At Bette Hochberger, CPA, CGMA, we often get asked about the fractional CFO job description. Many businesses are curious about this innovative financial role.

A fractional CFO can be a game-changer for companies looking to boost their financial strategy without the cost of a full-time executive. In this post, we’ll explore what a fractional CFO does and why they’re becoming increasingly popular in today’s business landscape.

What Does a Fractional CFO Actually Do?

The Fractional CFO Defined

A fractional CFO provides high-level financial strategy and management on a part-time or contract basis. This role has gained significant popularity, especially among small to medium-sized businesses seeking top-tier financial guidance without the full-time executive price tag.

The Fractional Advantage

Fractional CFO services provide small businesses with access to financial expertise without the cost of a full-time CFO. A startup might engage a fractional CFO for 10 hours a month, paying only for the time and expertise they need.

The biggest advantage of fractional CFOs is that they give companies access to higher caliber talent than they could afford otherwise. This highlights the immediate impact a fractional CFO can have on a company’s financial health.

Ideal Candidates for Fractional CFO Services

Startups and scale-ups benefit most from fractional CFO services. These businesses often require sophisticated financial guidance but lack resources for a full-time CFO. A fractional CFO can help navigate crucial growth stages, from securing funding to managing rapid expansion.

Established businesses undergoing transitions or facing financial challenges also stand to gain. For example, a manufacturing company looking to expand into new markets might bring in a fractional CFO to assess financial feasibility and develop a strategic plan.

Beyond Number Crunching

Fractional CFOs do more than analyze numbers. They act as strategic partners, offering insights that drive business growth. These professionals help clients:

- Implement robust financial systems

- Develop pricing strategies

- Negotiate with investors and lenders

- Streamline operations for better profitability

The role adapts to each business’s unique needs. A tech startup might need help with venture capital funding, while a family-owned business might require assistance with succession planning.

The Value of Flexibility

In today’s fast-paced business environment, the flexibility and expertise offered by fractional CFOs prove invaluable. They provide a level of financial acumen that can determine the difference between stagnation and growth, making them an essential asset for businesses aiming to thrive in competitive markets.

As we move forward, let’s explore the specific responsibilities that make fractional CFOs indispensable to modern businesses.

