Cash flow forecasting separates thriving businesses from those that struggle to survive. According to the U.S. Bank, 82% of business failures stem from poor cash flow management.

We at Bette Hochberger, CPA, CGMA see companies transform their operations when they master this financial skill. The right forecasting approach turns uncertainty into strategic advantage.

Understanding Cash Flow Forecasting Fundamentals

What Makes Cash Flow Different From Profit

Cash flow measures actual money movement while profit exists only on paper. A company can show $100,000 in quarterly profits yet face bankruptcy because customers pay 90 days late. The Restaurant Industry Report shows 60% of profitable restaurants fail within their first year due to cash flow problems, not lack of profitability.

Profit includes non-cash items like depreciation and accounts receivable that never touch your bank account. Cash flow tracks only real money that enters and leaves your business account. This distinction becomes critical when you need to pay suppliers, employees, or loan payments (regardless of what your profit and loss statement shows).

The Three Cash Flow Components That Matter

Operating cash flow covers day-to-day business activities including customer payments and supplier costs. This component should generate positive results consistently to maintain business health. Investing cash flow tracks equipment purchases, property sales, and major asset transactions that support long-term growth.

Financing cash flow includes loan payments, investor funding, and dividend distributions. HighRadius research reveals 90% of large company treasurers rate their cash flow forecasting as unsatisfactory because they focus on single components instead of the complete picture.

Smart businesses track all three components weekly to spot problems before they become fatal. The cash flow statement provides the real story behind your financial health, showing exactly where money originates and where it goes each month.

Why Forecasting Accuracy Drives Growth

Accurate forecasting prevents the cash shortfalls that affect businesses, with 73% of businesses having grown despite challenges according to U.S. Bank data. Companies with precise 13-week rolling forecasts secure better credit terms and negotiate stronger supplier relationships.

The Citizens 2024 Business Outlook Report found 66% of businesses that use forecasting tools expect 10% growth compared to 23% of companies that rely on gut instinct. Regular financial forecasting reveals seasonal patterns that help you stockpile cash before slow periods and invest aggressively during peak seasons.

Monthly forecasts that extend 12 months ahead give you the confidence to hire key employees, purchase equipment, or expand locations without risking liquidity problems. These tools and methods form the foundation for effective cash flow management.

Essential Tools and Methods for Cash Flow Forecasting

Software Solutions Outperform Spreadsheets

Spreadsheets destroy accuracy faster than any other forecasting mistake. Over 80% of finance professionals report that Excel reliance creates version confusion and manual errors as businesses grow. HighRadius research shows companies that use automated forecasting software achieve better accuracy than spreadsheet users.

QuickBooks Advanced, Sage Intacct, and Float connect directly with accounting systems to pull real-time data without manual entry. Workday and Vena Solutions use AI to detect patterns in payment behavior and automatically adjust projections when customers change their payment schedules.

Rolling Forecasts Deliver Superior Results

Static annual budgets become worthless after three months while rolling forecasts improve the accuracy of forecasted and budgeted revenue by roughly 14% when compared to static forecasting. Rolling forecasts extend your visibility window constantly – when January ends, you add April to maintain the 13-week horizon.

This approach captures seasonal shifts and payment pattern changes that static budgets miss completely. Companies that use rolling forecasts spot cash shortfalls 8 weeks earlier than businesses stuck with annual projections. The continuous update process prevents the dangerous surprise of sudden cash gaps that destroy operations.

