Tax planning for businesses is a critical aspect of financial management. At Bette Hochberger, CPA, CGMA, we understand the complexities of business taxation and the impact it can have on your bottom line.

In this post, we’ll share essential tips and tricks to help you optimize your tax strategy and minimize your tax liability. From maximizing deductions to leveraging professional expertise, these insights will empower you to make informed decisions for your business’s financial future.

Maximizing Business Tax Deductions

Common Deductible Expenses

Business owners can reduce their tax liability by deducting various expenses related to their operations. These include advertising and marketing costs, employee education and training, and certain legal expenses. Travel expenses, when properly documented, also qualify for deductions. The IRS allows a standard mileage rate of 70 cents per mile for business-related driving in 2025, which can result in substantial savings for businesses with frequent travel.

Hidden Deduction Opportunities

Many businesses miss valuable deductions due to lack of awareness. The home office deduction (available to both homeowners and renters) can lead to significant tax savings, especially for small business owners. This deduction applies when a space is used regularly and exclusively for business. Self-employed individuals can also deduct health insurance premiums, which can substantially lower taxable income.

The Importance of Accurate Documentation

Maintaining precise records is essential for supporting all deductions claimed on your tax return. The IRS requires thorough documentation for every expense. Implementing a robust tracking system throughout the year will ensure you’re prepared in case of an audit. Many businesses find that using accounting software with automated receipt tracking simplifies this process and improves organization.

Leveraging Technology for Deduction Tracking

Modern technology offers numerous tools to streamline expense tracking and maximize deductions. Cloud-based accounting software (such as QuickBooks Online or Xero) allows real-time expense logging and categorization. Mobile apps enable you to capture receipts on the go, ensuring no deductible expense goes unrecorded. These digital solutions not only save time but also reduce the risk of human error in record-keeping.

Staying Informed on Tax Law Changes

Tax laws evolve constantly, and staying informed is critical to maximizing deductions. Eligible taxpayers may now deduct up to 20 percent of certain business income from domestic businesses operated as sole proprietorships. Subscribing to reputable tax news sources or working with a knowledgeable tax professional can help you stay ahead of these changes and identify new deduction opportunities as they arise.

As we move forward, it’s clear that maximizing deductions is just one piece of the tax planning puzzle. The next crucial step is to explore strategies for minimizing your overall business tax liability, which we’ll discuss in the following section.

Smart Tax Strategies for Businesses

Optimal Business Structure Selection

Your business structure significantly impacts your tax obligations. Limited Liability Companies (LLCs) typically avoid corporate income tax as pass-through entities. This can lead to substantial tax savings compared to traditional C-corporations. However, the best structure depends on your specific situation. Some businesses have saved thousands of dollars annually by switching from a sole proprietorship to an S-corporation.

Strategic Income and Expense Timing

Timing plays a critical role in tax planning. Cash-basis accounting users can potentially defer income by delaying invoice issuance until the next tax year. This strategy proves particularly effective if you anticipate a lower tax bracket in the following year. Conversely, accelerating expenses by prepaying certain costs before year-end can lower your current year’s taxable income. Prepaying rent or stocking up on office supplies in December (for example) can provide immediate tax benefits.