Key Duties of a Fractional CFO

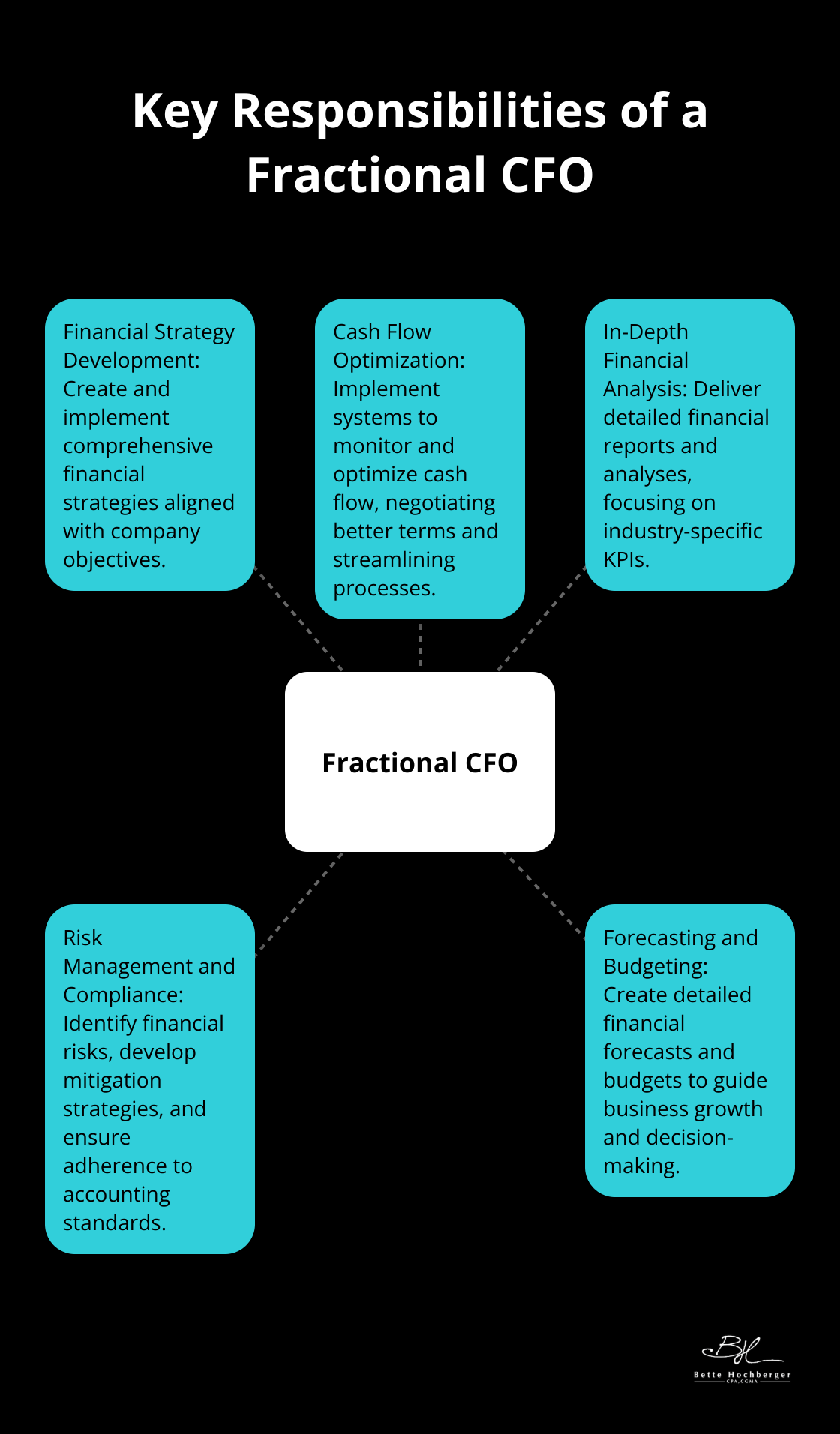

Fractional CFOs tackle a wide range of financial responsibilities essential for business success. Their role extends far beyond basic accounting, encompassing strategic planning and high-level financial management.

Financial Strategy Development

A primary duty of fractional CFOs involves the creation and implementation of comprehensive financial strategies. They analyze market trends, assess company performance, and create roadmaps for sustainable growth. For example, a fractional CFO might identify untapped revenue streams or suggest cost-cutting measures to improve profitability.

Fractional CFOs transform businesses by aligning financial goals with overall company objectives. They often work closely with leadership teams to ensure financial strategies support broader business initiatives.

Cash Flow Optimization

Effective cash flow management is vital for business survival and growth. Fractional CFOs excel in this area, implementing systems to monitor and optimize cash flow. They negotiate better payment terms with suppliers, streamline accounts receivable processes, or identify opportunities to reduce unnecessary expenses.

