Starting a new business is exciting, but it comes with a host of responsibilities. One of the most important is tax compliance for startups.

At my firm, we’ve seen many new companies struggle with their tax obligations. This post will guide you through common pitfalls and provide strategies to keep your startup on the right side of tax law.

What Taxes Do Startups Face?

Income Tax: The Baseline for All Businesses

Startups face a complex web of tax obligations. Income tax forms the foundation of these responsibilities. The amount owed depends on your business structure. Sole proprietors report business income on personal tax returns, while corporations file separate returns. About 94 percent of businesses in the U.S. are pass-through entities (meaning the business income “passes through” to the owner’s personal tax return).

Payroll Taxes: A Hidden Cost of Employment

Payroll taxes become unavoidable when you have employees. These include Social Security and Medicare taxes (FICA), as well as federal and state unemployment taxes. The current FICA tax rate is 12.4% for Social Security and 1.45% for Medicare, totaling 13.85%. Many startups underestimate the impact of these taxes on their bottom line.

Sales Tax: A State-by-State Challenge

Sales tax presents a particular challenge for startups, especially those selling products online. Each state enforces its own rules and rates. For instance, California imposes a base sales tax rate of 7.25% (the highest in the nation), while Oregon has no sales tax at all. Startups must track where they sell and comply with each jurisdiction’s requirements.

Key Deadlines: Mark Your Calendar

Tax deadlines vary based on your business structure and the types of taxes you owe. Here are some critical dates to remember:

- March 15: S-corporation and partnership tax returns due

- April 15: Individual and C-corporation tax returns due

- Quarterly estimated tax payments: April 15, June 15, September 15, January 15

Missing these deadlines can result in penalties and interest. In 2020, the IRS assessed over $14 billion in civil penalties related to individual and business income taxes.

The Importance of Meticulous Record-Keeping

Accurate record-keeping forms the foundation of tax compliance. The IRS requires businesses to keep records that support income, deductions, and credits reported on tax returns. This includes receipts, bank statements, and financial reports.

Digital tools can streamline this process. Cloud-based accounting software (like QuickBooks or Xero) can automatically categorize expenses and generate financial reports. These tools not only save time but also reduce the risk of errors that could trigger an audit.

The IRS can audit returns filed within the last three years, or up to six years if they suspect significant underreporting of income. Maintaining organized records serves as your best defense against potential audits and can save you thousands in penalties and professional fees.

Tax compliance for startups involves complexity, but it’s not insurmountable. With careful planning, accurate record-keeping, and timely filings, you can navigate the tax landscape successfully. However, many startups find themselves overwhelmed by these obligations. In the next section, we’ll explore common tax mistakes that startups often make and how to avoid them.

Common Tax Mistakes That Trip Up Startups

Startups often stumble when it comes to tax compliance. These missteps can lead to costly penalties and audits, potentially derailing a promising business. Let’s explore some of the most common tax pitfalls that new companies face.

Employee vs. Contractor Misclassification

One of the biggest tax headaches for startups is the incorrect classification of workers. The IRS takes a keen interest in this issue, as it directly impacts tax revenue.

Startups do not withhold or pay taxes on behalf of contractors. Instead, they issue IRS forms to independent contractors (also known as consultants). This distinction is crucial for tax compliance.

To avoid misclassification, review the IRS guidelines on worker classification carefully. Consider factors like behavioral control, financial control, and the relationship between the worker and the company. When uncertainty arises, consult with a tax professional.

Inadequate Expense Tracking

Poor expense tracking is another common pitfall. Implement a system for tracking expenses from the start. Use accounting software that automatically categorizes expenses and generates reports. Keep digital copies of all receipts (the IRS accepts these for most expenses under $75).

Overlooking Tax Credits

Many startups leave money on the table by missing available tax credits. The Research and Development (R&D) Tax Credit is a prime example. The maximum allowable percentage for R&D expenses is 16% of gross receipts.

