Small business tax credits can significantly reduce your tax burden and boost your bottom line. At Bette Hochberger, CPA, CGMA, we understand the importance of maximizing these opportunities for our clients.

This guide will walk you through three key tax credits available to small businesses in the United States. By understanding and leveraging these credits, you can potentially save thousands of dollars on your tax bill.

How the R&D Tax Credit Can Benefit Your Small Business

Understanding R&D Qualifications

The Research and Development (R&D) Tax Credit offers substantial benefits for small businesses that invest in innovation. The IRS defines qualified research activities broadly, including the development of new products, processes, or software, as well as improvements to existing ones. A software company creating a new app or a manufacturing firm enhancing its production process could potentially claim this credit. (Even unsuccessful research efforts may qualify.)

Small Business Eligibility

The Inflation Reduction Act of 2022 (IRA) has increased and modified the qualified small business payroll tax credit for increasing research activities. This provision applies to companies with no gross receipts for any tax year before the five-tax-year period ending with the claim year. Startups without income tax liability find this particularly advantageous.

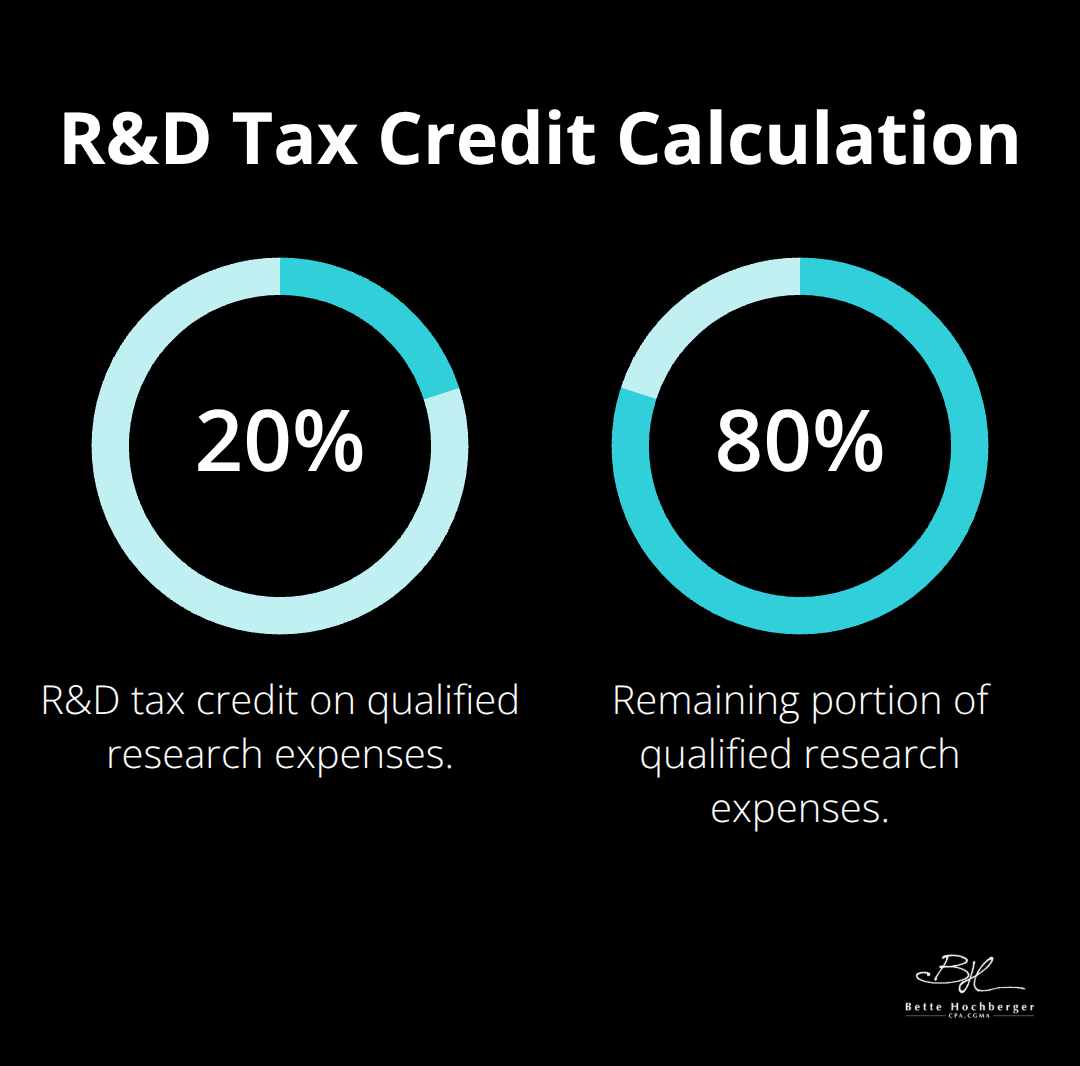

Credit Calculation and Claim Process

The R&D credit typically amounts to 20% of qualified research expenses over a base amount. These expenses may include:

- Wages for employees conducting research

- Supplies used in research

- Certain research contracted out to third parties

To claim the credit, businesses must file Form 6765 with their tax return. Detailed documentation of research activities and related expenses (project records, payroll information, and receipts for supplies and contract research) proves essential for substantiating claims.