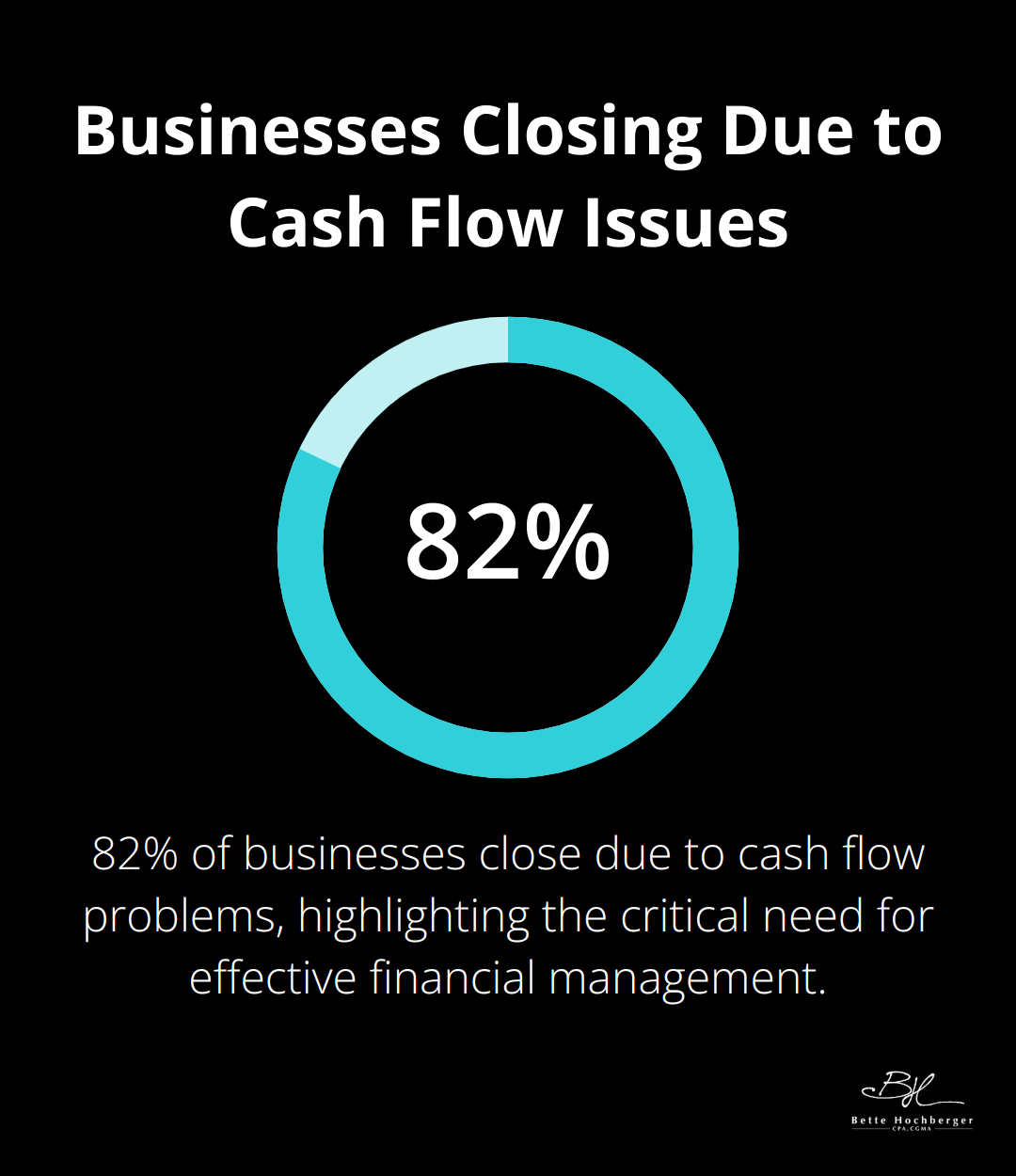

A recent article states that bank studies have shown as many as 82% of businesses close due to cash flow issues. Fractional CFOs help prevent such outcomes by maintaining a sharp focus on cash flow health.

In-Depth Financial Analysis

Fractional CFOs deliver detailed financial reports and analyses that guide decision-making. They go beyond basic profit and loss statements, offering insights into key performance indicators (KPIs) specific to the business and industry.

A fractional CFO working with a SaaS company might focus on metrics like customer acquisition cost (CAC), lifetime value (LTV), and churn rate. They use these insights to recommend strategies for improving overall financial performance.

Risk Management and Compliance

Risk management and regulatory compliance fall squarely within a fractional CFO’s responsibilities. They identify potential financial risks and develop mitigation strategies. This might involve implementing internal controls, ensuring adherence to accounting standards, or preparing for audits.

In industries with complex regulatory environments (such as healthcare or finance), fractional CFOs play a key role in navigating compliance requirements. They stay up-to-date with changing regulations and ensure the company’s financial practices meet all necessary standards.

Forecasting and Budgeting

Fractional CFOs create detailed financial forecasts and budgets. They use historical data, market trends, and business goals to project future financial performance. These forecasts serve as roadmaps for business growth and help companies make informed decisions about investments, hiring, and expansion.

