At Bette Hochberger, CPA, CGMA, we know that navigating S Corporation tax forms can be challenging. The Schedule K-1 (Form 1120S) is a critical document for S Corp shareholders, detailing their share of income, deductions, and credits.

Understanding this form is essential for accurate tax reporting and compliance. In this guide, we’ll break down the key components of Schedule K-1 and provide practical tips for reporting this information on your personal tax return.

What is Schedule K-1 for S Corps?

The Purpose of Schedule K-1

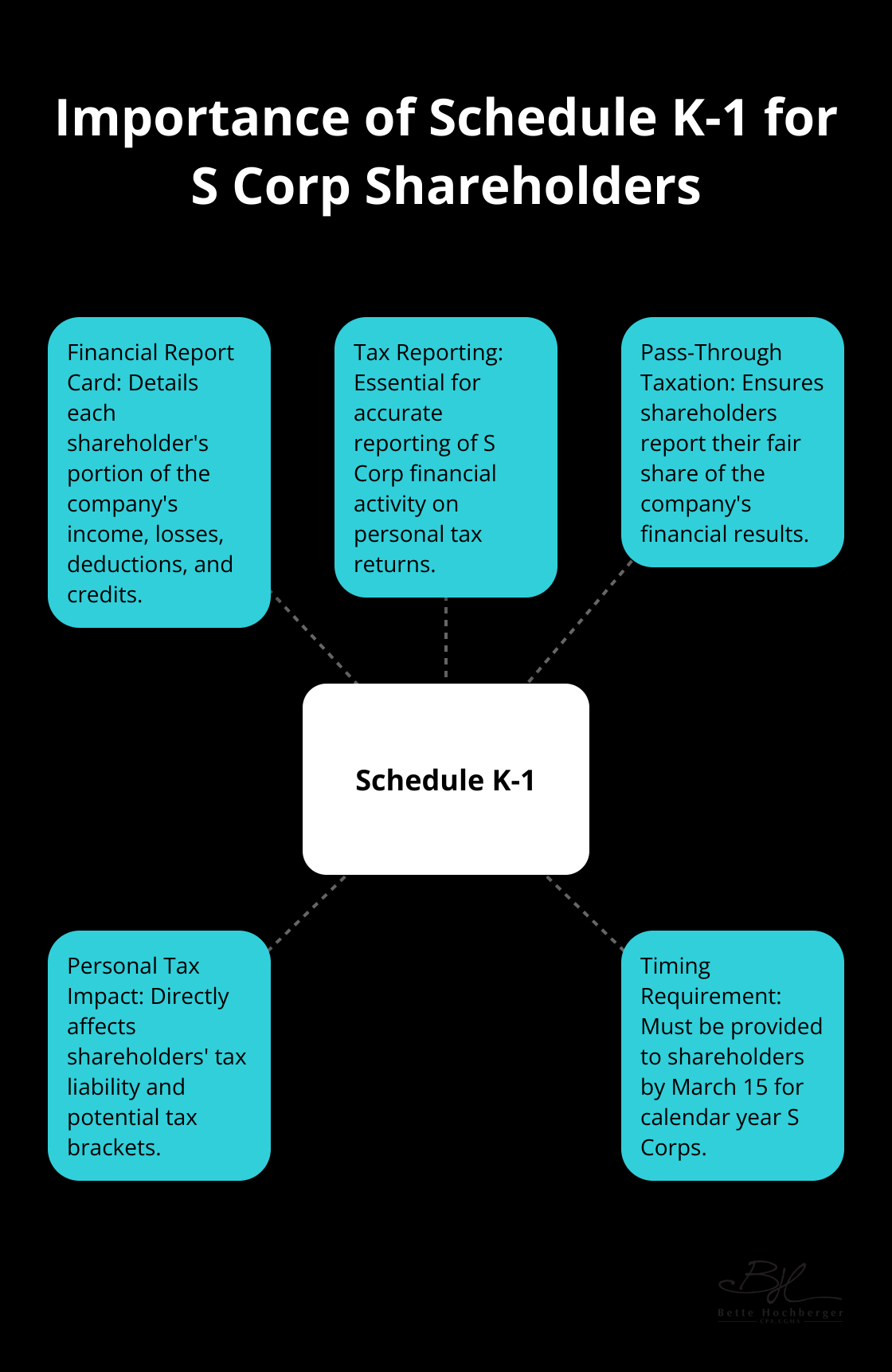

Schedule K-1 (Form 1120S) acts as a financial report card for S Corporation shareholders. This document outlines each shareholder’s portion of the company’s income, losses, deductions, and credits. Shareholders need this information to accurately report their share of the S Corp’s financial activity on personal tax returns.