Five Critical Metrics That Drive Success

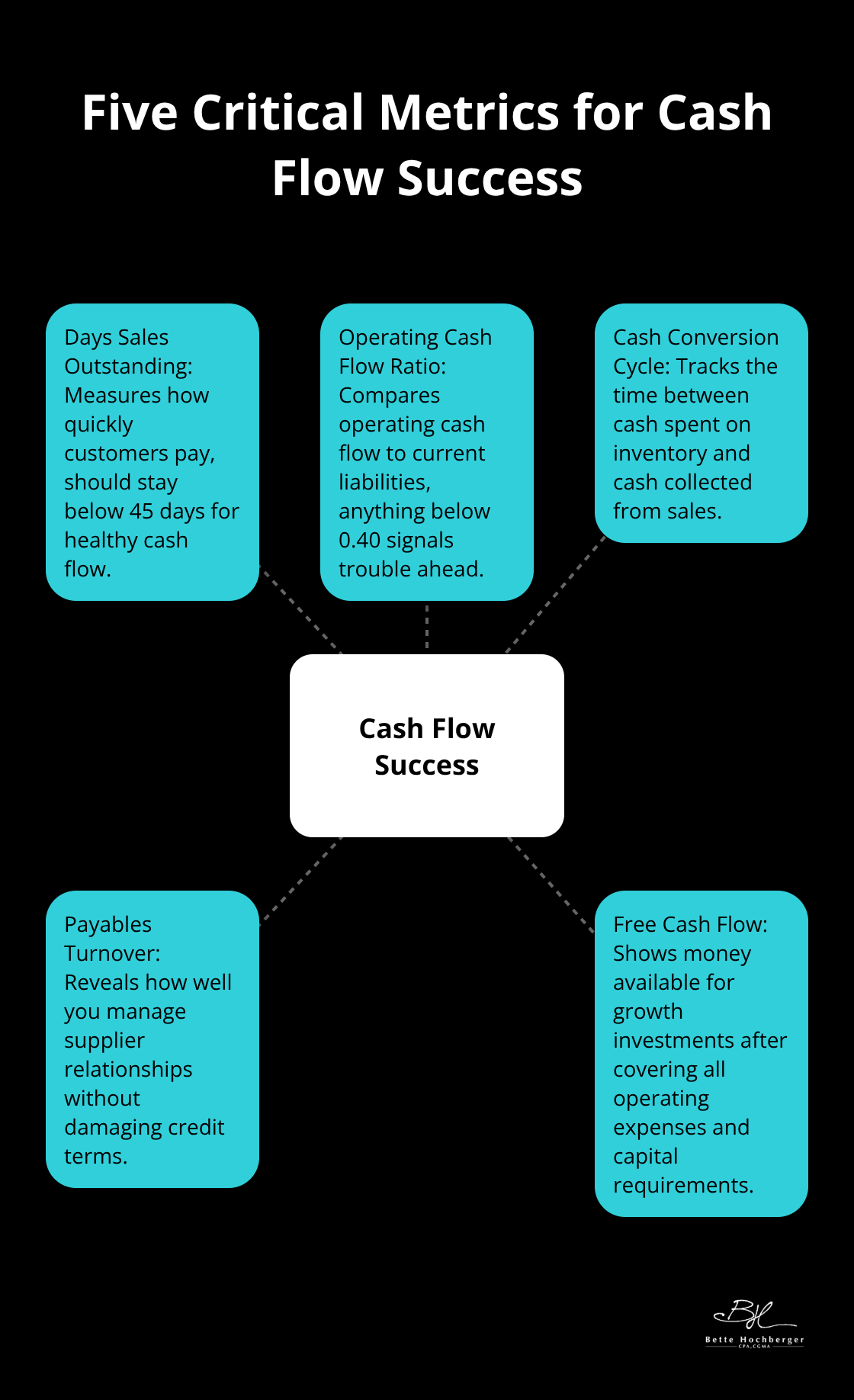

Days Sales Outstanding measures how quickly customers pay and should stay below 45 days for healthy cash flow. Operating Cash Flow Ratio compares operating cash flow to current liabilities (anything below 0.40 signals trouble ahead). Cash Conversion Cycle tracks the time between cash spent on inventory and cash collected from sales.

Payables turnover reveals how well you manage supplier relationships without damaging credit terms. Free cash flow shows money available for growth investments after covering all operating expenses and capital requirements. Monitor these weekly rather than monthly to catch problems while solutions remain simple.

Even the best tools and metrics fail when businesses make fundamental forecasting errors that sabotage their predictions. Professional cash flow risk management strategies help minimize these pitfalls and enhance business stability.

Common Cash Flow Forecasting Mistakes and How to Avoid Them

Customers Never Pay As Fast As You Hope

Revenue recognition happens when you send invoices, but cash collection takes weeks or months longer. Companies consistently overestimate collection speed, which creates dangerous cash gaps that force emergency borrowing. Understanding cash flow projection fundamentals helps businesses forecast future inflows and outflows more accurately.

B2B customers stretch payment terms during economic uncertainty and turn 30-day invoices into 90-day collections without warning. Track your actual collection patterns monthly rather than assume contract terms reflect reality. Weight your forecasts based on customer payment history – longtime clients who pay in 45 days should never be projected at 30 days.

Seasonal Patterns Destroy Unprepared Businesses

Retail businesses lose 40% of their revenue between January and March, yet most forecasts smooth these fluctuations into unrealistic monthly averages. Construction companies face 6-month winter slowdowns while tax firms generate 70% of annual revenue between February and April. These patterns repeat every year and make seasonal ignorance inexcusable.

Build three-year historical averages for each month to identify your true seasonal cycles. Manufacturing businesses should track both their own seasonality and their customers’ buying patterns (auto parts suppliers must prepare for July plant shutdowns and December holiday closures). Account for delayed seasonal effects where December sales create January collections and February inventory purchases.

Payment Terms Create Predictable Cash Timing

Net-30 terms mean 45-day collections while Net-60 terms stretch to 75 days in practice across most industries. Large corporate customers negotiate extended terms but pay consistently, while small businesses pay faster but less reliably. Government contracts offer the worst combination – 90-day terms with 120-day actual payment cycles.

Weight your accounts receivable aging by customer size and industry to predict realistic collection timing. Healthcare providers wait 90-120 days for insurance reimbursements regardless of stated terms. Professional service firms should expect 60-day collections from corporate clients and 30-day payments from small businesses, then adjust forecasts when clients change their payment behavior patterns (which happens more frequently than most businesses anticipate). Consider working with professional financial advisors to improve your cash flow management processes and avoid costly forecasting errors.

Final Thoughts

Accurate cash flow forecasting transforms financial uncertainty into strategic advantage. Companies that implement precise forecasting systems reduce their failure risk by 82% and position themselves for sustainable growth. The difference between businesses that thrive and those that struggle often comes down to their ability to predict and manage cash movement effectively.

Abandon spreadsheets for automated forecasting software that connects directly with your accounting system. Implement 13-week rolling forecasts that update weekly rather than rely on static annual budgets. Track your five critical metrics consistently and weight your projections based on actual customer payment patterns rather than contract terms (which rarely reflect reality).

The long-term impact extends far beyond avoiding cash shortfalls. Businesses with precise cash flow forecasting secure better credit terms, negotiate stronger supplier relationships, and make confident growth investments. We at Bette Hochberger, CPA, CGMA help businesses implement these forecasting strategies that create the foundation for sustained profitability and strategic growth.