Tax Credits and Incentives Utilization

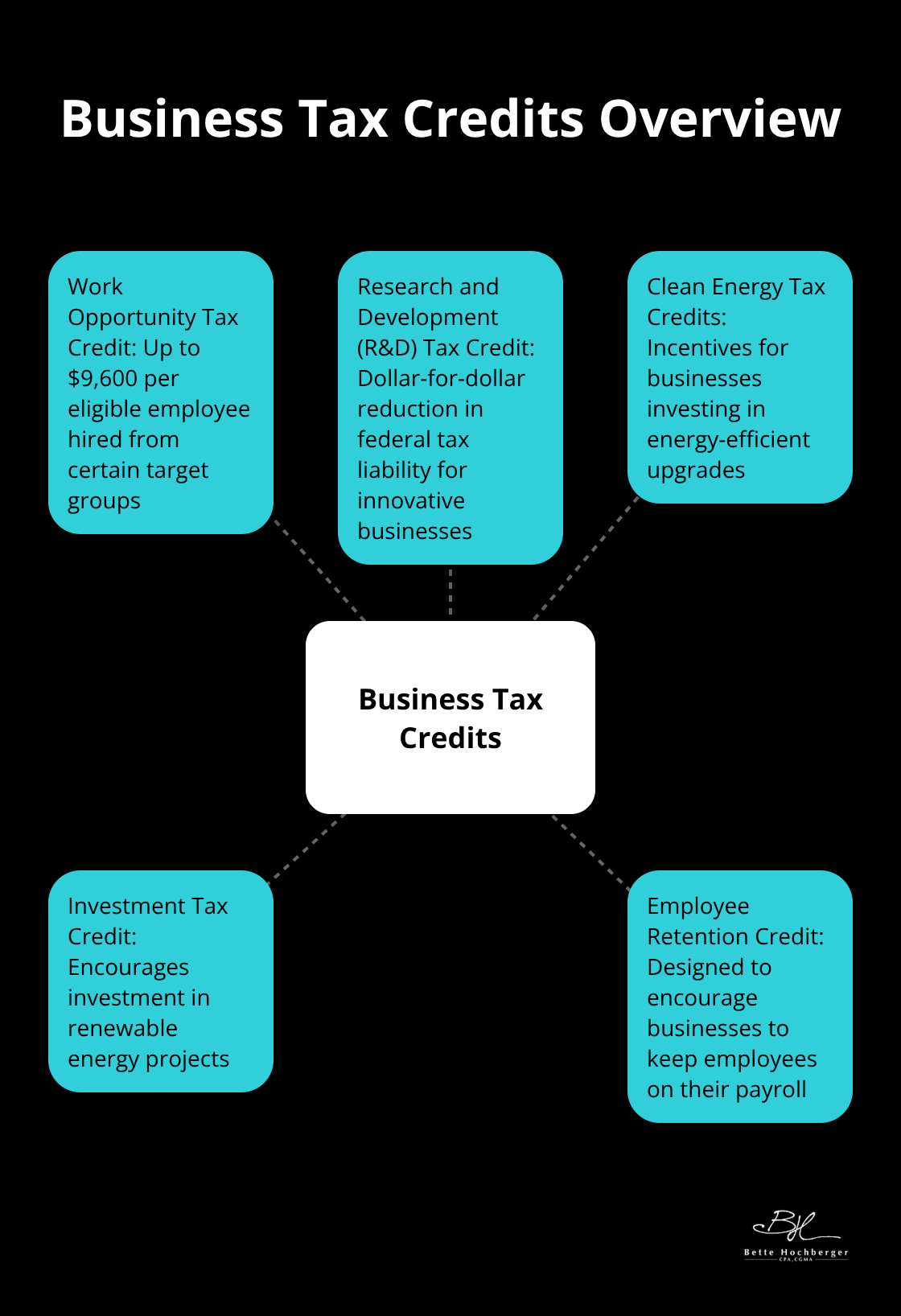

Tax credits reduce your tax bill dollar-for-dollar. Business tax credits are created to encourage companies to behave in certain ways. The Research and Development (R&D) Tax Credit, often overlooked, can transform innovative businesses’ tax situations. The Work Opportunity Tax Credit (WOTC) offers up to $9,600 per eligible employee hired from certain target groups.

Clean Energy Tax Incentives

The Inflation Reduction Act introduced clean energy tax credits. For an interactive guide to energy credits available under the Inflation Reduction Act, visit cleanenergy.gov. These incentives can significantly offset costs for businesses investing in energy-efficient upgrades. Commercial buildings can qualify for tax deductions up to $5 per square foot for energy-efficient improvements.

Professional Tax Guidance

Tax planning requires ongoing attention. Regular consultations with a tax professional help you stay ahead of changing laws and maximize tax-saving opportunities. A skilled CPA or tax advisor (such as those at Bette Hochberger, CPA, CGMA) can provide tailored strategies to ensure you don’t leave money on the table when it comes to your business taxes. Their expertise proves invaluable in navigating complex tax scenarios and identifying lesser-known deductions or credits that apply to your specific industry.