S Corps vs C Corps: Tax Reporting Differences

S Corps and C Corps differ significantly in their tax reporting methods. C Corps pay taxes at the corporate level, while S Corps pass income and losses directly to shareholders (a process known as pass-through taxation). This distinction underscores the importance of Schedule K-1 for S Corp shareholders, as it ensures each individual reports their fair share of the company’s financial results.

Impact on Shareholders’ Taxes

For S Corp shareholders, Schedule K-1 is more than just paperwork-it directly affects personal tax liability. The income reported on a K-1 must appear on individual tax returns, potentially influencing tax brackets and overall tax bills.

Timing and Preparation Requirements

S Corporations must provide Schedule K-1 to shareholders by the 15th day of the third month following the close of the tax year (typically March 15 for calendar year S Corps). Late or inaccurate K-1s can result in filing delays and potential penalties for shareholders.

Proactive Communication

Effective communication between the S Corp and its shareholders can streamline the K-1 process and reduce errors. Tax professionals recommend maintaining open lines of communication throughout the year to facilitate smooth K-1 preparation and distribution.

As we move forward, let’s examine the specific sections of Schedule K-1 and how to interpret the information they contain.

What’s Inside Schedule K-1?

Schedule K-1 (Form 1120S) is a key document for S Corporation shareholders. It consists of three main parts, each with a specific purpose in reporting the S Corp’s financial activities and their impact on individual shareholders.

Part I: Corporate Information

The first section of Schedule K-1 contains essential details about the S Corporation. This includes:

- Company name

- Address

- Employer Identification Number (EIN)

- Tax year for which the form is filed

This information links the K-1 to the correct S Corp and tax period when shareholders file their personal tax returns.

Part II: Shareholder Details

Part II focuses on the individual shareholder and includes:

- Shareholder’s name

- Address

- Taxpayer identification number (usually a Social Security number)

- Percentage of stock ownership

- Changes in ownership during the tax year

Accurate reporting in this section determines the shareholder’s proportional share of the S Corp’s financial results.