Other commonly missed opportunities include the Work Opportunity Tax Credit for hiring from certain target groups and various energy efficiency credits. These can significantly reduce your tax bill and free up capital for growth.

Stay informed about available credits in your industry and location. Tax laws change frequently, so regular check-ins with a tax professional can help ensure you’re not missing out on valuable savings.

Neglecting Estimated Tax Payments

Many startup founders, especially those transitioning from traditional employment, forget about estimated tax payments. The IRS requires these quarterly payments for individuals and businesses that expect to owe $1,000 or more in taxes when their return is filed.

Failing to make these payments can result in penalties and interest. Set reminders for the quarterly due dates (April 15, June 15, September 15, and January 15) and set aside funds regularly to cover these obligations.

Mixing Personal and Business Finances

A common mistake among new entrepreneurs is the failure to separate personal and business finances. This complicates record-keeping and can raise red flags with the IRS.

Open a separate business bank account and credit card as soon as you start your company. This separation will simplify your accounting, make tax preparation easier, and provide a clearer picture of your business’s financial health.

These tax mistakes can create significant hurdles for startups, but they’re not insurmountable. With proper planning and professional guidance, you can navigate the complex world of tax compliance successfully. In the next section, we’ll explore strategies to ensure your startup stays on top of its tax obligations.

How Can Startups Master Tax Compliance?