Maximizing the R&D Credit

Small businesses across various industries can potentially benefit from the R&D credit. It’s not limited to tech companies or large corporations. To maximize this opportunity:

- Identify all qualifying activities within your business

- Maintain meticulous records of research expenses

- Consider consulting with a tax professional to explore your options

The R&D Tax Credit can provide significant savings for businesses investing in innovation, allowing them to reinvest in growth and innovation. As we move forward, let’s explore another valuable tax credit that can benefit small businesses: the Work Opportunity Tax Credit (WOTC).

How the Work Opportunity Tax Credit Can Boost Your Business

Understanding the WOTC’s Financial Impact

The Work Opportunity Tax Credit (WOTC) offers small businesses a powerful tool to reduce their tax burden while promoting workforce diversity. This federal tax credit incentivizes employers to hire individuals from specific target groups who face significant employment barriers.

The WOTC provides substantial tax savings for eligible employers. Credit amounts vary based on the hired individual’s target group and first-year wages paid. For most target groups, employers can claim a credit of 40% of up to $6,000 of wages paid to, or incurred on behalf of, an individual who is in their first year of employment.

The Department of Labor provides WOTC performance data, including annual certification reporting, which highlights the program’s impact on businesses nationwide.

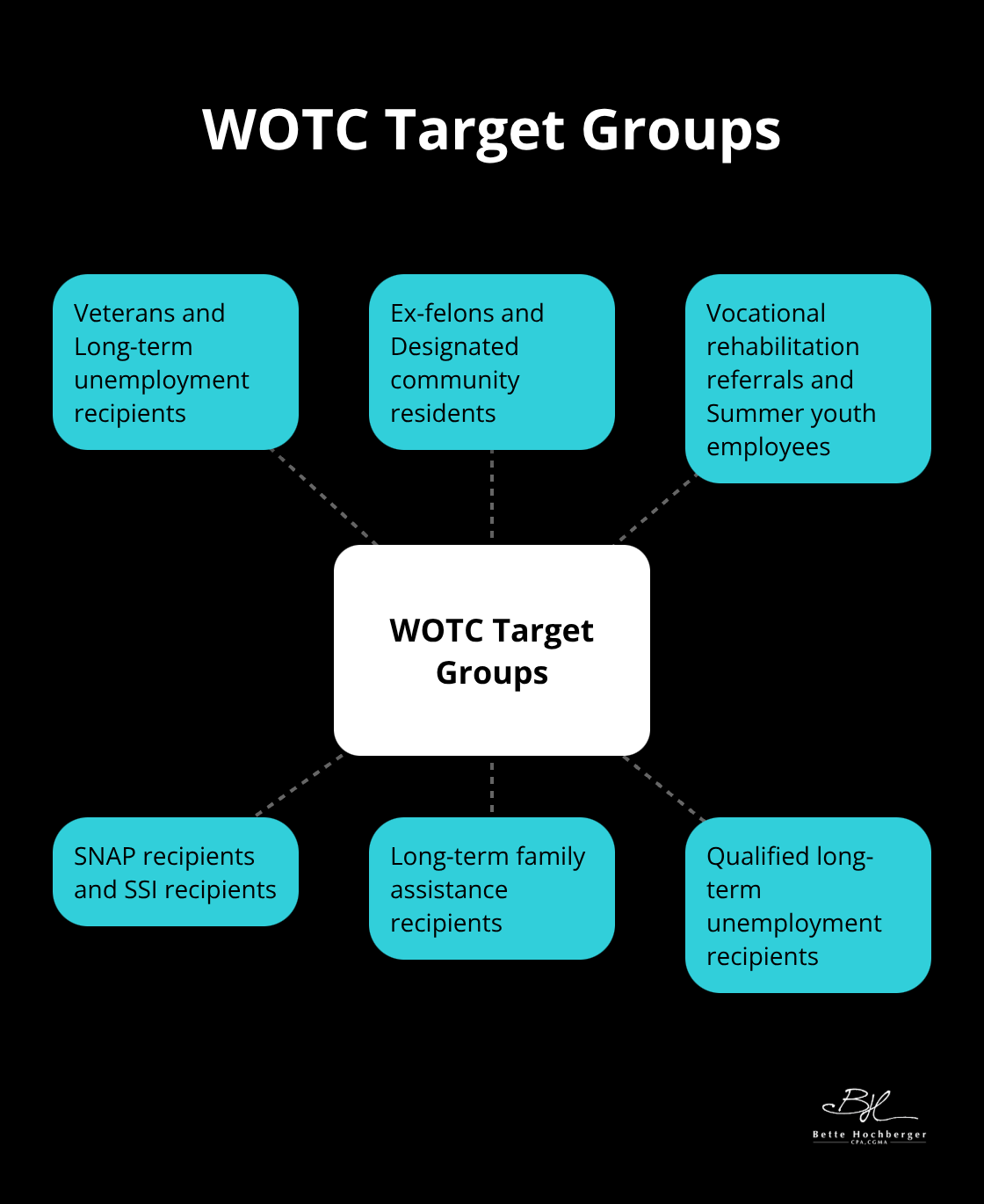

Identifying Eligible Hires

The WOTC program targets several specific groups:

- Veterans

- Long-term unemployment recipients

- Ex-felons

- Designated community residents in Empowerment Zones or Rural Renewal Counties

- Vocational rehabilitation referrals

- Summer youth employees in Empowerment Zones

- Supplemental Nutrition Assistance Program (SNAP) recipients

- Supplemental Security Income (SSI) recipients

- Long-term family assistance recipients