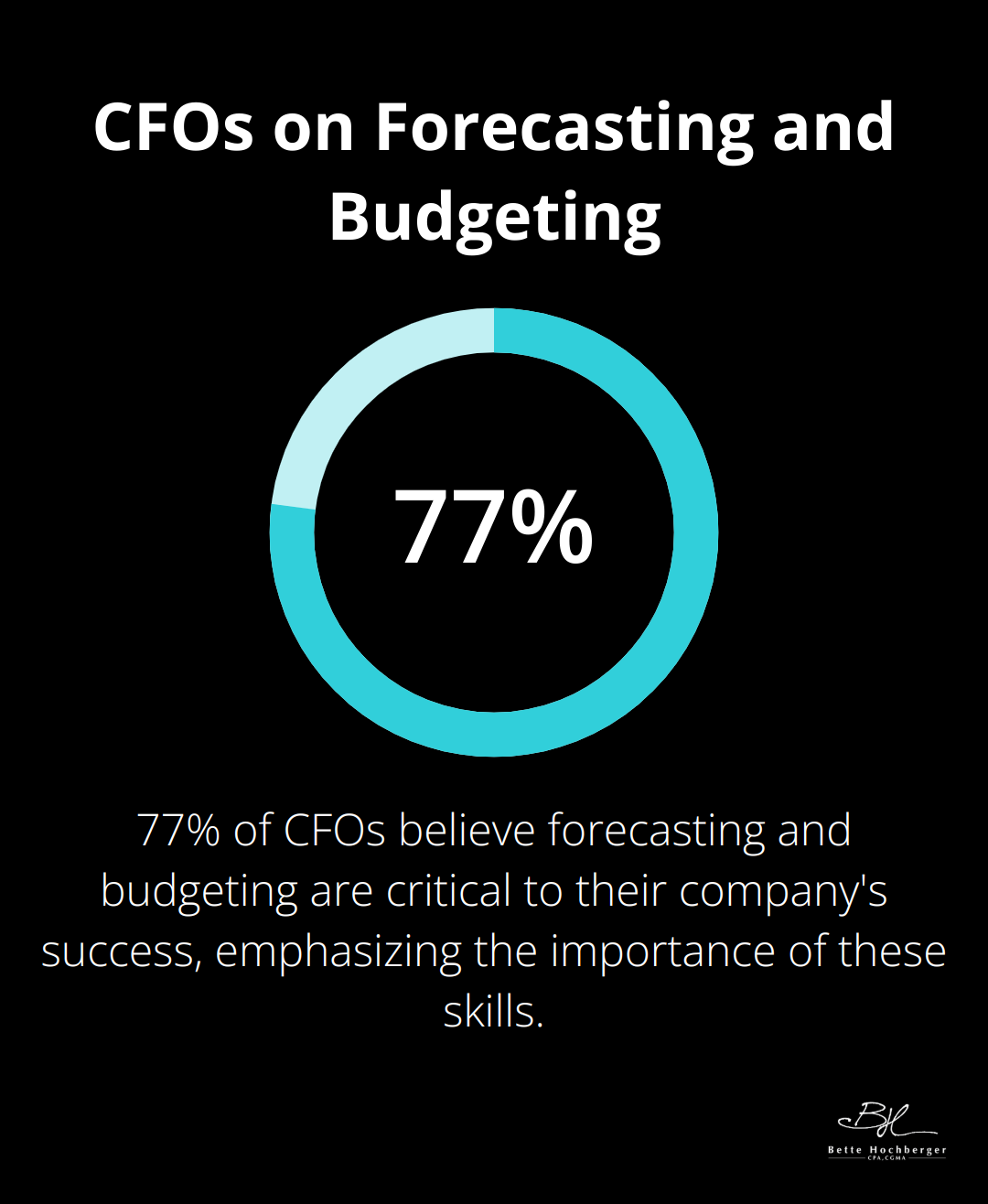

A survey by FP&A Trends found that 77% of CFOs believe forecasting and budgeting are critical to their company’s success. Fractional CFOs bring this vital skill to businesses that might not otherwise have access to such high-level financial planning.

The diverse skill set and strategic approach of fractional CFOs make them invaluable assets for companies looking to optimize their financial performance. As we explore the benefits of hiring a fractional CFO in the next section, you’ll see how these responsibilities translate into tangible advantages for businesses of all sizes.

Why Fractional CFOs Are Game-Changers

Unmatched Financial Expertise

Fractional CFOs offer cost efficiency by minimizing overhead costs and provide agile solutions that adjust to business needs. This broad perspective enables them to tackle complex financial challenges with innovative solutions. A fractional CFO who has worked with both startups and established corporations can apply lessons from rapid growth phases to help a mid-sized company scale efficiently.

Cost-Effective Financial Leadership

The financial benefits of hiring a fractional CFO are substantial. This saving doesn’t compromise quality; fractional CFOs often possess more diverse experience than their full-time counterparts.

Flexibility That Fits Your Business

One of the most significant advantages of fractional CFOs is their scalability. As business needs change, so can the level of CFO involvement. This flexibility proves particularly valuable for seasonal businesses or those experiencing rapid growth. A retail company might increase their fractional CFO’s hours during the holiday season to manage increased cash flow and inventory demands (a common practice in the industry).

Fresh Perspective for Better Decisions

Fractional CFOs provide an objective viewpoint that can transform businesses. They aren’t entrenched in company politics or historical ways of doing things, allowing them to identify inefficiencies and opportunities that internal teams might overlook. This fresh perspective can lead to transformative changes in financial strategy and operations.

Driving Growth Through Strategic Planning

The most significant impact of a fractional CFO is their ability to drive growth through strategic financial planning. They don’t just manage numbers; they translate financial data into actionable business strategies. For example, a fractional CFO might identify that a company’s customer acquisition costs are too high relative to customer lifetime value. They could then work with marketing and sales teams to develop more cost-effective acquisition strategies (directly impacting the company’s bottom line).

Final Thoughts

Fractional CFOs have become essential in today’s business world. These financial experts bring extensive experience and strategic insight to companies of all sizes. The fractional CFO job description includes developing financial strategies, optimizing cash flow, managing risks, and providing in-depth analysis.

Fractional CFOs adapt their services to each business’s unique needs. This flexibility, combined with cost-effectiveness, makes them attractive for startups, small to medium-sized businesses, and larger corporations facing financial challenges. They provide high-level financial expertise without the commitment of a full-time executive, enabling companies to make informed decisions and achieve strategic goals.

We at Bette Hochberger, CPA, CGMA offer personalized fractional CFO services tailored to your specific needs. Our team specializes in strategic tax planning, cash flow management, and financial strategy development (designed to minimize tax liabilities and ensure profitability). With our industry expertise, we help businesses across various sectors optimize their financial performance and drive sustainable growth.