Embrace Technology for Accurate Bookkeeping

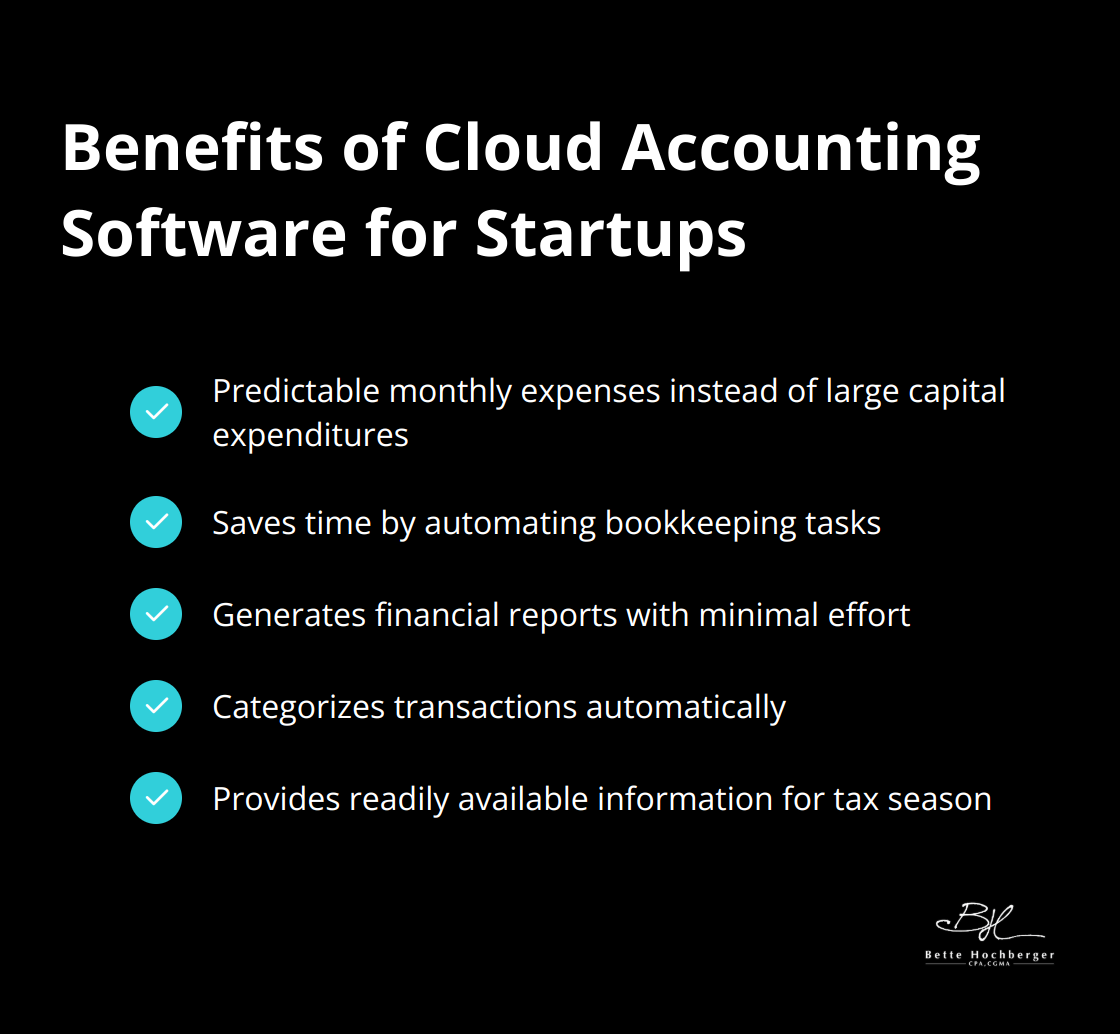

Tax compliance doesn’t have to be a nightmare for startups. The foundation of tax compliance is accurate financial records. Cloud-based accounting software like QuickBooks Online or Xero can automate much of your bookkeeping. These tools categorize transactions, track expenses, and generate financial reports with minimal effort.

One of the benefits of cloud accounting software solutions is that they offer predictable monthly expenses instead of large capital expenditures. This frees up more time for you to focus on growing your startup. When tax season arrives, you’ll have all the necessary information readily available.

Invest in Professional Tax Advice Early

Many startups try to cut costs by handling taxes in-house. This often becomes a costly mistake.

Investing in professional tax advice early can save you time and money in the long run. Tax professionals provide significant benefits, such as additional expertise, time-saving opportunities, and the ability to represent you before tax authorities. A qualified tax professional can help you structure your business for optimal tax efficiency, identify overlooked deductions, and ensure compliance with all relevant tax laws.

Stay Informed About Tax Law Changes

Tax laws constantly evolve, and staying informed is essential. The Tax Cuts and Jobs Act of 2017, for example, introduced significant changes that affected many startups. To stay updated, you can subscribe to tax law newsletters or follow reputable tax blogs.

Technology can also help you stay informed. Apps like CCH AnswerConnect provide real-time updates on tax law changes. This allows you to adapt your tax strategy proactively rather than reactively.

Plan for Growth and Changing Tax Obligations

As your startup grows, your tax obligations will change. Planning for these changes is essential. Consider working with a fractional CFO who can help you forecast your tax liabilities and adjust your strategy as your business evolves. This proactive approach can help you avoid surprises and make informed decisions about your company’s future.

Tax compliance isn’t just about avoiding penalties (although that’s certainly important). It’s about strategically positioning your startup for financial success. The right approach to tax compliance can turn this challenge into a strategic advantage for your growing business.

Final Thoughts

Tax compliance for startups requires a proactive approach to financial management. Accurate record-keeping, proper employee classification, and knowledge of available tax credits form the foundation of effective compliance. Technology and professional advice play vital roles in navigating the complex tax landscape, allowing startups to focus on growth and innovation.

Startups must view tax planning as an ongoing strategic process rather than a yearly event. This approach optimizes cash flow, minimizes liabilities, and supports informed business decisions. Treating tax compliance as a competitive advantage rather than a burden sets the stage for long-term financial success.

We at Bette Hochberger, CPA, CGMA specialize in tax compliance for startups and growing businesses. Our team offers personalized financial services, from strategic tax planning to Fractional CFO solutions, designed to minimize tax liabilities and ensure profitability. With our expertise, your startup can transform tax compliance into a solid financial foundation for future growth.