Why Professional Tax Guidance Matters

The Power of CPA Partnerships

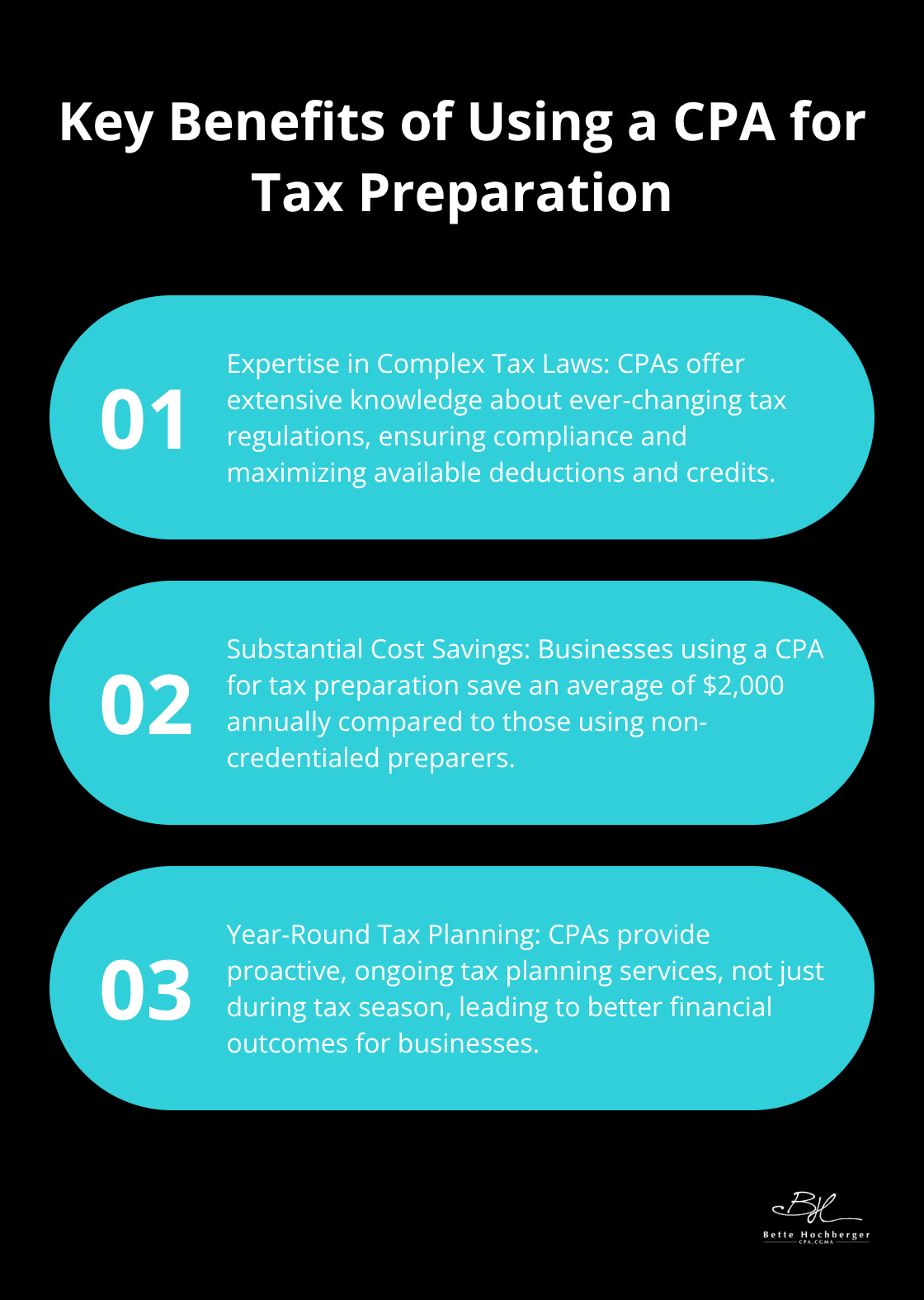

Professional tax guidance transforms businesses’ tax strategies. Certified Public Accountants (CPAs) offer extensive knowledge about complex, ever-changing tax laws and regulations. The Tax Cuts and Jobs Act of 2017 changed deductions, depreciation, expensing, tax credits and other tax items that affect businesses. CPAs help businesses navigate these changes and maximize available deductions and credits.

CPAs provide year-round tax planning services, not just during tax season. This proactive approach leads to substantial savings. A study by the National Society of Accountants found that businesses using a CPA for tax preparation saved an average of $2,000 annually (compared to those using non-credentialed preparers).

Fractional CFOs: A Strategic Asset

Fractional CFO services offer a cost-effective solution for high-level financial expertise to businesses that can’t justify a full-time CFO. These professionals develop comprehensive tax strategies tailored to specific business goals. They often bring industry-specific knowledge that uncovers unique tax-saving opportunities.

A fractional CFO might identify that a business qualifies for the Research and Development (R&D) Tax Credit, which provides a dollar-for-dollar reduction in federal tax liability. From 2025, it will be mandatory, with “qualified small businesses” and those with total QREs of $1.5 million or less, and gross receipts of $50 million or less.

Harnessing Technology for Tax Efficiency

Modern tax management relies heavily on technology. Cloud-based accounting software streamlines record-keeping and provides real-time financial data. These platforms often integrate with tax preparation software, which reduces the risk of errors and saves time during tax filing.

Data analytics tools help identify tax-saving opportunities and forecast tax liabilities. Predictive analytics helps businesses optimize the timing of income recognition and expense deductions to minimize tax burdens.

Choosing the Right Tax Professional

Selecting the right tax professional is critical for effective tax planning. Look for professionals with experience in your industry and a track record of helping businesses similar to yours. Consider their qualifications, such as CPA certification or specialized tax credentials.

A good tax professional should offer proactive advice, not just reactive tax preparation. They should communicate complex tax concepts in understandable terms and be available to answer questions throughout the year.

The Value of Ongoing Tax Planning

Tax planning is not a one-time event but an ongoing process. Regular meetings with your tax professional allow you to adjust strategies as your business evolves and tax laws change. This continuous approach helps you stay ahead of potential tax issues and capitalize on new opportunities for tax savings.

Final Thoughts

Tax planning for businesses requires a strategic approach to optimize financial outcomes. Companies can reduce their tax liability through careful deduction management, smart income timing, and utilization of available credits. Professional guidance proves invaluable in navigating complex tax laws and identifying industry-specific opportunities.

Bette Hochberger, CPA, CGMA offers expert tax planning services tailored to your business needs. Our team specializes in comprehensive strategies that minimize tax burdens and enhance profitability. We provide personalized solutions that align with your specific industry and business goals.

Effective tax planning demands ongoing attention and expertise (not just during tax season). Partnering with skilled professionals empowers you to take control of your business’s tax strategy. Don’t miss out on potential savings – contact us today to set your business up for long-term financial success.