Incorporating your business is a big step that can bring significant benefits. At Bette Hochberger, CPA, CGMA & Associates PLLC, we often guide entrepreneurs through this important decision.

This guide will help you understand if incorporating is right for your business. We’ll explore the advantages, types of corporations, and steps to take if you decide to move forward.

Why Incorporate Your Business

Incorporation can transform small businesses. Let’s explore the concrete benefits that make this move worthwhile.

Shield Your Personal Assets

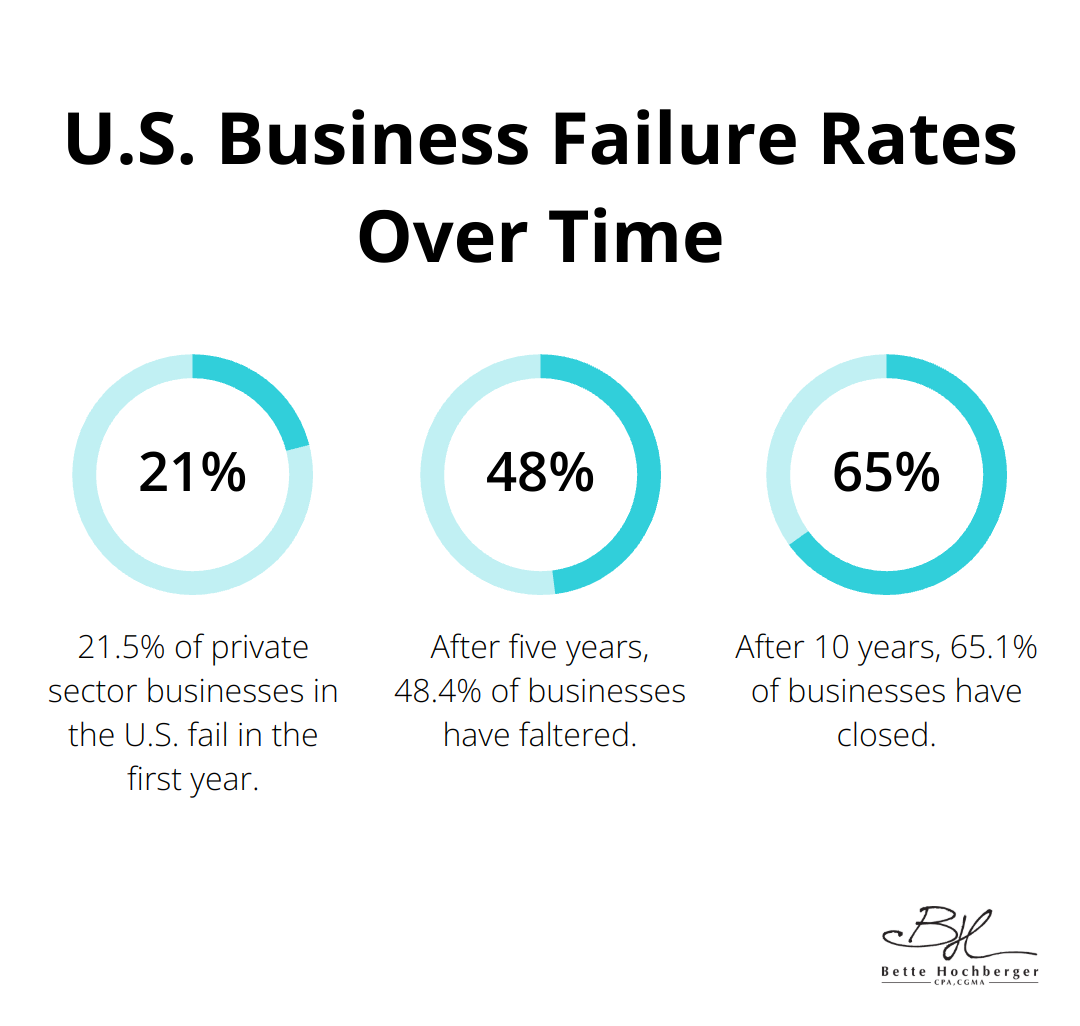

Incorporation offers protection to your personal assets. If your business faces legal action or accumulates debt, your personal property (like your home or savings) typically remains off-limits to creditors. This separation between personal and business finances provides a critical safeguard. 21.5% of private sector businesses in the U.S. fail in the first year. After five years, 48.4% have faltered. After 10 years, 65.1% have closed. Incorporation acts as a safety net, ensuring that a business setback doesn’t become a personal financial disaster.

Optimize Your Tax Situation

Incorporation can lead to significant tax advantages. C Corporations can deduct 100% of their charitable contributions, which exceeds the limits for individuals. S Corporations offer potential savings on self-employment taxes. In 2024, the first $160,200 of net earnings from self-employment will be subject to the 12.4% Social Security portion of the self-employment tax. Incorporating and electing S Corp status potentially reduces this tax burden on a portion of your income.