Part III: Financial Information

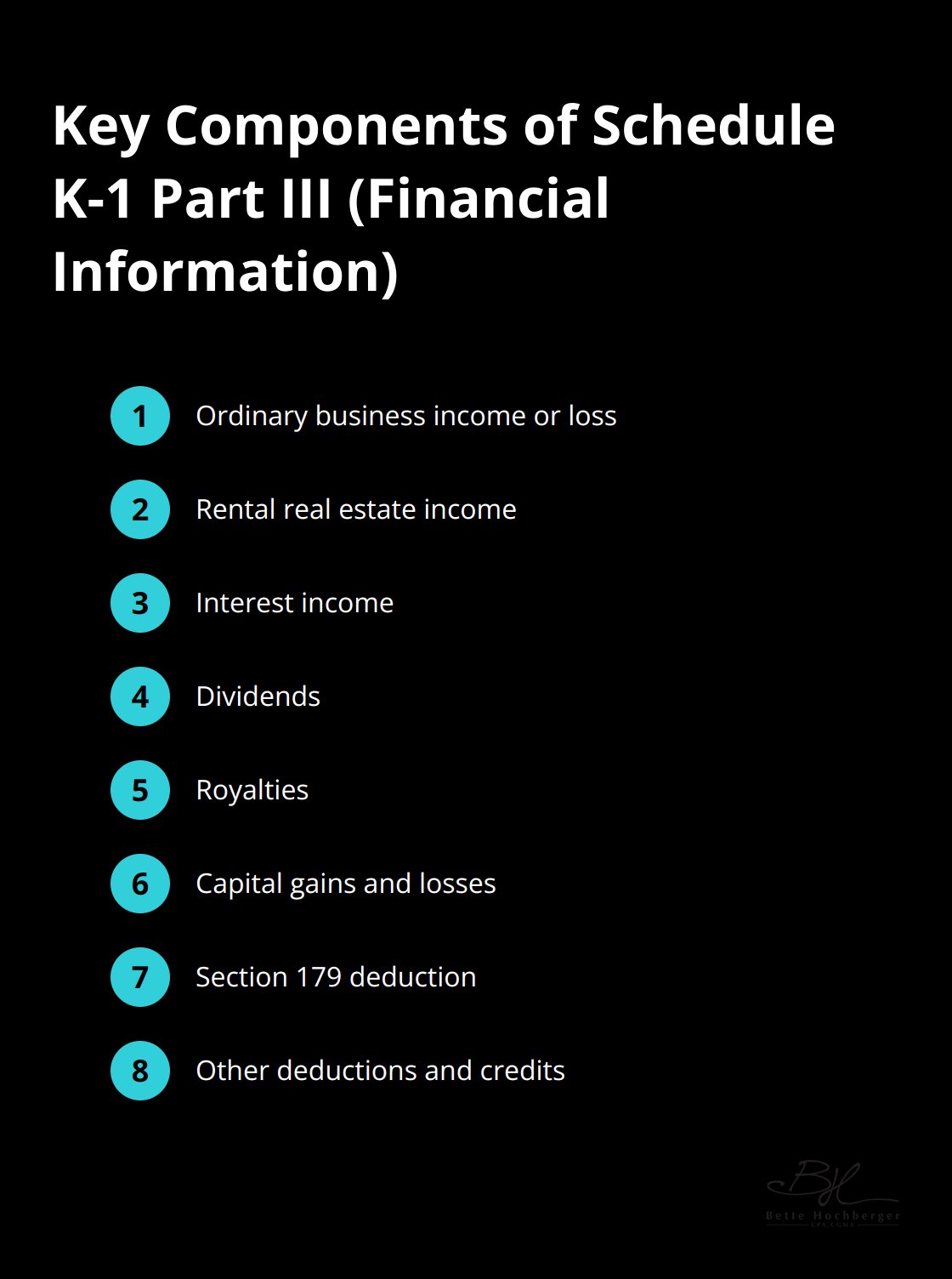

Part III forms the core of Schedule K-1. It details the shareholder’s share of income, deductions, credits, and other items from the S Corporation. This section breaks down into various categories:

- Ordinary business income or loss

- Rental real estate income

- Interest income

- Dividends

- Royalties

- Capital gains and losses

- Section 179 deduction

- Other deductions and credits

Each line item in Part III corresponds to specific lines on the shareholder’s personal tax return (Form 1040). For example, ordinary business income reported on Schedule K-1 typically appears on Schedule E of Form 1040.

Nuances of Part III

Understanding Part III is essential for accurate tax reporting. The treatment of passive activity losses can significantly impact a shareholder’s tax liability. These losses may face limitations based on the shareholder’s level of participation in the business.

S Corp shareholders should pay close attention to items like guaranteed payments and distributions. Schedule K-1 doesn’t show actual dividend distributions the corporation made to you. The corporation must report such amounts totaling $10 or more.

Professional Assistance

The complexity of Schedule K-1 often requires professional help. Tax laws change frequently, and the interplay between S Corp income and personal taxes can be intricate. Working with a qualified tax professional can ensure compliance and optimize tax strategies based on the information reported on Schedule K-1. Numerous strategies and tips can be used by S corporation owners to lower their taxes, including deductions and credits.

As we move forward, let’s explore how to report Schedule K-1 information on personal tax returns and avoid common pitfalls in the process.

Transferring K-1 Data to Your 1040

Mapping K-1 Items to Form 1040

S Corporation shareholders must report Schedule K-1 information on their personal tax returns accurately. This process requires precision and knowledge of how different income types appear on Form 1040 or, if you were born before January 2, 1960, Form 1040-SR.

