 for married couples filing jointly and $191,950 for other filers.

If your taxable income exceeds these thresholds, you’ll need to use the more complex Form 8995-A. This form involves additional calculations and potential limitations based on W-2 wages and qualified property.

Restrictions for Specific Businesses

Certain types of businesses, known as Specified Service Trades or Businesses (SSTBs), face additional restrictions. These include fields such as health, law, accounting, and financial services. If you operate an SSTB and your income exceeds the threshold, your QBI deduction may be reduced or eliminated entirely.

Strategic Planning

Proper planning can help business owners maximize their QBI deduction. For example, a small retail business owner might reduce their taxable income by strategically timing equipment purchases and retirement contributions. This approach could keep their income below the threshold, allowing them to use Form 8995 and claim the full QBI deduction.

Understanding these nuances is essential for maximizing your tax benefits. While Form 8995 offers a simplified approach to claiming the QBI deduction, it’s important to carefully consider your business structure, income levels, and long-term financial goals when determining the best approach for your tax strategy.

Final Thoughts

Form 8995 provides small business owners with a simplified method to claim the QBI deduction. This form allows eligible taxpayers to reduce their taxable income by up to 20% of their qualified business income, which can result in substantial tax savings. Small business owners must maintain detailed records of their income and expenses throughout the year to support their claims and ensure compliance.

The complexities of tax law can make it challenging for business owners to navigate the QBI deduction process alone. Professional assistance can prove invaluable in maximizing tax benefits and ensuring accurate filing. Bette Hochberger, CPA, CGMA specializes in personalized financial services for businesses and professionals, offering expertise in strategic tax planning and preparation.

Our team uses advanced cloud technology to serve diverse industries and help clients grow their wealth through effective tax strategies and outsourced accounting services. We strive to minimize tax liabilities, manage cash flow, and ensure profitability for our clients. The QBI deduction can significantly impact your bottom line, making it worthwhile to understand and properly utilize Form 8995.