Boost Your Business Credibility

An incorporated business often appears more credible to potential clients, partners, and investors. A study by the Kauffman Foundation found that incorporated businesses are 23% more likely to get external funding compared to unincorporated entities. This enhanced credibility can translate into tangible benefits (such as better terms with suppliers or increased customer trust).

Access to Capital

Incorporation opens up more avenues for raising capital. Corporations can issue stocks, making it easier to attract investors. This ability to sell shares provides a clear advantage over sole proprietorships or partnerships when it comes to funding growth or expansion.

Perpetual Existence

Corporations exist as separate entities from their owners. This means the business can continue to operate even if ownership changes. This perpetual existence provides stability and makes it easier to transfer ownership, sell the business, or pass it on to heirs.

Now that we’ve covered the benefits of incorporation, let’s explore the different types of corporate structures available to businesses.

Which Corporate Structure Fits Your Business

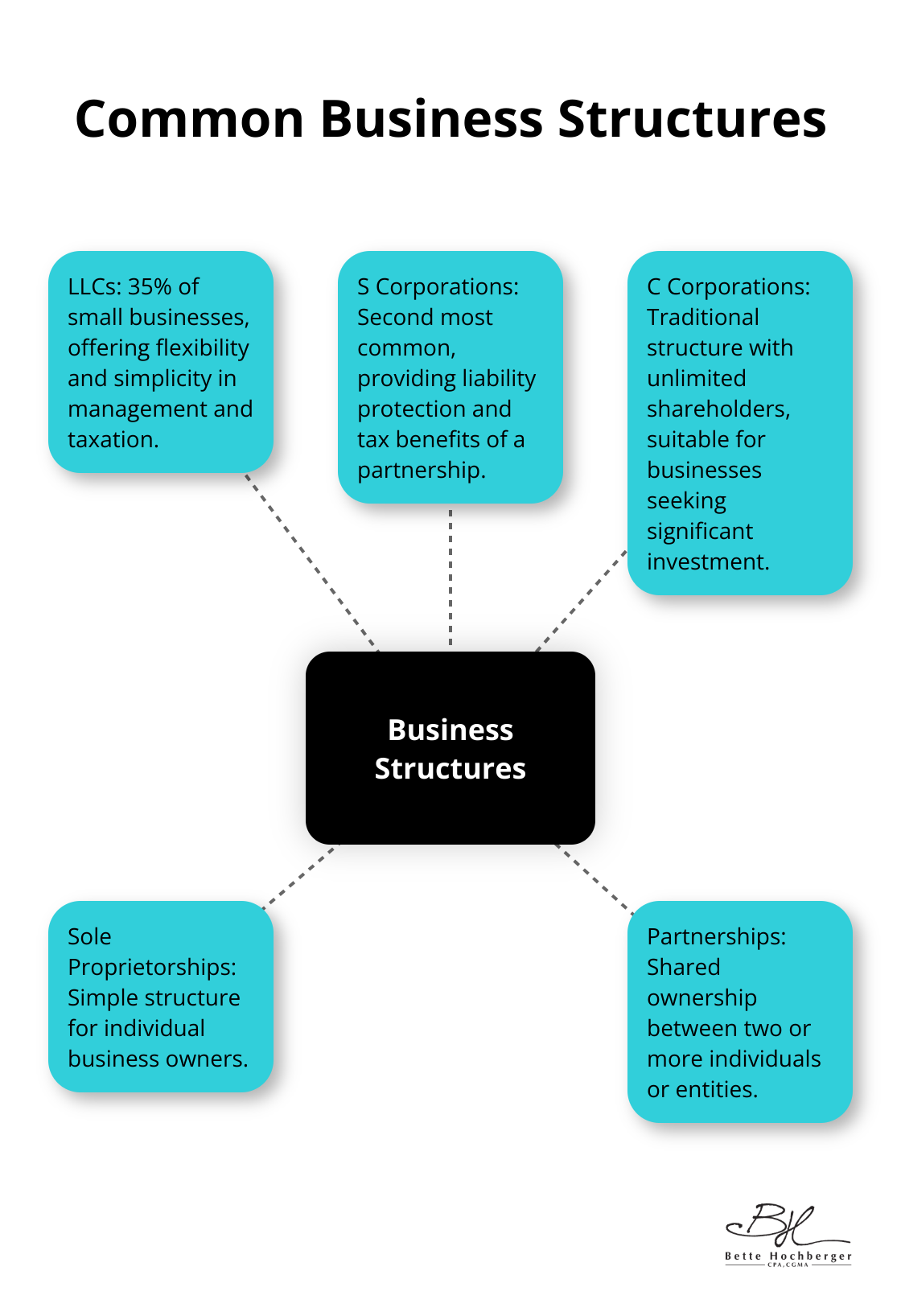

Choosing the right corporate structure is a pivotal decision for your business. Each type offers distinct advantages and considerations. Let’s explore the most common structures to help you make an informed choice.