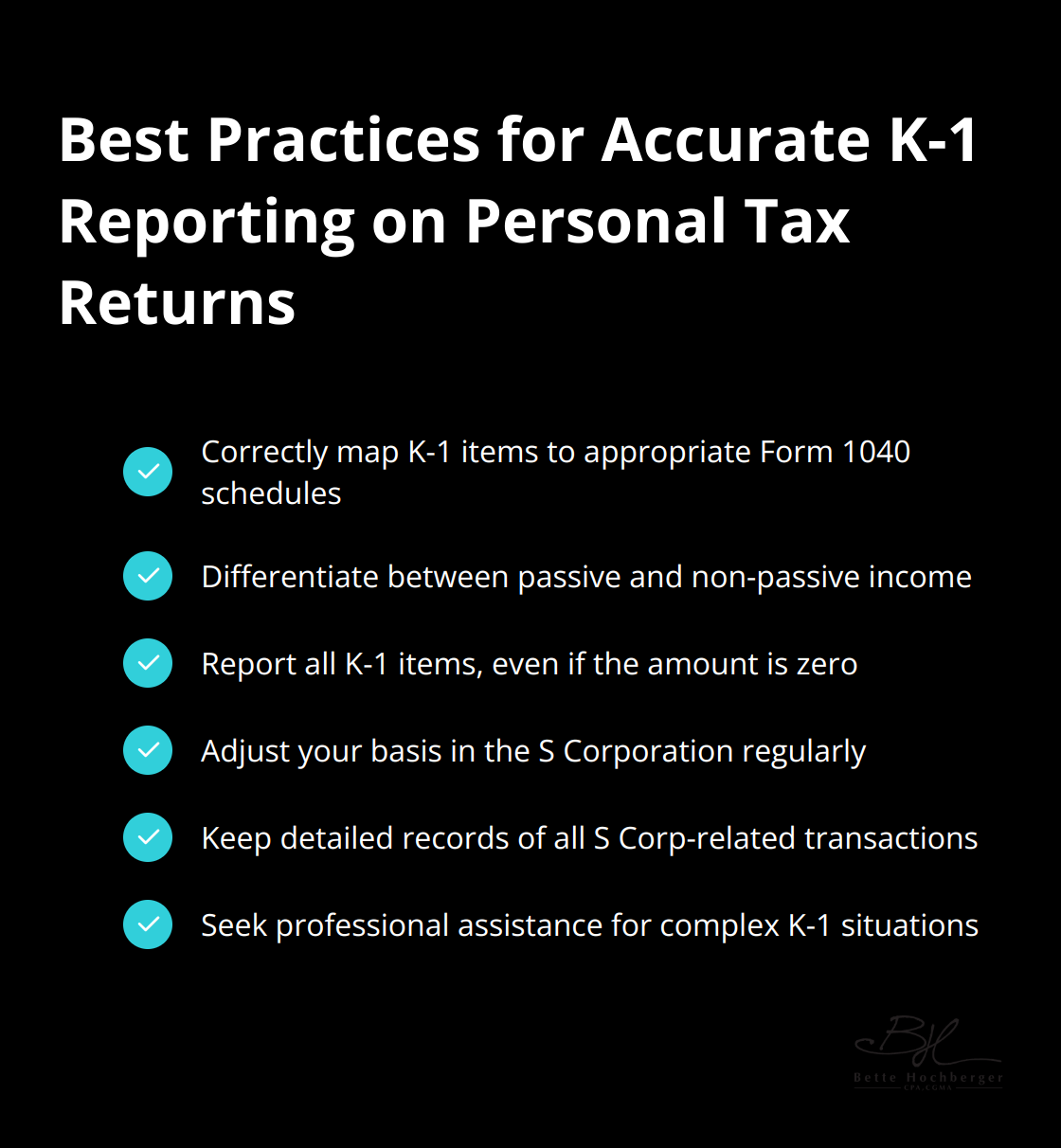

Each line item on Schedule K-1 links to a specific section of Form 1040 or its associated schedules. Ordinary business income from Line 1 of Schedule K-1 typically appears on Schedule E of Form 1040. Interest income (Line 4) goes on Schedule B, while dividends (Line 5) end up on Schedule B or Form 1040 directly (depending on the amount).

Capital gains and losses from Lines 7 and 8 of Schedule K-1 must appear on Schedule D. It’s important to differentiate between short-term and long-term gains or losses, as they have distinct tax implications. Section 179 deductions from Line 11 belong on Form 4562 before transferring to Schedule E.

Common Reporting Errors to Avoid

Misclassification of passive and non-passive income ranks as a frequent mistake. The IRS enforces strict rules about passive activity losses, and incorrect reporting can trigger audits. Another error involves the failure to report all K-1 items. Even if a particular line shows zero, it might still need to appear on your 1040.

Shareholders often neglect to adjust their basis in the S Corporation. This adjustment proves essential for accurate calculation of gains or losses on future stock sales. Detailed records of basis changes throughout the year can reduce time and stress during tax season.

K-1’s Effect on Tax Liability

Schedule K-1 information can significantly influence your overall tax liability. Business losses might offset other income, potentially lowering your tax bracket. On the flip side, substantial business profits could push you into a higher tax bracket.

Credits reported on Schedule K-1 can directly reduce your tax bill. These might include the Work Opportunity Credit or credits related to renewable energy investments. Understanding how these credits apply to your situation can lead to substantial tax savings.

Professional Assistance

The complexity of Schedule K-1 often necessitates professional help. Tax laws change frequently, and the interplay between S Corp income and personal taxes can become intricate. Working with a qualified tax professional (such as those at Bette Hochberger, CPA, CGMA) can ensure compliance and optimize tax strategies based on the information reported on Schedule K-1.

Record Keeping Best Practices

Maintaining meticulous records throughout the year simplifies the K-1 reporting process. Create a system to track all S Corporation-related income, expenses, and transactions. This practice not only eases tax preparation but also provides valuable documentation in case of an audit.

Final Thoughts

Schedule K-1 serves as a critical link between S Corporation finances and shareholder tax returns. Accurate preparation and timely distribution of this document ensure proper reporting and help avoid IRS issues. S Corp shareholders must understand Schedule K-1 intricacies to navigate the tax filing process effectively.

The complexity of Schedule K-1 and its impact on personal taxes often requires professional guidance. Tax laws change frequently, and the interaction between S Corp income and individual taxes can become complicated. Seeking assistance from qualified tax professionals can ensure compliance with current regulations and optimize tax strategies.

Bette Hochberger, CPA, CGMA specializes in S Corporation taxation, including Schedule K-1 nuances. Our expert team provides personalized guidance to help you understand your K-1, accurately report its information, and develop strategies to minimize tax liability while ensuring IRS compliance. Schedule K-1 plays a vital role in your overall tax strategy as an S Corp shareholder.