- Qualified long-term unemployment recipients

Navigating the Application Process

To claim the WOTC, employers must follow these steps:

- Pre-screen potential hires using IRS Form 8850 on or before the job offer date.

- Submit Form 8850 to the state workforce agency within 28 days after the employee starts work.

- Once certified, claim the credit on Form 5884 when filing your federal tax return.

Maximizing WOTC Benefits

To optimize your WOTC benefits:

- Implement a systematic screening process for all new hires.

- Train your HR team on WOTC eligibility criteria and application procedures.

- Partner with local workforce agencies to connect with eligible candidates.

- Maintain detailed records of all WOTC-related documentation (this will prove invaluable during potential audits).

The strategic incorporation of the WOTC into your hiring practices can significantly reduce your tax liability while contributing to workforce diversity and economic growth in your community. As we explore tax credits further, let’s turn our attention to another valuable opportunity for small businesses: the Small Business Health Care Tax Credit.

How the Small Business Health Care Tax Credit Reduces Your Costs

Understanding the Credit’s Purpose

The Small Business Health Care Tax Credit provides financial relief to eligible employers who offer health insurance to their employees. This credit, introduced as part of the Affordable Care Act, makes employee health coverage more affordable for small businesses.

Eligibility Requirements

To qualify for this credit, your business must meet specific criteria:

- Employ fewer than 25 full-time equivalent employees (FTEs)

- Pay average annual wages below $59,000 per FTE (as of 2024)

- Cover at least 50% of employee health insurance premium costs

- Purchase coverage through the Small Business Health Options Program (SHOP) Marketplace

The Internal Revenue Service (IRS) offers detailed guidelines on calculating FTEs and average annual wages. These calculations determine your eligibility for the credit.