C Corporations: The Standard Bearer

C Corporations represent the most traditional corporate structure. They exist as separate legal entities from their owners, providing strong liability protection. C Corps can have an unlimited number of shareholders, which makes them attractive for businesses seeking significant investment. However, they face double taxation (the corporation pays taxes on profits, and shareholders pay taxes on dividends).

In 2022, the corporate tax rate for C Corps was a flat 21%. This rate can prove advantageous for high-earning businesses. C Corps also offer more flexibility in deducting fringe benefits like health insurance.

S Corporations: Tax-Efficient Small Business Option

S Corporations combine the liability protection of a corporation with the tax benefits of a partnership. Profits and losses pass through to shareholders’ personal tax returns, avoiding double taxation. However, S Corps limit themselves to 100 shareholders and one class of stock.

A key advantage of S Corps is the potential for tax savings on self-employment income. In 2024, only the first $160,200 of net earnings will be subject to the 12.4% Social Security tax. S Corp owners can pay themselves a reasonable salary and take additional income as distributions, potentially reducing their overall tax burden.

LLCs: Flexibility and Simplicity

Limited Liability Companies (LLCs) offer flexibility in management structure and taxation. They can be taxed as sole proprietorships, partnerships, S Corps, or C Corps. LLCs provide liability protection without the formal structure requirements of corporations.

LLCs are popular among small businesses due to their simplicity. According to the National Association of Small Business’s 2020 survey, 35% of small businesses are structured as LLCs, making it the most common choice after S Corporations.

B Corporations: For the Socially Conscious

B Corporations are a newer option for businesses that want to balance profit with social and environmental impact. They must consider the impact of their decisions on workers, community, and environment, in addition to shareholders.

As of December 2023, there are nearly 8,000 Certified B Corps employing over 700,000 people across various countries. While not suitable for every business, B Corps can attract socially conscious consumers and investors.

Selecting the right corporate structure depends on various factors including your business goals, growth plans, and tax considerations. Professional guidance can help you navigate these choices and ensure you select the structure that best aligns with your business objectives and financial strategy. Now that we’ve explored the different corporate structures, let’s move on to the practical steps involved in incorporating your business.

How to Incorporate Your Business

Select Your Business Name

Your first task is to choose a unique and memorable business name. With 2.4 million establishments expanding employment in the United States, name selection becomes critical. Check your state’s business name database to ensure your chosen name isn’t already taken. Many states provide online search tools for this purpose. Consider trademark issues as well; the United States Patent and Trademark Office (USPTO) database can help you avoid potential conflicts.

Decide Where to Incorporate

Your incorporation state can significantly impact your business. While Delaware is popular for its business-friendly laws, it’s not always the best choice. In 2024, 68.2 percent of Fortune 500 companies incorporated in Delaware. However, for small businesses, incorporating in your home state often makes more sense due to lower costs and simpler compliance requirements. Evaluate factors like state taxes, legal protections, and ongoing compliance requirements before you make your decision.

File Articles of Incorporation

Once you’ve chosen your name and state, file your Articles of Incorporation. This document typically includes your business name, purpose, registered agent information, and initial directors. Filing fees vary widely by state (ranging from around $50 to over $500).

Create Corporate Bylaws

After filing, create comprehensive corporate bylaws. These internal rules govern how your corporation will operate. While not all states require bylaws to be filed, they’re essential for smooth operations and can protect you in legal disputes.

Obtain Licenses and Permits

Next, obtain necessary licenses and permits. Requirements vary based on your industry and location. Try to use the Small Business Administration’s tool to identify federal and state license requirements for your specific business.

Apply for an EIN

Lastly, apply for an Employer Identification Number (EIN) from the IRS. This nine-digit number is essential for tax purposes, opening business bank accounts, and hiring employees. You can apply online for free through the IRS website, typically receiving your EIN immediately after application.

Final Thoughts

Incorporating your business brings numerous advantages, from asset protection to tax optimization and enhanced credibility. The process involves careful consideration of different corporate structures and important steps such as choosing a business name and filing necessary documents. Professional guidance proves invaluable when navigating the complexities of incorporation.

At Bette Hochberger, CPA, CGMA & Associates PLLC, we offer personalized financial services for businesses and professionals. Our expertise in strategic tax planning, Fractional CFO services, and tax preparation can help you through the incorporation process. We aim to minimize tax liabilities, manage cash flow, and ensure profitability for your business.

If you consider incorporating, assess your long-term goals, financial situation, and growth plans. Research different corporate structures and their implications for your specific industry and circumstances. Consult with financial and legal professionals to make the best decision for your business’s long-term success and growth in today’s competitive marketplace.