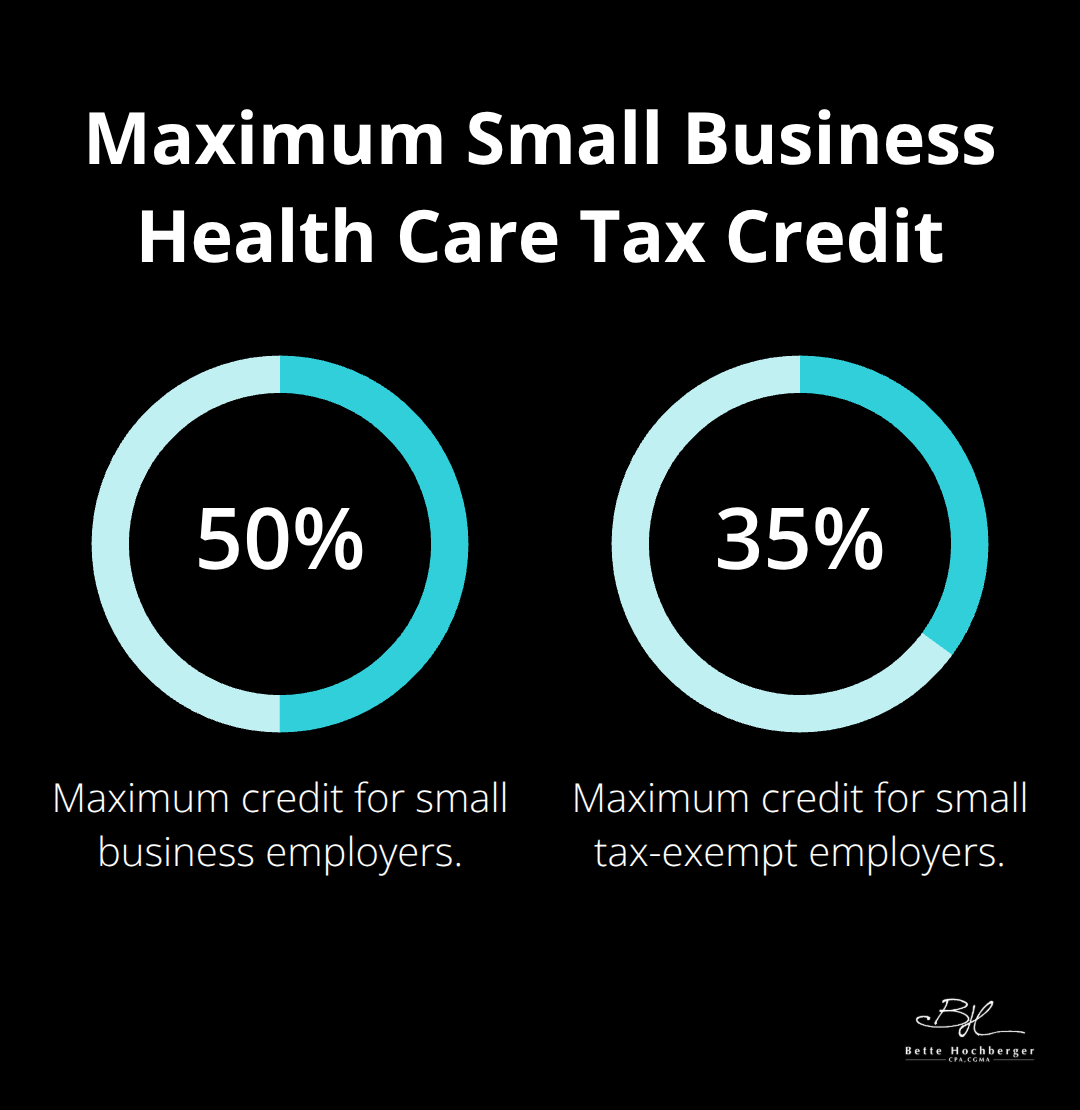

Potential Savings

The credit amount varies based on several factors, including the number of employees and average wages. For tax years 2014 and later, the maximum credit is:

- 50% of premiums paid for small business employers

- 35% of premiums paid for small tax-exempt employers

For instance, if you have 10 FTEs with average annual wages of $25,000 and you pay $70,000 in health care premiums, you could potentially receive a credit of up to $35,000 (50% of premiums paid).

Claiming Process

To claim this credit, you must file Form 8941 (Credit for Small Employer Health Insurance Premiums) with your annual income tax return. The credit is part of the general business credit, which you can carry back or forward to other tax years if you can’t use it in the current year.

Maintain detailed records of employee hours, wages, and health insurance costs throughout the year. This documentation will simplify the process when you file your taxes and claim the credit.

Strategic Planning

You can only claim the Small Business Health Care Tax Credit for two consecutive years. Plan strategically to maximize its benefits within this timeframe. This credit can positively impact your bottom line by reducing your tax liability, allowing you to reinvest in growth, hire new employees, or improve your existing health care offerings.

Final Thoughts

Small business tax credits offer significant opportunities to reduce tax burdens and boost profitability. The R&D Tax Credit, Work Opportunity Tax Credit, and Small Business Health Care Tax Credit provide unique advantages for companies investing in innovation, workforce diversity, and employee health. The U.S. tax code contains numerous other small business tax credits that could benefit your company (it’s worth exploring all available options).

Navigating tax credits can challenge even experienced business owners. Working with professionals who understand tax law nuances will help you maximize your benefits. We at Bette Hochberger, CPA, CGMA specialize in strategic tax planning and preparation for small businesses.

Effective tax planning requires ongoing attention. As your business evolves, so will your tax credit opportunities. Maintain detailed records and seek expert advice to leverage small business tax credits effectively. This approach will free up resources for your company’s growth and success.